Nj Insurance Companies

In the state of New Jersey, insurance is an integral part of daily life, providing financial protection and peace of mind to residents and businesses alike. From auto insurance to health coverage and homeowners' policies, the insurance industry plays a crucial role in the Garden State's economy and the well-being of its residents. This comprehensive guide aims to delve into the world of New Jersey insurance companies, exploring the key players, the regulatory landscape, and the unique features of the state's insurance market.

The Landscape of New Jersey Insurance

New Jersey boasts a diverse insurance market, with a wide array of providers offering various types of coverage to meet the needs of its diverse population. From established, national insurance carriers to regional and local providers, the competition in the Garden State is fierce, resulting in a range of insurance options for consumers.

Key Players in the NJ Insurance Market

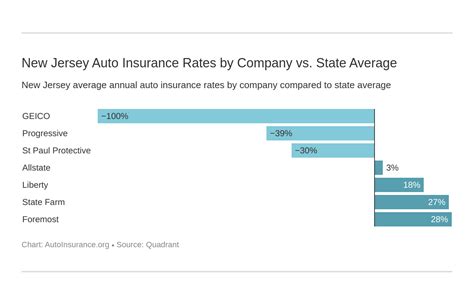

Several prominent insurance companies have a significant presence in New Jersey, providing a broad spectrum of insurance products and services. Some of the leading players in the market include:

- State Farm: A well-known national brand, State Farm offers a comprehensive range of insurance products, including auto, home, life, and health insurance. With a strong focus on customer service and a network of local agents, State Farm has a significant presence in New Jersey.

- Allstate: Another major national insurer, Allstate provides auto, home, renters, and business insurance. Known for its innovative products and digital offerings, Allstate has a strong foothold in the Garden State, catering to a wide range of customers.

- Progressive: Progressive Insurance is a leading provider of auto insurance, offering competitive rates and a range of coverage options. With a focus on online and mobile services, Progressive has gained popularity among tech-savvy New Jersey residents.

- GEICO: The Government Employees Insurance Company, or GEICO, is a prominent insurer offering auto insurance and other products to a wide range of customers, including those in New Jersey. Known for its humorous advertising campaigns, GEICO has built a solid reputation for affordability and customer satisfaction.

- New Jersey Manufacturers Insurance Company (NJM): A prominent regional insurer, NJM provides auto, homeowners, and business insurance exclusively to New Jersey residents and businesses. Known for its excellent customer service and competitive rates, NJM has a strong reputation in the state.

These companies, along with many others, contribute to the vibrant and competitive insurance landscape in New Jersey, offering residents and businesses a wide array of choices when it comes to insurance coverage.

Regulatory Environment in New Jersey

The insurance industry in New Jersey is subject to a comprehensive regulatory framework aimed at protecting consumers and ensuring the stability of the market. The primary regulator is the New Jersey Department of Banking and Insurance (DOBI), which oversees all aspects of the insurance industry in the state, including licensing, rate approvals, consumer protection, and market conduct examinations.

The DOBI works to ensure that insurance companies operating in New Jersey meet strict standards for financial stability, consumer protection, and fair practices. It reviews and approves insurance rates, monitors company solvency, and investigates consumer complaints to ensure that insurance companies are acting in the best interests of their policyholders.

| Regulator | Function |

|---|---|

| New Jersey Department of Banking and Insurance (DOBI) | Licensing, rate approvals, consumer protection, market conduct examinations |

In addition to the DOBI, other regulatory bodies play a role in overseeing specific aspects of the insurance industry. For instance, the New Jersey Compensation Rating and Inspection Bureau (NJCRIB) administers the workers' compensation insurance system in the state, while the New Jersey Property-Liability Insurance Guaranty Association provides protection for policyholders in the event of an insurer's insolvency.

Insurance Products and Coverage in New Jersey

New Jersey residents have access to a wide range of insurance products, each designed to address specific needs and risks. Here’s an overview of some of the key insurance categories available in the Garden State:

Auto Insurance

Auto insurance is a critical component of financial protection for New Jersey drivers. The state requires all vehicle owners to carry a minimum level of liability insurance, which covers bodily injury and property damage in the event of an at-fault accident. Additionally, New Jersey drivers have the option to purchase various types of coverage, including collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

New Jersey is known for its no-fault auto insurance system, which means that regardless of who is at fault in an accident, drivers must turn to their own insurance company for coverage of medical expenses and lost wages up to the policy limits. This system aims to streamline the claims process and provide faster compensation for injured parties.

Homeowners’ Insurance

For homeowners in New Jersey, insurance is essential to protect against a range of risks, including fire, theft, and natural disasters. The state’s diverse geography, with its coastal areas, forests, and urban centers, presents a unique set of challenges for homeowners’ insurance. Coverage options typically include protection for the dwelling, personal property, liability, and additional living expenses in the event of a covered loss.

Given the state's vulnerability to hurricanes and other natural disasters, many New Jersey homeowners opt for comprehensive coverage, including flood insurance, which is typically not covered under standard homeowners' policies.

Health Insurance

Access to quality healthcare is a top priority for New Jersey residents, and health insurance plays a crucial role in ensuring this access. The state has a robust health insurance market, with a variety of plans offered by both national and regional insurers. New Jersey residents can choose from various types of health insurance, including individual, family, and employer-sponsored plans.

The state's healthcare system is governed by the New Jersey Department of Health (NJDOH), which works to ensure that residents have access to quality, affordable healthcare. The department also oversees the implementation of the Affordable Care Act (ACA) in the state, providing a healthcare marketplace where individuals and small businesses can shop for and purchase health insurance plans.

Life Insurance

Life insurance is an important component of financial planning for many New Jersey residents. It provides a measure of financial security for loved ones in the event of the policyholder’s death. New Jersey residents can choose from a variety of life insurance products, including term life, whole life, and universal life insurance.

The state's life insurance market is highly competitive, with a range of providers offering innovative products and customizable coverage options to meet the diverse needs of its residents.

Business Insurance

For businesses operating in New Jersey, insurance is crucial to mitigate risks and protect against financial losses. The state’s business insurance market offers a wide range of coverage options, including general liability, professional liability (errors and omissions), property insurance, workers’ compensation, and cyber liability insurance.

New Jersey's business insurance landscape is shaped by the state's diverse economy, which includes industries such as manufacturing, healthcare, finance, and tourism. Businesses can tailor their insurance coverage to address the unique risks associated with their industry and operations.

The Future of Insurance in New Jersey

The insurance industry in New Jersey is constantly evolving, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Here are some key trends and developments that are shaping the future of insurance in the Garden State:

Digital Transformation

The insurance industry in New Jersey, like many others, is undergoing a digital transformation. Insurers are investing in technology to enhance the customer experience, streamline processes, and improve operational efficiency. This includes the adoption of digital platforms for policy management, claims processing, and customer service, as well as the integration of artificial intelligence and machine learning to automate tasks and improve decision-making.

Telemedicine and Digital Health

The rise of telemedicine and digital health solutions is transforming the healthcare landscape in New Jersey and impacting the health insurance market. Many health insurance providers are now offering telemedicine services as part of their plans, allowing policyholders to access medical care remotely. This not only improves access to healthcare but also reduces costs for both insurers and policyholders.

Data-Driven Insurance

With the advent of big data and advanced analytics, insurance companies in New Jersey are leveraging data to make more informed decisions and offer personalized coverage. By analyzing vast amounts of data, insurers can better understand customer needs, predict risks, and develop innovative products. This data-driven approach is transforming the way insurance is priced, packaged, and delivered, leading to more efficient and effective coverage options for consumers.

Regulatory and Legislative Changes

The insurance industry in New Jersey is subject to ongoing regulatory and legislative changes, which can have a significant impact on the market. For instance, changes to state laws and regulations related to auto insurance, such as adjustments to minimum liability limits or modifications to no-fault laws, can affect the cost and availability of coverage for drivers. Similarly, changes to healthcare regulations can impact the affordability and accessibility of health insurance plans.

The state's regulatory bodies, such as the DOBI and NJDOH, play a crucial role in overseeing these changes and ensuring that they align with the best interests of consumers and the stability of the insurance market.

Climate Change and Natural Disasters

New Jersey’s vulnerability to natural disasters, particularly hurricanes and coastal storms, is a significant factor shaping the insurance landscape. As climate change continues to impact weather patterns, the frequency and severity of these events may increase, leading to higher insurance costs and greater demand for comprehensive coverage. Insurers in the state are adapting their strategies and risk management approaches to address these evolving risks.

Conclusion

The insurance market in New Jersey is a dynamic and competitive space, offering residents and businesses a wide array of coverage options to meet their unique needs. From auto insurance and homeowners’ policies to health and life coverage, the Garden State’s insurance providers are committed to delivering financial protection and peace of mind. As the industry continues to evolve, driven by technology, regulatory changes, and environmental factors, New Jersey residents can expect to see innovative products, improved customer experiences, and enhanced protection against a range of risks.

What is the average cost of auto insurance in New Jersey?

+The average cost of auto insurance in New Jersey varies based on several factors, including the driver’s age, driving record, vehicle type, and coverage limits. According to recent data, the average annual premium for a liability-only policy in the state is around 1,600, while a full-coverage policy can cost upwards of 2,500. However, rates can vary significantly depending on individual circumstances.

Are there any discounts available for New Jersey homeowners’ insurance?

+Yes, there are several discounts available for New Jersey homeowners’ insurance. These may include discounts for multiple policies (e.g., bundling auto and home insurance), safety features (such as smoke detectors or burglar alarms), loyalty (for long-term customers), and even occupation-related discounts. It’s worth exploring these options with your insurance provider to see if you’re eligible for any savings.

How does New Jersey’s healthcare marketplace work?

+New Jersey’s healthcare marketplace, also known as the Health Insurance Marketplace, is a platform where individuals and small businesses can shop for and purchase health insurance plans. It’s governed by the Affordable Care Act (ACA) and offers a range of plans from various insurers. Residents can compare plans based on cost, coverage, and other factors, and enroll during the annual open enrollment period or if they qualify for a special enrollment period due to certain life events.

What are some tips for choosing the right life insurance policy in New Jersey?

+When selecting a life insurance policy in New Jersey, it’s important to consider your specific needs and financial goals. Factors to consider include the amount of coverage you need (based on your financial obligations and goals), the type of policy (term life, whole life, or universal life), and the financial strength and reputation of the insurance company. It’s also advisable to review the policy’s terms and conditions, including any exclusions or limitations, to ensure it meets your expectations.