Do I Need Workers Comp Insurance

As a business owner, one of the crucial decisions you'll make is determining whether you need workers' compensation insurance. This type of insurance, often referred to as workers' comp, is designed to provide coverage for employees who suffer work-related injuries or illnesses. It's a vital aspect of running a business, as it not only protects your employees but also ensures compliance with state laws and regulations.

In this comprehensive guide, we will delve into the world of workers' compensation insurance, exploring its intricacies, benefits, and the reasons why it's an essential consideration for any business. By the end, you'll have a clear understanding of whether workers' comp insurance is a necessity for your enterprise.

Understanding Workers’ Compensation Insurance

Workers’ compensation insurance is a form of coverage that offers financial protection to both employees and employers in the event of workplace accidents, injuries, or illnesses. It’s a no-fault system, meaning that regardless of who is at fault for the incident, the injured employee is entitled to receive benefits. This insurance provides a safety net for employees, ensuring they receive the necessary medical care and compensation for lost wages without having to prove negligence or engage in lengthy legal battles.

For employers, workers' comp insurance serves as a crucial risk management tool. It helps mitigate the financial impact of workplace injuries, provides a structured framework for handling claims, and ensures compliance with state-mandated regulations. Additionally, it can enhance the overall safety culture within an organization, as employers are incentivized to prioritize employee well-being and implement preventive measures.

Why Do Businesses Need Workers’ Comp Insurance?

The necessity of workers’ compensation insurance stems from a combination of legal requirements, ethical considerations, and practical benefits. Here’s a deeper look at each aspect:

Legal Compliance

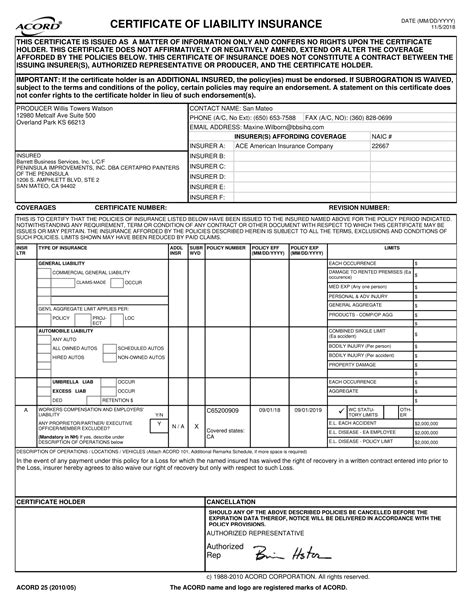

In most states, having workers’ compensation insurance is a legal mandate for businesses with employees. State laws vary, but they typically require employers to provide coverage for their workforce. Failure to comply with these regulations can result in severe penalties, including fines, lawsuits, and even the revocation of your business license.

For instance, in the state of California, all employers with one or more employees must carry workers' compensation insurance, with a few exceptions for specific industries. Similarly, Texas mandates that businesses with employees obtain workers' comp coverage through the state-run insurance program or a private carrier. Non-compliance can lead to substantial fines and legal consequences.

Employee Protection

The primary purpose of workers’ comp insurance is to protect employees. When an employee sustains an injury or develops an illness due to their work, this insurance ensures they receive the necessary medical treatment and financial support. It covers medical expenses, lost wages, and, in severe cases, provides compensation for permanent disabilities or even death benefits to surviving family members.

By offering this protection, businesses demonstrate their commitment to the well-being of their employees. It fosters a sense of trust and loyalty within the workforce, knowing that their employer has their best interests at heart, even in unfortunate circumstances.

Risk Management

Workers’ compensation insurance is an effective risk management strategy. It helps businesses prepare for and manage the financial impact of workplace injuries. Without this coverage, employers would be responsible for covering all medical expenses and lost wages, which can quickly become a significant burden, especially for small businesses.

Additionally, workers' comp insurance often includes services such as return-to-work programs and injury prevention initiatives. These programs aim to expedite the recovery process for injured employees and reduce the likelihood of future incidents, creating a safer and more productive workplace.

Peace of Mind

For business owners, workers’ compensation insurance provides peace of mind. Knowing that your employees are protected in the event of an accident or illness allows you to focus on running your business without the constant worry of potential financial liabilities. It streamlines the claims process, ensuring a swift and fair resolution for all parties involved.

The Benefits of Workers’ Comp Insurance

Workers’ compensation insurance offers a range of advantages that extend beyond legal compliance. Here are some key benefits to consider:

Medical Coverage for Employees

Perhaps the most critical benefit of workers’ comp insurance is the medical coverage it provides to injured employees. This coverage includes not only immediate emergency treatment but also ongoing care, rehabilitation, and even specialized medical services if needed. By ensuring access to quality healthcare, workers’ comp insurance promotes the recovery and well-being of employees.

Wage Replacement

Workers’ compensation insurance also covers a portion of an employee’s lost wages during their recovery period. This wage replacement helps employees maintain their financial stability, allowing them to focus on healing without the added stress of financial strain. It’s a vital aspect of supporting employees through challenging times.

Protection Against Lawsuits

In many cases, workers’ compensation insurance acts as a legal safeguard for employers. By providing coverage for work-related injuries, it reduces the likelihood of employees pursuing costly and time-consuming lawsuits against the company. This protection is particularly valuable, as it helps maintain a positive relationship between employers and employees.

Improved Employee Morale

When employees know that their employer has their back in the event of an injury, it can boost morale and job satisfaction. It demonstrates a commitment to employee welfare, fostering a positive work environment and potentially increasing productivity. Employees are more likely to feel valued and supported when their employer takes proactive measures to protect them.

Enhanced Safety Culture

Workers’ compensation insurance often includes resources and initiatives focused on workplace safety. These may include safety training programs, injury prevention workshops, and even incentives for implementing safety protocols. By promoting a culture of safety, businesses can reduce the frequency and severity of workplace accidents, leading to improved productivity and employee retention.

Factors to Consider When Deciding on Workers’ Comp Insurance

While workers’ compensation insurance is generally a necessity for businesses with employees, there are certain factors to consider when making this decision. These factors can help you determine the extent of coverage you need and the best approach to securing it.

Industry and Risk Assessment

Different industries carry varying levels of risk. For example, construction work is inherently more hazardous than office-based jobs. When assessing your need for workers’ comp insurance, consider the nature of your business and the associated risks. High-risk industries may require more comprehensive coverage to adequately protect their workforce.

State Regulations

As mentioned earlier, state laws play a significant role in determining whether you need workers’ compensation insurance. Research the specific regulations in your state to understand the legal requirements and potential penalties for non-compliance. This knowledge will guide your decision-making process and help you navigate the insurance landscape effectively.

Cost Considerations

Workers’ compensation insurance comes at a cost, and it’s essential to factor this into your business budget. The premium you pay for workers’ comp insurance is influenced by various factors, including the size of your workforce, the nature of your business, and your claims history. It’s crucial to shop around and compare rates from different insurers to find the most suitable coverage at a competitive price.

Self-Insuring vs. Purchasing Insurance

In some cases, businesses may consider self-insuring for workers’ compensation. This approach involves setting aside funds to cover potential claims rather than purchasing insurance. However, self-insuring is typically feasible only for larger, well-established companies with the financial resources to manage the risk. For most businesses, purchasing insurance from a reputable provider is the more practical option.

Employee Count

The number of employees you have can impact your decision regarding workers’ comp insurance. In some states, there are exemptions for businesses with a small number of employees. For instance, in New York, businesses with fewer than four employees are exempt from carrying workers’ compensation insurance. However, it’s essential to note that even with exemptions, having insurance is often a wise choice to protect both your employees and your business.

Choosing the Right Workers’ Comp Insurance Provider

Once you’ve decided that workers’ compensation insurance is a necessity for your business, the next step is selecting the right provider. Here are some key considerations to help you make an informed decision:

Reputation and Financial Stability

Look for insurance providers with a solid reputation in the industry. Research their financial stability and track record to ensure they can provide long-term support and pay out claims as needed. A financially stable insurer is essential to avoid potential issues with claim payments in the future.

Customized Coverage

Every business is unique, and your workers’ compensation insurance should reflect your specific needs. Choose a provider that offers customizable coverage options, allowing you to tailor the policy to your industry, workforce size, and risk profile. This ensures you’re not paying for unnecessary coverage while still receiving adequate protection.

Claims Handling Process

The claims handling process is a critical aspect of workers’ comp insurance. Look for a provider with a streamlined and efficient claims process. This includes prompt claim reviews, clear communication, and a dedicated team to assist with any issues that may arise. A provider with a reputation for fair and timely claim settlements can provide peace of mind.

Safety Resources and Support

Consider choosing an insurance provider that offers additional resources and support to enhance workplace safety. This may include access to safety consultants, training materials, and other tools to help you create a safer work environment. By partnering with such a provider, you can proactively reduce the likelihood of workplace injuries and improve overall employee well-being.

Premium Costs and Payment Options

Compare premium costs and payment options across different insurers. While price should not be the sole deciding factor, it’s essential to find a provider that offers competitive rates without compromising on coverage quality. Additionally, consider the payment flexibility they offer, such as monthly or quarterly installments, to ensure a manageable financial burden for your business.

Implementing Workers’ Comp Insurance: A Step-by-Step Guide

Now that you understand the importance and benefits of workers’ compensation insurance, let’s walk through a step-by-step guide to help you implement this coverage effectively:

Step 1: Research State Requirements

Start by researching the specific workers’ compensation laws and regulations in your state. Understand the mandatory coverage requirements, exemptions (if any), and potential penalties for non-compliance. This knowledge will guide your decision-making process and ensure you’re meeting your legal obligations.

Step 2: Assess Your Business Risks

Conduct a thorough risk assessment of your business. Consider the nature of your industry, the tasks your employees perform, and the potential hazards they may face. Identify areas where workplace injuries or illnesses are more likely to occur. This assessment will help you determine the extent of coverage you need and the specific risks you should prioritize.

Step 3: Compare Insurance Providers

Research and compare multiple workers’ compensation insurance providers. Look for providers that offer customized coverage options, competitive premiums, and a strong reputation for claims handling. Consider their financial stability and the additional resources they provide to support workplace safety initiatives.

Step 4: Obtain Quotes and Review Policies

Contact the shortlisted insurance providers and request quotes based on your business needs. Review the policies carefully, paying attention to the coverage limits, exclusions, and any additional benefits or services offered. Ensure that the policy aligns with your risk assessment and provides adequate protection for your employees.

Step 5: Choose a Provider and Obtain Coverage

Based on your research and comparison, select the insurance provider that best meets your business needs. Work with their representatives to finalize the policy details, including coverage limits, premium costs, and payment terms. Once the policy is in place, ensure that all your employees are aware of the coverage and understand the claims process.

Step 6: Implement Workplace Safety Measures

Workers’ compensation insurance is just one part of the equation. To further protect your employees and reduce the likelihood of workplace injuries, implement comprehensive safety measures. This may include regular safety training sessions, hazard identification and mitigation practices, and the use of personal protective equipment. By prioritizing workplace safety, you can create a culture of prevention and reduce the need for workers’ comp claims.

Step 7: Monitor and Review Coverage Regularly

Workers’ compensation insurance is not a one-time decision. It’s essential to monitor and review your coverage regularly. Stay updated with any changes in state regulations, and adjust your policy as needed to ensure compliance. Additionally, review your coverage limits and consider increasing them if your business grows or if the risk profile changes significantly.

Conclusion: A Safer and More Secure Workplace

Workers’ compensation insurance is not just a legal requirement; it’s an essential component of creating a safer and more secure workplace. By providing financial protection and medical coverage for employees, businesses demonstrate their commitment to employee well-being. Additionally, workers’ comp insurance helps mitigate financial risks, improves safety culture, and fosters a positive relationship between employers and employees.

As you navigate the world of workers' compensation insurance, remember that it's a crucial aspect of responsible business ownership. By following the steps outlined in this guide and partnering with a reputable insurance provider, you can ensure that your employees are protected and that your business remains compliant and financially secure.

For more information on workers' compensation insurance and to explore customized coverage options, don't hesitate to reach out to industry experts and reputable insurance providers. They can provide further guidance tailored to your specific business needs, helping you make informed decisions and create a safer work environment.

What happens if I don’t have workers’ compensation insurance and an employee gets injured?

+Failing to have workers’ compensation insurance can result in severe penalties. You may face fines, lawsuits, and even the loss of your business license. Additionally, injured employees may pursue legal action against you, leading to costly settlements or verdicts. It’s crucial to have the proper coverage to protect both your business and your employees.

Can I purchase workers’ comp insurance for independent contractors or freelancers?

+The coverage of independent contractors or freelancers through workers’ compensation insurance depends on state laws and the nature of the work they perform. In some cases, certain types of independent contractors may be eligible for coverage, while others may not. It’s essential to consult with an insurance professional to understand the specific requirements and options available in your state.

Are there any industries exempt from workers’ compensation insurance requirements?

+Some states provide exemptions for specific industries or businesses with a limited number of employees. However, these exemptions vary widely, and it’s crucial to research the laws in your state. Even if you fall under an exemption, it’s often advisable to have workers’ comp insurance to protect your business and employees.

How can I reduce my workers’ compensation insurance premiums?

+To reduce workers’ compensation insurance premiums, focus on implementing effective workplace safety measures. This includes regular safety training, hazard identification and mitigation, and the use of proper protective equipment. By reducing the frequency and severity of workplace injuries, you can demonstrate a lower risk profile to insurers, potentially leading to lower premiums.