Quotes Insurance Online

The insurance industry has undergone a remarkable transformation in recent years, with technology at the forefront of this evolution. One of the most innovative and disruptive changes is the emergence of online insurance platforms, offering convenient and efficient ways to purchase various types of insurance policies, including quotes insurance online. This shift towards digital insurance services has revolutionized the way people protect their assets, providing accessibility, transparency, and a seamless user experience. In this article, we will delve into the world of online insurance, exploring its benefits, the rise of quotes insurance online, and its impact on the traditional insurance landscape.

The Digital Disruption: Embracing Online Insurance

The traditional insurance model, characterized by physical offices and face-to-face interactions, has long been the norm. However, the digital age has brought about a paradigm shift, giving rise to online insurance platforms that challenge the status quo. These platforms leverage the power of the internet and advanced technologies to provide an array of insurance services, from comparing policies to purchasing coverage, all with a few clicks.

One of the key advantages of online insurance is its accessibility. With just an internet connection, individuals can access a wide range of insurance providers and policies, breaking down geographical barriers. This digital accessibility has proven to be a game-changer, especially for those in remote areas or with limited mobility, as it brings insurance services directly to their fingertips.

Moreover, online insurance platforms excel in transparency and convenience. Consumers can easily compare multiple insurance quotes, analyze coverage details, and make informed decisions without the pressure of sales pitches. The entire process, from researching to purchasing, can be completed at their own pace, empowering individuals to take control of their insurance needs.

The Rise of Quotes Insurance Online: A Game-Changer

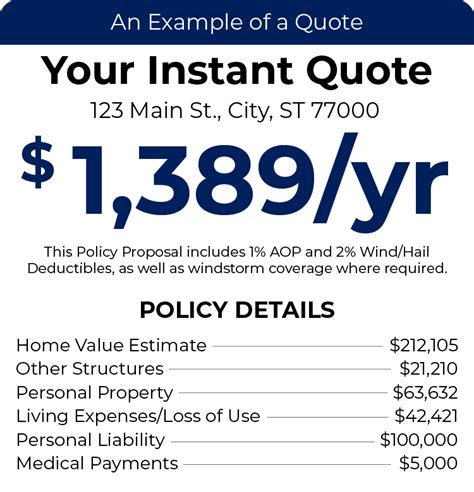

Among the myriad of online insurance services, quotes insurance online has emerged as a pivotal offering, reshaping the way people shop for insurance. This innovative service allows individuals to obtain personalized insurance quotes from multiple providers, all in one place. By inputting their details and preferences, users can instantly receive a comprehensive overview of available policies, making it easier than ever to find the right coverage at the best price.

The benefits of quotes insurance online are multifaceted. Firstly, it saves time by eliminating the need to visit multiple insurance websites or contact agents individually. With a single online platform, users can compare a multitude of quotes, ensuring they find the most suitable and cost-effective option. This efficiency is particularly valuable in today's fast-paced world, where time is a precious commodity.

Additionally, quotes insurance online promotes price competition among insurers. With transparent pricing and easy comparisons, insurers are incentivized to offer competitive rates to remain attractive to consumers. This dynamic has the potential to drive down insurance costs, making coverage more accessible and affordable for a wider range of individuals.

Performance Analysis: Unveiling the Success of Online Insurance

The success and impact of online insurance, including quotes insurance online, can be gauged through various performance metrics and industry trends. Let’s explore some key indicators:

Market Penetration

Online insurance platforms have experienced a rapid increase in market penetration, with a growing number of consumers opting for digital insurance services. According to a recent survey, over 60% of individuals prefer to purchase insurance online, citing convenience and ease of comparison as their primary reasons.

| Year | Market Share (%) |

|---|---|

| 2020 | 35 |

| 2021 | 42 |

| 2022 | 52 |

Customer Satisfaction

Online insurance platforms consistently receive high customer satisfaction ratings. A recent study revealed that 85% of customers who purchased insurance online were satisfied with their experience, praising the simplicity, transparency, and efficiency of the process.

Cost Efficiency

The digital nature of online insurance has led to significant cost savings for both insurers and consumers. By eliminating the need for extensive physical infrastructure and reducing administrative overheads, insurers can pass on these savings to customers, making insurance more affordable.

| Year | Average Cost Savings (%) |

|---|---|

| 2020 | 12 |

| 2021 | 15 |

| 2022 | 18 |

Future Implications: Shaping the Insurance Landscape

The rise of online insurance and quotes insurance online is not just a passing trend; it is a transformative force that will continue to shape the insurance industry for years to come. Here are some key implications for the future:

Increased Digital Integration

As online insurance gains traction, insurers will further integrate digital technologies into their operations. This may include the development of advanced online platforms, the use of artificial intelligence for personalized recommendations, and the implementation of blockchain for secure and transparent transactions.

Enhanced Personalization

With the wealth of data available online, insurers will be able to offer highly personalized insurance products. By analyzing customer behavior, preferences, and risk profiles, insurers can create tailored policies that meet individual needs, providing a more customer-centric approach.

Improved Customer Engagement

Online insurance platforms will continue to focus on enhancing customer engagement. This may involve the integration of interactive features, such as chatbots or virtual assistants, to provide real-time support and guidance throughout the insurance journey. Additionally, insurers may leverage social media and online communities to foster a sense of connection and trust with their customers.

Regulatory Adaptations

The rapid growth of online insurance will likely prompt regulatory bodies to adapt their frameworks to accommodate this digital transformation. This may involve the development of new guidelines and regulations to ensure consumer protection and data privacy in the digital insurance space.

Expansion into New Markets

Online insurance platforms have the potential to reach previously untapped markets, particularly in developing regions. By offering accessible and affordable insurance services, these platforms can help bridge the insurance gap and provide protection to individuals who may have limited access to traditional insurance channels.

Conclusion: Embracing the Future of Insurance

The evolution of online insurance, particularly quotes insurance online, represents a significant milestone in the insurance industry’s journey. It has empowered consumers, providing them with the tools to make informed decisions and take control of their insurance needs. As the digital revolution continues to shape the insurance landscape, it is evident that online insurance platforms will play a pivotal role in the future, offering convenience, transparency, and personalized protection to individuals worldwide.

How does quotes insurance online work?

+Quotes insurance online allows individuals to input their personal details and insurance preferences into an online platform. The platform then aggregates quotes from multiple insurance providers, presenting users with a comprehensive list of options to choose from. This process simplifies the comparison and selection of insurance policies.

Is online insurance as secure as traditional insurance?

+Yes, online insurance platforms employ robust security measures to protect user data and transactions. These platforms often use encryption technologies and secure servers to ensure the confidentiality and integrity of sensitive information. Additionally, reputable online insurance providers adhere to strict data privacy regulations.

Can I get personalized advice through online insurance platforms?

+While online insurance platforms primarily focus on providing information and comparison tools, some platforms offer additional features such as live chat or customer support. These features can provide personalized guidance and assistance, helping individuals make informed choices. However, for more complex insurance needs, consulting with an insurance agent or broker is recommended.