Quote Vehicle Insurance

Welcome to our comprehensive guide on understanding and obtaining the best vehicle insurance quotes. In today's fast-paced world, having reliable insurance for your vehicle is not just a necessity but a smart financial decision. Whether you're a seasoned driver or a new car owner, navigating the world of insurance can be complex. This article aims to demystify the process, providing you with expert insights and practical tips to secure the most suitable and cost-effective coverage for your vehicle.

The Importance of Vehicle Insurance

Vehicle insurance is a cornerstone of responsible car ownership. It provides financial protection against a range of unforeseen events, from minor fender benders to major accidents, ensuring you and your vehicle are covered. Beyond the legal requirements, having comprehensive insurance offers peace of mind, knowing that you’re prepared for any eventuality on the road.

However, with numerous insurance providers and policy options available, finding the right coverage at the best price can be daunting. That's why we've compiled this guide, drawing on industry expertise and real-world examples to empower you with the knowledge to make informed decisions.

Understanding Your Insurance Needs

Before diving into quotes, it’s crucial to understand your specific insurance needs. This involves assessing various factors, including the type of vehicle you own, your driving history, and the level of coverage you require. Different vehicles and drivers come with unique risks and requirements, so tailoring your insurance to these factors is essential.

Vehicle Type and Value

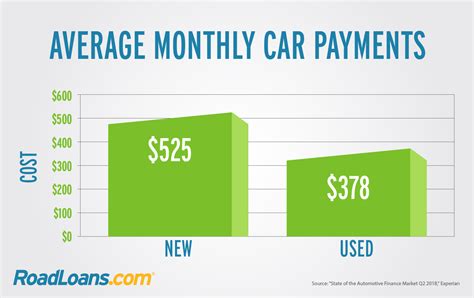

The type and value of your vehicle play a significant role in determining your insurance costs. High-performance cars, luxury vehicles, and certain makes and models known for frequent theft or accidents may attract higher premiums. On the other hand, older, more affordable cars might be more cost-effective to insure.

Additionally, the value of your vehicle influences the level of coverage you need. For newer, more expensive cars, comprehensive insurance that covers repairs, replacements, and liability is often recommended. For older vehicles, basic liability coverage might be more suitable.

| Vehicle Type | Insurance Considerations |

|---|---|

| Luxury Cars | Higher premiums due to theft and accident risks, specialized repair needs |

| Classic Cars | Customized policies, limited mileage, agreed value coverage |

| Electric Vehicles | Unique coverage for battery and charging equipment, potential discounts |

Driving History and Demographics

Your driving history and personal demographics are key factors in insurance pricing. A clean driving record with no accidents or violations typically results in lower premiums. Conversely, a history of accidents or traffic violations may lead to higher rates or even difficulty in finding coverage.

Age and gender can also influence insurance costs. Younger drivers, particularly males, are often considered higher risk and may face higher premiums. However, this can vary significantly based on individual driving records and other factors.

Coverage Requirements

Understanding your state’s minimum insurance requirements is vital. While these vary, they typically include liability coverage for bodily injury and property damage. However, depending on your circumstances and preferences, you may wish to explore additional coverage options, such as:

- Collision Coverage: Pays for repairs or replacement of your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damage from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who has little or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Obtaining Accurate Quotes

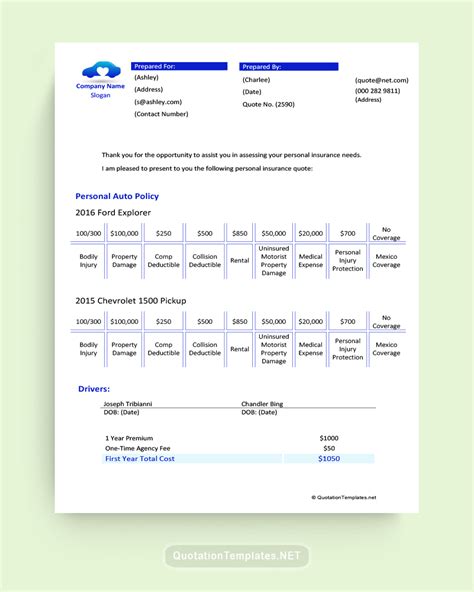

Getting accurate insurance quotes involves more than just comparing prices. It requires providing detailed and honest information about your vehicle, driving history, and desired coverage. Here’s a step-by-step guide to help you obtain the most precise quotes:

Gather Your Information

Before requesting quotes, ensure you have the following details readily available:

- Vehicle information: Make, model, year, VIN, mileage, and any modifications.

- Driving history: Accidents, violations, and any gap in coverage.

- Coverage preferences: The type and level of coverage you require.

- Personal details: Age, gender, marital status, and any relevant discounts (e.g., good student, veteran status).

Compare Multiple Providers

Don’t settle for the first quote you receive. Compare rates from at least three to five reputable insurance companies. Online quote comparison tools can be a convenient way to quickly gather multiple quotes, but remember to also explore options with local insurance agents who can offer personalized advice.

Be Transparent

Provide accurate and honest information when requesting quotes. Withholding or misrepresenting details can lead to unexpected issues when filing a claim, potentially resulting in claim denials or even legal consequences. It’s always best to be upfront about your driving history and vehicle details.

Explore Discounts

Insurance providers offer a range of discounts that can significantly reduce your premiums. These may include:

- Multi-Policy Discounts: If you bundle your auto insurance with other policies, such as home or renters insurance, you may qualify for a discount.

- Good Driver Discounts: Rewards for maintaining a clean driving record over a certain period.

- Low Mileage Discounts: For drivers who log fewer miles annually.

- Safe Driver Programs: Some insurers offer discounts for participating in driving programs or using monitoring devices.

- Loyalty Discounts: Rewards for staying with the same insurer over an extended period.

Analyzing and Selecting the Right Policy

Once you’ve obtained a range of quotes, it’s time to analyze and select the policy that best suits your needs and budget. Here’s a structured approach to guide your decision-making process:

Compare Coverage and Premiums

Start by comparing the coverage limits and deductibles offered by each policy. Ensure that the policies you’re considering provide the level of coverage you require, whether it’s for liability, collision, comprehensive, or other specific types of coverage. Then, compare the premiums associated with these policies.

It's important to note that the cheapest policy might not always be the best option. Consider the reputation and financial stability of the insurance company, as well as their claims handling process and customer service ratings. You want to ensure that you're not only getting a good deal but also reliable coverage from a reputable provider.

Review Policy Exclusions and Limitations

Every insurance policy comes with certain exclusions and limitations. These are situations or events that are not covered by the policy. Carefully review these exclusions to ensure that they align with your expectations and needs. For example, some policies may have restrictions on coverage for certain types of accidents or damage.

Consider Additional Benefits

Beyond the standard coverage, some insurance providers offer additional benefits or perks that can enhance your policy. These might include roadside assistance, rental car coverage, or accident forgiveness. While these benefits can be valuable, they often come at an additional cost. Assess whether these benefits are worth the extra expense based on your personal circumstances.

Read the Fine Print

Insurance policies can be lengthy and filled with complex language. Take the time to read through the fine print, including the policy terms and conditions. Understanding these details can help you avoid any surprises or misunderstandings later on. If there are any clauses or terms that you don’t understand, don’t hesitate to reach out to the insurance provider for clarification.

Seek Professional Advice

If you’re unsure about which policy to choose or have specific concerns, consider seeking advice from an independent insurance agent or a financial advisor. These professionals can provide valuable insights and guidance based on your unique situation and needs. They can help you navigate the complex world of insurance and ensure that you make an informed decision.

The Future of Vehicle Insurance

The insurance industry is continually evolving, and the future of vehicle insurance looks set to bring exciting innovations and changes. One notable trend is the increasing use of telematics and connected car technologies. These advancements allow insurance providers to gather real-time data on driving behavior, which can lead to more personalized and accurate insurance policies.

Additionally, the rise of autonomous vehicles is likely to have a significant impact on insurance. As self-driving cars become more prevalent, the nature of accidents and liability may shift, potentially leading to new types of insurance coverage and pricing models.

Furthermore, the insurance industry is embracing digital transformation, with an increasing focus on online platforms and digital services. This shift towards digitalization is expected to enhance the customer experience, making it easier and more convenient for policyholders to manage their insurance needs.

Conclusion: Empowering Your Insurance Journey

Obtaining the right vehicle insurance doesn’t have to be a daunting task. By understanding your specific needs, comparing quotes, and analyzing policies with a critical eye, you can make an informed decision that provides the best coverage at the most competitive price. Remember, insurance is a vital aspect of responsible car ownership, and by staying informed and proactive, you can ensure you’re adequately protected on the road.

How often should I review my insurance policy?

+It’s a good practice to review your insurance policy annually or whenever significant life changes occur, such as purchasing a new vehicle, getting married, or relocating. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I switch insurance providers mid-policy?

+Yes, you can switch insurance providers at any time. However, be mindful of any potential penalties or fees associated with canceling your current policy early. It’s often best to time your switch with your policy’s renewal date.

What happens if I don’t have insurance and get into an accident?

+If you’re at fault in an accident and don’t have insurance, you may be held personally liable for any damages or injuries caused. This can result in significant financial repercussions. It’s always recommended to maintain adequate insurance coverage.