Quotes For Life Insurance Policies

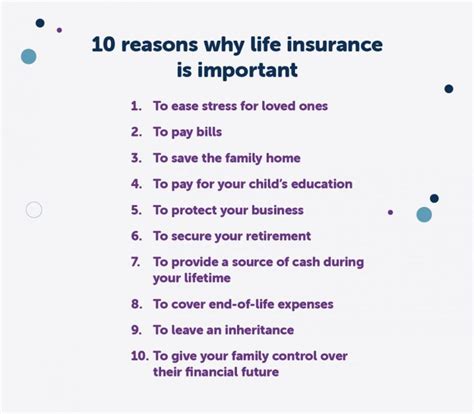

In the world of life insurance, understanding the fine print and ensuring you get the best coverage for your needs is crucial. One aspect that often comes into play is the inclusion of quotes or limitations within your policy. These quotes can significantly impact the benefits you receive, so it's essential to delve into this topic to make informed decisions about your life insurance coverage.

Unveiling the Significance of Quotes in Life Insurance Policies

A quote or limitation in a life insurance policy refers to a specific clause that restricts or modifies the coverage provided by the policy. These quotes are typically included to address certain conditions or scenarios that may affect the insurer’s risk exposure. While they might seem like a hindrance, quotes are an essential tool for insurers to manage their risk effectively.

For instance, a common quote you might find in a life insurance policy is a suicide exclusion clause. This clause states that the policy does not cover death by suicide, typically within a specific timeframe after the policy's inception. Other common quotes include exclusions for high-risk activities like skydiving or certain pre-existing medical conditions.

Understanding these quotes is vital for policyholders. They help you make informed decisions about your coverage and ensure you are aware of any limitations. For example, if you have a history of medical issues, you might need to consider a policy with more comprehensive coverage or seek out insurers who offer specialized policies for individuals with pre-existing conditions.

How Quotes Impact Policy Premiums

The presence of quotes in a life insurance policy can also influence the premium you pay. Insurers carefully assess the risk associated with each policyholder and adjust premiums accordingly. Policies with more extensive coverage or fewer quotes may result in higher premiums to offset the increased risk.

Take the example of a policy for an individual who is an avid skydiver. Due to the high-risk nature of this activity, the policy might include a quote excluding coverage for injuries or death resulting from skydiving. This quote, while necessary for the insurer's risk management, might lead to a higher premium for the policyholder.

| Policy Type | Premium | Coverage |

|---|---|---|

| Standard Policy | $500/year | General coverage with a few standard quotes |

| High-Risk Policy | $750/year | Extensive coverage with specific quotes for high-risk activities |

| Specialized Policy | $650/year | Tailored coverage for individuals with pre-existing conditions, with modified quotes |

Navigating Quotes: Strategies for Policyholders

As a policyholder, it’s essential to adopt a proactive approach when dealing with quotes in your life insurance policy. Here are some strategies to consider:

- Review and Understand: Carefully read and comprehend the quotes in your policy. If any terms are unclear, don't hesitate to seek clarification from your insurer or a financial advisor.

- Compare Policies: Shop around and compare different life insurance policies. Understanding the quotes and their implications can help you make an informed decision about which policy best suits your needs and budget.

- Consider Add-ons: Some insurers offer add-on coverage options that can enhance your policy's benefits. These add-ons might include specific coverage for high-risk activities or additional benefits for certain medical conditions. Evaluate these options based on your lifestyle and health status.

- Regular Review: Life insurance policies should be reviewed periodically, especially if your circumstances change. Getting married, having children, or experiencing a significant change in health status are all reasons to reassess your policy and ensure it still meets your needs.

By adopting these strategies, you can better navigate the complexities of quotes in life insurance policies and ensure you have the coverage you need without unnecessary limitations.

The Future of Life Insurance: Emerging Trends and Innovations

The life insurance industry is continuously evolving, and several emerging trends are shaping the future of policies and coverage. Here’s a glimpse into some of these innovations:

Digital Transformation

The digital age has revolutionized the way we interact with insurance providers. Many insurers are now offering online platforms and mobile apps for policyholders to manage their accounts, submit claims, and even purchase new policies. This digital transformation enhances convenience and efficiency, making it easier for individuals to access and understand their coverage.

Personalized Policies

Insurers are increasingly adopting a personalized approach to life insurance policies. By leveraging advanced analytics and data, insurers can offer tailored policies that consider an individual’s unique health, lifestyle, and financial situation. This customization can result in more comprehensive coverage and better-suited quotes for each policyholder.

Health and Wellness Incentives

Incentivizing policyholders to maintain a healthy lifestyle is a growing trend in the life insurance industry. Some insurers offer discounts or rewards for policyholders who engage in healthy activities or achieve specific wellness goals. This approach not only benefits the policyholder’s health but can also lead to reduced quotes and premiums over time.

Blockchain and Smart Contracts

The integration of blockchain technology and smart contracts is revolutionizing the insurance industry. Smart contracts can automate various processes, including policy issuance, claim verification, and payout, enhancing efficiency and reducing administrative costs. Additionally, blockchain’s immutable ledger provides enhanced security and transparency, benefiting both insurers and policyholders.

Frequently Asked Questions

What is a life insurance quote or limitation?

+

A quote or limitation in a life insurance policy refers to a specific clause that restricts or modifies the coverage provided by the policy. It helps insurers manage their risk exposure by addressing certain conditions or scenarios.

How do quotes impact policy premiums?

+

The presence of quotes in a policy can influence the premium you pay. Policies with more extensive coverage or fewer quotes may result in higher premiums to offset the increased risk associated with the policyholder’s circumstances.

Can I negotiate quotes in my life insurance policy?

+

While quotes are typically standard and non-negotiable, you can discuss your concerns and circumstances with your insurer. In some cases, insurers may offer alternative policies or add-ons that better suit your needs and budget.

Are there any emerging trends in life insurance policies?

+

Yes, the life insurance industry is evolving with several emerging trends. These include digital transformation, personalized policies, health and wellness incentives, and the integration of blockchain and smart contracts, all of which aim to enhance the policyholder’s experience and coverage.

How often should I review my life insurance policy?

+

It’s recommended to review your life insurance policy periodically, especially if your circumstances change significantly. Major life events like marriage, having children, or changes in health status should trigger a review to ensure your policy still meets your needs.