Geico Insurence

Welcome to an in-depth exploration of GEICO, one of the leading insurance providers in the United States. With a rich history spanning over eight decades, GEICO has revolutionized the insurance industry with its innovative approach and commitment to customer satisfaction. In this comprehensive article, we will delve into the origins, growth, services, and impact of GEICO, providing you with an expert overview of this iconic brand.

A Brief History of GEICO: From Modest Beginnings to Industry Leadership

GEICO, short for Government Employees Insurance Company, was founded in 1936 by Leo and Lillian Goodwin. Their initial goal was to provide affordable auto insurance to government employees, a niche market that was often overlooked by traditional insurance companies. With a vision to offer competitive rates and excellent service, GEICO began its journey in a small office in Washington, D.C.

The company's early success can be attributed to its innovative direct-to-consumer business model, which eliminated the need for agents and allowed GEICO to pass on the savings to its customers. This strategy, combined with effective marketing campaigns, helped GEICO establish a strong presence in the insurance market. By the 1950s, GEICO had expanded its customer base beyond government employees, catering to a wider range of individuals and families.

One of GEICO's most significant milestones was its decision to go public in 1977. This move not only provided financial stability but also allowed the company to further expand its operations and diversify its offerings. GEICO's stock has since become a popular investment choice, reflecting the company's reputation for financial strength and stability.

The Evolution of GEICO’s Services: Going Beyond Auto Insurance

While GEICO started as an auto insurance provider, its product portfolio has evolved significantly over the years. Today, GEICO offers a comprehensive range of insurance products to meet the diverse needs of its customers.

Auto Insurance

GEICO’s auto insurance remains its flagship offering, providing coverage for a wide array of vehicles, including cars, motorcycles, RVs, and even classic cars. The company offers personalized policies that cater to individual needs, whether it’s liability-only coverage or comprehensive plans with additional benefits.

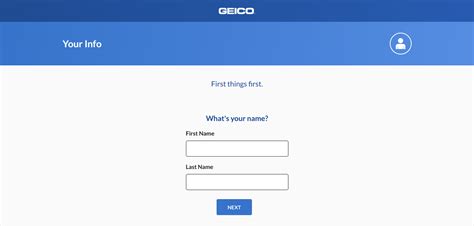

One of GEICO's strengths in auto insurance is its focus on digital convenience. Customers can easily obtain quotes, purchase policies, and manage their accounts online or through the GEICO mobile app. The company's online platform also provides valuable resources, such as a coverage calculator and a network of licensed agents available for personalized assistance.

Homeowners and Renters Insurance

GEICO’s expansion into homeowners and renters insurance has allowed it to become a one-stop shop for customers’ insurance needs. The company offers customizable policies that protect against various risks, including property damage, theft, and liability claims. GEICO’s homeowners insurance provides coverage for dwellings, personal property, and additional living expenses in case of a covered loss.

For renters, GEICO offers affordable policies that safeguard personal belongings and provide liability protection. The company's renters insurance is particularly attractive to those seeking comprehensive coverage at a reasonable cost.

Life Insurance and Other Financial Services

GEICO has expanded its financial services to include life insurance, offering term life and whole life policies to provide customers with financial security. The company’s life insurance products are designed to meet different needs, whether it’s protecting a family’s future or building long-term wealth.

Additionally, GEICO offers other financial services, such as banking and investment products, further solidifying its position as a trusted partner for customers' financial well-being.

GEICO’s Impact: A Commitment to Customer Satisfaction and Innovation

GEICO’s success can be attributed to its unwavering commitment to customer satisfaction and continuous innovation. The company has consistently received high marks for its customer service, with a focus on providing efficient and personalized assistance.

GEICO's innovative spirit is evident in its use of technology to enhance the customer experience. The company was an early adopter of online insurance services, recognizing the potential of the digital realm to streamline processes and improve accessibility. Today, GEICO's online platform and mobile app are industry-leading, offering a seamless and user-friendly experience.

Moreover, GEICO's marketing campaigns have become iconic, with memorable slogans and catchy advertisements that have left a lasting impression on consumers. The company's advertising strategies have effectively communicated its value proposition, contributing to its brand recognition and customer loyalty.

Community Engagement and Giving Back

Beyond its business operations, GEICO has demonstrated a strong commitment to community engagement and giving back. The company supports various charitable initiatives and organizations, focusing on education, safety, and environmental sustainability. GEICO’s philanthropic efforts have made a positive impact on communities across the United States.

One notable initiative is the GEICO Giveback Program, which encourages employees to volunteer and donate to causes they are passionate about. The company matches employee donations, further amplifying the impact of their charitable contributions.

| Key GEICO Statistics | Data |

|---|---|

| Year Founded | 1936 |

| Number of Customers | Over 30 million |

| Employees | Approximately 40,000 |

| Annual Premiums Written | $32.3 billion (2022) |

| J.D. Power Rankings | Top auto insurance company for customer satisfaction |

The Future of GEICO: Navigating the Digital Landscape

As the insurance industry continues to evolve, GEICO is well-positioned to thrive in the digital era. The company’s strong online presence and mobile capabilities have become essential tools for attracting and retaining customers. GEICO’s focus on data-driven decision-making and analytics will further enhance its ability to offer personalized and tailored insurance solutions.

Furthermore, GEICO's commitment to sustainability and environmental responsibility is likely to play a significant role in its future growth. The company has already taken steps to reduce its environmental impact, and its efforts in this area are expected to gain traction as consumers become more conscious of sustainable practices.

With a solid foundation and a track record of innovation, GEICO is poised to continue its journey as a leader in the insurance industry. Its ability to adapt to changing market dynamics and meet the evolving needs of its customers ensures that GEICO will remain a trusted partner for generations to come.

What makes GEICO stand out among other insurance providers?

+GEICO’s unique selling proposition lies in its combination of competitive rates, excellent customer service, and innovative use of technology. The company’s direct-to-consumer business model has allowed it to offer affordable insurance options while providing a seamless digital experience. GEICO’s focus on customer satisfaction and its commitment to continuous improvement set it apart from its competitors.

How has GEICO’s digital presence impacted its success?

+GEICO’s early adoption of digital technologies has been a key driver of its success. The company’s online platform and mobile app have made insurance services more accessible and convenient for customers. By embracing digital innovation, GEICO has been able to reach a wider audience and provide efficient, personalized experiences, contributing to its strong market position.

What are some of GEICO’s notable community initiatives?

+GEICO is actively involved in various community initiatives, including education programs, safety campaigns, and environmental sustainability efforts. The company’s Giveback Program encourages employee volunteering and charitable contributions, with GEICO matching employee donations. These initiatives reflect GEICO’s commitment to making a positive impact beyond its business operations.