Insurance For Commercial Buildings

Insurance is an essential aspect of safeguarding commercial buildings, protecting businesses from potential financial losses and ensuring their long-term viability. This comprehensive guide will delve into the world of insurance for commercial buildings, exploring the various aspects that business owners need to consider to secure adequate coverage. From understanding the different types of policies to assessing risks and choosing the right provider, we'll cover it all, ensuring you have the knowledge to make informed decisions.

Understanding the Need for Commercial Building Insurance

Commercial building insurance is a critical component of any business’s risk management strategy. It provides a safety net against unforeseen events, such as natural disasters, fires, vandalism, or even liability claims. Without adequate insurance, businesses could face devastating financial consequences, potentially leading to bankruptcy or closure.

The purpose of this insurance is to offer financial protection and peace of mind. It covers not only the physical structure of the building but also its contents, including valuable equipment, inventory, and fixtures. Furthermore, it extends to liability coverage, safeguarding the business against claims arising from accidents or injuries that occur on the premises.

The need for commercial building insurance is further emphasized by the potential impact of unforeseen events. For instance, a fire could not only destroy the building and its contents but also disrupt business operations, resulting in lost revenue and productivity. Insurance provides the means to rebuild and recover, ensuring the business can continue to operate and fulfill its obligations to customers, employees, and stakeholders.

Types of Commercial Building Insurance Policies

Commercial building insurance policies come in various forms, each tailored to meet specific needs and cover different risks. Understanding the types available is crucial in selecting the right coverage for your business.

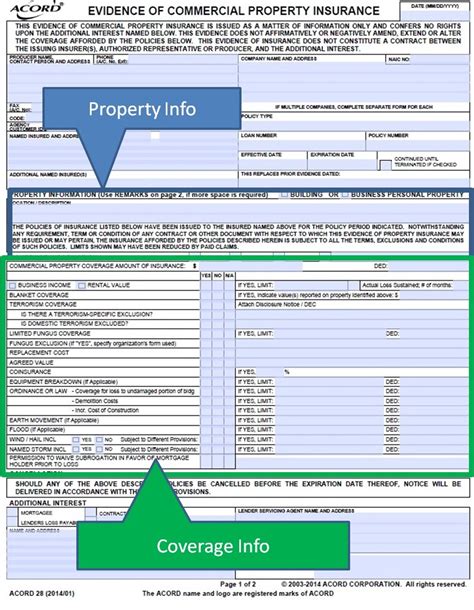

Property Insurance

Property insurance is the cornerstone of commercial building coverage. It protects the physical structure of the building, as well as its contents, from a wide range of perils, including fire, lightning, windstorms, hail, vandalism, and more. This type of insurance typically covers the cost of repairs or replacement, ensuring the building is restored to its pre-loss condition.

Additionally, property insurance may include coverage for business interruption, which compensates for lost income and ongoing expenses during the period when the business is unable to operate due to a covered loss. This coverage is essential for businesses to maintain financial stability during challenging times.

Liability Insurance

Liability insurance is designed to protect the business from claims arising from accidents, injuries, or property damage that occur on the premises. It covers the legal costs and any damages awarded against the business. This type of insurance is particularly crucial for businesses that host customers or the public, as it provides a safety net against potential lawsuits.

For example, if a customer slips and falls on a wet floor in your retail store, liability insurance would cover the costs associated with the claim, including medical expenses and legal fees. Without this coverage, the business could face significant financial strain and reputational damage.

Specialty Insurance

In addition to property and liability insurance, businesses may require specialty insurance policies to address unique risks. These policies are tailored to specific industries or types of businesses and offer coverage for specific perils or situations.

For instance, a technology company may require cyber liability insurance to protect against data breaches and cyber attacks. Similarly, a manufacturing business might need product liability insurance to cover claims arising from defective products. These specialty policies ensure that businesses have comprehensive protection tailored to their specific needs.

Assessing Risks and Determining Coverage Needs

When it comes to commercial building insurance, assessing risks and determining coverage needs is a critical step. Every business is unique, and understanding the specific risks it faces is essential to securing adequate protection.

Identifying Potential Risks

Start by conducting a thorough risk assessment. Consider the location of your business and the potential natural disasters or weather-related risks it may face, such as hurricanes, floods, or earthquakes. Assess the likelihood of fires, vandalism, or theft, and evaluate the risk of liability claims, especially if your business regularly interacts with the public.

For example, if your business is located in a flood-prone area, you'll want to ensure that your policy includes flood coverage. Similarly, if your business involves hazardous materials or heavy machinery, you'll need to consider additional liability coverage to protect against potential accidents or environmental damage.

Calculating Coverage Amounts

Once you’ve identified the potential risks, it’s time to calculate the appropriate coverage amounts. This involves determining the value of your building, its contents, and any other assets that need protection. It’s crucial to be accurate in this assessment to ensure you have sufficient coverage in the event of a loss.

Consider the cost of rebuilding your commercial building to its pre-loss condition. This includes not only the physical structure but also the cost of replacing equipment, furniture, and inventory. Additionally, factor in the potential loss of income during the rebuilding process, as this can have a significant financial impact on your business.

Reviewing Policy Limits and Deductibles

When reviewing insurance policies, pay close attention to policy limits and deductibles. Policy limits represent the maximum amount the insurer will pay for a covered loss, while deductibles are the portion of the loss that the insured must pay out of pocket before the insurance coverage kicks in.

Ensure that the policy limits are sufficient to cover the potential losses your business may face. For instance, if your building and its contents are valued at $2 million, you'll want to ensure your policy limits are at least that amount, if not higher, to provide adequate protection.

Deductibles can vary significantly between policies. While higher deductibles may result in lower premiums, it's important to consider whether your business can afford to pay the deductible in the event of a claim. Striking the right balance between deductibles and premiums is crucial to ensure your business can handle potential out-of-pocket expenses.

Choosing the Right Insurance Provider

Selecting the right insurance provider is a critical decision that can significantly impact the effectiveness of your commercial building insurance coverage. Here’s a closer look at the factors to consider when choosing an insurance company.

Reputation and Financial Stability

Start by researching the reputation and financial stability of potential insurance providers. Look for companies with a solid track record of paying claims promptly and fairly. A company with a strong financial foundation is more likely to be able to meet its obligations, even in the face of large-scale disasters.

Consider seeking out companies that have been in business for a significant period, as this often indicates stability and experience. You can also refer to financial rating agencies, such as AM Best or Moody's, to assess the financial strength and creditworthiness of insurance providers.

Coverage Options and Customization

Different businesses have unique needs, and the ability to customize insurance coverage is crucial. Look for insurance providers that offer a wide range of coverage options and the flexibility to tailor policies to your specific requirements.

For instance, if your business has specialized needs, such as coverage for fine art or high-value equipment, ensure the provider offers endorsements or riders to add this coverage to your policy. The ability to customize your insurance ensures that you're not paying for coverage you don't need while still maintaining comprehensive protection.

Claims Handling Process and Customer Service

The claims handling process and customer service are critical aspects of any insurance provider. You want to choose a company that has a reputation for efficient and fair claims handling. Look for providers that offer 24⁄7 claims reporting and have a streamlined process for documenting and processing claims.

Additionally, consider the level of customer service provided. Are their representatives easily accessible and knowledgeable? Do they offer resources and guidance to help you understand your coverage and navigate the claims process? Choosing an insurance provider with excellent customer service ensures you have the support you need when it matters most.

Comparing Quotes and Premiums

Finally, it’s essential to compare quotes and premiums from different insurance providers. While cost is an important consideration, it shouldn’t be the sole factor in your decision. Remember that the cheapest policy may not offer the coverage you need, and a higher-priced policy could provide significant benefits in terms of coverage and claims handling.

When comparing quotes, ensure you're comparing apples to apples. Look at the coverage limits, deductibles, and exclusions to ensure you're getting a true comparison. Consider the value you're receiving for your premium, taking into account the coverage provided and the reputation and stability of the insurance provider.

Obtaining and Maintaining Commercial Building Insurance

Once you’ve chosen the right insurance provider and secured the appropriate coverage, the work isn’t over. Obtaining commercial building insurance is just the beginning; maintaining and reviewing your policy is an ongoing process to ensure your business remains protected.

Obtaining the Policy

When obtaining your commercial building insurance policy, ensure you thoroughly review the terms and conditions. Understand the coverage limits, deductibles, and any exclusions or limitations. Don’t hesitate to ask questions or seek clarification on any aspect of the policy to ensure you have a clear understanding of your coverage.

It's also a good idea to keep a copy of your policy documents in a secure location, both physically and digitally. This ensures you have easy access to the details of your coverage in the event of a claim or if you need to make any changes to your policy.

Regular Policy Reviews

Commercial building insurance policies should be reviewed regularly to ensure they remain up-to-date and aligned with your business’s needs. As your business grows, changes locations, or experiences other significant changes, your insurance coverage may need to be adjusted accordingly.

For instance, if you've expanded your business and acquired additional property or equipment, you'll want to ensure your policy limits are increased to cover these new assets. Regular policy reviews also provide an opportunity to reassess your risks and ensure you have the appropriate coverage in place.

Keeping Records and Documentation

Maintaining accurate records and documentation is crucial when it comes to commercial building insurance. Keep detailed records of your building’s value, including any improvements or upgrades, as well as the value of its contents. This documentation will be invaluable in the event of a claim, ensuring you receive the full compensation you’re entitled to.

Additionally, keep records of any maintenance or repair work done on the building. This information can be useful in demonstrating the condition of the property and its upkeep, which may impact your insurance coverage and claims process.

Understanding Exclusions and Limitations

Every insurance policy has exclusions and limitations, and it’s important to understand these nuances. Exclusions are specific situations or perils that are not covered by the policy, while limitations refer to restrictions on coverage, such as policy limits or deductibles.

By understanding the exclusions and limitations of your policy, you can take steps to mitigate these risks or explore additional coverage options. For instance, if your policy excludes coverage for flood damage, you may want to consider purchasing separate flood insurance to protect your business in the event of a flood.

Conclusion: Protecting Your Business’s Future

Commercial building insurance is a vital component of any business’s risk management strategy. By understanding the types of policies available, assessing risks, and choosing the right provider, you can secure the protection your business needs to thrive. Obtaining and maintaining adequate insurance coverage ensures your business can weather unforeseen events and continue to serve its customers and stakeholders.

Remember, insurance is not just about financial protection; it's about safeguarding your business's future and ensuring its long-term viability. With the right insurance coverage in place, you can have the peace of mind to focus on growing and innovating your business, knowing you're protected against potential losses.

What are the common exclusions in commercial building insurance policies?

+Common exclusions in commercial building insurance policies may include damage caused by floods, earthquakes, nuclear incidents, and wear and tear. It’s essential to review the policy carefully to understand the specific exclusions and limitations.

How often should I review my commercial building insurance policy?

+It’s recommended to review your policy annually or whenever significant changes occur in your business, such as expansions, relocations, or significant upgrades to your building or equipment.

Can I bundle my commercial building insurance with other types of business insurance?

+Yes, many insurance providers offer bundling options, allowing you to combine multiple types of insurance, such as property, liability, and business interruption coverage, into a single policy. Bundling can often result in cost savings and simplified policy management.