Best Health Insurance For Cheap

In today's healthcare landscape, finding the best health insurance plan that fits your budget can be a challenging task. With a myriad of options available, ranging from comprehensive coverage to more affordable, basic plans, it's essential to strike a balance between cost and quality. This comprehensive guide aims to provide an in-depth analysis of the best health insurance options for those seeking affordability without compromising on essential benefits.

Understanding Health Insurance Options

The healthcare industry offers a diverse range of insurance plans, each designed to cater to specific needs. From High-Deductible Health Plans (HDHPs) to Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs), the choices can be overwhelming. Add to this the variety of providers and plans available on the Health Insurance Marketplace, and the task of finding a cheap yet comprehensive plan becomes even more intricate.

To navigate this complex landscape, it's crucial to understand the different types of health insurance plans and how they work. For instance, HDHPs typically offer lower premiums but require higher out-of-pocket expenses, while PPOs provide more flexibility in choosing healthcare providers but may have higher monthly costs.

Key Considerations for Affordable Health Insurance

- Premium Costs: This is the amount you pay monthly to maintain your health insurance coverage. Lower premiums are often attractive, but it’s essential to consider the overall plan benefits and potential out-of-pocket expenses.

- Deductibles and Out-of-Pocket Limits: Deductibles are the amounts you must pay out of pocket before your insurance coverage kicks in. Out-of-pocket limits, on the other hand, are the maximum amounts you’ll pay in a year for covered services. Understanding these limits is crucial for managing healthcare costs effectively.

- Network of Providers: Different health insurance plans have different networks of healthcare providers. If you have a preferred doctor or hospital, ensure they are in-network to avoid higher out-of-network costs.

- Coverage Benefits: Review the plan’s coverage benefits to ensure they align with your healthcare needs. Consider factors like prescription drug coverage, mental health services, and specialty care.

- Tax Benefits: Some health insurance plans, especially those on the Marketplace, may offer tax benefits or subsidies to reduce your overall costs. Understanding these benefits can significantly impact your decision.

Top Affordable Health Insurance Plans

Now, let’s delve into some of the best health insurance plans that offer a balance between affordability and comprehensive coverage.

High-Deductible Health Plans (HDHPs)

HDHPs are often a popular choice for those seeking affordable health insurance. These plans typically have lower monthly premiums, making them an attractive option for individuals or families on a tight budget. However, it’s important to note that HDHPs have higher deductibles, which means you’ll need to pay more out of pocket before your insurance coverage starts.

Despite the higher deductibles, HDHPs offer several benefits. Firstly, they are often paired with Health Savings Accounts (HSAs), which allow you to save money tax-free for medical expenses. Secondly, HDHPs provide a cost-effective option for individuals who are generally healthy and don't anticipate frequent medical visits.

| HDHP Advantage | Example Data |

|---|---|

| Lower Monthly Premiums | Gold HealthPlan HDHP: $250/month |

| Health Savings Accounts (HSAs) | Tax-free savings for medical expenses |

| Flexibility for Healthy Individuals | Ideal for those with few healthcare needs |

Silver Plans on the Health Insurance Marketplace

The Health Insurance Marketplace, also known as the Health Insurance Exchange, offers a range of plans, including the popular Silver plans. These plans are designed to provide a balance between cost and coverage, making them an excellent option for those seeking affordability without compromising on essential benefits.

Silver plans typically cover about 70% of healthcare costs, with the remaining 30% paid by the policyholder. This means that while you may have slightly higher premiums compared to HDHPs, you'll benefit from lower out-of-pocket costs when you need medical services. Additionally, Silver plans often qualify for cost-sharing reductions, which can further lower your out-of-pocket expenses.

| Silver Plan Benefits | Example Data |

|---|---|

| Balanced Cost and Coverage | Covers ~70% of healthcare costs |

| Potential Cost-Sharing Reductions | Lower out-of-pocket expenses |

| Wide Range of Providers | In-network access to various healthcare professionals |

Catastrophic Health Insurance Plans

Catastrophic health insurance plans are specifically designed for individuals under 30 or those who qualify for a hardship exemption. These plans offer limited coverage but can be a lifesaver in emergency situations. With low premiums and high deductibles, catastrophic plans provide a safety net for unexpected medical emergencies.

While catastrophic plans may not cover routine healthcare services, they can be a cost-effective option for young, healthy individuals who want basic coverage. However, it's important to note that these plans have strict limits on what they cover, and you may need to pay for additional coverage if you require more comprehensive care.

| Catastrophic Plan Features | Example Data |

|---|---|

| Low Premiums | Starting at $150/month |

| High Deductibles | Up to $8,550 (2023 data) |

| Limited Coverage | 3 primary care visits per year |

Maximizing Affordable Health Insurance Benefits

Now that we’ve explored some of the best affordable health insurance plans, let’s discuss strategies to maximize your benefits and keep costs down.

Health Savings Accounts (HSAs)

Health Savings Accounts are a powerful tool for managing healthcare costs, especially if you have a High-Deductible Health Plan. HSAs allow you to save money tax-free, which can then be used to pay for qualified medical expenses. The funds in your HSA roll over year after year, and you can invest the money, allowing it to grow over time.

By contributing to an HSA, you can effectively reduce your taxable income and have more funds available for healthcare needs. It's a great way to plan for future medical expenses and manage your health insurance costs effectively.

Understanding Your Coverage

It’s crucial to understand what your health insurance plan covers and what it doesn’t. Review your policy documents thoroughly to know your benefits, deductibles, and out-of-pocket limits. This knowledge will help you make informed decisions about your healthcare and avoid unexpected costs.

Additionally, keep in mind that some plans may have specific requirements or processes for certain services. For instance, you may need prior authorization for certain treatments or procedures. Being aware of these details can help you navigate your health insurance plan more effectively.

Shopping Around for Providers

When it comes to healthcare, shopping around can save you a significant amount of money. If your health insurance plan offers a network of providers, take advantage of this. Compare the costs of different providers within the network for various services. You might find that the costs vary significantly, and choosing a more affordable option can reduce your out-of-pocket expenses.

Additionally, if you're considering a procedure or treatment, don't hesitate to get a second opinion. This can provide valuable insights into your healthcare options and potentially lead to more cost-effective choices.

Future of Affordable Health Insurance

The landscape of affordable health insurance is constantly evolving, influenced by various factors such as policy changes, technological advancements, and market trends. As we look to the future, several trends and developments are likely to shape the availability and affordability of health insurance plans.

Telehealth and Digital Health Solutions

The integration of telehealth and digital health solutions has revolutionized the healthcare industry, offering convenient and accessible care options. With the continued growth of these technologies, we can expect to see an expansion in the range of services offered remotely, from consultations and diagnoses to monitoring and follow-up care. This shift towards virtual healthcare not only improves access to care but also has the potential to reduce costs, as it eliminates the need for physical visits and can streamline certain procedures.

Furthermore, digital health platforms are increasingly being utilized for health insurance purposes. From enrollment and claim processes to managing benefits and accessing resources, these platforms offer a streamlined and efficient experience. Insurers are leveraging technology to enhance customer engagement and provide personalized services, which can lead to improved cost management and more affordable options for consumers.

| Telehealth Benefits | Example Data |

|---|---|

| Improved Access to Care | Reduced wait times, increased convenience |

| Cost Efficiency | Lower costs for insurers and consumers |

| Enhanced Customer Engagement | Personalized services, improved satisfaction |

Value-Based Care Models

The traditional fee-for-service model, where healthcare providers are reimbursed based on the volume of services delivered, is being increasingly replaced by value-based care models. These models focus on the quality and outcomes of care, rather than the quantity of services provided. By incentivizing providers to deliver efficient and effective care, value-based models have the potential to reduce healthcare costs and improve patient outcomes.

Under value-based care, providers are rewarded for achieving certain quality metrics and for keeping patients healthy, which can lead to more cost-effective care. This shift in reimbursement models is expected to drive down the overall cost of healthcare, making insurance plans more affordable for consumers.

Health Insurance Market Dynamics

The health insurance market is highly dynamic, with continuous entry and exit of providers, mergers and acquisitions, and changes in regulatory environments. These factors can influence the availability and affordability of insurance plans. For instance, increased competition in the market can drive down premiums, making insurance more accessible. On the other hand, market consolidation or changes in regulations may lead to fewer options and potentially higher costs.

Additionally, the ongoing trend of consumer-driven healthcare is expected to continue shaping the market. This shift towards empowering consumers to make informed choices about their healthcare, including insurance plans, has the potential to drive down costs and improve quality. As consumers become more educated and engaged, they can negotiate better rates and demand more cost-effective options.

Conclusion

Finding the best health insurance for cheap is a complex but crucial task. By understanding the different types of plans, considering key factors like premiums and deductibles, and exploring options like HDHPs, Silver plans, and catastrophic coverage, you can make an informed decision. Additionally, maximizing benefits through strategies like HSAs and staying informed about coverage details can further enhance your experience with affordable health insurance.

As the healthcare industry continues to evolve, staying updated on trends and developments is essential. From the rise of telehealth and digital health solutions to the shift towards value-based care models, the future of affordable health insurance looks promising. By embracing these changes and staying engaged, consumers can expect improved access, quality, and affordability in healthcare and insurance.

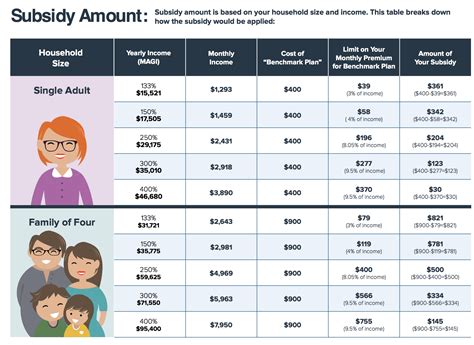

How can I find out if I qualify for a subsidy on the Health Insurance Marketplace?

+To determine if you qualify for a subsidy on the Health Insurance Marketplace, you’ll need to provide information about your household size and income. Based on this data, the Marketplace will calculate your eligibility for financial assistance, which can reduce your monthly premiums and out-of-pocket costs. It’s a good idea to review the income guidelines and use the Marketplace’s subsidy calculator to estimate your potential savings.

Are there any health insurance plans that cover dental and vision care?

+Yes, some health insurance plans do include dental and vision coverage. These are often referred to as comprehensive plans. However, it’s important to note that not all plans offer this coverage, and the level of coverage can vary significantly. When comparing plans, be sure to review the benefits carefully to understand what’s included and what additional costs you may incur for dental and vision care.

What is the difference between an HMO and a PPO plan?

+An HMO (Health Maintenance Organization) and a PPO (Preferred Provider Organization) are two different types of health insurance plans. HMOs typically require you to choose a primary care physician (PCP) who coordinates your care and refers you to specialists within the HMO network. PPOs, on the other hand, offer more flexibility, allowing you to see any provider within the network without a referral. PPOs generally have higher premiums but offer more choice and convenience.