Personal Liability Insurance Renters

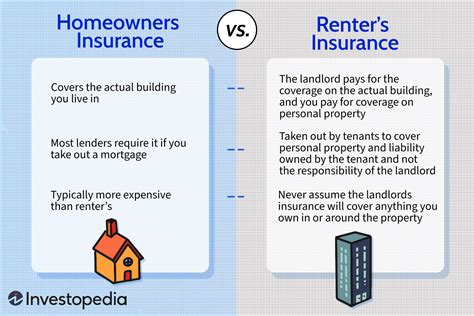

Personal liability insurance is a crucial aspect of financial planning, especially for individuals who rent their homes. Renters may often overlook the importance of this coverage, assuming that their landlord's insurance will protect them in case of any unforeseen incidents. However, the reality is quite different, and understanding the role and benefits of personal liability insurance is essential for every renter.

In this comprehensive guide, we will delve into the world of personal liability insurance for renters, exploring its intricacies, benefits, and real-life applications. By the end of this article, you will have a clear understanding of why this type of insurance is a must-have for renters and how it can provide invaluable protection in various situations.

Understanding Personal Liability Insurance

Personal liability insurance, often simply referred to as liability insurance, is a type of coverage that protects individuals from financial losses resulting from claims of bodily injury or property damage caused by the policyholder or their family members. It provides a safety net for individuals, offering financial assistance in cases where they are held legally responsible for causing harm or damage to others.

For renters, personal liability insurance is particularly important as it covers a wide range of potential incidents that may occur within or around their rented property. These incidents can include accidents that result in bodily harm to guests, damage to the landlord's property, or even lawsuits filed against the renter for alleged negligence.

The Role of Personal Liability Insurance for Renters

Renters often assume that their landlord's insurance will cover any damages or injuries that occur within the rented property. However, this is a common misconception. Landlord insurance policies typically cover the building and its structure, but they do not extend to the personal belongings or actions of the tenants.

Here's a real-life scenario to illustrate the importance of personal liability insurance for renters: Imagine you're hosting a dinner party at your rented apartment. During the evening, one of your guests slips and falls, breaking their arm. The guest decides to file a lawsuit against you, claiming that your negligence caused their injury. Without personal liability insurance, you would be solely responsible for covering the medical expenses and any legal fees associated with the lawsuit.

This is where personal liability insurance steps in as a vital protection. It provides financial coverage for the medical costs, legal defense, and potential settlements or judgments arising from such incidents. By having this insurance, renters can rest assured that they are protected against the potentially devastating financial consequences of such situations.

Coverage and Benefits of Personal Liability Insurance

Personal liability insurance offers a comprehensive range of coverage and benefits, ensuring that renters are well-protected in various scenarios. Here's an overview of the key aspects of this insurance:

Bodily Injury Coverage

This coverage applies when an individual is injured on the renter's property or as a result of the renter's actions. It covers medical expenses, pain and suffering, and loss of income for the injured party. For instance, if a visitor trips over a loose rug in your apartment and sustains an injury, bodily injury coverage would step in to cover the necessary medical treatments.

Property Damage Coverage

Property damage coverage is crucial for renters, as it protects against claims of damage to the landlord's property or a neighbor's belongings. Whether it's a burst pipe that floods the apartment below or an accidental fire that damages the building, this coverage ensures that the renter is not held financially responsible for such incidents.

Legal Defense and Settlement Costs

In the event of a lawsuit, personal liability insurance provides coverage for legal defense costs. This includes hiring an attorney, court fees, and any settlements or judgments awarded against the renter. Having this coverage ensures that renters have the necessary resources to defend themselves and avoid personal financial ruin.

Personal Liability Coverage Extensions

Personal liability insurance policies often come with additional coverage extensions that further enhance protection. These may include coverage for slander or libel claims, personal injury claims (such as false arrest or invasion of privacy), and even coverage for accidents that occur away from the rented property, providing global protection for the policyholder.

Real-Life Examples of Personal Liability Insurance in Action

To better understand the impact and benefits of personal liability insurance, let's explore some real-life scenarios where this coverage has proven to be invaluable for renters.

Scenario 1: Guest Injury

Imagine a renter, John, who frequently hosts his friends for game nights at his apartment. During one such gathering, a friend accidentally trips over a loose board on the balcony, sustaining a serious injury. The friend sues John for negligence, demanding compensation for medical expenses and pain and suffering. With personal liability insurance, John's policy covers the legal fees, medical costs, and any settlement reached, providing him with the necessary financial support to navigate this challenging situation.

Scenario 2: Property Damage

Emily, a tenant in a shared apartment building, accidentally starts a fire while cooking. The fire spreads to the neighboring unit, causing significant damage. Without personal liability insurance, Emily would be responsible for covering the repairs and any additional living expenses for the affected neighbors. However, with this coverage, her insurance provider steps in to handle the financial burden, ensuring that she is not left with a massive debt.

Scenario 3: Legal Defense

David, a renter, is accused of causing bodily harm to a neighbor during a heated argument. The neighbor files a lawsuit, seeking compensation for medical bills and emotional distress. David's personal liability insurance policy provides him with legal representation, covering the costs of hiring a lawyer and any court-related expenses. This coverage ensures that David has access to a fair defense and protects him from potentially overwhelming legal fees.

Performance Analysis and Expert Insights

According to industry experts, personal liability insurance is an essential component of a renter's financial safety net. The potential risks and liabilities associated with renting a property are diverse and can have significant financial implications. By investing in personal liability insurance, renters can protect themselves from these risks and avoid the devastating consequences of unexpected incidents.

Industry data reveals that the average cost of personal liability insurance for renters is relatively affordable, ranging from $150 to $300 per year, depending on the coverage limits and the renter's location. This investment provides peace of mind and ensures that renters are prepared for any unforeseen circumstances that may arise.

Furthermore, personal liability insurance offers additional benefits beyond coverage for specific incidents. Many policies include access to legal advice and assistance, providing renters with valuable resources to navigate complex legal matters. This added layer of support can be invaluable in situations where renters require guidance on their rights and responsibilities.

| Coverage Type | Average Cost per Year |

|---|---|

| Basic Personal Liability Insurance | $150-$200 |

| Enhanced Coverage (Increased Limits) | $200-$300 |

In the event of a claim, the claims process for personal liability insurance is straightforward. Renters can file a claim with their insurance provider, providing details of the incident and any relevant documentation. The insurance company will then assess the claim, investigate the circumstances, and determine the appropriate level of coverage and compensation. This process ensures that renters receive timely and efficient support during challenging times.

Future Implications and Industry Trends

Looking ahead, the importance of personal liability insurance for renters is only expected to grow. With increasing awareness of the potential risks and liabilities associated with renting, more individuals are recognizing the value of this coverage. Insurance providers are also adapting to meet the changing needs of renters, offering customized policies and enhanced benefits to cater to a wider range of situations.

As the rental market continues to evolve, personal liability insurance is likely to become an even more integral part of renters' financial strategies. With the rising cost of healthcare and legal fees, having this coverage in place can provide a crucial safety net, ensuring that renters are not left vulnerable to the financial burdens of unexpected incidents.

Additionally, advancements in technology are expected to play a significant role in the future of personal liability insurance. Insurance providers are leveraging data analytics and digital tools to enhance the efficiency and accuracy of claims processes. This means that renters can anticipate faster claim settlements and more streamlined interactions with their insurance providers.

Frequently Asked Questions (FAQ)

How much does personal liability insurance typically cost for renters?

+The cost of personal liability insurance for renters varies depending on several factors, including the coverage limits, the renter's location, and any additional endorsements. On average, basic personal liability insurance ranges from $150 to $200 per year, while enhanced coverage with higher limits can cost between $200 and $300 annually.

What happens if I don't have personal liability insurance and an incident occurs on my rented property?

+If you don't have personal liability insurance and an incident occurs on your rented property that results in bodily injury or property damage, you may be held financially responsible for the resulting costs. This could include medical expenses, legal fees, and any settlements or judgments awarded against you. Without insurance coverage, these costs can be devastating and may lead to significant financial hardship.

Can personal liability insurance cover incidents that occur outside of my rented property?

+Yes, many personal liability insurance policies include coverage for incidents that occur away from your rented property. This coverage, known as "global protection" or "personal liability coverage extensions," ensures that you are protected even when accidents happen outside of your immediate living space.

How do I choose the right personal liability insurance coverage limits for my needs?

+When selecting personal liability insurance coverage limits, consider your financial situation and the potential risks associated with your rented property. Experts recommend choosing limits that align with your assets and liabilities. It's important to strike a balance between having adequate coverage and keeping the cost of insurance manageable. Consult with an insurance professional to determine the right coverage limits for your specific circumstances.

What should I do if I need to file a claim under my personal liability insurance policy?

+If you need to file a claim under your personal liability insurance policy, contact your insurance provider as soon as possible. Provide them with all the necessary details about the incident, including any relevant documentation. Your insurance company will guide you through the claims process, assess the circumstances, and determine the appropriate level of coverage and compensation.

In conclusion, personal liability insurance is an indispensable tool for renters, offering protection against a wide range of potential incidents and liabilities. By investing in this coverage, renters can safeguard their financial well-being and navigate unexpected challenges with confidence. With the right personal liability insurance policy, renters can enjoy peace of mind, knowing they are prepared for whatever the future may bring.