Average Price For Renters Insurance

Renters insurance is an essential yet often overlooked aspect of financial planning for individuals living in rental properties. As the cost of living continues to rise, understanding the average price of renters insurance becomes crucial for budget-conscious renters. This article aims to provide a comprehensive guide to the average cost of renters insurance, offering insights into factors that influence premiums and strategies to secure the best coverage at an affordable price.

Understanding Renters Insurance Premiums

Renters insurance policies vary in price depending on several key factors. These include the location of the rental property, the coverage limits selected by the policyholder, and the deductible amount chosen. Additionally, insurers may consider the crime rate and natural disaster risk associated with the area when determining premiums.

On average, renters insurance policies cost $15 to $30 per month, although prices can vary significantly based on individual circumstances. For instance, a renter in a high-crime or high-risk area may pay upwards of $50 per month for adequate coverage.

To illustrate, let's consider the case of Sarah, a young professional renting an apartment in a major city. Based on her location and coverage needs, Sarah's renters insurance policy costs her $25 per month. This policy provides $30,000 in personal property coverage, $100,000 in liability protection, and a $500 deductible. While her premium is higher than the national average due to her urban location, Sarah's policy offers comprehensive protection for her belongings and personal liability.

Factors Influencing Renters Insurance Prices

Coverage Limits and Deductibles

The amount of coverage an individual chooses directly impacts the premium they pay. Higher coverage limits often result in higher premiums. Similarly, a lower deductible can increase the policy’s cost. Renters should carefully consider their coverage needs and financial situation when selecting limits and deductibles to ensure they have adequate protection without overpaying.

For instance, if Sarah opted for a higher deductible of $1,000, her monthly premium could potentially decrease by 10-15%, resulting in a more affordable policy. However, this would mean she would need to pay a larger portion out-of-pocket in the event of a claim.

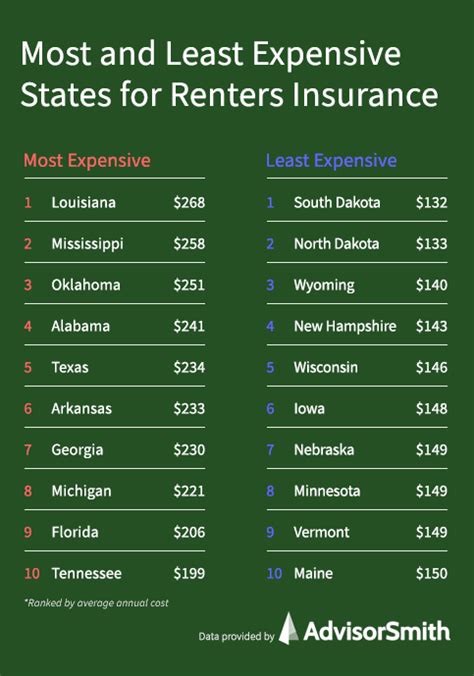

Location and Risk Factors

The location of the rental property plays a significant role in determining insurance premiums. Areas with higher crime rates or a history of natural disasters may result in higher insurance costs. Insurers consider these factors when assessing the risk associated with a particular property, which ultimately influences the premium.

Imagine a renter, John, who lives in an area prone to hurricanes. His renters insurance policy would likely reflect the higher risk, with premiums potentially exceeding $50 per month. This increased cost reflects the potential for higher claims due to the natural disaster risk in his region.

Additional Coverage Options

Renters insurance policies often offer optional additional coverages, such as personal liability, medical payments, or loss of use coverage. While these add-ons can provide valuable protection, they also increase the policy’s overall cost. Renters should carefully assess their needs and budget before adding these optional coverages to their policy.

For example, if John decided to add personal liability coverage to his policy, his premium would likely increase by 10-20%. While this additional coverage provides peace of mind in the event of a liability claim, it also comes at a higher cost.

Strategies for Affordable Renters Insurance

Shop Around and Compare Quotes

One of the most effective ways to secure affordable renters insurance is to compare quotes from multiple insurers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three providers is recommended. Online comparison tools and insurance brokers can assist in this process, making it easier to find the best deal.

Sarah, for instance, used an online comparison tool to obtain quotes from various insurers. By comparing these quotes, she was able to find a policy that offered similar coverage to her existing plan but with a 15% lower premium. This simple step allowed her to save money without compromising on protection.

Bundle Policies for Discounts

Bundling renters insurance with other policies, such as auto insurance, can often lead to significant savings. Many insurers offer discounts when customers purchase multiple policies, known as multi-policy discounts. By bundling their insurance needs, renters can take advantage of these discounts and reduce their overall insurance costs.

John, recognizing the potential savings, decided to bundle his renters insurance with his auto insurance policy. As a result, he received a 10% discount on both policies, reducing his total insurance costs and providing him with the convenience of a single insurer for all his insurance needs.

Increase Deductibles

As mentioned earlier, increasing the deductible on a renters insurance policy can lead to lower premiums. While this strategy requires the policyholder to pay a larger portion out-of-pocket in the event of a claim, it can be an effective way to reduce monthly insurance costs, especially for those with adequate savings to cover potential losses.

Sarah, after careful consideration, decided to increase her deductible from $500 to $1,000. This change resulted in a 12% decrease in her monthly premium, saving her money each month. However, she ensured she had sufficient savings to cover the increased deductible should a claim arise.

Conclusion

Renters insurance is an essential component of financial protection for individuals living in rental properties. By understanding the factors that influence insurance premiums and employing strategies to secure affordable coverage, renters can ensure they have the protection they need without straining their budgets. Whether it’s shopping around for the best quotes, bundling policies, or increasing deductibles, there are various ways to obtain comprehensive renters insurance at a reasonable cost.

Frequently Asked Questions

How much does renters insurance typically cost per month?

+The average monthly cost of renters insurance ranges from 15 to 30, although prices can vary significantly based on factors such as location, coverage limits, and deductibles.

What factors influence the price of renters insurance?

+Several factors influence renters insurance prices, including the location of the rental property, coverage limits, deductibles, crime rate, and natural disaster risk.

Can I lower my renters insurance premium?

+Yes, there are strategies to lower your renters insurance premium. These include shopping around for quotes, bundling policies, and increasing your deductible. It’s important to carefully consider your coverage needs and financial situation when making these decisions.

What additional coverage options are available with renters insurance?

+Renters insurance policies often offer optional additional coverages, such as personal liability, medical payments, and loss of use coverage. These add-ons can provide valuable protection but also increase the policy’s overall cost.

How can I find the best renters insurance policy for my needs?

+To find the best renters insurance policy for your needs, compare quotes from multiple insurers, assess your coverage needs and budget, and consider bundling policies to take advantage of multi-policy discounts.