Farmers Insurance Companies

The Farmers Insurance Companies, commonly known as Farmers Insurance Group or simply Farmers, is a leading provider of insurance and financial services in the United States. With a rich history spanning over a century, this insurance giant has grown to become a trusted name in the industry, offering a comprehensive range of insurance products and services to individuals and businesses across the nation.

A Legacy of Protection: The Farmers Story

Farmers Insurance was founded in 1928 by Thomas E. Leavey and John C. Tyler with a simple yet powerful mission: to provide reliable insurance protection to the hardworking farmers and ranchers of California. The company’s early success can be attributed to its innovative approach, offering insurance policies that were tailored to the unique needs of agricultural communities.

Over the decades, Farmers expanded its reach beyond agriculture, branching out to serve a diverse range of customers. Today, the Farmers Insurance Companies encompass a vast network of subsidiaries and brands, each specializing in different areas of insurance coverage.

Key Milestones in Farmers’ Journey:

- 1936: Farmers expands beyond California, entering the Arizona market.

- 1945: The company introduces its iconic slogan, “Farmers stands by you,” reflecting its commitment to customer service.

- 1956: Farmers becomes the first insurer to offer coverage for snowmobiles.

- 1968: The Farmers Group, Inc. is formed, consolidating various Farmers-owned companies under one entity.

- 1978: Farmers launches its personal lines business, offering auto and home insurance to individuals.

- 1998: Farmers acquires Bristol West Holdings, expanding its presence in the non-standard auto insurance market.

- 2013: The Farmers Exchanges and Zurich Insurance Group announce a strategic partnership, strengthening Farmers’ position in the industry.

The Farmers Insurance Portfolio: Comprehensive Coverage

Farmers Insurance Companies offer a diverse range of insurance products to meet the needs of its customers. Here’s an overview of their key offerings:

Auto Insurance

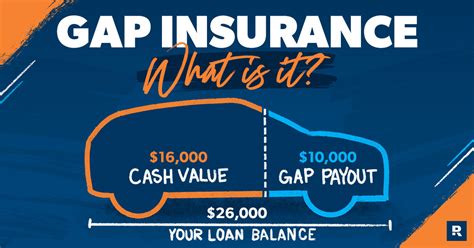

Farmers’ auto insurance policies provide comprehensive coverage for car owners, including liability protection, collision coverage, and medical payments. The company also offers additional benefits such as rental car reimbursement and gap coverage.

Home Insurance

Farmers’ home insurance policies protect homeowners and renters against various risks, including fire, theft, and natural disasters. Their coverage options include personal property protection, liability coverage, and additional living expenses.

Life Insurance

Farmers offers a variety of life insurance products, including term life, whole life, and universal life insurance. These policies provide financial protection for individuals and their families, ensuring peace of mind.

Business Insurance

Farmers’ business insurance division caters to the unique needs of small and large businesses. They offer coverage for commercial property, liability, workers’ compensation, and business interruption, among other specialized policies.

Specialty Insurance

Farmers also provides specialty insurance products, such as umbrella insurance, which offers additional liability protection, and pet insurance, which covers veterinary costs for pet owners.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Rental Car Reimbursement |

| Home Insurance | Dwelling, Personal Property, Liability, Additional Living Expenses |

| Life Insurance | Term Life, Whole Life, Universal Life, Accidental Death Coverage |

| Business Insurance | Commercial Property, Liability, Workers' Compensation, Business Interruption |

| Specialty Insurance | Umbrella Insurance, Pet Insurance, Identity Theft Protection |

Innovation and Customer Experience

Farmers Insurance has consistently focused on innovation to enhance the customer experience. The company has embraced digital technologies, offering online and mobile platforms for policy management and claims processing. Their digital tools provide customers with convenient access to their insurance information and allow for efficient claims reporting.

Additionally, Farmers has implemented advanced analytics and data-driven approaches to personalize insurance offerings and improve risk assessment. This has enabled the company to provide competitive rates and tailored coverage solutions to its customers.

The Future of Farmers Insurance

As the insurance landscape continues to evolve, Farmers Insurance Companies remain dedicated to adapting and meeting the changing needs of their customers. With a focus on technology, sustainability, and community involvement, Farmers is well-positioned to navigate the challenges and opportunities of the future.

The company's strategic partnerships and acquisitions have expanded its reach and capabilities, allowing it to offer an even broader range of insurance products and services. Farmers' commitment to customer service and its long-standing reputation for reliability ensure its continued success and relevance in the industry.

As Farmers Insurance looks ahead, its legacy of protection and innovation will undoubtedly shape the future of insurance, providing peace of mind and financial security to individuals and businesses alike.

Frequently Asked Questions

How can I contact Farmers Insurance for customer support or to report a claim?

+

Farmers Insurance provides multiple channels for customer support and claims reporting. You can reach their customer service team by phone, email, or live chat through their official website. Additionally, Farmers offers a dedicated claims hotline for prompt assistance in the event of an insurance-related incident.

What sets Farmers Insurance apart from other insurance providers in the market?

+

Farmers Insurance stands out for its commitment to innovation, customer satisfaction, and personalized insurance solutions. The company’s extensive range of insurance products, combined with its focus on technology and data-driven approaches, sets it apart from competitors. Farmers’ dedication to community involvement and its rich history of serving diverse customer needs further contribute to its unique position in the industry.

Does Farmers Insurance offer discounts on insurance policies?

+

Yes, Farmers Insurance provides a variety of discounts to help customers save on their insurance premiums. These discounts may include multi-policy discounts (bundling auto and home insurance), safe driver discounts, loyalty discounts for long-term customers, and discounts for certain safety features in vehicles or homes. It’s advisable to discuss these options with a Farmers insurance agent to maximize potential savings.

How does Farmers Insurance handle claims and ensure a smooth claims process for its customers?

+

Farmers Insurance prioritizes a seamless and efficient claims process. The company utilizes advanced technology and a dedicated claims team to promptly assess and resolve claims. Customers can report claims online, by phone, or through the Farmers mobile app, ensuring convenience and timely assistance. Farmers’ focus on customer satisfaction ensures a supportive and empathetic approach throughout the claims journey.

What are the key benefits of choosing Farmers Insurance for my insurance needs?

+

Choosing Farmers Insurance offers several key benefits. First, their comprehensive range of insurance products ensures you can find coverage tailored to your specific needs. Additionally, Farmers’ focus on innovation and technology enhances the customer experience, providing convenient online and mobile tools. Their strong financial stability and commitment to community involvement make Farmers a reliable and trusted partner for your insurance requirements.