Monthly Car Insurance Rates

When it comes to car insurance, one of the most significant factors that influence your overall costs is the monthly rate. Understanding how these rates are calculated and what affects them can help drivers make informed decisions about their coverage and potentially save money on their insurance premiums. In this comprehensive guide, we will delve into the world of monthly car insurance rates, exploring the key factors, providing real-world examples, and offering valuable insights to assist drivers in navigating this complex landscape.

Understanding Monthly Car Insurance Rates

Monthly car insurance rates are the recurring costs associated with maintaining an active insurance policy for your vehicle. These rates are typically calculated based on a variety of factors, each contributing to the overall premium you pay. It’s important to note that insurance providers use complex algorithms and data analysis to determine these rates, considering numerous variables that can impact the risk associated with insuring a particular driver.

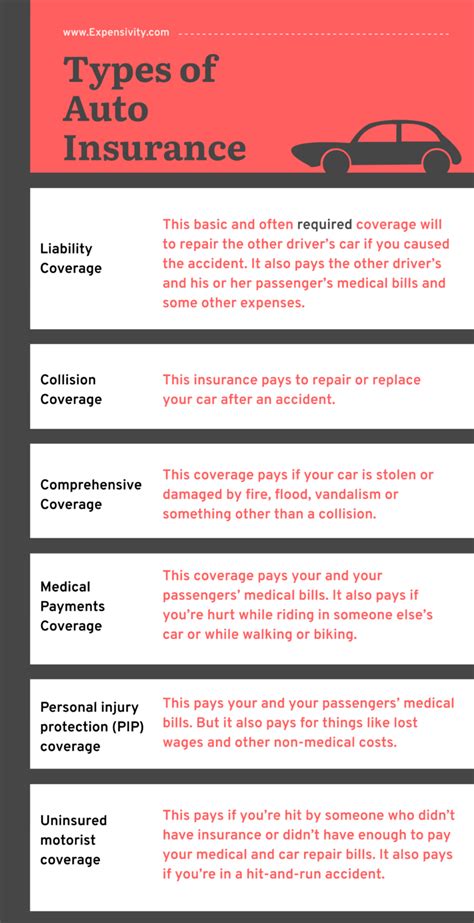

One of the primary considerations is the level of coverage you choose. Car insurance policies can vary significantly in terms of the types and limits of coverage they offer. For instance, a basic liability-only policy will generally have lower monthly rates compared to a comprehensive policy that includes collision, comprehensive, and additional coverage options. The more coverage you opt for, the higher your monthly premiums are likely to be.

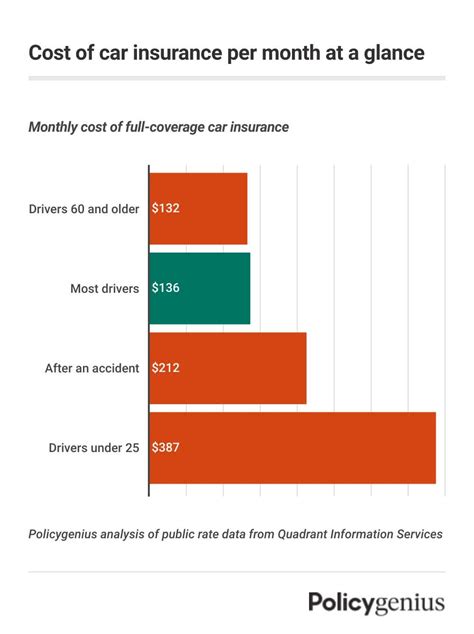

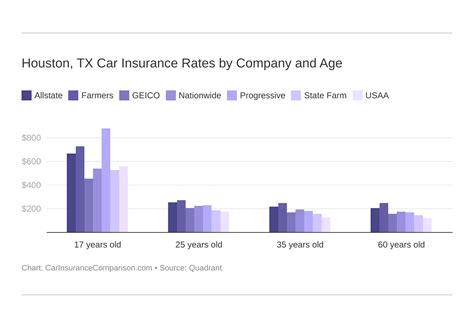

Additionally, insurance companies assess the risk profile of each driver. This involves evaluating various factors such as age, gender, driving history, and location. For example, younger drivers, particularly those under the age of 25, are often considered higher-risk and may face higher monthly rates due to their lack of experience on the road. Similarly, drivers with a history of accidents or traffic violations may also be charged higher premiums, as they are statistically more likely to file insurance claims.

Another crucial factor is the vehicle itself. Insurance providers take into account the make, model, and year of your car, as well as its safety ratings and repair costs. Vehicles that are more expensive to repair or have a higher likelihood of being involved in accidents may result in higher monthly rates. Additionally, certain vehicle modifications or customizations can also impact your insurance costs.

Factors Influencing Monthly Rates

The calculation of monthly car insurance rates is a complex process that involves numerous variables. Let’s explore some of the key factors that can significantly impact your insurance premiums:

Driving Record

Your driving history plays a pivotal role in determining your monthly rates. Insurance companies closely examine your record to assess your level of risk. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic citations may result in higher rates. For instance, let’s consider a hypothetical case where Driver A has a perfect driving record for the past 10 years, while Driver B has been involved in multiple accidents and received several speeding tickets. Insurance providers would likely offer Driver A more favorable rates due to their proven safe driving behavior.

Credit Score

Believe it or not, your credit score can also influence your monthly car insurance rates. Many insurance companies use credit-based insurance scoring to assess the risk associated with insuring a particular individual. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Drivers with higher credit scores are often viewed as more responsible and may be offered lower premiums. On the other hand, individuals with lower credit scores may face higher rates, as insurance providers perceive them as a higher risk.

Age and Gender

Age and gender are two demographic factors that insurance companies consider when calculating monthly rates. Statistically, younger drivers, especially those under the age of 25, are involved in a higher number of accidents compared to older, more experienced drivers. As a result, younger drivers often pay higher premiums. Similarly, gender can also play a role, with some insurance providers charging different rates for male and female drivers based on historical data. However, it’s important to note that the consideration of gender in insurance rates is a controversial topic, and some states have implemented regulations to limit its impact.

Location and Mileage

Your geographical location and the number of miles you drive annually can also affect your monthly insurance rates. Insurance providers analyze data on accident rates, crime statistics, and traffic conditions in different areas. Drivers residing in urban areas with higher populations and increased traffic congestion may face higher premiums due to the elevated risk of accidents. Additionally, the number of miles you drive each year can impact your rates, as higher mileage often correlates with a greater chance of being involved in an accident.

| Factor | Impact on Rates |

|---|---|

| Clean Driving Record | Lower Rates |

| High Credit Score | Lower Rates |

| Young Age (Under 25) | Higher Rates |

| Urban Location | Higher Rates |

| High Annual Mileage | Higher Rates |

Strategies to Lower Monthly Car Insurance Rates

While various factors influence your monthly car insurance rates, there are strategies you can employ to potentially reduce your premiums. Here are some effective approaches to consider:

Shop Around and Compare

One of the simplest yet most powerful strategies is to compare quotes from multiple insurance providers. Each company has its own rating system and considerations, so getting quotes from several insurers can help you identify the most competitive rates for your specific situation. Online comparison tools and insurance broker services can streamline this process, allowing you to quickly assess multiple options.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, known as a multi-policy discount. By bundling your insurance, you can often save money on your monthly premiums and streamline your insurance management.

Maintain a Good Driving Record

As mentioned earlier, your driving record is a significant factor in determining your insurance rates. By maintaining a clean driving record and avoiding accidents or traffic violations, you can keep your monthly premiums low. Safe driving practices, such as obeying traffic laws, wearing seatbelts, and avoiding distracted driving, not only help prevent accidents but also contribute to a positive driving history.

Consider Higher Deductibles

Increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower monthly premiums. While this strategy may require a higher upfront payment in the event of a claim, it can result in significant savings on your monthly insurance costs. However, it’s important to choose a deductible amount that you can comfortably afford in case of an accident.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or memberships. Additionally, some insurers provide discounts for vehicles equipped with advanced safety features or anti-theft devices. By exploring the available discounts and meeting the criteria, you can potentially lower your monthly insurance rates.

Future Implications and Technological Advances

The world of car insurance is continuously evolving, and technological advancements are shaping the industry in significant ways. One notable development is the introduction of usage-based insurance, also known as pay-as-you-drive (PAYD) or pay-how-you-drive (PHYD) insurance. This innovative approach utilizes telematics devices or smartphone apps to monitor and analyze driving behavior, such as acceleration, braking, and mileage. Insurance providers then use this data to offer customized rates based on an individual’s actual driving habits.

Usage-based insurance has the potential to revolutionize the industry by providing more accurate assessments of risk and offering drivers the opportunity to take control of their insurance costs. For instance, drivers with safe and cautious driving habits may qualify for lower premiums, while those with riskier driving behaviors may face higher rates. This pay-as-you-drive model promotes safer driving practices and rewards responsible drivers with more affordable insurance options.

Furthermore, the integration of autonomous vehicle technology is expected to have a profound impact on car insurance in the future. As self-driving cars become more prevalent, insurance providers will need to adapt their policies and rates to accommodate this new paradigm. The reduced risk of human error and potential for safer roads may lead to lower insurance premiums for autonomous vehicle owners. However, the complex legal and liability issues surrounding autonomous vehicles will also play a significant role in shaping insurance rates and coverage.

In conclusion, understanding the factors that influence monthly car insurance rates is crucial for drivers looking to make informed decisions about their coverage. By considering variables such as driving record, credit score, age, location, and mileage, individuals can take proactive steps to potentially reduce their insurance premiums. Additionally, exploring strategies like shopping around, bundling policies, maintaining a good driving record, and utilizing available discounts can further contribute to lower monthly rates. As the car insurance industry continues to evolve with technological advancements, drivers can expect more personalized and data-driven insurance options in the future.

How often do car insurance rates change?

+Car insurance rates can change periodically, typically every six months or annually. However, certain life events or changes in your driving circumstances may trigger a rate adjustment at any time. It’s always a good idea to review your policy and compare quotes regularly to ensure you’re getting the best rates.

Can I negotiate my car insurance rates?

+Negotiating car insurance rates is not a common practice, as insurance providers use standardized rating systems. However, you can still shop around and compare quotes to find the most competitive rates for your specific situation. Additionally, discussing your coverage options and any available discounts with your insurance agent can help you optimize your policy.

What is the average monthly car insurance rate?

+The average monthly car insurance rate can vary significantly depending on factors such as location, driving record, and coverage levels. According to recent data, the national average monthly premium for minimum liability coverage is approximately 130, while full coverage policies can range from 150 to $200 per month. However, these averages are just estimates, and your actual rates may be higher or lower based on your individual circumstances.