Geico Homeowners Insurance Quote

GEICO, well-known for its auto insurance offerings, also provides homeowners insurance, offering a comprehensive suite of coverage options to protect homeowners against various risks. Obtaining a GEICO homeowners insurance quote is a straightforward process, and this guide will walk you through the key steps, highlighting the coverage options and the benefits of choosing GEICO for your home insurance needs.

Understanding GEICO Homeowners Insurance Coverage

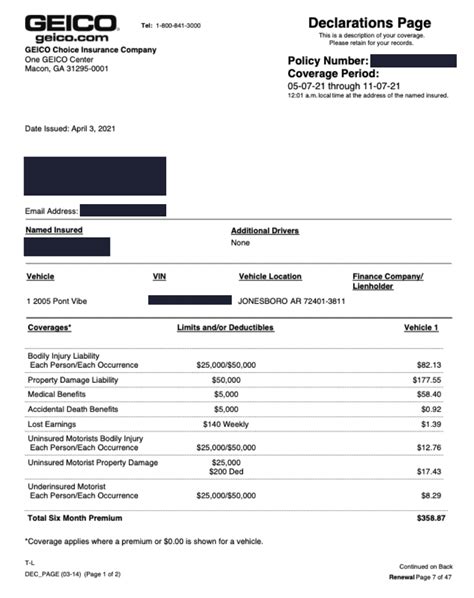

GEICO’s homeowners insurance, or homeowners policy, is designed to provide financial protection for your home and its contents. It covers a range of potential risks, including damage from fire, windstorms, hail, vandalism, and more. The policy also offers liability protection, covering medical expenses and legal fees if someone is injured on your property.

The coverage options with GEICO are extensive and customizable, allowing homeowners to tailor their policy to their specific needs. Some of the key coverage types include:

- Dwelling Coverage: This covers the structure of your home, including walls, roofs, and foundations.

- Personal Property Coverage: Protects your belongings, such as furniture, clothing, and electronics.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you damage someone else's property.

- Medical Payments Coverage: Covers medical expenses for injuries sustained on your property, regardless of fault.

- Loss of Use Coverage: Reimburses you for additional living expenses if your home becomes uninhabitable due to a covered loss.

- Additional Coverages: GEICO offers various optional coverages, such as identity theft protection, water backup coverage, and personal liability umbrella to enhance your policy.

Dwelling Coverage in Detail

Dwelling coverage is a fundamental part of any homeowners insurance policy, and GEICO offers flexible options to ensure your home is adequately protected. This coverage typically provides:

- Protection against covered perils, such as fire, windstorms, hail, and vandalism.

- Coverage for the structure of your home, including the main dwelling, attached structures like decks and porches, and even detached structures like sheds and garages.

- Options for replacement cost coverage, which ensures you can rebuild your home to its pre-loss condition, or actual cash value coverage, which provides compensation based on the current value of your home.

| Coverage Type | Description |

|---|---|

| Replacement Cost | Pays to rebuild your home at current market prices without deducting for depreciation. |

| Actual Cash Value | Covers the cost of replacing your home minus depreciation. |

Personal Property Coverage: Protecting Your Belongings

Personal property coverage is an essential part of your homeowners insurance policy, as it safeguards your belongings from various risks. GEICO’s personal property coverage includes:

- Protection for your personal belongings, such as furniture, clothing, electronics, and appliances, against covered perils.

- Coverage for additional living expenses if you need to relocate temporarily due to a covered loss.

- Optional endorsements for high-value items like jewelry, art, or collectibles, which often have coverage limits within the standard policy.

When determining your personal property coverage, it's crucial to consider the replacement cost of your belongings. GEICO offers replacement cost coverage for personal property, ensuring you receive the full cost to replace your items without depreciation.

Getting a GEICO Homeowners Insurance Quote

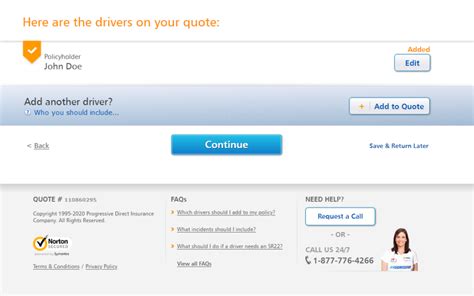

Obtaining a GEICO homeowners insurance quote is a simple process, and you have multiple options to choose from:

- Online Quote: Visit GEICO's website and use their online quote tool. Provide basic information about your home, location, and desired coverage options. The quote tool will guide you through the process and provide an estimate.

- Phone Quote: Call GEICO's customer service line and speak to a representative. They will ask you questions about your home and coverage needs and provide you with a quote over the phone.

- Agent Quote: GEICO has licensed insurance agents available to assist you. You can schedule a call or visit with an agent who can provide a personalized quote based on your specific circumstances.

Factors Affecting Your Quote

Several factors influence the cost of your homeowners insurance quote, including:

- Location: Your home's location is a significant factor. Areas with a higher risk of natural disasters, crime, or extreme weather conditions may have higher insurance premiums.

- Home Value and Age: The value and age of your home play a role in determining your quote. Older homes may require more extensive coverage and could be more costly to insure.

- Coverage Options: The coverage limits and additional endorsements you choose will impact your quote. Higher coverage limits and more comprehensive coverage options typically result in a higher premium.

- Deductibles: Your chosen deductible amount can affect your premium. Higher deductibles usually result in lower premiums, while lower deductibles can provide more financial protection in the event of a claim.

Benefits of Choosing GEICO for Homeowners Insurance

GEICO offers a range of benefits that make it an attractive choice for homeowners insurance:

- Competitive Rates: GEICO is known for its competitive insurance rates, ensuring you receive value for your money.

- Comprehensive Coverage: Their homeowners insurance policies offer extensive coverage options, allowing you to customize your policy to your specific needs.

- Excellent Customer Service: GEICO provides exceptional customer service, with a dedicated team of licensed agents available to assist you.

- Online Convenience: GEICO's online platform allows you to manage your policy, make payments, and file claims conveniently.

- Discounts: GEICO offers various discounts, including multi-policy discounts if you bundle your homeowners and auto insurance, as well as safety discounts for features like smoke detectors and security systems.

Discounts and Savings with GEICO

GEICO provides several opportunities for homeowners to save on their insurance premiums. Some of the key discounts include:

- Multi-Policy Discount: Save up to 25% when you bundle your homeowners and auto insurance policies with GEICO.

- New Home Discount: Receive a discount if you've recently purchased a new home.

- Safety Features Discount: Get a discount if your home has certain safety features, such as burglar alarms, smoke detectors, or sprinkler systems.

- Loyalty Discount: Enjoy savings for being a long-term GEICO customer.

- Military Discount: Active duty military, veterans, and their families can benefit from a military discount.

These discounts can significantly reduce your insurance premiums, making GEICO's homeowners insurance an even more affordable option.

Conclusion: Why Choose GEICO for Your Homeowners Insurance Needs

GEICO’s homeowners insurance offers a comprehensive and customizable policy, ensuring your home and belongings are protected. With competitive rates, excellent customer service, and a range of coverage options, GEICO provides a reliable and trusted solution for homeowners. Obtaining a quote is simple and can be done online, over the phone, or with the assistance of a licensed agent.

When it comes to protecting your home, choosing GEICO gives you peace of mind, knowing you have the coverage you need at a price that fits your budget. Don't wait; get your GEICO homeowners insurance quote today and take the first step towards safeguarding your home and its contents.

Can I customize my GEICO homeowners insurance policy to fit my specific needs?

+Yes, GEICO offers a range of coverage options and additional endorsements to tailor your policy to your specific circumstances. You can choose coverage limits, deductibles, and add-on coverages to create a policy that suits your needs.

Does GEICO offer discounts on homeowners insurance?

+Yes, GEICO provides various discounts to help reduce your insurance premiums. These include multi-policy discounts, new home discounts, safety features discounts, loyalty discounts, and military discounts.

How do I file a claim with GEICO homeowners insurance?

+Filing a claim with GEICO is straightforward. You can start the process online, over the phone, or with the assistance of your licensed agent. GEICO provides a dedicated claims team to guide you through the process and ensure a smooth and efficient resolution.