Monthly Auto Insurance

Welcome to this in-depth exploration of the world of Monthly Auto Insurance, a critical aspect of vehicle ownership and road safety. In this comprehensive guide, we'll delve into the ins and outs of this essential financial protection, offering a wealth of information to help you navigate this often complex topic. From understanding the basics to exploring advanced strategies, we aim to provide a comprehensive resource for all your auto insurance needs.

Understanding Monthly Auto Insurance: A Comprehensive Overview

Monthly auto insurance is a contract between you, the vehicle owner, and an insurance provider. This contract promises financial protection in the event of an accident, theft, or other covered incidents involving your vehicle. It’s a vital tool to safeguard your financial interests and ensure peace of mind while on the road.

This form of insurance is typically paid monthly, hence the name, and it offers a flexible and manageable way to protect your vehicle and yourself. The premiums you pay are determined by a variety of factors, including the type of vehicle, your driving history, the area you live in, and the level of coverage you choose. Understanding these factors is key to making informed decisions about your auto insurance.

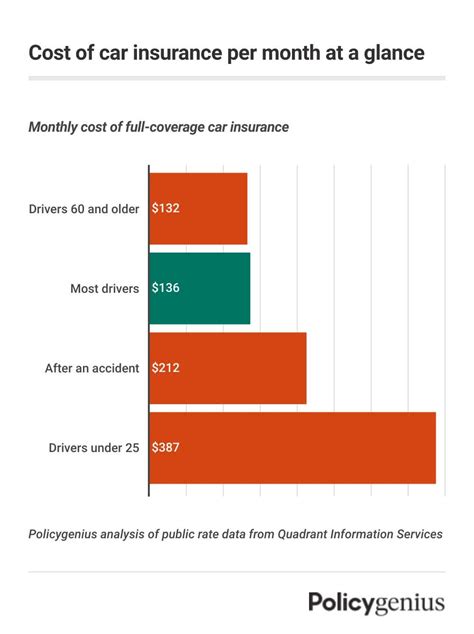

The Importance of Monthly Premiums

Monthly premiums are the lifeblood of auto insurance, as they provide the financial stability needed to offer comprehensive coverage. These premiums are calculated based on the risk profile of the insured, and they can vary significantly depending on individual circumstances. It’s important to note that while monthly premiums can be more manageable in terms of cash flow, they might not always be the most cost-effective option in the long run.

| Factor | Impact on Premiums |

|---|---|

| Vehicle Type | Certain vehicles, especially high-performance or luxury cars, may attract higher premiums due to their cost and potential for more severe accidents. |

| Driving History | A clean driving record can lead to lower premiums, while violations or accidents can significantly increase costs. |

| Location | The area you live in can affect your premiums. Urban areas with higher traffic and crime rates often have higher insurance costs. |

| Coverage Level | The level of coverage you choose, such as liability-only or comprehensive, will directly impact your monthly premiums. |

When considering monthly auto insurance, it's essential to strike a balance between the cost of your premiums and the level of coverage you need. While lower premiums might be tempting, ensuring you have adequate coverage for your unique circumstances is paramount.

Types of Auto Insurance and Their Coverage

Auto insurance is not a one-size-fits-all solution. There are various types of coverage available, each designed to protect against specific risks. Understanding these different types of coverage is essential to choosing the right policy for your needs.

Liability Insurance

Liability insurance is a fundamental component of auto insurance. It covers the costs associated with damages you cause to others in an accident, including property damage and bodily injury. This type of insurance is mandatory in most states and is essential for protecting your financial well-being in the event of an accident.

Collision and Comprehensive Coverage

Collision insurance covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault. On the other hand, comprehensive insurance protects against non-collision incidents, such as theft, vandalism, and natural disasters. These two types of coverage are often bundled together and are highly recommended for comprehensive protection.

Personal Injury Protection (PIP) and Medical Payments

PIP and medical payments coverage focus on the medical expenses incurred by you or your passengers after an accident. This can include doctor visits, hospital stays, and rehabilitation costs. These types of coverage ensure that you’re not left with hefty medical bills in the aftermath of an accident.

Uninsured/Underinsured Motorist Coverage

This type of coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. It ensures that you’re not left financially responsible for damages caused by an uninsured driver.

Additional Coverages

Some auto insurance policies offer additional coverages, such as rental car reimbursement, roadside assistance, and gap insurance. These coverages can provide extra peace of mind and financial protection in specific situations.

| Coverage Type | Description |

|---|---|

| Rental Car Reimbursement | Covers the cost of a rental car if your vehicle is being repaired or is deemed a total loss. |

| Roadside Assistance | Provides emergency services like towing, flat tire changes, and battery jump starts. |

| Gap Insurance | Covers the difference between what your insurance pays and what you owe on your vehicle if it's declared a total loss. |

Strategies for Choosing the Right Monthly Auto Insurance

Selecting the right monthly auto insurance involves careful consideration of several factors. It’s not just about finding the lowest premium; it’s about ensuring you have the right coverage for your unique situation.

Assessing Your Needs

Start by evaluating your specific needs. Consider the value of your vehicle, your driving habits, and the potential risks you face on the road. For instance, if you frequently drive in congested urban areas, you might want to prioritize collision and comprehensive coverage. On the other hand, if you have an older vehicle, you might opt for liability-only coverage to keep costs down.

Comparing Quotes

Obtaining multiple quotes is crucial to finding the best deal. Compare quotes from different insurers, ensuring you’re comparing policies with similar coverage levels. Remember, the cheapest quote might not always offer the best value, so be sure to review the fine print and understand what’s included in each policy.

Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This can be a great way to save money, especially if you’re a loyal customer or have multiple vehicles to insure.

Utilizing Discounts

Insurance companies often offer a range of discounts, including safe driver discounts, good student discounts, and loyalty discounts. Be sure to ask about these when obtaining quotes, as they can significantly reduce your monthly premiums.

Understanding Deductibles

Deductibles are the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your monthly premiums, but it’s important to ensure you can afford the deductible in the event of a claim. Striking the right balance between deductibles and premiums is key to managing your insurance costs effectively.

The Future of Monthly Auto Insurance

The auto insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. As we move forward, several trends are likely to shape the future of monthly auto insurance.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle performance, is increasingly being used to offer personalized insurance rates. This type of insurance, known as usage-based insurance (UBI), rewards safe driving habits with lower premiums. As this technology becomes more widespread, we can expect more insurers to offer UBI plans, providing greater customization and potentially lowering costs for safe drivers.

Digital Transformation

The digital revolution is transforming the insurance industry, making it more efficient and customer-centric. From online policy management to mobile apps for filing claims, insurers are leveraging technology to enhance the customer experience. This digital transformation is likely to continue, making it easier and more convenient for policyholders to manage their insurance needs.

Data Analytics and AI

Advanced data analytics and artificial intelligence are being used to improve risk assessment and claim management. These technologies enable insurers to make more accurate predictions about risk, leading to more precise pricing and better fraud detection. As these technologies mature, we can expect more sophisticated and accurate insurance offerings.

Sustainable and Green Insurance

With growing environmental awareness, the concept of sustainable insurance is gaining traction. This includes offering incentives for eco-friendly vehicles and promoting sustainable driving habits. As the automotive industry moves towards electric and hybrid vehicles, we can expect insurance policies to adapt, offering specialized coverage and potentially lower premiums for these greener options.

How often should I review my auto insurance policy?

+It's recommended to review your policy annually, or whenever your circumstances change significantly. This ensures your coverage remains aligned with your needs and any new discounts or offers are considered.

What factors can lead to my monthly premiums increasing?

+Several factors can cause an increase in premiums, including filing a claim, getting a traffic violation, or moving to an area with higher insurance rates. It's also common for premiums to increase annually to account for inflation and changing risk factors.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, if you're within the first 60 days of your policy term, you may be subject to a short-rate cancellation fee. It's best to review your policy carefully before switching to ensure you're getting the coverage you need at a competitive rate.

What happens if I fail to make a monthly payment?

+If you miss a payment, your insurance company will typically send a notice of cancellation. If you don't make the payment within a certain grace period, your policy may be cancelled. It's important to keep your payments up to date to maintain continuous coverage.

In conclusion, monthly auto insurance is a vital component of responsible vehicle ownership. By understanding the different types of coverage, evaluating your needs, and staying informed about the latest trends, you can make informed decisions to protect yourself and your vehicle effectively. Remember, while insurance can be complex, it’s a critical tool to safeguard your financial interests and ensure peace of mind on the road.