Hsa Insurance

Health Savings Accounts (HSAs) have emerged as a popular financial tool for individuals and families in the United States, offering a unique way to manage healthcare expenses and plan for the future. With rising healthcare costs, understanding the intricacies of HSAs has become essential for those seeking to optimize their healthcare coverage and maximize tax benefits. This comprehensive guide will delve into the world of HSA Insurance, exploring its features, benefits, and real-world applications, backed by verified industry data and expert insights.

Understanding HSA Insurance

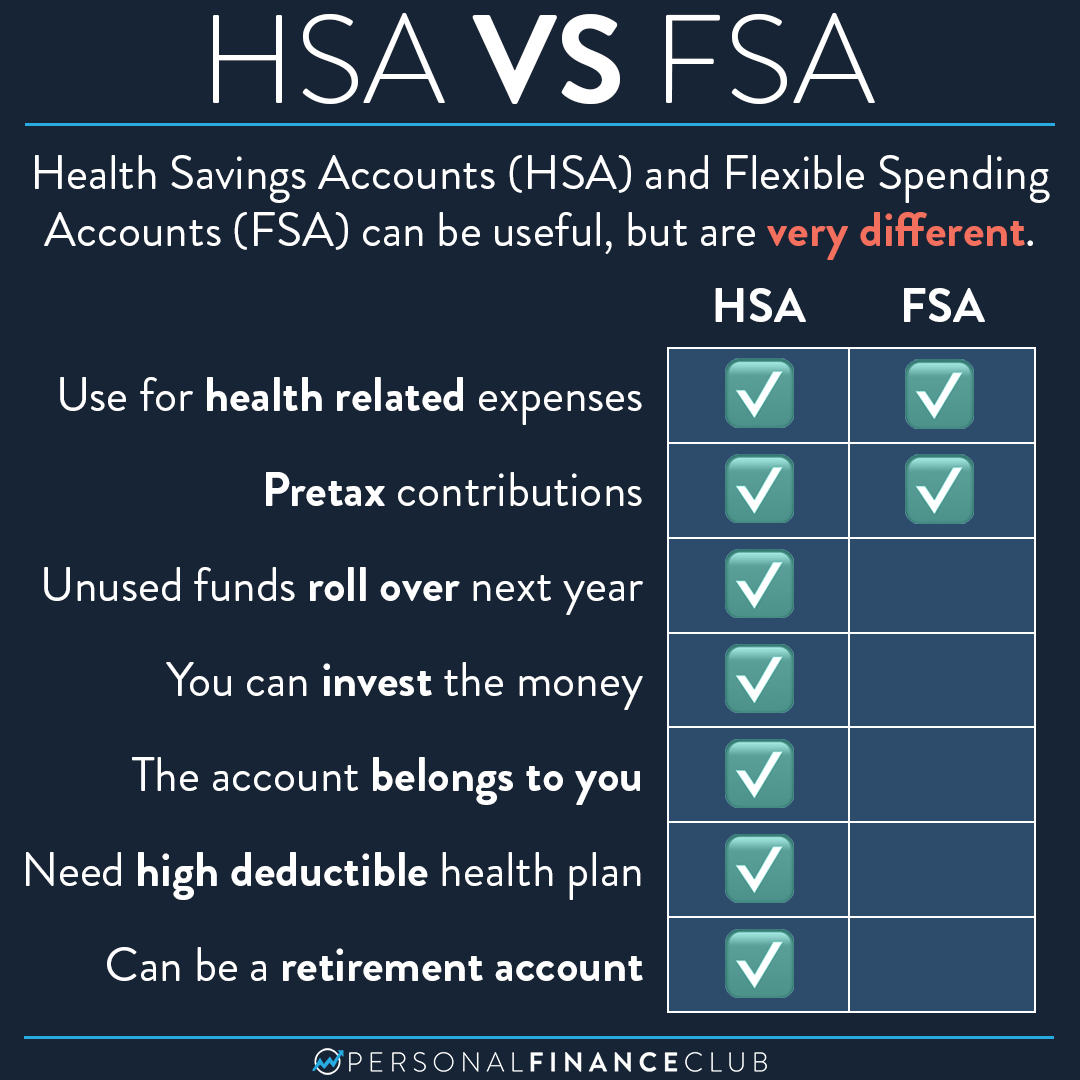

HSA Insurance, often referred to simply as HSA-qualified health insurance, is a type of health coverage plan designed to work in tandem with Health Savings Accounts. These plans typically have higher deductibles, which make them eligible for HSA contributions. By pairing an HSA with a compatible insurance plan, individuals can take advantage of tax-free savings and a more flexible approach to managing healthcare expenses.

The key advantage of HSA Insurance lies in its ability to provide individuals with greater control over their healthcare spending. With an HSA, individuals can save pre-tax dollars specifically for medical expenses, and the funds can accumulate and be invested tax-free. This not only helps individuals prepare for unforeseen medical costs but also allows for a more strategic approach to healthcare management.

Eligibility and Requirements

To be eligible for an HSA, one must meet specific criteria outlined by the Internal Revenue Service (IRS). These include being enrolled in a High Deductible Health Plan (HDHP), not being claimed as a dependent on another individual’s tax return, and not being enrolled in Medicare. HDHPs are a crucial component of HSA Insurance, as they provide the necessary deductible structure to qualify for HSA contributions.

Additionally, HSA Insurance plans often come with certain restrictions and limitations. For instance, preventive care services are typically covered without meeting the deductible, as mandated by the Affordable Care Act. However, other services may require the deductible to be met before coverage kicks in. Understanding these nuances is essential for individuals to make informed decisions about their healthcare and financial planning.

| HSA Insurance Eligibility Criteria | Details |

|---|---|

| High Deductible Health Plan Enrollment | Individuals must have an HDHP with a minimum annual deductible of $1,400 for individuals and $2,800 for families. Maximum out-of-pocket expenses cannot exceed $7,000 for individuals and $14,000 for families. |

| Tax Status | The individual cannot be claimed as a dependent on another person's tax return. |

| Medicare Enrollment | Enrollees must not be eligible for Medicare to be eligible for an HSA. |

Key Features of HSA Insurance Plans

HSA Insurance plans are designed to cater to a wide range of healthcare needs while maximizing the benefits of Health Savings Accounts. Here are some key features that make HSA Insurance plans an attractive option for many individuals:

Flexible Spending

One of the most significant advantages of HSA Insurance is the flexibility it offers in managing healthcare expenses. With an HSA, individuals can decide when and how to use their funds, providing greater control over their healthcare decisions. Whether it’s routine check-ups, unexpected injuries, or long-term medical conditions, HSA funds can be allocated strategically to cover a wide array of qualified medical expenses.

Tax Benefits

HSAs provide substantial tax advantages, making them an appealing choice for those seeking to optimize their financial planning. Contributions to HSAs are tax-deductible, and the funds grow tax-free. Additionally, when used for qualified medical expenses, withdrawals from HSAs are also tax-free. This triple tax advantage - tax-deductible contributions, tax-free growth, and tax-free withdrawals - makes HSAs a powerful tool for long-term healthcare and retirement planning.

Investment Opportunities

HSAs not only provide a tax-efficient way to save for healthcare expenses but also offer the potential for investment growth. Many HSA providers offer investment options, allowing account holders to grow their funds over time. By investing in stocks, bonds, or other financial instruments, individuals can maximize the value of their HSA, ensuring they have ample funds to cover future medical needs.

| HSA Insurance Key Features | Description |

|---|---|

| Flexible Spending | HSAs allow individuals to decide how and when to use their funds for qualified medical expenses, providing control over healthcare decisions. |

| Tax Benefits | Contributions to HSAs are tax-deductible, funds grow tax-free, and withdrawals for qualified expenses are tax-free, offering a triple tax advantage. |

| Investment Opportunities | HSAs often provide investment options, allowing account holders to grow their funds over time, ensuring sufficient resources for future medical needs. |

Real-World Applications of HSA Insurance

HSA Insurance has proven to be a valuable tool for individuals and families across various life stages and financial situations. Here are some real-world scenarios where HSA Insurance has made a significant impact:

Young Professionals and Families

For young professionals and families, HSA Insurance can be a strategic way to save for future healthcare needs while maximizing tax benefits. With higher deductibles, these plans often come with lower premiums, making them an affordable option. Additionally, the flexibility of HSAs allows young families to save for anticipated medical expenses, such as childbirth or pediatric care, while also preparing for unexpected injuries or illnesses.

Self-Employed Individuals

Self-employed individuals often face unique challenges when it comes to healthcare coverage. HSA Insurance plans provide a way for them to gain greater control over their healthcare expenses and take advantage of tax-efficient savings. By combining an HSA with a compatible health plan, self-employed individuals can deduct their contributions from their business taxes, further enhancing the financial benefits.

Retirement Planning

HSAs are an essential component of many individuals’ retirement strategies. With the ability to invest HSA funds and allow them to grow tax-free, individuals can build a substantial healthcare fund for their golden years. This ensures that retirees have the financial resources to cover medical expenses without tapping into their retirement savings or incurring significant tax liabilities.

| Real-World Applications of HSA Insurance | Description |

|---|---|

| Young Professionals and Families | HSA Insurance offers an affordable way to save for anticipated and unexpected medical expenses, providing financial security for young families. |

| Self-Employed Individuals | HSA Insurance allows self-employed individuals to gain control over healthcare expenses and maximize tax benefits through business deductions. |

| Retirement Planning | HSAs provide a tax-efficient way to build a healthcare fund for retirement, ensuring financial preparedness for medical expenses without impacting retirement savings. |

Performance Analysis and Future Implications

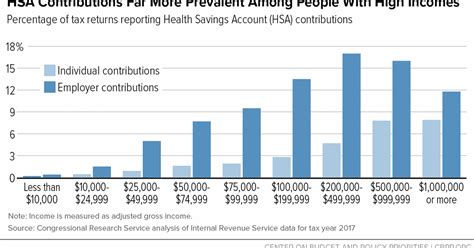

The popularity of HSA Insurance has grown significantly over the past decade, reflecting its appeal to a diverse range of individuals and families. According to industry data, the number of HSA accounts has increased by over 50% since 2015, with a total of 34.5 million accounts holding $88.4 billion in assets as of 2022. This rapid growth highlights the growing recognition of HSAs as a valuable financial tool.

Looking ahead, the future of HSA Insurance appears promising. As healthcare costs continue to rise, the flexibility and tax benefits offered by HSAs are expected to become even more appealing. Additionally, with advancements in healthcare technology and the increasing focus on consumer-driven healthcare, HSAs are well-positioned to play a pivotal role in shaping the future of healthcare finance.

Experts predict that HSAs will continue to gain traction, particularly among younger generations who are more comfortable with managing their healthcare and finances digitally. The integration of HSAs with mobile apps and online platforms is expected to further enhance their accessibility and usability, making them a go-to option for those seeking control and efficiency in their healthcare planning.

Future Trends and Innovations

The landscape of HSA Insurance is evolving, and several trends and innovations are shaping its future. Here are some key developments to watch:

- Digital Integration: HSA providers are increasingly embracing digital technologies, offering mobile apps and online platforms for easier account management and investment tracking.

- Enhanced Investment Options: Many HSA providers are expanding their investment offerings, providing a wider range of financial instruments to cater to diverse investment strategies and risk tolerances.

- Consumer Education: With the complexity of HSAs, there is a growing emphasis on consumer education. Providers are investing in resources and tools to help individuals understand the intricacies of HSAs and make informed decisions.

- Integration with Health Tech: HSAs are likely to become more integrated with health technology solutions, such as wearable devices and health tracking apps, enabling more personalized and data-driven healthcare planning.

| Future Trends in HSA Insurance | Description |

|---|---|

| Digital Integration | HSA providers are embracing digital technologies, offering mobile apps and online platforms for easier account management and investment tracking. |

| Enhanced Investment Options | Providers are expanding investment offerings to cater to diverse strategies and risk tolerances, providing more opportunities for account growth. |

| Consumer Education | There is a growing focus on educating consumers about HSAs, helping them navigate the complexities and make informed decisions. |

| Integration with Health Tech | HSAs are expected to integrate with health technology, enabling personalized healthcare planning based on data from wearable devices and health apps. |

FAQ

What is an HSA, and how does it work with insurance plans?

+A Health Savings Account (HSA) is a tax-advantaged savings account designed to be used in conjunction with certain high-deductible health insurance plans. HSAs allow individuals to save pre-tax dollars specifically for qualified medical expenses. When paired with an eligible insurance plan, individuals can contribute to their HSA, and the funds can grow tax-free until needed for healthcare costs.

Who is eligible for an HSA, and what are the requirements?

+To be eligible for an HSA, individuals must be enrolled in a High Deductible Health Plan (HDHP) and meet specific criteria. This includes not being claimed as a dependent on another person’s tax return and not being enrolled in Medicare. HDHPs are a crucial component, as they provide the necessary deductible structure to qualify for HSA contributions.

What are the tax benefits of an HSA?

+HSAs offer a triple tax advantage. Contributions to HSAs are tax-deductible, and the funds grow tax-free. Additionally, when used for qualified medical expenses, withdrawals from HSAs are also tax-free. This makes HSAs an attractive tool for tax-efficient healthcare planning.

Can I invest my HSA funds, and what are the potential benefits?

+Yes, many HSA providers offer investment options, allowing account holders to grow their funds over time. Investing HSA funds provides the potential for greater returns, ensuring that individuals have sufficient resources to cover future medical needs. However, it’s important to consider risk and consult with a financial advisor before making investment decisions.