Car Insurance Quotes For California

When it comes to car insurance in California, understanding the unique factors that influence quotes is essential. From the diverse range of cities and regions to the varying levels of traffic and accident rates, each area presents its own set of considerations. Additionally, California's insurance regulations and the numerous provider options further complicate the process of obtaining an accurate quote. This article aims to provide an in-depth analysis of car insurance quotes in California, offering valuable insights to help you navigate the complexities and make informed decisions.

Understanding the Cost of Car Insurance in California

California is known for its high cost of living, and car insurance is no exception. The average annual premium for car insurance in the Golden State is significantly higher than the national average. This is largely due to the state’s large population, high traffic density, and strict insurance regulations. Understanding the factors that influence these quotes is crucial for drivers looking to find the best coverage at the most affordable price.

The Impact of Location

California’s diverse landscape, from bustling cities to serene coastal towns, greatly influences car insurance quotes. Urban areas like Los Angeles and San Francisco typically have higher premiums due to increased traffic congestion and higher accident rates. On the other hand, rural areas may offer more affordable rates, but they often come with limited coverage options and fewer provider choices.

Here’s a comparison of average annual premiums in some of California’s major cities:

| City | Average Annual Premium |

|---|---|

| Los Angeles | 1,850</td> </tr> <tr> <td>San Francisco</td> <td>1,600 |

| San Diego | 1,500</td> </tr> <tr> <td>Sacramento</td> <td>1,400 |

| Fresno | $1,250 |

Risk Factors and Their Influence

Several risk factors play a significant role in determining car insurance quotes in California. These include:

- Driving Record: A clean driving record can lead to substantial savings, while violations, accidents, and DUI convictions can significantly increase your premiums.

- Vehicle Type: The make, model, and age of your vehicle impact your quote. Sports cars and luxury vehicles often have higher premiums due to their increased risk of theft and higher repair costs.

- Credit Score: Surprisingly, your credit score can influence your insurance rates. A higher credit score is often associated with lower premiums, as it is seen as an indicator of financial responsibility.

- Age and Gender: Young drivers, especially males, typically face higher premiums due to their perceived higher risk on the road. However, this gap narrows as drivers gain experience and reach their mid-20s.

The Role of Coverage and Deductibles

The level of coverage you choose and the deductibles you opt for can greatly affect your insurance quote. California requires drivers to carry minimum liability coverage, but it’s important to consider additional coverage options to protect yourself financially in case of an accident.

Here’s a breakdown of the typical coverage options and their impact on quotes:

| Coverage Type | Description | Impact on Premium |

|---|---|---|

| Liability Coverage | Covers injuries and damages you cause to others. | Mandatory but relatively affordable. |

| Collision Coverage | Covers damages to your own vehicle in an accident. | Optional but can significantly increase your premium. |

| Comprehensive Coverage | Covers non-collision incidents like theft, vandalism, and natural disasters. | Optional but provides peace of mind and moderate premium increase. |

| Uninsured/Underinsured Motorist Coverage | Protects you if an at-fault driver has insufficient insurance. | Highly recommended but not mandatory, with a moderate impact on premium. |

Additionally, choosing higher deductibles can lower your premium, as you’re agreeing to pay more out of pocket before your insurance kicks in.

Navigating the Complexities of California Car Insurance Quotes

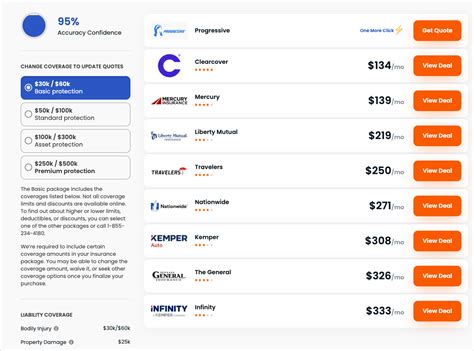

With the vast array of insurance providers in California, it can be challenging to know where to start. Each provider has its own unique offerings, discounts, and pricing structures, making it essential to compare quotes from multiple sources.

Comparing Providers and Their Offerings

California is home to both national and regional insurance providers, each with its own strengths and weaknesses. National providers often have more resources and can offer broader coverage options, while regional providers may have a better understanding of local risks and can provide more personalized service.

Here’s a comparison of some of the top car insurance providers in California, based on average annual premiums and key features:

| Provider | Average Annual Premium | Key Features |

|---|---|---|

| State Farm | 1,600</td> <td>Offers a wide range of coverage options and discounts, including good student and defensive driving discounts.</td> </tr> <tr> <td>GEICO</td> <td>1,550 | Known for its competitive rates and online convenience. Offers discounts for military members and federal employees. |

| Progressive | 1,700</td> <td>Provides flexible payment options and customizable coverage. Offers snapshot discount based on driving behavior.</td> </tr> <tr> <td>Allstate</td> <td>1,800 | Offers comprehensive coverage and a range of discounts, including safe driver and loyalty bonuses. |

| Esurance | $1,450 | Known for its digital-first approach and convenient online tools. Offers a variety of discounts, including for paperless billing and safe driving. |

Understanding Discounts and Savings Opportunities

California insurance providers offer a multitude of discounts to help lower your premiums. These can include:

- Safe Driver Discounts: Rewards drivers with clean records and no recent accidents or violations.

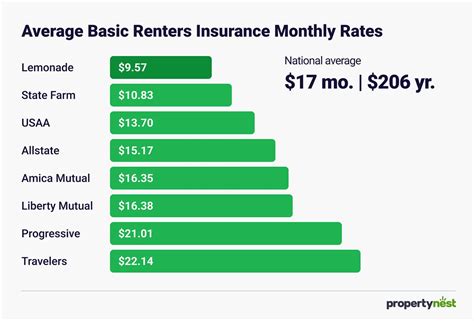

- Multi-Policy Discounts: Combining your car insurance with other policies, such as home or renters insurance, can lead to significant savings.

- Good Student Discounts: Students with a certain GPA or higher may be eligible for this discount.

- Loyalty Discounts: Many providers offer discounts for long-term customers.

- Usage-Based Insurance (UBI) Discounts: These programs, like Progressive’s Snapshot, monitor your driving behavior and can lead to discounts for safe driving.

It’s crucial to explore these discounts when comparing quotes to ensure you’re getting the best rate possible.

The Impact of Driving Behavior and Claims History

Your driving behavior and claims history have a significant impact on your car insurance quotes in California. A history of safe driving and few or no claims can lead to substantial savings. On the other hand, frequent claims and violations can result in higher premiums or even policy cancellations.

Here’s a breakdown of how driving behavior and claims history can affect your quote:

| Factor | Impact on Premium |

|---|---|

| At-Fault Accidents | Increased premiums, potentially for multiple years. |

| Moving Violations | Can lead to higher premiums, especially if they result in points on your license. |

| Safe Driving Record | Rewards with lower premiums and potential discounts. |

| Frequent Claims | May result in higher premiums or policy cancellations. |

Future Outlook and Considerations for California Drivers

As California continues to evolve, several factors will influence the future of car insurance quotes in the state. These include:

- Autonomous Vehicles: The increasing presence of autonomous vehicles on California roads may lead to a decrease in accident rates, potentially lowering insurance premiums over time.

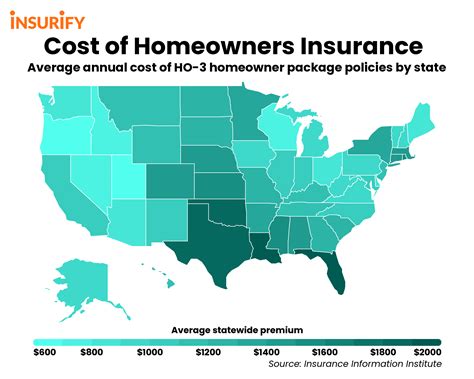

- Environmental Factors: Natural disasters like earthquakes and wildfires are a constant concern in California. The insurance industry will need to adapt to these risks, which may impact premiums in affected areas.

- Changing Regulations: California’s insurance regulations are subject to change, and any updates could have a significant impact on premiums and coverage options.

- Advancements in Telematics: Usage-based insurance programs are becoming more sophisticated, offering drivers the opportunity to save by demonstrating safe driving behavior.

Staying informed about these developments and their potential impact on insurance is crucial for California drivers.

What is the average car insurance cost in California per month?

+

The average monthly car insurance cost in California is around $150, but this can vary greatly depending on factors like location, driving record, and coverage choices.

Do I need to buy car insurance if I already have health insurance in California?

+

Yes, California law requires all drivers to carry car insurance, regardless of their health insurance status. Car insurance protects you financially in case of an accident, covering both property damage and bodily injury.

Can I get car insurance with a suspended license in California?

+

It can be challenging to get car insurance with a suspended license, as many providers will consider this a high risk. However, there are specialized high-risk insurance providers that may offer coverage in such situations.

How often should I review my car insurance policy in California?

+

It’s recommended to review your car insurance policy annually to ensure you’re still getting the best coverage and rate. Factors like your driving record, vehicle changes, and life events can all impact your insurance needs.