Private Mortgage Insurance Definition

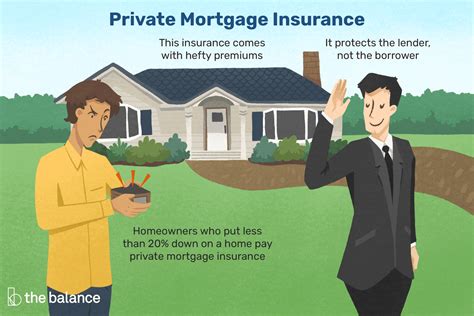

Private Mortgage Insurance, commonly known as PMI, is a vital component of the home buying process for many prospective homeowners. It is a safeguard that provides protection to lenders and enables borrowers to secure a mortgage with a lower down payment, typically less than 20% of the home's purchase price. Understanding PMI is essential for anyone considering homeownership, as it can significantly impact the overall cost of buying a home and the terms of your mortgage.

Understanding Private Mortgage Insurance (PMI)

PMI is a type of insurance policy that protects lenders from potential losses if a borrower defaults on their mortgage loan. This insurance is typically required when the borrower’s down payment is less than 20% of the home’s value. By purchasing PMI, borrowers can access more favorable mortgage terms and rates, making homeownership more attainable.

The primary purpose of PMI is to mitigate the risk associated with low-equity loans. Lenders often view loans with a small down payment as riskier, as the borrower has less skin in the game. PMI acts as a safety net, assuring the lender that, in the event of default, they will not incur a significant financial loss.

While PMI is an additional cost for borrowers, it can be a worthwhile investment. It allows individuals to purchase a home sooner, even if they haven't saved up the traditional 20% down payment. This can be particularly beneficial for first-time homebuyers or those who may not have access to substantial funds.

How PMI Works

When a borrower applies for a conventional mortgage with a down payment of less than 20%, the lender will likely require PMI. The borrower pays a premium, which is typically added to their monthly mortgage payment. This premium is calculated based on factors such as the loan amount, loan-to-value ratio, credit score, and the type of mortgage.

PMI is designed to cover a portion of the loan amount, usually ranging from 20% to 25% of the original loan value. This coverage ensures that, in the event of default, the lender can recover the remaining balance of the loan. As the borrower pays down the mortgage, their equity in the home increases, and eventually, they may be able to cancel PMI.

It's important to note that PMI is different from mortgage insurance provided by government entities like the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). These government-backed programs have their own rules and requirements for mortgage insurance, which are distinct from private PMI.

| Key Differences | Private PMI | Government-Backed Programs |

|---|---|---|

| Eligibility | Conventional loans with < 20% down payment | FHA loans, VA loans, and other government-insured programs |

| Premium Costs | Typically based on loan amount and credit score | Often lower and may be included in the loan amount |

| Cancellation | Can be canceled when the borrower reaches 20-25% equity | May have different requirements or automatic cancellation triggers |

Benefits of Private Mortgage Insurance

PMI offers several advantages to both borrowers and lenders:

- Lower Barrier to Entry: PMI allows borrowers to purchase a home with a smaller down payment, making homeownership more accessible.

- Competitive Interest Rates: Lenders often offer more favorable interest rates on loans with PMI, as the insurance reduces their risk.

- Flexibility: Borrowers can choose from various PMI options, including single-premium PMI or monthly premium payments, depending on their financial situation.

- Equity Building: As borrowers make mortgage payments and their home's value appreciates, they build equity, which can lead to the cancellation of PMI.

Canceling Private Mortgage Insurance

Borrowers can cancel PMI once they reach a certain level of equity in their home. This is typically when the loan-to-value ratio (LTV) reaches 80%, meaning the borrower has paid down their mortgage to the point where they owe 80% or less of the home’s original value. However, the exact cancellation requirements can vary depending on the lender and the type of mortgage.

To cancel PMI, borrowers may need to request cancellation from their lender and provide documentation of their current home value. Some lenders may automatically cancel PMI when the loan reaches a certain point in its term, regardless of the LTV.

The Impact of PMI on Homeownership

PMI has a significant impact on the home buying process and can influence a borrower’s financial decisions. Here’s how it can affect various aspects of homeownership:

Affordability and Down Payments

PMI allows borrowers to purchase a home sooner by reducing the required down payment. This can be especially beneficial for those who are just starting their careers or have limited savings. However, it’s essential to consider the long-term costs of PMI, as it can add thousands of dollars to the overall cost of the mortgage.

Monthly Mortgage Payments

The addition of PMI to a borrower’s monthly mortgage payment can increase their monthly financial obligations. Borrowers should carefully consider their budget and ensure they can afford the higher monthly payments associated with PMI.

Loan Terms and Interest Rates

Lenders often offer better interest rates and more flexible loan terms for loans with PMI. This can result in significant savings over the life of the loan, making it a worthwhile consideration for borrowers.

Home Equity and Resale Value

PMI can impact a borrower’s home equity and resale value. As the borrower pays down the mortgage and the home’s value appreciates, they build equity. This equity can lead to the cancellation of PMI and provide a financial cushion if the borrower decides to sell their home.

Financial Planning and Strategy

Borrowers should carefully plan their financial strategy when considering PMI. They should weigh the benefits of a lower down payment and more accessible homeownership against the long-term costs of PMI. It’s also essential to consider how PMI fits into their overall financial goals and plans.

Alternative Options to Private Mortgage Insurance

While PMI is a common and often necessary component of the home buying process, there are alternative options available for borrowers. These alternatives can provide similar benefits without the added cost of PMI.

Higher Down Payment

One of the most straightforward ways to avoid PMI is by making a larger down payment. By putting down 20% or more of the home’s purchase price, borrowers can often avoid PMI altogether. This option requires more savings upfront but can save thousands of dollars in PMI premiums over the life of the loan.

Government-Backed Loans

Government-backed loans, such as FHA loans, VA loans, and USDA loans, often have lower down payment requirements and include mortgage insurance as part of the loan. While this insurance is similar to PMI, it may have different rules and requirements for cancellation.

Piggyback Loans

A piggyback loan, also known as a 80-10-10 loan, is a strategy where the borrower takes out two loans to purchase a home. The primary loan covers 80% of the home’s value, while the second loan, often called a piggyback loan, covers 10% of the value. The borrower then provides a 10% down payment. This strategy can avoid PMI, as the primary loan is less than 80% of the home’s value.

Lender-Paid Mortgage Insurance (LPMI)

In some cases, lenders may offer LPMI, where the lender pays the mortgage insurance premium on behalf of the borrower. This can be a more affordable option for borrowers, as the premium is typically rolled into the interest rate of the loan. However, it’s essential to note that LPMI may result in a higher overall interest rate.

Conclusion

Private Mortgage Insurance is a critical component of the home buying process, offering protection to lenders and accessibility to borrowers. While PMI can add to the overall cost of a mortgage, it provides an opportunity for individuals to purchase a home sooner and with more favorable loan terms. Understanding the ins and outs of PMI is essential for anyone considering homeownership, as it can significantly impact their financial decisions and long-term goals.

Frequently Asked Questions

Can I avoid PMI if I have a good credit score?

+While a good credit score is essential for obtaining favorable mortgage terms, it may not be enough to avoid PMI. PMI is typically required for conventional loans with a down payment of less than 20%, regardless of credit score. However, a higher credit score can lead to lower PMI premiums and more favorable loan terms.

How long do I have to pay PMI?

+The duration of PMI payments can vary depending on the lender and the type of mortgage. Generally, borrowers pay PMI until their loan-to-value ratio (LTV) reaches 80%, at which point they may be eligible to cancel PMI. Some loans may have automatic cancellation triggers, while others may require borrowers to request cancellation.

Can I refinance my loan to remove PMI?

+Refinancing can be an option to remove PMI, but it depends on several factors. If your home’s value has increased since you purchased it, you may be able to refinance with a higher loan amount and remove PMI. However, refinancing comes with its own costs and considerations, so it’s essential to weigh the pros and cons.

Are there any disadvantages to PMI?

+While PMI provides benefits to both borrowers and lenders, it does come with some drawbacks. The most significant disadvantage is the additional cost of PMI premiums, which can add thousands of dollars to the overall cost of the mortgage. Additionally, PMI can make monthly mortgage payments more expensive and may impact a borrower’s ability to qualify for other loans or financial products.