Medical Insurance Enrollment Period

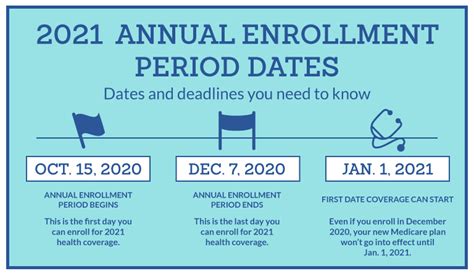

The Medical Insurance Enrollment Period is a critical time for individuals and families to review, select, and enroll in healthcare coverage. This annual event, often referred to as the Open Enrollment Period, allows people to assess their insurance needs, compare different plans, and make informed decisions to secure their health and financial well-being for the upcoming year.

Understanding the Open Enrollment Period

The Open Enrollment Period is a designated timeframe set by the government and insurance providers, during which anyone can enroll in a health insurance plan, regardless of their health status. This period ensures that individuals have the opportunity to access affordable healthcare and protects them from being denied coverage due to pre-existing conditions.

The exact dates of the enrollment period can vary depending on the region and the specific insurance marketplace. For instance, in the United States, the Affordable Care Act (ACA) typically sets a nationwide Open Enrollment Period, often lasting from November through December, with some states offering extended enrollment periods.

Key Features of the Enrollment Period

- Guaranteed Issue: During this period, insurance companies cannot refuse to sell a plan or charge more based on an individual's health status. This ensures that everyone has equal access to healthcare coverage.

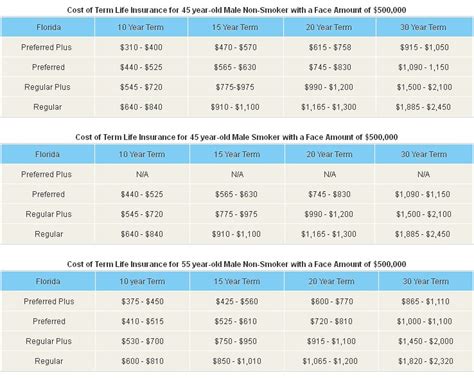

- Plan Comparison: The enrollment period encourages a thorough evaluation of different health insurance plans. This includes comparing costs, coverage details, provider networks, and additional benefits to find the best fit for one's healthcare needs.

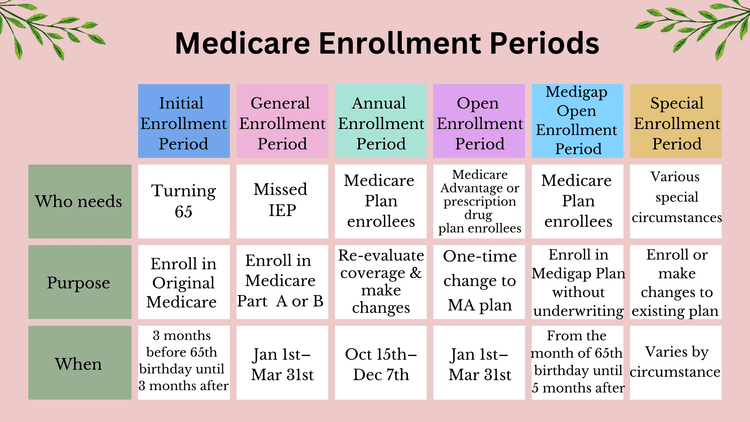

- Special Enrollment Periods: Outside the standard Open Enrollment Period, individuals may qualify for a Special Enrollment Period (SEP) if they experience certain life events, such as marriage, birth or adoption of a child, loss of other coverage, or a change in income.

Navigating the Enrollment Process

Enrolling in a health insurance plan can be a complex process, but with the right tools and resources, it can be streamlined and less daunting.

Steps to Enrollment

- Assess Your Needs: Begin by understanding your healthcare needs and those of your family. Consider factors like regular medical appointments, prescription medications, and potential future healthcare requirements.

- Research Plans: Explore the various health insurance plans available. Compare their premiums, deductibles, copayments, and out-of-pocket maximums. Also, examine the plan's coverage for essential health benefits, such as hospitalization, prescription drugs, and mental health services.

- Understand Network Providers: Health insurance plans often have networks of healthcare providers. It's crucial to check if your current doctors and preferred hospitals are included in the plan's network to avoid unexpected costs.

- Evaluate Additional Benefits: Some plans offer extra benefits like dental, vision, or wellness programs. Consider if these add-ons are valuable for your personal situation.

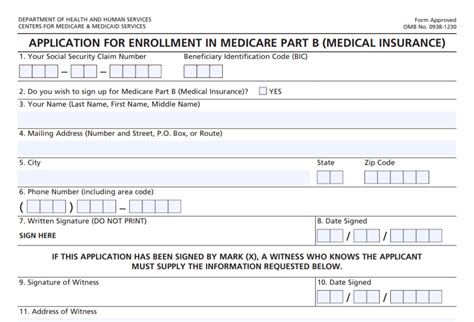

- Apply and Enroll: Once you've selected a plan, complete the application process. This usually involves providing personal and financial information, and in some cases, verifying your identity.

Tips for a Smooth Enrollment

- Start Early: Begin your research well before the enrollment period opens. This gives you ample time to compare plans, understand the terminology, and make an informed decision.

- Use Online Tools: Many insurance providers and government websites offer online tools and calculators to help you estimate costs and choose the right plan. These resources can simplify the comparison process.

- Seek Assistance: If you're unsure about the process or have specific questions, consider reaching out to insurance brokers or navigators. They can provide guidance tailored to your situation.

- Review Your Coverage: Don't forget to review your current coverage during the enrollment period. Even if you're satisfied with your existing plan, it's essential to ensure it still meets your needs and that the terms and conditions haven't changed.

The Impact of the Enrollment Period

The Medical Insurance Enrollment Period plays a pivotal role in the healthcare landscape, influencing the accessibility and affordability of healthcare for millions of people.

Access to Healthcare

The enrollment period ensures that individuals and families can secure healthcare coverage, even if they have pre-existing conditions or face financial challenges. This access to healthcare services is crucial for maintaining overall health and well-being.

Financial Protection

Health insurance provides financial protection against the high costs of medical care. During the enrollment period, individuals can choose plans that align with their budget and healthcare needs, ensuring they are not burdened with unaffordable medical expenses.

Public Health Benefits

By encouraging widespread enrollment, the Medical Insurance Enrollment Period contributes to improved public health. Increased access to healthcare services can lead to early detection and treatment of diseases, better management of chronic conditions, and overall healthier communities.

| Key Enrollment Metrics | Relevant Data |

|---|---|

| Number of Enrollees | In the U.S., over 13.8 million people enrolled in healthcare coverage through the Affordable Care Act (ACA) Marketplace during the 2022 Open Enrollment Period. |

| Enrollment Trends | Enrollment has been steadily increasing over the years, with a notable rise in younger adults signing up for coverage. |

| Impact on Uninsured Rates | The Open Enrollment Period has significantly reduced the number of uninsured individuals in the U.S., especially among low-income and minority populations. |

Frequently Asked Questions

What happens if I miss the Open Enrollment Period?

+

If you miss the Open Enrollment Period, you may still be able to enroll in a health insurance plan if you qualify for a Special Enrollment Period (SEP). A SEP is triggered by specific life events, such as losing other health coverage, getting married, having a baby, or moving to a new area. During a SEP, you have a limited window to enroll in a plan without the need for a guaranteed issue.

Can I change my health insurance plan during the Open Enrollment Period?

+

Yes, the Open Enrollment Period is a time when you can not only enroll in a new plan but also switch to a different plan that better suits your needs. This is an opportunity to review your current coverage, compare it with other available options, and make a change if necessary. Keep in mind that the specifics of plan changes during the enrollment period may vary depending on your region and the insurance marketplace.

Are there any age restrictions for enrolling in health insurance during the Open Enrollment Period?

+

No, there are typically no age restrictions during the Open Enrollment Period. Anyone, regardless of age, can enroll in a health insurance plan during this time. This includes young adults, middle-aged individuals, and seniors. It’s an opportunity for all to assess their healthcare needs and select an appropriate plan.

How do I know if I’m eligible for financial assistance during the enrollment period?

+

Eligibility for financial assistance during the enrollment period depends on your income and family size. Generally, if your household income is below a certain threshold (which varies by state and family size), you may qualify for subsidies to help cover the cost of your health insurance premiums. It’s advisable to use the online calculators or consult with an insurance broker to determine your eligibility and the amount of financial assistance you may receive.