Insurance Home And Auto

The world of insurance is vast and complex, offering financial protection and peace of mind to individuals and families. One of the most common types of insurance is home and auto insurance, which provides coverage for two of life's most significant investments: your home and your vehicle. In this comprehensive guide, we will delve into the intricacies of home and auto insurance, exploring its importance, coverage options, and how it can safeguard your most valuable assets.

Understanding Home and Auto Insurance

Home and auto insurance are essential components of a comprehensive financial plan. They offer protection against unforeseen events and potential losses that can arise from owning a home and operating a vehicle. By understanding the scope and benefits of these insurance policies, you can make informed decisions to secure your assets and future.

Home Insurance: Protecting Your Sanctuary

Your home is more than just a physical structure; it’s a sanctuary where memories are made and lives are built. Home insurance is designed to protect this precious asset from a wide range of perils, ensuring that you can rebuild and recover in the event of a disaster. Here’s a closer look at what home insurance entails.

Home insurance typically covers structural damage caused by natural disasters like hurricanes, tornadoes, and wildfires. It also provides liability protection, safeguarding you from lawsuits if someone is injured on your property. Additionally, home insurance covers personal belongings such as furniture, electronics, and clothing, ensuring that you can replace them if they are damaged or stolen.

When choosing home insurance, it's crucial to assess your specific needs and the unique risks associated with your location. For instance, if you live in an area prone to flooding, you may need to consider additional flood insurance coverage. Consulting with an insurance professional can help you tailor your policy to your circumstances.

| Home Insurance Coverage Types | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home. |

| Personal Property Coverage | Covers belongings inside your home, including furniture and appliances. |

| Liability Coverage | Provides protection against lawsuits resulting from injuries on your property. |

| Additional Living Expenses | Covers temporary living costs if your home becomes uninhabitable due to a covered event. |

Auto Insurance: Navigating the Roads with Confidence

Your vehicle is not just a means of transportation; it’s a symbol of freedom and mobility. Auto insurance is crucial for ensuring that you can navigate the roads safely and financially secure. Here’s an in-depth look at the key components of auto insurance.

Auto insurance provides liability coverage to protect you financially if you cause an accident that results in injuries or property damage to others. It also covers damage to your vehicle caused by collisions, theft, or natural disasters. Additionally, auto insurance offers medical payments coverage, which can help cover the costs of medical treatment for you and your passengers in the event of an accident.

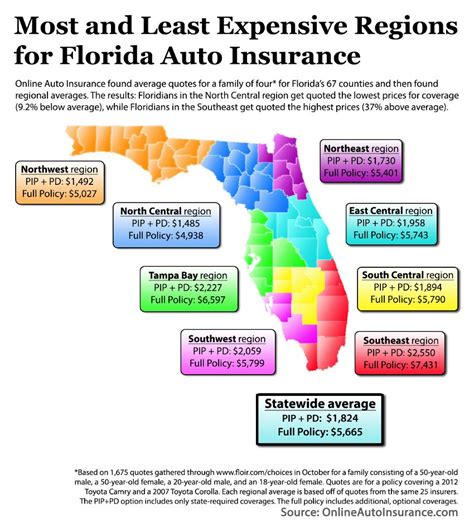

When selecting auto insurance, it's important to consider your driving history and the value of your vehicle. If you have a clean driving record, you may be eligible for discounts. Additionally, the make, model, and age of your car can impact the cost and coverage options available to you.

| Auto Insurance Coverage Types | Description |

|---|---|

| Liability Coverage | Covers injuries and property damage caused to others in an accident you're at fault for. |

| Collision Coverage | Pays for repairs or replacement of your vehicle if it's damaged in a collision. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, or natural disasters. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers in an accident. |

The Benefits of Bundling Home and Auto Insurance

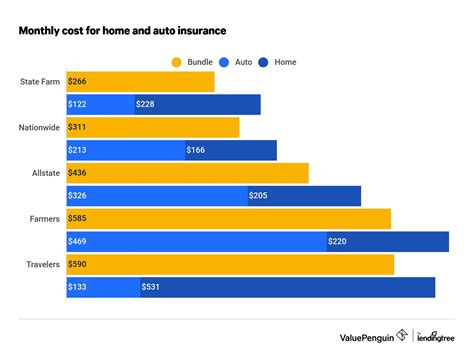

Bundling your home and auto insurance policies can offer significant advantages, both in terms of convenience and cost savings. Many insurance providers offer multi-policy discounts when you insure multiple assets with them. Additionally, bundling your policies simplifies your insurance management, as you only need to deal with one insurer and one renewal date.

When you bundle your home and auto insurance, you gain access to a range of benefits, including:

- Discounts: Insurance companies often provide discounts of up to 20% when you combine your home and auto policies. This can lead to substantial savings over time.

- Convenience: Managing your insurance needs becomes more straightforward with a single insurer. You can easily make policy changes, update coverage, and renew your policies in one place.

- Better Coverage: Bundling your policies can lead to enhanced coverage options. For instance, some insurers offer discounts on home insurance if your auto insurance is with them, and vice versa.

- Customized Plans: Bundling allows you to create a personalized insurance plan that suits your specific needs and budget. You can tailor your coverage to your unique circumstances.

Real-Life Example: The Smith Family’s Experience

Let’s consider the Smith family, who recently decided to bundle their home and auto insurance policies. By doing so, they not only saved money but also gained peace of mind.

The Smiths had been paying separate premiums for their home and auto insurance, but when they explored the option of bundling, they discovered significant savings. Their insurer offered a 15% discount on their home insurance and a 10% discount on their auto insurance when they combined the policies. This resulted in an annual savings of over $600.

Additionally, the Smiths found that bundling their policies made it easier to manage their insurance needs. They could now make updates or changes to both policies with a single call to their insurer. This streamlined approach saved them time and effort.

The customized plan the Smiths created allowed them to increase their liability coverage for their home and add comprehensive coverage for their auto policy, ensuring they were fully protected against a range of potential risks.

Choosing the Right Home and Auto Insurance Provider

Selecting the right insurance provider is a critical step in securing your home and auto assets. Here are some key factors to consider when choosing an insurer:

Reputation and Financial Stability

Look for an insurance company with a solid reputation in the industry. Check reviews and ratings from independent sources to assess their customer satisfaction and claim handling processes. Additionally, ensure the insurer is financially stable, as this guarantees they can pay out claims even in challenging economic times.

Coverage Options and Customization

Different homes and vehicles come with unique risks. Choose an insurer that offers a wide range of coverage options and allows for customization. This ensures you can tailor your policy to your specific needs, whether you require additional liability coverage or specialized coverage for high-value items.

Discounts and Savings

Inquire about the discounts and savings opportunities offered by the insurer. Many providers offer multi-policy discounts, as we’ve discussed, but they may also provide additional savings for things like safe driving, loyalty, or bundling with other insurance products.

Claim Process and Customer Service

The claim process is a critical aspect of insurance. Choose an insurer with a straightforward and efficient claim process. Look for providers with a reputation for quick response times and fair claim settlements. Additionally, ensure the insurer has a dedicated customer service team that is easily accessible and responsive to your needs.

Technology and Digital Tools

In today’s digital age, many insurers offer online or mobile tools to manage your policies and file claims. Consider insurers that provide user-friendly digital platforms, as these can simplify the insurance process and enhance your overall experience.

Understanding Your Coverage Limits and Deductibles

When selecting home and auto insurance, it’s crucial to understand the coverage limits and deductibles associated with your policies. These factors directly impact the level of protection you have and the out-of-pocket costs you may incur in the event of a claim.

Coverage Limits

Coverage limits refer to the maximum amount your insurance provider will pay for a covered loss. For example, if your home insurance policy has a dwelling coverage limit of $500,000, that’s the maximum amount the insurer will pay to rebuild your home in the event of a total loss.

It's important to choose coverage limits that align with the actual replacement cost of your assets. Underinsuring can leave you financially vulnerable, while overinsuring may result in unnecessary premium costs.

Deductibles

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. For instance, if your auto insurance policy has a 500 deductible and you're involved in an accident, you'll need to pay 500 towards the repairs before your insurer covers the remaining costs.

Higher deductibles often result in lower premiums, as you're assuming more financial responsibility. However, it's important to choose a deductible that you can afford in the event of a claim.

The Future of Home and Auto Insurance: Innovations and Trends

The insurance industry is evolving, and home and auto insurance are no exception. Here are some of the latest innovations and trends shaping the future of these insurance sectors.

Telematics and Usage-Based Insurance

Usage-based insurance, also known as telematics, is gaining popularity in the auto insurance industry. This innovative approach uses real-time data from devices installed in your vehicle to monitor driving behavior. Insurers can then offer personalized premiums based on your actual driving habits, rewarding safe drivers with lower rates.

Home Automation and Smart Devices

The rise of home automation and smart devices is transforming home insurance. Many insurers now offer discounts for homes equipped with smart technology, as these devices can enhance security and prevent losses. For instance, smart smoke detectors and water leak sensors can quickly alert homeowners and insurers to potential hazards, reducing the risk of significant damage.

Digital Claims Processing

The digital revolution is also impacting the claims process. Many insurers now offer digital tools that allow policyholders to file claims online or through mobile apps. This streamlines the claims process, making it more efficient and reducing the time it takes to receive a settlement.

Data Analytics and Risk Assessment

Advanced data analytics is enabling insurers to more accurately assess risks and price policies. By analyzing vast amounts of data, insurers can identify patterns and trends that help them offer more tailored coverage options and competitive premiums.

Conclusion: Securing Your Future with Home and Auto Insurance

Home and auto insurance are essential components of financial planning, offering protection and peace of mind. By understanding the coverage options, benefits, and innovations in these insurance sectors, you can make informed decisions to safeguard your most valuable assets.

Whether you're a homeowner, a driver, or both, the right insurance policy can provide the security you need to navigate life's uncertainties. By choosing the right insurer, understanding your coverage limits, and staying informed about industry trends, you can ensure that you're adequately protected and prepared for whatever the future holds.

What is the difference between home insurance and homeowners insurance?

+Home insurance and homeowners insurance are often used interchangeably, but there can be subtle differences. Home insurance typically refers to the coverage of the physical structure of your home and its contents, while homeowners insurance is a broader term that includes additional coverage, such as liability protection and coverage for additional living expenses.

Is auto insurance mandatory?

+Yes, auto insurance is mandatory in most states. It is legally required to have at least a minimum level of liability coverage to protect you financially if you cause an accident that results in injuries or property damage to others.

How often should I review my home and auto insurance policies?

+It’s recommended to review your home and auto insurance policies annually or whenever there are significant changes in your life, such as purchasing a new home, adding a teen driver to your auto policy, or making substantial home improvements. Regular reviews ensure your coverage remains adequate and up-to-date.