Best Insurance Auto

The quest for the best auto insurance often tops the list of essential financial decisions for many vehicle owners. With countless options available, choosing the right auto insurance provider can be a daunting task. However, understanding your needs, researching extensively, and comparing policies can help you find the best fit. This article delves into the key considerations and strategies to guide you in selecting the ideal auto insurance for your specific requirements.

Understanding Auto Insurance: The Basics

Auto insurance, at its core, provides financial protection against potential vehicle-related damages and liabilities. It’s a contract between you (the policyholder) and the insurance company, ensuring that you receive coverage for losses and damages as outlined in your policy.

Types of Auto Insurance Coverage

Auto insurance policies typically offer a range of coverage options, each designed to protect against different types of incidents and liabilities. Here’s a breakdown of the most common types:

- Liability Coverage: This is the most fundamental type, covering damages you cause to others’ vehicles or property. It also provides protection against bodily injury claims of others involved in an accident.

- Collision Coverage: This option covers the cost of repairing or replacing your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This type of insurance protects against non-collision incidents like theft, vandalism, natural disasters, or damage caused by animals.

- Medical Payments or Personal Injury Protection (PIP): These cover the medical expenses of you and your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient coverage to pay for the damages.

Factors Influencing Auto Insurance Rates

The cost of auto insurance, often referred to as the premium, can vary significantly based on several factors. These include:

- Vehicle Type and Usage: Different vehicles have different insurance rates. Factors like the make, model, year, and purpose of the vehicle (personal, business, or pleasure) can influence the premium.

- Driver’s Profile: Your driving history, including accidents and traffic violations, plays a crucial role. Younger drivers and those with a history of accidents or violations may pay higher premiums.

- Location: Where you live and where you primarily drive your vehicle can impact rates. Areas with higher traffic volumes or crime rates may see increased insurance costs.

- Coverage and Deductibles: The level of coverage you choose and the deductible amount (the portion you pay out-of-pocket before insurance coverage kicks in) can significantly affect your premium.

- Discounts: Many insurers offer discounts for various reasons, such as having multiple policies with the same insurer, being a safe driver, or installing safety features in your vehicle.

Top Auto Insurance Providers

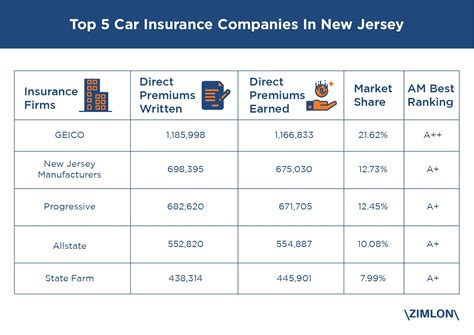

The auto insurance market is highly competitive, with numerous providers offering a range of coverage options and unique benefits. Here’s an overview of some of the top players in the industry:

State Farm

State Farm is a leading provider of auto insurance, known for its extensive network of agents and customer service. They offer a comprehensive range of coverage options, including standard policies and specialized coverage for unique situations. State Farm also provides discounts for multiple policies, safe driving, and early signing.

Geico

Geico, an acronym for Government Employees Insurance Company, is one of the largest auto insurers in the U.S. They’re renowned for their competitive rates and digital-first approach, making it convenient for customers to manage their policies online or via their mobile app. Geico offers a variety of coverage options and provides discounts for safe driving, military personnel, and vehicle safety features.

Progressive

Progressive is another prominent name in the auto insurance industry, known for its innovative approaches to insurance. They offer a range of coverage options and unique features like the Name Your Price tool, which allows customers to set their desired premium and then see the coverage options that fit that price.

Allstate

Allstate provides a comprehensive suite of insurance products, including auto, home, and life insurance. They’re known for their wide range of coverage options and add-ons, such as rental car coverage, roadside assistance, and accident forgiveness. Allstate also offers discounts for safe driving, multiple policies, and certain vehicle safety features.

USAA

USAA is a unique insurer, primarily serving active and retired military members and their families. They’re known for their exceptional customer service and competitive rates. USAA offers a range of auto insurance options, including comprehensive coverage, and provides discounts for safe driving and loyalty.

Strategies for Choosing the Best Auto Insurance

Selecting the best auto insurance involves more than just picking a well-known provider. It requires a thoughtful consideration of your specific needs and a thorough comparison of various policies. Here are some strategies to help you make an informed decision:

Define Your Needs

Before diving into comparisons, it’s crucial to understand your specific insurance needs. Consider factors like your vehicle’s make and model, your driving habits and history, and any unique circumstances (e.g., teenagers in the household, high-risk driving areas, etc.). This self-assessment will help you identify the coverage types and levels that are most relevant to you.

Research and Compare

Take the time to research and compare multiple auto insurance providers. Look beyond just the premium costs; delve into the details of the policies, including coverage limits, deductibles, and any unique features or benefits. Online resources, customer reviews, and independent ratings can provide valuable insights into a provider’s reputation and customer satisfaction.

Explore Coverage Options

Understand the different coverage types available and assess which ones are essential for your situation. For instance, if you drive an older vehicle, collision and comprehensive coverage might not be as crucial as liability coverage. On the other hand, if you have a new car with a loan, comprehensive coverage is often required by the lender.

Consider Deductibles

Deductibles can significantly impact your premium. Higher deductibles generally result in lower premiums, but it’s important to choose a deductible amount that you’re comfortable paying out-of-pocket in the event of a claim. Remember, the lower the deductible, the higher the premium.

Take Advantage of Discounts

Many insurance providers offer a variety of discounts. These can include discounts for safe driving, bundling multiple policies, installing safety features in your vehicle, or being a member of certain organizations. Be sure to inquire about all applicable discounts when getting quotes.

Read the Fine Print

Don’t just focus on the premium and coverage limits. Take the time to read the policy documents, especially the exclusions and limitations. Understanding these details can help you avoid surprises if you need to make a claim.

Assess Customer Service and Claims Handling

Consider the provider’s reputation for customer service and claims handling. While premiums and coverage are important, you also want an insurer who will be there for you when you need them. Online reviews and ratings can provide insights into a provider’s responsiveness and effectiveness in handling claims.

Shop Around and Get Quotes

Don’t settle for the first quote you receive. Shop around and get quotes from multiple providers. Online quote tools can make this process quicker and easier. Remember, prices can vary significantly between providers, so it’s worth taking the time to compare.

The Bottom Line

Choosing the best auto insurance involves a careful balance of coverage, cost, and provider reputation. By understanding your needs, researching extensively, and comparing policies, you can make an informed decision that provides the right level of protection at a competitive price. Remember, auto insurance is an essential financial safeguard, so it’s worth investing the time to find the best fit for your circumstances.

Frequently Asked Questions

What is the average cost of auto insurance in the U.S.?

+The average cost of auto insurance in the U.S. varies widely based on factors such as location, driving history, and the type of coverage chosen. According to recent data, the national average for annual car insurance premiums is around 1,674. However, rates can range from as low as 500 to over $3,000, depending on individual circumstances.

How can I lower my auto insurance premiums?

+There are several strategies to potentially lower your auto insurance premiums. These include maintaining a clean driving record, increasing your deductible, bundling policies with the same insurer, taking advantage of discounts for safe driving or vehicle safety features, and shopping around for the best rates.

What factors influence auto insurance rates the most?

+The three main factors that influence auto insurance rates are your driving history, the type of vehicle you drive, and your location. A history of accidents or traffic violations can lead to higher premiums, as can driving a high-performance or luxury vehicle. Living in an area with high traffic volumes or a high crime rate can also increase insurance costs.

Do I need comprehensive and collision coverage?

+The need for comprehensive and collision coverage depends on your individual circumstances and the value of your vehicle. If you have a loan or lease on your vehicle, the lender may require you to carry these coverages. However, if your vehicle is older and has low resale value, these coverages may not be cost-effective, as the premiums can outweigh the potential benefits.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary coverage. Additionally, reviewing your policy periodically can help you identify any new discounts or coverage options that might be beneficial.