Best Health Insurance In The Us

In the United States, health insurance is a critical component of the healthcare system, providing individuals and families with access to essential medical services and financial protection. With a vast array of options available, choosing the best health insurance plan can be a daunting task. This comprehensive guide aims to explore the landscape of health insurance in the US, offering expert insights and analysis to help readers make informed decisions about their coverage.

Understanding Health Insurance Options in the US

The US healthcare system offers a diverse range of health insurance plans, each with its own set of features, benefits, and limitations. Understanding the different types of insurance available is the first step in selecting the best plan for your needs.

Private Health Insurance

Private health insurance plans are typically offered by commercial insurance companies and are the most common form of coverage in the US. These plans can be further categorized into:

- Individual Plans: Designed for single individuals, these plans offer personalized coverage and can be customized to suit specific needs.

- Family Plans: Tailored for families, these plans provide comprehensive coverage for multiple members, often with cost-saving benefits.

- Employer-Sponsored Plans: Many employers offer health insurance as a benefit to their employees, providing access to group plans that may offer lower premiums.

Public Health Insurance

Public health insurance programs are government-funded and often cater to specific demographics or income levels. Some of the notable public insurance options in the US include:

- Medicare: A federal program primarily for individuals aged 65 and older, as well as those with certain disabilities. Medicare is divided into different parts, each covering specific aspects of healthcare.

- Medicaid: A state and federal program that provides healthcare coverage for low-income individuals and families. Eligibility criteria vary by state.

- Children’s Health Insurance Program (CHIP): This program provides low-cost health coverage for children in families who earn too much to qualify for Medicaid but cannot afford private insurance.

Specialized Health Insurance

In addition to the above, there are specialized health insurance plans designed for specific needs. These include:

- Dental and Vision Insurance: Separate plans that cover dental and vision care, often offered as supplementary coverage to primary health insurance plans.

- Short-Term Health Insurance: Designed for temporary coverage, these plans offer basic health benefits for a limited period, usually less than a year.

- Travel Health Insurance: Tailored for individuals traveling abroad, these plans provide coverage for medical emergencies and other health-related incidents during travel.

Key Factors to Consider When Choosing Health Insurance

When evaluating health insurance plans, several critical factors should be taken into consideration to ensure you select the best option for your specific needs.

Coverage and Benefits

Understanding the scope of coverage and the benefits provided is essential. Consider the following:

- In-Network Providers: Review the list of healthcare providers, including doctors, hospitals, and specialists, that are part of the plan’s network. In-network services are typically more affordable.

- Covered Services: Check the plan’s coverage for essential services like doctor visits, hospital stays, prescription drugs, mental health services, and preventive care.

- Pre-Existing Conditions: Ensure that the plan covers pre-existing conditions without imposing waiting periods or exclusions.

Cost and Financial Considerations

The financial aspects of health insurance are crucial. Here are some key cost-related factors to evaluate:

- Premiums: The amount you pay monthly to maintain your insurance coverage. Compare premiums across plans to find the most affordable option.

- Deductibles: The amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles often mean lower premiums.

- Copayments and Coinsurance: These are the amounts you pay for covered services after meeting your deductible. Copayments are fixed amounts, while coinsurance is a percentage of the total cost.

- Out-of-Pocket Maximum: This is the limit on how much you’ll pay out of pocket in a year for covered services. After reaching this maximum, the insurance plan covers 100% of the costs.

Network and Access to Care

The healthcare provider network and your access to care are vital aspects to consider:

- Network Size: A larger network often means more options for healthcare providers and facilities, potentially reducing out-of-pocket costs.

- Specialist Access: Ensure that the plan provides access to specialists in your area, especially if you have specific health needs or chronic conditions.

- Urgent Care and Emergency Services: Understand how the plan covers these services and whether there are any restrictions or additional costs involved.

Customer Service and Claims Process

The efficiency and responsiveness of the insurance provider’s customer service and claims handling can significantly impact your experience:

- Customer Support: Assess the availability and quality of customer support, including phone, email, and online assistance.

- Claims Processing: Review the claims process, including how claims are submitted, processed, and reimbursed. Look for plans with a straightforward and timely claims process.

- Member Portals and Apps: Check if the insurance provider offers digital tools for managing your coverage, viewing benefits, and submitting claims.

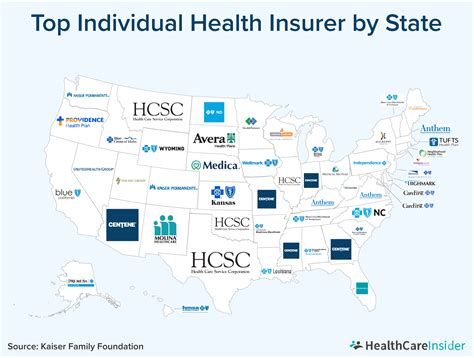

Performance Analysis of Leading Health Insurance Providers

To help you make an informed decision, let’s analyze some of the leading health insurance providers in the US based on key performance indicators and real-world experiences.

UnitedHealthcare

Overview: UnitedHealthcare is one of the largest health insurance providers in the US, offering a wide range of plans, including employer-sponsored, individual, and Medicare Advantage options. They have a strong focus on preventive care and wellness programs.

Performance Highlights:

- Excellent network of providers, covering over 1.3 million healthcare professionals and 6,500 hospitals.

- Offers innovative digital tools for managing health and accessing care, such as the UnitedHealthcare app.

- Known for its robust customer service, with a 24⁄7 nurse line and personalized health coaching.

Aetna

Overview: Aetna is a leading national health insurance provider, offering a comprehensive range of plans, including individual, family, and Medicare options. They emphasize personalized care and health management.

Performance Highlights:

- Extensive network of over 1.2 million healthcare professionals and 5,700 hospitals.

- Provides a range of wellness programs and tools, including online health assessments and personalized health plans.

- Offers a seamless digital experience with the Aetna Navigator app for managing health and benefits.

Blue Cross Blue Shield

Overview: Blue Cross Blue Shield is a federation of independent, locally operated insurance companies, offering plans across the US. They are known for their extensive network and personalized coverage options.

Performance Highlights:

- One of the largest healthcare provider networks, covering over 96% of the US population.

- Offers a wide range of plans, including individual, family, and employer-sponsored options, with customizable benefits.

- Provides access to Blue365, a program offering exclusive discounts on health and wellness products and services.

Cigna

Overview: Cigna is a global health service company, offering health insurance plans and wellness services in the US and internationally. They focus on integrated care and personalized health management.

Performance Highlights:

- Comprehensive network of over 1.3 million healthcare professionals and 6,200 hospitals.

- Provides access to the Cigna Health App, offering personalized health insights and care coordination.

- Offers a range of wellness programs, including stress management tools and personalized health coaching.

Humana

Overview: Humana is a leading health insurance provider, specializing in Medicare Advantage plans and offering a range of other insurance options. They emphasize personalized care and senior-focused wellness programs.

Performance Highlights:

- Extensive network of over 1.2 million healthcare professionals and 5,500 hospitals.

- Provides access to the Humana Vitality program, offering rewards and incentives for healthy behaviors.

- Offers a seamless digital experience with the Humana app for managing health and benefits, including telemedicine services.

Expert Insights and Recommendations

Based on the analysis of leading health insurance providers and an understanding of key performance indicators, here are some expert recommendations to help you choose the best health insurance plan for your needs:

Assess Your Health Needs

Before selecting a plan, evaluate your current and potential future health needs. Consider factors such as pre-existing conditions, chronic illnesses, and any specific healthcare services you may require regularly.

Compare Plans and Networks

Compare different insurance plans based on coverage, benefits, and cost. Pay close attention to the network of providers, ensuring that your preferred doctors and hospitals are included. Look for plans that offer flexibility and customization to align with your needs.

Evaluate Financial Considerations

Assess the financial implications of each plan, including premiums, deductibles, and out-of-pocket costs. Consider your budget and potential health expenses to find a balance between affordable coverage and comprehensive benefits.

Prioritize Customer Service

The quality of customer service and claims handling can significantly impact your experience. Choose a provider with a reputation for responsive and efficient customer support, ensuring that you have easy access to assistance when needed.

Consider Digital Tools and Wellness Programs

In today’s digital age, many insurance providers offer innovative tools and wellness programs to enhance your health management. Evaluate the availability and quality of these resources, as they can provide valuable support and convenience.

Seek Professional Advice

If you’re unsure about which plan to choose, consider consulting with an insurance broker or a financial advisor who specializes in health insurance. They can provide personalized guidance based on your specific circumstances and needs.

Conclusion

Choosing the best health insurance plan in the US requires a thorough understanding of your health needs, a careful evaluation of different plan options, and a consideration of key performance indicators. By following the expert insights and recommendations outlined in this guide, you can make an informed decision that ensures you and your loved ones have access to quality healthcare coverage.

What is the average cost of health insurance in the US?

+The average cost of health insurance varies based on factors such as age, location, and plan type. As of 2023, the average monthly premium for an individual plan is around 450, while family plans average around 1,150. However, these figures can vary significantly depending on the specific plan and provider.

Are there any government programs to assist with health insurance costs?

+Yes, the US government offers several programs to assist with health insurance costs. These include Medicaid for low-income individuals and families, Medicare for seniors and certain disabled individuals, and the Children’s Health Insurance Program (CHIP) for children in families with limited income. Additionally, the Affordable Care Act (ACA) provides tax credits and subsidies to help individuals and families purchase health insurance through the Health Insurance Marketplace.

Can I switch health insurance plans during the year?

+Generally, you can only switch health insurance plans during the annual Open Enrollment Period, which typically runs from November to January. However, certain life events, such as losing job-based coverage, getting married, or having a baby, may qualify you for a Special Enrollment Period, allowing you to enroll in a new plan outside of the regular Open Enrollment Period.

What are some tips for reducing health insurance costs?

+To reduce health insurance costs, consider the following tips: shop around for plans and compare premiums and benefits; evaluate high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs); take advantage of employer-sponsored plans, as they often offer lower premiums; and explore government programs like Medicaid or Medicare if eligible.