How Much Property Damage Car Insurance Do I Need

Car insurance is a vital aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other incidents that can lead to property damage. Determining the appropriate amount of coverage for property damage is essential to ensure you are adequately protected without overpaying for unnecessary coverage. This comprehensive guide will delve into the factors that influence your property damage insurance needs and provide insights to help you make an informed decision.

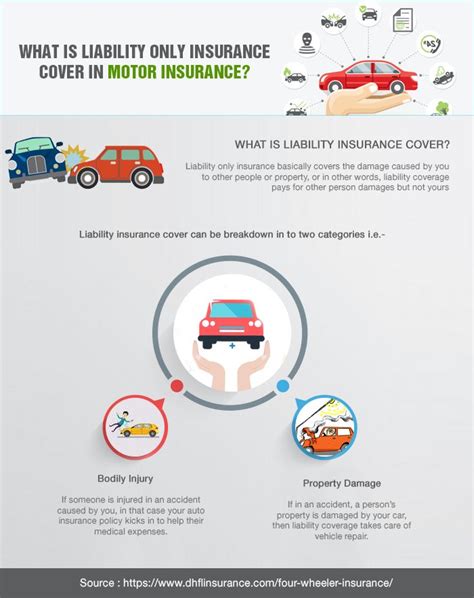

Understanding Property Damage Liability Coverage

Property damage liability coverage is a crucial component of your car insurance policy. It protects you financially if your vehicle causes damage to someone else’s property, including their vehicle, fence, mailbox, or even a building. This coverage is designed to cover the cost of repairs or replacements, ensuring you don’t face overwhelming financial burdens as a result of an accident.

The amount of property damage liability coverage you require depends on several factors, including your state's legal requirements, the value of your assets, and your personal financial situation. Let's explore these factors in more detail to help you determine the optimal coverage level.

State-Specific Legal Requirements

Every state in the United States has its own set of minimum legal requirements for car insurance, including property damage liability coverage. These minimums are typically expressed in terms of dollars per accident. For instance, a common minimum requirement is $25,000 in property damage liability coverage.

While meeting the state's minimum requirement is a legal necessity, it may not provide sufficient protection for your specific needs. It's essential to understand that the minimum coverage amount is often set based on average costs, which may not account for the potential for significant damage or the rising costs of repairs.

Some states, such as California, have higher minimum requirements for property damage liability coverage, recognizing the potential for more extensive damage in densely populated areas. In California, the minimum requirement is $5,000 higher than the national average, at $30,000.

| State | Minimum Property Damage Liability Coverage |

|---|---|

| Alabama | $20,000 |

| California | $30,000 |

| Florida | $10,000 |

| New York | $25,000 |

| Texas | $25,000 |

It's crucial to note that these minimum requirements are the legal floor, and you may want to consider exceeding them to ensure more comprehensive protection. The next section will delve into the factors that can influence your decision to increase your coverage beyond the state-mandated minimums.

Asset Protection and Personal Financial Situation

Beyond state-specific legal requirements, your personal financial situation and the value of your assets play a significant role in determining the appropriate amount of property damage liability coverage. Here’s why:

- Asset Protection: If you own valuable assets, such as a home, investments, or a business, you'll want to ensure that your insurance coverage protects these assets in the event of a lawsuit. For example, if you cause an accident resulting in significant property damage, and your coverage is insufficient, the injured party could sue you for the remaining amount, potentially jeopardizing your assets.

- Personal Financial Situation: Your income and savings also play a role in determining the right level of coverage. If you have substantial savings or a high income, you may be able to afford a higher deductible and, in turn, opt for lower insurance premiums. However, it's essential to strike a balance and ensure you're not underinsured, leaving you vulnerable to significant out-of-pocket expenses.

Consider a scenario where you cause an accident that totals another vehicle, resulting in damages exceeding $50,000. If your property damage liability coverage is only $25,000 (the minimum in many states), you could be personally responsible for the remaining $25,000. This amount could quickly deplete your savings or lead to financial hardship.

Risk Assessment and Personal Circumstances

Your personal circumstances and driving habits can also influence the amount of property damage liability coverage you need. Here are some factors to consider:

- Urban vs. Rural Living: If you reside in an urban area with a higher density of vehicles and a greater risk of accidents, you may want to consider higher coverage limits to account for the increased likelihood of property damage.

- Teen Drivers: If you have teenage drivers in your household, you may face a higher risk of accidents due to their inexperience. In such cases, higher property damage liability coverage can provide added protection.

- High-Value Vehicles: If you drive an expensive vehicle or own a collection of high-end cars, you'll want to ensure your insurance coverage reflects the potential cost of repairing or replacing these vehicles.

Remember, the goal is to strike a balance between adequate coverage and affordable premiums. By assessing your personal circumstances and risk factors, you can make an informed decision about the appropriate level of property damage liability coverage.

Choosing the Right Coverage: Expert Recommendations

When determining the optimal amount of property damage liability coverage, it’s beneficial to seek the advice of insurance experts. Here are some recommendations from industry professionals to guide your decision-making process:

- Aim for $100,000 or Higher: Many insurance experts recommend opting for property damage liability coverage of at least $100,000. This level of coverage provides a more substantial safety net, reducing the likelihood of facing significant out-of-pocket expenses in the event of an accident.

- Consider Umbrella Policies: If you have significant assets or a high net worth, an umbrella policy can provide an additional layer of protection. Umbrella policies offer excess liability coverage, extending beyond your standard car insurance policy limits.

- Regularly Review and Adjust Coverage: Your insurance needs may change over time due to changes in your assets, income, or personal circumstances. It's essential to review your coverage annually and adjust it as necessary to ensure you're always adequately protected.

The Impact of Higher Coverage on Premiums

One of the primary concerns when increasing your property damage liability coverage is the potential impact on your insurance premiums. While higher coverage limits generally result in increased premiums, the exact cost increase can vary based on several factors, including your insurance provider, driving record, and the state you reside in.

Let's explore some real-world examples to illustrate the potential premium increases associated with higher property damage liability coverage:

Example 1: Increasing Coverage from 25,000 to 100,000

In this scenario, we’ll assume a driver with a clean driving record and a standard car insurance policy with the following coverage limits:

- Liability Coverage: $25,000

- Collision Coverage: $500 deductible

- Comprehensive Coverage: $500 deductible

If this driver were to increase their property damage liability coverage from $25,000 to $100,000, they could expect a premium increase of approximately 10-15% per year. This increase may vary depending on the insurance company and other factors.

For instance, let's say this driver's current annual premium is $1,200. Increasing the property damage liability coverage to $100,000 could result in an additional cost of $120 to $180 per year, bringing the total annual premium to $1,320 to $1,380.

Example 2: Adding an Umbrella Policy

If you have substantial assets or a high net worth, an umbrella policy can provide added protection. Umbrella policies typically offer excess liability coverage, extending beyond your standard car insurance policy limits. The cost of an umbrella policy can vary, but it often ranges from 150 to 300 per year for $1 million in additional coverage.

For example, if you have a standard car insurance policy with $100,000 in property damage liability coverage and you purchase a $1 million umbrella policy, your total liability coverage would be $1.1 million. The cost of the umbrella policy would be an additional expense, but it provides a significant increase in protection for a relatively low cost.

Balancing Coverage and Cost

When deciding on the right amount of property damage liability coverage, it’s crucial to find a balance between adequate protection and affordable premiums. Here are some strategies to help you achieve this balance:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage options and premiums. This can help you identify the most cost-effective coverage for your needs.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or renters insurance. Many insurance companies offer discounts for customers who bundle multiple policies, potentially reducing your overall premiums.

- Review Deductibles: Evaluate your deductibles for collision and comprehensive coverage. Increasing your deductibles can lower your premiums, but it's essential to ensure you can afford the out-of-pocket expenses in the event of a claim.

- Safe Driving Habits: Maintain a clean driving record. Insurance companies often offer discounts for safe drivers, which can reduce your premiums over time.

Additional Considerations and Tips

As you navigate the process of determining your property damage liability coverage needs, here are some additional considerations and tips to keep in mind:

Understanding Your Policy

Take the time to thoroughly review your car insurance policy. Understand the specific coverage limits, deductibles, and any exclusions or limitations. This knowledge will help you make informed decisions about your coverage needs and potential adjustments.

Personal Injury Protection (PIP) Coverage

While this article primarily focuses on property damage liability coverage, it’s important to note that Personal Injury Protection (PIP) coverage is another crucial aspect of car insurance. PIP coverage provides financial protection for medical expenses and lost wages resulting from an accident, regardless of who is at fault. Consider adding PIP coverage to your policy to ensure comprehensive protection.

Uninsured/Underinsured Motorist Coverage

In addition to property damage liability coverage, consider adding uninsured/underinsured motorist coverage to your policy. This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. It provides an added layer of protection, ensuring you’re not left financially burdened in such situations.

Regular Policy Review

As your circumstances and needs change over time, it’s essential to review your car insurance policy regularly. This includes reassessing your coverage limits, deductibles, and any additional coverage options. By staying proactive, you can ensure your policy remains aligned with your needs and provides adequate protection.

Shop Around and Negotiate

Don’t be afraid to shop around for car insurance quotes. Compare prices and coverage options from multiple providers to find the best value. Additionally, consider negotiating with your insurance company. Sometimes, simply asking for a better rate or exploring discounts can lead to savings without compromising your coverage.

Understanding Deductibles

Deductibles are an important aspect of car insurance policies. When choosing your property damage liability coverage, consider the potential impact of deductibles. A higher deductible can lower your premiums, but it means you’ll pay more out of pocket if you need to make a claim. Strike a balance that aligns with your financial comfort level and risk tolerance.

Consider Your Driving Habits

Your driving habits and risk profile can influence the amount of property damage liability coverage you need. If you have a history of accidents or frequent traffic violations, you may want to consider higher coverage limits to mitigate the financial impact of potential claims. On the other hand, if you have a clean driving record and are a cautious driver, you may be able to opt for lower coverage limits with confidence.

FAQ

What is the minimum property damage liability coverage required by law in my state?

+The minimum property damage liability coverage required by law varies from state to state. You can check your state’s specific requirements by visiting your state’s Department of Insurance website or contacting your local insurance regulator. It’s important to meet these minimums to avoid legal consequences.

How much should I increase my property damage liability coverage beyond the minimum requirement?

+Insurance experts generally recommend increasing your property damage liability coverage to at least $100,000. This provides a more substantial safety net and reduces the likelihood of facing significant out-of-pocket expenses in the event of an accident. However, your specific needs may vary based on your assets and financial situation.

What happens if I cause an accident and my property damage liability coverage is insufficient?

+If you cause an accident and your property damage liability coverage is insufficient to cover the total damages, you may be held personally responsible for the remaining amount. This could lead to significant out-of-pocket expenses or even a lawsuit, potentially impacting your assets and financial stability.

Can I reduce my property damage liability coverage to lower my insurance premiums?

+While reducing your property damage liability coverage may lower your insurance premiums, it’s important to carefully consider the potential risks. Insufficient coverage could leave you vulnerable to significant financial losses in the event of an accident. It’s generally recommended to maintain adequate coverage to protect your assets.

Are there any discounts or strategies to reduce my insurance premiums while maintaining adequate coverage?

+Yes, there are several strategies to reduce your insurance premiums while maintaining adequate coverage. These include bundling policies, increasing deductibles, maintaining a clean driving record, and shopping around for quotes from multiple insurance providers. Additionally, some insurance companies offer discounts for safe driving habits or loyalty.