Inexpensive Car Insurance Quotes

Finding inexpensive car insurance quotes can be a challenging task, especially with the vast array of insurance providers and the many factors that influence premiums. In today's fast-paced world, it's essential to navigate the insurance market wisely to secure the best coverage at an affordable price. This article aims to provide a comprehensive guide to help you understand the process of obtaining inexpensive car insurance quotes, offering valuable insights and practical tips to make the process smoother and more cost-effective.

Understanding Car Insurance Premiums

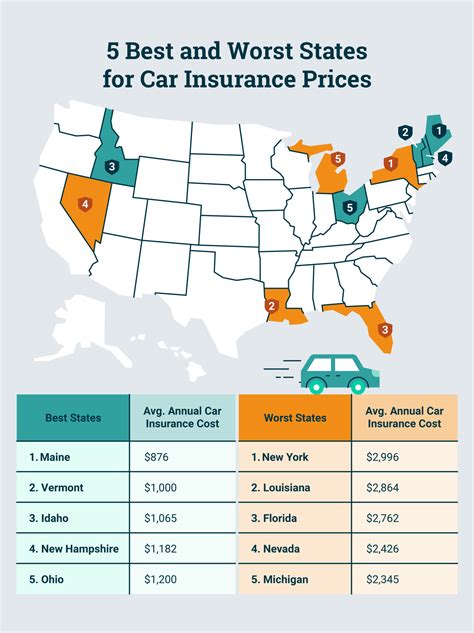

Car insurance premiums are influenced by a multitude of factors, including your driving history, the type of vehicle you own, your age and gender, and even your location. These factors are carefully evaluated by insurance providers to assess the level of risk associated with insuring your vehicle. Understanding these influences is the first step towards securing the best quotes.

The Impact of Your Driving Record

Your driving history plays a pivotal role in determining your insurance premiums. A clean driving record with no accidents or traffic violations often leads to lower insurance costs. Conversely, if you’ve had accidents or received tickets, your premiums are likely to be higher. Insurance companies view these incidents as indicators of potential future risks.

| Driving Record | Impact on Premiums |

|---|---|

| Clean Record | Lower Premiums |

| Accidents or Violations | Higher Premiums |

It's worth noting that the impact of these incidents on your premiums can vary significantly depending on the severity of the violation and the time elapsed since it occurred. Some insurance companies offer programs to help drivers with less-than-perfect records improve their standing over time.

Vehicle Type and Usage

The type of vehicle you drive also influences your insurance costs. Generally, sports cars and luxury vehicles are more expensive to insure due to their higher repair costs and greater likelihood of theft. Conversely, standard sedans and compact cars often have lower insurance premiums.

Additionally, the purpose for which you use your vehicle can impact your insurance costs. For instance, if you use your car primarily for business purposes, your insurance premiums may be higher than if you use it solely for personal travel. This is because business use typically entails more miles driven and potentially more risk.

Comparing Insurance Quotes

Once you have a good understanding of the factors that influence car insurance premiums, it’s time to start comparing quotes. This step is crucial to finding the most affordable coverage that suits your needs.

Online Quote Comparison Tools

Online quote comparison tools have revolutionized the insurance shopping process. These platforms allow you to enter your details once and receive multiple quotes from various insurance providers. This not only saves time but also provides a comprehensive view of the market, allowing you to make informed decisions.

When using online quote comparison tools, ensure that you provide accurate and detailed information. Any discrepancies between your online quote and the final policy could lead to unexpected costs or coverage gaps.

Working with an Insurance Broker

While online tools are convenient, working with an insurance broker can also be beneficial. Brokers have access to multiple insurance providers and can often negotiate better rates on your behalf. They can also provide personalized advice and help you understand the intricacies of different policies.

When meeting with an insurance broker, be sure to ask about any discounts you may be eligible for. Many providers offer discounts for various reasons, such as safe driving records, vehicle safety features, or even certain professional affiliations.

Maximizing Savings on Car Insurance

In addition to comparing quotes, there are several strategies you can employ to maximize your savings on car insurance.

Bundle Your Policies

Bundling your insurance policies, such as combining your car insurance with your home or renters’ insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, which can make your overall insurance costs more affordable.

Explore Discounts

Insurance providers offer a wide range of discounts, and it’s worth exploring these options to reduce your premiums. Common discounts include safe driver discounts, student discounts, loyalty discounts, and discounts for completing defensive driving courses.

Some insurance companies also offer usage-based insurance programs, where your driving habits are monitored and your premiums adjusted accordingly. These programs can be beneficial for safe drivers, as they offer the potential for significant savings.

Adjust Your Coverage

Reviewing your insurance coverage regularly and adjusting it as needed can also help reduce your premiums. For example, if you’ve paid off your car loan, you may no longer need collision coverage. Or, if you’ve added safety features to your vehicle, you may be eligible for a discount on your comprehensive coverage.

It's important to strike a balance between adequate coverage and affordability. While it may be tempting to reduce your coverage to lower your premiums, ensure that you still have the necessary protection in case of an accident or other unforeseen event.

Final Thoughts and Next Steps

Securing inexpensive car insurance quotes is a multifaceted process that involves understanding the factors that influence premiums, comparing quotes, and employing cost-saving strategies. By taking a proactive approach and staying informed, you can navigate the insurance market confidently and find the best coverage at the most affordable price.

Remember, car insurance is a necessary expense, and while it's important to save money, it's equally crucial to ensure you have adequate coverage. Take the time to review your options, ask questions, and make informed decisions. Your peace of mind and financial well-being are worth the effort.

How often should I review my car insurance policy and quotes?

+It’s a good practice to review your car insurance policy and quotes annually, or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for unnecessary features.

What factors can I control to lower my insurance premiums?

+You can control factors such as your driving habits, the safety features of your vehicle, and the type of coverage you choose. Additionally, maintaining a clean driving record and exploring discounts can significantly impact your premiums.

Are there any hidden costs associated with car insurance quotes?

+It’s important to carefully review the terms and conditions of any insurance policy. Some providers may have additional fees or charges, such as administration fees or surcharges for specific types of claims. Ensure you understand all potential costs before finalizing your policy.