Nys Car Insurance

New York State (NYS) car insurance is a crucial aspect of vehicle ownership and operation within the state. With its diverse landscape, bustling cities, and unique road conditions, NYS has developed a comprehensive insurance framework to protect drivers, passengers, and other road users. Understanding the specifics of NYS car insurance is essential for anyone residing in or driving through the state.

Comprehensive Coverage Requirements in NYS

The state of New York mandates that all vehicle owners maintain a minimum level of insurance coverage to operate their vehicles legally. This is to ensure financial protection in the event of accidents, injuries, or property damage. The specific requirements outlined by the New York State Department of Financial Services (NYSDFS) are as follows:

- Bodily Injury Liability Coverage: This coverage is essential to provide financial protection in the event that you, as the policyholder, cause an accident resulting in bodily injury or death to others. The NYSDFS mandates a minimum liability limit of $25,000 per person and $50,000 per accident.

- Property Damage Liability Coverage: Similarly, this coverage protects you from financial losses if your vehicle causes damage to someone else's property. The required minimum limit for this coverage is $10,000 per accident.

- Uninsured Motorist Bodily Injury Coverage: This coverage safeguards you and your passengers if you are involved in an accident with an uninsured or underinsured driver. The NYSDFS requires a minimum limit of $25,000 per person and $50,000 per accident.

- No-Fault Insurance (Personal Injury Protection): New York is a no-fault state, which means that your insurance company will cover your medical expenses and lost wages up to the policy limits, regardless of who is at fault in an accident. The required minimum limit for this coverage is $50,000 per person.

While these are the mandatory minimum coverage requirements, it is often recommended to purchase additional coverage to ensure comprehensive protection. This can include higher liability limits, collision coverage, comprehensive coverage for non-accident-related damages, and medical payments coverage.

Factors Influencing NYS Car Insurance Rates

Car insurance rates in New York can vary significantly based on several factors. Insurance providers use these factors to assess the level of risk associated with insuring a particular driver or vehicle. Some of the key factors that influence insurance rates in NYS include:

- Driver's Age and Driving History: Younger drivers, especially those under the age of 25, often face higher insurance premiums due to their relative lack of experience on the road. Similarly, drivers with a history of accidents, traffic violations, or insurance claims may also be considered high-risk and pay higher rates.

- Vehicle Type and Usage: The make, model, and year of your vehicle can impact your insurance rates. High-performance cars, luxury vehicles, and those with a higher likelihood of theft or damage may attract higher premiums. Additionally, the purpose for which you use your vehicle (commuting, business, pleasure) can also influence your rates.

- Location: The area where you live and drive plays a significant role in determining your insurance rates. Urban areas with higher population densities and traffic volumes often result in higher premiums due to increased accident risks. Similarly, regions with a history of severe weather conditions or natural disasters may also impact insurance costs.

- Credit Score: In many cases, insurance providers in New York consider an individual's credit score when determining insurance rates. Drivers with a higher credit score are often viewed as more financially responsible and may qualify for lower premiums.

- Discounts and Bundling: Many insurance companies offer discounts to encourage safe driving practices or to reward certain behaviors. These can include discounts for completing defensive driving courses, maintaining a clean driving record, or installing safety features in your vehicle. Additionally, bundling multiple insurance policies (such as auto and home insurance) with the same provider can often result in significant savings.

Understanding NYS Insurance Regulations

New York State has a comprehensive set of regulations governing the insurance industry to protect consumers and ensure fair practices. These regulations are enforced by the NYSDFS, which plays a vital role in overseeing the insurance market. Some key regulations to be aware of include:

- Policy Cancellation and Non-Renewal: Insurance companies are required to provide advance notice before canceling or non-renewing a policy. The NYSDFS mandates a minimum notice period of 30 days for non-renewal and 10 days for cancellation. Additionally, insurers must provide a valid reason for cancellation or non-renewal, such as non-payment of premiums or significant changes in risk factors.

- Claims Handling and Settlement: Insurance companies are obligated to handle claims promptly and fairly. They must acknowledge receipt of a claim within 15 business days and investigate and respond to the claim within 30 business days. If a claim is denied, the insurer must provide a detailed explanation of the reasons for the denial.

- Insurance Fraud and Penalties: New York has strict laws against insurance fraud, which includes intentionally providing false information to an insurance company or engaging in other deceptive practices. Penalties for insurance fraud can be severe, including fines, imprisonment, or both.

- Consumer Protection: The NYSDFS actively works to protect consumers by enforcing regulations, investigating complaints, and providing resources and education to help individuals understand their rights and responsibilities.

Navigating the NYS Insurance Market

With numerous insurance providers operating in New York, choosing the right car insurance policy can be a daunting task. To make an informed decision, consider the following steps:

- Research Multiple Providers: Compare rates and coverage options from at least three different insurance companies. Online comparison tools and insurance brokerages can be valuable resources for this.

- Understand Your Coverage Needs: Assess your specific requirements based on your vehicle, driving habits, and financial situation. Consider the mandatory minimum coverage and any additional coverage you may need.

- Check for Discounts: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for completing defensive driving courses. These can significantly reduce your insurance premiums.

- Review Policy Terms and Conditions: Carefully read the policy documents to understand the coverage limits, exclusions, and any additional benefits or services included in your policy.

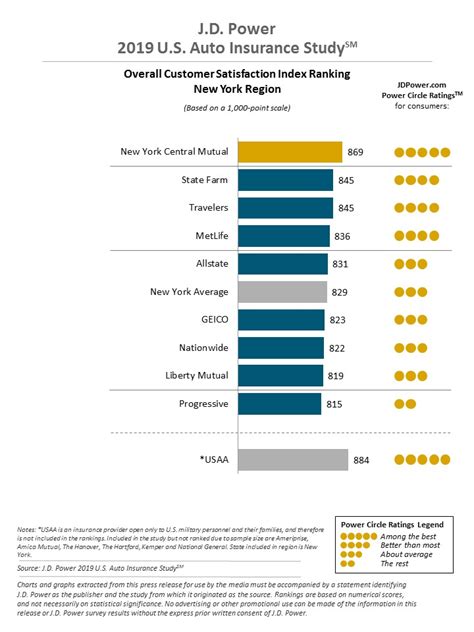

- Consider Customer Service and Claims Handling: Research the reputation of the insurance provider, including their customer service quality and claims handling process. Look for reviews and ratings from other policyholders to ensure a positive experience.

- Seek Professional Advice: If you're unsure about your insurance needs or have complex requirements, consider consulting an insurance agent or broker who can provide personalized guidance and recommendations.

By understanding the comprehensive coverage requirements, the factors influencing rates, and the regulatory environment in NYS, you can make informed decisions about your car insurance. Remember that while insurance is a legal requirement, it also provides vital financial protection in the event of accidents or other unforeseen circumstances.

How often should I review my car insurance policy in New York State?

+It is recommended to review your car insurance policy annually or whenever you experience significant life changes, such as getting married, purchasing a new vehicle, or moving to a different location. Regular policy reviews ensure that your coverage remains adequate and that you are taking advantage of any applicable discounts.

Can I get car insurance with a suspended license in New York State?

+Obtaining car insurance with a suspended license can be challenging but not impossible. Some insurance companies may be willing to provide coverage under specific circumstances, such as if the suspension was for a minor violation or if you have completed the required steps to reinstate your license. However, it is important to disclose your license status to potential insurers to avoid any legal issues.

Are there any specialized insurance programs for high-risk drivers in NYS?

+Yes, New York State offers a program called the New York Automobile Insurance Plan (NYAIP), which provides insurance coverage for high-risk drivers who are unable to obtain coverage through the voluntary market. This program ensures that even drivers with a history of accidents, violations, or other high-risk factors can obtain the mandatory insurance coverage required by law.