Cheapest Home Insurance Companies

Home insurance is an essential aspect of protecting your biggest investment and safeguarding your financial well-being. With a multitude of insurance providers offering various policies and rates, finding the cheapest option that provides adequate coverage can be a daunting task. In this comprehensive guide, we will delve into the world of home insurance, exploring the factors that influence rates, uncovering the cheapest providers, and providing valuable insights to help you make an informed decision.

Understanding Home Insurance Rates

The cost of home insurance can vary significantly depending on a range of factors. Let’s explore some key aspects that impact insurance rates:

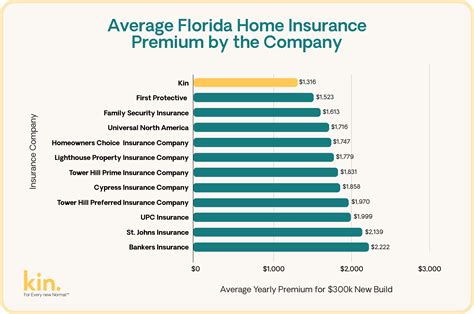

Location

Your geographic location plays a pivotal role in determining insurance rates. Areas prone to natural disasters, such as hurricanes, tornadoes, or earthquakes, typically have higher insurance premiums. Additionally, regions with high crime rates or a history of severe weather events may also see elevated insurance costs.

Home Value and Construction

The value and construction of your home significantly influence insurance rates. Older homes, especially those in need of repairs or with outdated electrical or plumbing systems, may attract higher premiums. Newer homes with modern construction techniques and materials are often viewed as less risky, leading to lower insurance costs.

Coverage Amount and Deductibles

The amount of coverage you choose directly affects your insurance rates. Higher coverage limits generally result in higher premiums. Additionally, selecting a higher deductible can lower your insurance costs. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. It’s essential to find a balance between coverage and deductibles that suits your financial situation and risk tolerance.

Homeowner’s Insurance Claims History

Your insurance claims history is a critical factor in determining rates. If you have a history of frequent claims, even for minor incidents, insurance companies may view you as a higher risk and charge higher premiums. Maintaining a clean claims history can help keep your insurance costs down.

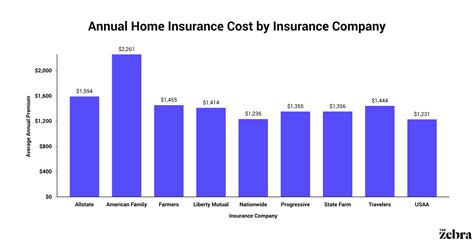

Cheapest Home Insurance Companies

Now, let’s explore some of the top home insurance providers known for offering competitive rates without compromising on coverage:

State Farm

State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including home insurance. They are known for their competitive rates and comprehensive coverage options. State Farm provides personalized policies tailored to individual needs, making it a popular choice for homeowners seeking affordable insurance.

Allstate

Allstate is another well-established insurance company with a strong presence across the country. They offer a wide array of insurance products, including home insurance. Allstate’s “Your Choice” home insurance policy provides flexibility, allowing homeowners to customize their coverage to meet their specific needs. Their competitive rates and extensive coverage options make them a top contender for affordable home insurance.

Progressive

Progressive is a leading insurance provider that offers a range of insurance products, including home insurance. They are known for their innovative approach and competitive pricing. Progressive’s home insurance policies provide coverage for a variety of perils, including fire, theft, and natural disasters. Their customizable policies and affordable rates make them an attractive option for homeowners.

USAA

USAA is a unique insurance provider exclusively serving military personnel, veterans, and their families. They offer comprehensive home insurance policies with competitive rates. USAA’s commitment to providing exceptional service and coverage tailored to the needs of military families has earned them a strong reputation in the industry.

GEICO

GEICO, known for its catchy advertising campaigns, is a well-known insurance provider offering a wide range of insurance products. Their home insurance policies provide coverage for various perils and include additional benefits like identity theft protection. GEICO’s competitive rates and excellent customer service make them a popular choice for homeowners seeking affordable insurance.

Comparative Analysis

When comparing home insurance providers, it’s essential to evaluate their policies based on coverage, customer service, and financial stability. While the cheapest option may be tempting, it’s crucial to ensure that the provider offers adequate coverage for your specific needs. Here’s a comparative analysis of the top providers mentioned above:

| Provider | Coverage Options | Customer Service | Financial Stability |

|---|---|---|---|

| State Farm | Comprehensive coverage, including optional add-ons | Excellent customer service with a dedicated agent system | Strong financial stability with an A++ rating from AM Best |

| Allstate | Flexible coverage with customizable options | Good customer service, with 24/7 support available | Stable financial position with an A+ rating from AM Best |

| Progressive | Comprehensive coverage with customizable options | Excellent customer service and digital tools for policy management | Solid financial stability with an A rating from AM Best |

| USAA | Tailored coverage for military families with additional benefits | Exceptional customer service with a strong focus on military members | Strong financial position with an A++ rating from AM Best |

| GEICO | Comprehensive coverage with additional benefits like identity theft protection | Good customer service with 24/7 support and digital tools | Stable financial stability with an A++ rating from AM Best |

Each of these providers offers competitive rates and comprehensive coverage options. It's important to compare quotes from multiple providers and evaluate their policies based on your specific needs and circumstances.

Tips for Finding the Cheapest Home Insurance

Here are some valuable tips to help you find the cheapest home insurance while ensuring adequate coverage:

- Compare quotes from multiple providers to get a clear understanding of the market rates.

- Understand your coverage needs and customize your policy accordingly.

- Consider increasing your deductible to lower your insurance costs.

- Maintain a clean claims history to avoid higher premiums.

- Look for discounts offered by providers, such as multi-policy discounts or loyalty rewards.

- Regularly review your policy and adjust it as your needs change.

By following these tips and staying informed about the latest trends in home insurance, you can make an educated decision and find the cheapest home insurance option that provides the coverage you need.

Future Implications

The home insurance landscape is continually evolving, and staying updated on industry trends is crucial. As technology advances, insurance providers are embracing digital tools and data analytics to offer more personalized and efficient services. This shift towards digital insurance can lead to increased competition and potentially lower insurance costs for homeowners.

Additionally, the rising awareness of environmental risks and climate change is influencing insurance policies. Insurance providers are adapting their coverage to address these emerging risks, which may impact insurance rates in the future. Staying informed about these developments will be essential for homeowners to make informed decisions and navigate the evolving insurance market.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and aligned with your needs.

What factors can lead to an increase in my home insurance rates?

+Several factors can lead to an increase in home insurance rates, including a history of claims, changes in your home’s value or construction, and even local market trends. Regularly reviewing your policy can help you identify potential rate increases.

Are there any discounts available for home insurance policies?

+Yes, many insurance providers offer discounts for various reasons. Common discounts include multi-policy discounts (bundling home and auto insurance), loyalty rewards, and safety features (such as smoke detectors or security systems). It’s worth exploring these options to lower your insurance costs.