Progressive Progressive Insurance Company

In the rapidly evolving landscape of the insurance industry, Progressive Insurance Company stands out as a pioneer and innovator. With a rich history spanning over 50 years, Progressive has consistently challenged the status quo, introducing groundbreaking products and services that have revolutionized the way insurance is perceived and consumed. This article delves into the world of Progressive Insurance, exploring its innovative strategies, unique offerings, and the impact it has had on the industry and its customers.

A Legacy of Innovation: Progressive’s Journey

Founded in 1971 by Peter Lewis, Progressive Insurance Company began its journey with a simple yet powerful vision: to offer customers the ability to purchase car insurance directly, eliminating the need for agents. This bold move disrupted the traditional insurance model, empowering customers with choice and control over their insurance decisions.

Over the years, Progressive has continued to push the boundaries of innovation, consistently introducing industry-first products and services. One of its earliest innovations was the introduction of the Pay-As-You-Drive (PAYD) insurance, which allowed customers to pay insurance premiums based on their actual driving behavior. This concept, now widely adopted, revolutionized the pricing structure of auto insurance, making it more fair and personalized.

The Power of Technology: Driving Innovation

Progressive’s success can be attributed, in large part, to its embrace of technology. The company has consistently leveraged cutting-edge technologies to enhance the customer experience and streamline its operations. One of its most notable technological advancements is the Snapshot program, a usage-based insurance (UBI) offering that uses telematics to monitor driving behavior. Snapshot provides customers with the opportunity to save on their insurance premiums by demonstrating safe driving habits, a concept that has not only been successful in attracting customers but has also encouraged safer driving practices across the board.

Furthermore, Progressive's commitment to digital transformation has resulted in a range of innovative digital tools and platforms. Their mobile app, for instance, offers customers the convenience of managing their insurance policies on the go, filing claims, and accessing policy documents with just a few taps. This digital-first approach has not only improved customer satisfaction but has also reduced operational costs and increased efficiency.

A Diverse Product Portfolio: Catering to All

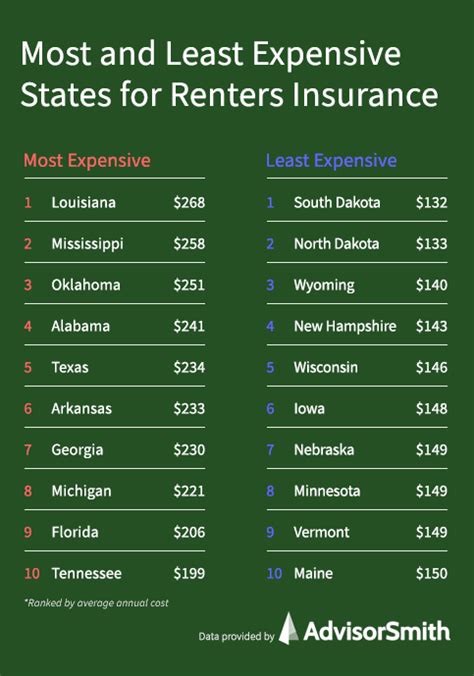

Beyond its groundbreaking innovations, Progressive Insurance Company offers a comprehensive range of insurance products, catering to the diverse needs of its customers. From auto insurance, which forms the core of its business, to homeowners’, renters’, and life insurance, Progressive provides a one-stop shop for all insurance needs.

One of the key strengths of Progressive's product portfolio is its customization. Whether it's commercial auto insurance for businesses or motorcycle insurance for enthusiasts, Progressive offers tailored coverage options that address the unique requirements of its diverse customer base. This attention to detail and customization has been a key differentiator, allowing Progressive to build strong, lasting relationships with its customers.

Community Engagement and Social Responsibility

Progressive Insurance Company’s commitment to innovation and customer-centricity extends beyond its products and services. The company actively engages with communities, supporting various initiatives that promote safety, education, and environmental sustainability. Through its charitable arm, the Progressive Insurance Foundation, the company has funded numerous programs aimed at improving road safety, promoting financial literacy, and supporting disaster relief efforts.

Additionally, Progressive has made significant strides in its environmental sustainability initiatives. The company has implemented various green practices in its operations, including energy-efficient offices, paperless processes, and eco-friendly vehicle fleets. These efforts not only reduce the company's environmental footprint but also set an example for other businesses to follow.

The Future of Insurance: Progressive’s Vision

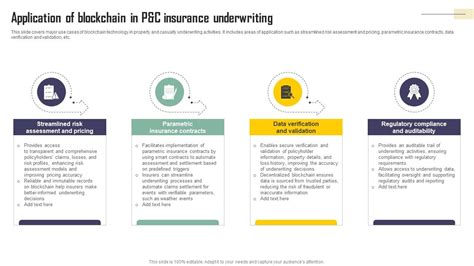

As the insurance industry continues to evolve, Progressive Insurance Company remains at the forefront, shaping the future of insurance with its forward-thinking approach. With a focus on continuous innovation, Progressive is exploring new technologies such as artificial intelligence, machine learning, and blockchain to further enhance its offerings and customer experience.

One of the key areas of focus for Progressive is the development of smart home technologies and their integration with insurance. By leveraging these technologies, Progressive aims to offer more accurate and personalized homeowners' insurance policies, providing customers with greater peace of mind and value.

Furthermore, Progressive is committed to expanding its global footprint, exploring new markets and partnerships to bring its innovative insurance solutions to a wider audience. With a strong focus on customer satisfaction and a relentless pursuit of innovation, Progressive is well-positioned to continue its legacy of leadership in the insurance industry.

Frequently Asked Questions

How does Progressive’s Snapshot program work, and what benefits does it offer to customers?

+The Snapshot program is a usage-based insurance offering from Progressive. It uses a small device plugged into your car’s diagnostic port to monitor driving behavior, including miles driven, time of day, and braking habits. Based on this data, customers can receive personalized insurance rates, with the potential for significant discounts for safe driving. This program not only rewards safe drivers but also provides valuable feedback to improve driving habits.

What sets Progressive’s auto insurance apart from its competitors, and why should customers choose Progressive for their insurance needs?

+Progressive’s auto insurance stands out for its innovative approach, personalized coverage options, and focus on customer convenience. With offerings like the Snapshot program and a range of discounts, Progressive provides customers with the opportunity to save on their insurance premiums while also enjoying the benefits of digital tools and platforms that simplify the insurance experience. Additionally, Progressive’s strong financial stability and commitment to community engagement make it a trusted choice for insurance.

How has Progressive’s embrace of technology impacted its operations and customer experience, and what further technological advancements can we expect from Progressive in the future?

+Progressive’s embrace of technology has transformed its operations, making it more efficient and customer-centric. The company’s digital tools, such as its mobile app and online platforms, have streamlined the insurance process, making it easier for customers to manage their policies and access support. Looking ahead, Progressive is exploring technologies like AI and blockchain to further personalize insurance offerings and enhance customer experiences. These advancements will continue to drive innovation and improve customer satisfaction.