Gap Insurance State Farm

In the intricate world of car insurance, understanding the nuances of coverage is paramount. Gap insurance, a specialized form of protection, plays a crucial role in safeguarding policyholders from financial gaps that may arise due to unforeseen circumstances. State Farm, a renowned insurance provider, offers this coverage as an integral part of its comprehensive insurance portfolio. This article delves deep into the intricacies of Gap Insurance by State Farm, exploring its benefits, applicability, and the scenarios where it proves invaluable.

Understanding Gap Insurance

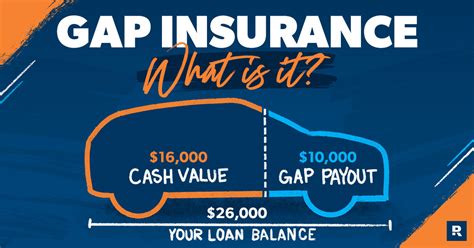

Gap insurance, often referred to as Guaranteed Asset Protection, serves as a financial safety net for vehicle owners. It bridges the gap between the actual cash value (ACV) of a vehicle and the outstanding balance on a car loan or lease. This coverage is particularly beneficial when a vehicle is declared a total loss due to an accident, theft, or other covered perils.

In such instances, standard insurance policies often pay out the ACV, which may not be sufficient to cover the entire loan amount, leaving the policyholder with a financial shortfall. Gap insurance steps in to cover this difference, ensuring the policyholder isn't left with a substantial debt burden.

The Importance of Gap Insurance

The value of a new car can depreciate rapidly, often losing up to 20% of its value in the first year alone. This depreciation can lead to a situation where the loan balance exceeds the vehicle’s actual worth, creating what’s known as negative equity. Gap insurance addresses this issue by providing coverage for the difference between the vehicle’s depreciated value and the outstanding loan amount.

For instance, if you've financed a car for $30,000 and it's now worth $25,000 due to depreciation, standard insurance would cover only the current value of $25,000. However, with Gap insurance, the policyholder would receive the full $30,000, ensuring they're not left with a financial loss.

State Farm’s Gap Insurance Coverage

State Farm’s Gap insurance policy is designed to provide comprehensive protection for policyholders. It covers various scenarios where a vehicle may be deemed a total loss, including accidents, theft, and even natural disasters. The coverage extends to both leased and financed vehicles, offering peace of mind to drivers across different ownership scenarios.

Key Features of State Farm’s Gap Insurance

- Total Loss Protection: In the event of a total loss, Gap insurance covers the difference between the vehicle’s ACV and the remaining loan or lease balance.

- Lease Coverage: For leased vehicles, Gap insurance ensures that the policyholder isn’t responsible for any remaining lease payments or early termination fees.

- Financed Vehicle Coverage: If a financed vehicle is totaled, Gap insurance pays off the remaining loan balance, eliminating the financial burden.

- Depreciation Coverage: This policy accounts for the rapid depreciation of new vehicles, ensuring policyholders aren’t left with negative equity.

Who Should Consider Gap Insurance?

Gap insurance is particularly beneficial for individuals who have leased or financed their vehicles. New car buyers, who often face rapid depreciation, and those with long-term loans or leases can significantly benefit from this coverage. Additionally, individuals who frequently trade in their vehicles or upgrade to new models may find Gap insurance an essential safeguard against financial loss.

| Vehicle Ownership Scenario | Benefits of Gap Insurance |

|---|---|

| Leased Vehicles | Protects against residual value and potential early termination fees. |

| Financed Vehicles | Covers the gap between the vehicle's depreciated value and the outstanding loan balance. |

| New Car Buyers | Offers protection against rapid depreciation, ensuring no financial loss in case of a total loss. |

How to Obtain Gap Insurance from State Farm

Adding Gap insurance to your State Farm policy is a straightforward process. It can be included as an add-on to your existing auto insurance policy, providing seamless coverage. The cost of Gap insurance is typically minimal, often just a few dollars per month, making it an affordable and prudent choice for vehicle owners.

State Farm's knowledgeable agents can guide you through the process, ensuring you understand the coverage and its benefits. They can also provide personalized advice based on your specific vehicle ownership scenario, helping you make an informed decision about Gap insurance.

Conclusion

Gap insurance, as offered by State Farm, is a critical component of comprehensive vehicle protection. It safeguards policyholders from financial pitfalls that may arise due to rapid vehicle depreciation or unforeseen total losses. By understanding the value of this coverage and its applicability, vehicle owners can make informed decisions to protect their financial interests.

As with any insurance coverage, it's essential to review your policy regularly and ensure it aligns with your current vehicle ownership and usage scenarios. State Farm's Gap insurance provides an invaluable layer of protection, offering peace of mind and financial security for drivers across the nation.

How does Gap insurance work in practice?

+Gap insurance comes into play when a vehicle is deemed a total loss due to an accident, theft, or other covered perils. In such cases, standard insurance policies cover the vehicle’s actual cash value (ACV). However, if the ACV is less than the outstanding loan or lease balance, Gap insurance steps in to cover the difference. This ensures that policyholders aren’t left with a financial burden, as the insurance provider pays off the remaining loan or lease amount.

Is Gap insurance necessary for all vehicle owners?

+Gap insurance is particularly beneficial for individuals who have leased or financed their vehicles. It’s also recommended for new car buyers who face rapid depreciation. However, it’s essential to assess your specific circumstances and financial situation. If you have substantial equity in your vehicle or have paid off a significant portion of your loan, Gap insurance may not be as crucial. Consulting with an insurance expert can help you make an informed decision based on your needs.

What are the limitations of Gap insurance coverage?

+Gap insurance has certain limitations and exclusions. It typically doesn’t cover situations where a vehicle is damaged but not deemed a total loss. Additionally, it may not cover certain types of losses, such as those resulting from wear and tear or mechanical breakdowns. It’s crucial to review the policy terms and conditions to understand the specific scenarios and perils covered by Gap insurance.