How Does Home Insurance Work

Home insurance, often referred to as homeowner's insurance, is a vital aspect of protecting one of the most significant investments an individual or family is likely to make - their home. This comprehensive coverage provides financial protection against various risks and perils that homeowners may face, ensuring peace of mind and stability in the face of unforeseen events. The mechanics of home insurance are intricate and tailored to meet the unique needs of each homeowner, and understanding how it works is essential for making informed decisions and maximizing the benefits it offers.

Understanding the Basics of Home Insurance Policies

A home insurance policy is a legally binding contract between the policyholder (the homeowner) and the insurance company. This contract outlines the specific terms, conditions, and coverage details of the insurance plan. It’s a comprehensive document that spells out what perils are covered, the limits of those coverages, any applicable deductibles, and the exclusions - the events or damages not covered by the policy.

The core of a home insurance policy is typically divided into two main parts: Property Coverage and Liability Coverage. Property Coverage protects the physical structure of the home and its contents against damages or losses caused by covered perils. This can include events like fire, windstorm, hail, lightning, explosion, vandalism, and more. The policy will also cover personal belongings like furniture, appliances, electronics, and clothing, up to a certain limit.

On the other hand, Liability Coverage safeguards the homeowner against legal claims and financial losses arising from accidents or injuries that occur on the insured property. This coverage extends beyond the physical structure of the home, covering the policyholder's legal responsibility for bodily injury or property damage to others.

Key Components of Home Insurance Policies

- Coverage Limits: These are the maximum amounts the insurance company will pay for covered losses. They vary depending on the type of coverage and the policy. It’s important to ensure that the limits are sufficient to cover the potential cost of rebuilding or replacing your home and its contents.

- Deductibles: A deductible is the amount the policyholder agrees to pay out of pocket before the insurance coverage kicks in. Higher deductibles often lead to lower premiums, so it’s a balance between what you can afford to pay upfront and the level of coverage you need.

- Additional Coverages: Many home insurance policies offer optional additional coverages, such as flood insurance, earthquake insurance, or coverage for high-value items like jewelry or artwork. These add-ons can be crucial for protecting against specific risks that aren’t covered under standard policies.

- Policy Exclusions: Understanding what is not covered by your home insurance policy is just as important as knowing what is. Common exclusions include damage caused by floods, earthquakes, poor maintenance, wear and tear, and intentional acts.

| Coverage Type | Key Details |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home. It covers the cost of rebuilding or repairing the house due to covered perils. |

| Personal Property Coverage | Covers the cost of replacing personal belongings like furniture, electronics, and clothing if they are damaged or lost due to a covered peril. |

| Liability Coverage | Provides financial protection against legal claims and lawsuits resulting from bodily injury or property damage to others that occur on the insured property. |

| Medical Payments Coverage | Covers medical expenses for guests injured on the insured property, regardless of liability. |

| Loss of Use Coverage | Reimburses the policyholder for additional living expenses if they have to temporarily relocate due to a covered loss. |

The Claims Process: Navigating the Path to Recovery

When a covered loss occurs, the policyholder initiates a claim with their insurance company. This process can be straightforward for minor incidents or more complex for extensive damages. Understanding the claims process is essential for efficient and effective recovery.

Initiating a Claim

The first step in the claims process is to notify your insurance company about the loss as soon as possible. Most insurers have a dedicated claims hotline or online portal where you can report the incident. It’s important to provide as much detail as possible about the event and any damage it caused.

After reporting the claim, the insurance company will assign an adjuster to assess the damage and determine the extent of the loss. The adjuster will inspect the property, review the policy coverage, and gather evidence to support the claim. This may include taking photographs, obtaining estimates from contractors, or reviewing documentation related to the loss.

Assessing the Damage and Coverage

The insurance adjuster will carefully evaluate the damage to the home and its contents to determine what is covered under the policy. They will consider the type of peril that caused the damage, the extent of the loss, and any applicable policy exclusions or limitations. The adjuster’s role is to ensure that the claim is handled fairly and in accordance with the terms of the insurance contract.

During the assessment process, it's beneficial for the policyholder to provide any relevant documentation, such as receipts, photographs, or maintenance records, to support the claim. This can help expedite the process and ensure a more accurate evaluation of the loss.

Filing a Claim and the Resolution Process

Once the adjuster has completed their assessment, they will prepare an estimate of the damages and present it to the policyholder. This estimate will outline the repairs or replacements needed and the associated costs. If the policyholder agrees with the estimate, they can proceed with the necessary repairs and submit receipts or invoices to the insurance company for reimbursement.

In some cases, there may be a disagreement between the policyholder and the insurance company regarding the extent of the damage or the value of the claim. In such situations, it's advisable to seek professional advice or mediation to resolve the dispute. Homeowners should be aware of their rights and the resources available to them to ensure they receive fair and adequate compensation for their losses.

| Claim Type | Description |

|---|---|

| First-Party Claims | These are claims filed by the policyholder directly with their insurance company for damages to their own property or personal injury. |

| Third-Party Claims | These are claims filed by someone who has been injured or suffered property damage on the insured property. The claim is made against the policyholder's liability coverage. |

| Subrogation Claims | If the insurance company pays out a claim and believes that another party is responsible for the loss, they may pursue legal action against that party to recover the payment. This is known as subrogation. |

Types of Home Insurance Policies: Tailoring Coverage to Your Needs

Home insurance policies come in various forms, each designed to meet the unique needs and circumstances of different homeowners. Understanding the different types of policies available is crucial for selecting the right coverage that provides the best protection for your home and belongings.

HO-1: Basic Form Policy

The HO-1 policy is the most basic form of home insurance coverage. It provides limited protection against specific perils, including fire, lightning, windstorm or hail, explosion, riot or civil commotion, aircraft, vehicles, smoke, vandalism, and theft. This policy is often recommended for older homes or those with lower replacement costs.

HO-2: Broad Form Policy

The HO-2 policy, also known as the Broad Form policy, offers more extensive coverage than the HO-1 policy. In addition to the perils covered by the HO-1 policy, the HO-2 policy also provides coverage for damage caused by falling objects, weight of ice, snow, or sleet, accidental discharge or overflow of water or steam, sudden and accidental damage from artificially generated electrical current, and more. This policy is suitable for a wider range of homes and provides better protection against a variety of risks.

HO-3: Special Form Policy

The HO-3 policy, often referred to as the Special Form policy, is the most common and comprehensive form of home insurance coverage. It provides protection against all risks of physical loss to the dwelling and its contents, except for those specifically excluded in the policy. The HO-3 policy covers a broad range of perils, including fire, lightning, windstorm, hail, explosion, vandalism, and more. This policy is ideal for newer homes or those with higher replacement costs.

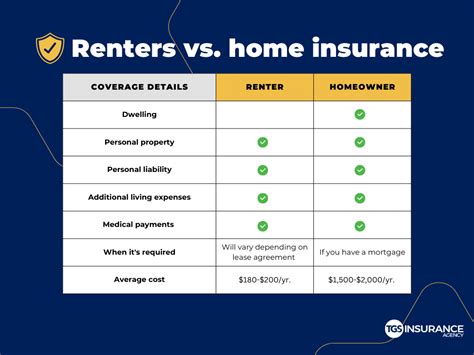

HO-4: Renter’s Insurance Policy

The HO-4 policy is specifically designed for renters, providing coverage for their personal belongings and liability protection. This policy covers the cost of replacing personal property in the event of a covered loss, such as fire, theft, or vandalism. It also provides liability coverage for accidents that occur on the rented premises, protecting the renter from legal claims and financial losses.

HO-5: Comprehensive Form Policy

The HO-5 policy, known as the Comprehensive Form policy, offers the highest level of coverage for homeowners. It provides protection for the dwelling and its contents against all risks, except those specifically excluded in the policy. The HO-5 policy is ideal for high-value homes or those with valuable personal belongings, as it offers the most extensive coverage and protection against a wide range of perils.

| Policy Type | Coverage |

|---|---|

| HO-1 | Basic coverage for specific perils, including fire, lightning, windstorm, and vandalism. |

| HO-2 | More extensive coverage than HO-1, including additional perils like falling objects and accidental water damage. |

| HO-3 | Comprehensive coverage for all risks except those specifically excluded, suitable for newer homes. |

| HO-4 | Designed for renters, providing coverage for personal belongings and liability protection. |

| HO-5 | Highest level of coverage, offering protection against all risks for high-value homes and belongings. |

Common Home Insurance Claims: Understanding Risks and Protection

Home insurance policies are designed to protect homeowners against a wide range of risks and perils. Understanding the most common types of claims can help policyholders better prepare for potential losses and ensure they have adequate coverage in place.

Fire and Smoke Damage

Fire is one of the most devastating perils that can affect a home. Home insurance policies typically provide coverage for fire damage, including the cost of rebuilding or repairing the structure, replacing personal belongings, and covering additional living expenses if the home becomes uninhabitable during repairs. Smoke damage, which can result from a fire or other sources, is also covered under most policies.

Water Damage

Water damage is another common claim under home insurance policies. This can include damage caused by burst pipes, appliance failures, roof leaks, or natural disasters like hurricanes or heavy rainfall. However, it’s important to note that standard home insurance policies often exclude coverage for flood damage, which requires a separate flood insurance policy.

Theft and Burglary

Theft and burglary are unfortunately common occurrences that can result in significant losses for homeowners. Home insurance policies typically cover the cost of replacing stolen items and may also provide coverage for any necessary repairs to the home, such as broken doors or windows. It’s crucial to review your policy’s coverage limits and exclusions to ensure you have adequate protection for your belongings.

Wind and Storm Damage

Windstorms, hurricanes, and other severe weather events can cause significant damage to homes, from broken windows and roof damage to uprooted trees and fallen power lines. Home insurance policies typically provide coverage for these types of damages, although it’s important to understand any policy limitations or deductibles that may apply.

Liability Claims

Liability claims can arise when someone is injured on your property or if your actions result in property damage to others. Home insurance policies typically include liability coverage, which can help protect you from financial losses and legal expenses associated with such claims. It’s essential to understand the limits of your liability coverage and consider any additional coverage you may need, such as umbrella insurance.

| Claim Type | Description |

|---|---|

| Fire and Smoke Damage | Coverage for rebuilding or repairing the structure, replacing personal belongings, and covering additional living expenses if the home becomes uninhabitable. |

| Water Damage | Coverage for damage caused by burst pipes, appliance failures, roof leaks, and natural disasters (except flood damage, which requires a separate policy). |

| Theft and Burglary | Coverage for replacing stolen items and any necessary repairs to the home. |

| Wind and Storm Damage | Coverage for damages caused by windstorms, hurricanes, and other severe weather events, including broken windows, roof damage, and fallen trees. |

| Liability Claims | Protection against financial losses and legal expenses resulting from bodily injury or property damage to others on your property. |

Factors Influencing Home Insurance Premiums

The cost of home insurance, known as the premium, is determined by several factors. Understanding these factors can help homeowners make informed decisions when choosing an insurance policy and potentially save on their premiums.

Location and Risk Factors

The location of your home plays a significant role in determining insurance premiums. Areas prone to natural disasters like hurricanes, floods, or wildfires typically have higher premiums due to the increased risk of claims. Similarly, homes located in high-crime areas may also face higher premiums due to the risk of theft and vandalism.

Home Value and Replacement Cost

The value of your home and its replacement cost are key factors in determining insurance premiums. Homes with higher replacement costs will generally have higher premiums to ensure adequate coverage. It’s important to review your policy regularly and adjust coverage limits to reflect any changes in your home’s value or market conditions.

Deductibles and Coverage Options

The deductible you choose can significantly impact your insurance premium. Higher deductibles typically result in lower premiums, as the policyholder assumes more financial responsibility in the event of a claim. Additionally, the coverage options you select, such as additional endorsements or riders, can also affect your premium. It’s a balance between the cost of the premium and the level of coverage you need.

Credit Score and Claims History

Insurance companies often consider an individual’s credit score when determining premiums. A higher credit score can lead to lower premiums, as it is seen as an indicator of financial stability and responsibility. Additionally, your claims history can also impact your premiums. Multiple claims, especially within a short period, may result in higher premiums or even non-renewal of your policy.

Safety Features and Preventive Measures

Installing safety features in your home, such as smoke detectors, fire sprinklers, burglar alarms, and deadbolt locks, can lead to lower insurance premiums. These features reduce the risk of loss and may qualify you for discounts. Additionally, taking preventive measures to protect your home, such as regular maintenance and updates, can also lower your premiums and reduce the likelihood of claims.

| Factor | Impact on Premium |

|---|---|

| Location and Risk Factors | Areas prone to natural disasters or high crime rates |