Capital One Insurance Coverage

Capital One Insurance Coverage: Navigating the Financial Safety Net

Introduction to Capital One’s Insurance Services

Capital One, a leading financial institution, offers a comprehensive range of insurance services to cater to its customers’ diverse needs. This article delves into the world of Capital One insurance, exploring the types of coverage available, the benefits they provide, and how they contribute to overall financial security. By understanding Capital One’s insurance offerings, individuals can make informed decisions to safeguard their assets and mitigate potential risks.

Understanding Capital One’s Insurance Portfolio

Capital One’s insurance portfolio is designed to provide a holistic approach to risk management, offering coverage for various aspects of personal and business finances. Here’s an overview of the key insurance services provided by Capital One:

Auto Insurance

Capital One Auto Insurance offers comprehensive coverage for vehicles, including liability, collision, and comprehensive protection. The insurance plans are tailored to meet individual needs, providing options for deductibles, coverage limits, and additional perks such as rental car reimbursement and roadside assistance. Capital One’s auto insurance aims to protect policyholders against financial losses resulting from accidents, theft, or other unforeseen events.

Key Features:

- Flexible coverage options

- Competitive rates

- Claims assistance available 24/7

- Discounts for safe driving and multi-policy holders

Homeowners Insurance

Capital One's Homeowners Insurance provides essential protection for one of the most significant investments - a home. The insurance coverage extends to the dwelling, personal belongings, and liability, offering peace of mind against damage, theft, or liability claims. Capital One's policies are customizable, allowing homeowners to choose coverage limits and deductibles that align with their specific needs and budget.

Coverage Highlights:

- Dwelling coverage for structural damage

- Personal property protection

- Liability coverage for legal defense and settlements

- Optional endorsements for additional coverage, e.g., water backup or identity theft

Renters Insurance

For individuals renting a home or apartment, Capital One's Renters Insurance is an essential safety net. This insurance coverage protects personal belongings against theft, damage, or loss, providing financial reimbursement in case of an unfortunate event. Renters insurance also includes liability coverage, safeguarding against legal expenses and claims arising from accidents or injuries on the rental property.

Key Benefits:

- Affordable premiums

- Flexible coverage limits

- Quick and efficient claims process

- Personal property replacement cost coverage

Life Insurance

Capital One's Life Insurance policies are designed to provide financial security and peace of mind to policyholders and their loved ones. The insurance offerings include term life insurance, which offers coverage for a specified period, and permanent life insurance, which provides lifelong protection. Capital One's life insurance plans can be tailored to meet individual needs, with options for additional riders to enhance coverage.

Types of Life Insurance:

- Term Life Insurance - Coverage for a set period (e.g., 10, 20, or 30 years)

- Permanent Life Insurance - Whole life, universal life, or variable universal life insurance

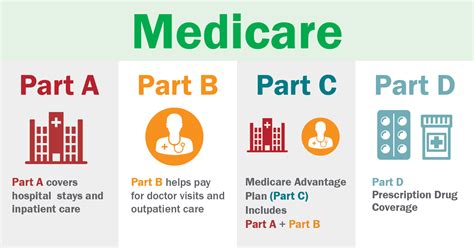

Health Insurance

Capital One partners with reputable insurance providers to offer a range of health insurance plans, including individual and family coverage. The health insurance plans cover essential medical services, prescriptions, and preventive care, ensuring policyholders have access to quality healthcare without financial strain. Capital One's health insurance options provide flexibility and choice, allowing individuals to select the plan that best suits their healthcare needs and budget.

Health Insurance Coverage:

- Medical care coverage for hospital stays, surgeries, and specialist visits

- Prescription drug coverage

- Preventive care services, including vaccinations and annual check-ups

- Optional dental and vision coverage

The Benefits of Capital One Insurance

Capital One's insurance services offer a multitude of benefits to customers, providing financial protection and peace of mind. Here's a deeper look at the advantages of choosing Capital One's insurance coverage:

Financial Security

Capital One’s insurance plans are designed to protect policyholders against financial losses resulting from unforeseen events. Whether it’s an auto accident, a home burglary, or a medical emergency, insurance coverage provides the necessary funds to cover expenses and mitigate the financial impact.

Peace of Mind

By having insurance coverage in place, individuals can rest assured knowing they are protected against potential risks. Capital One’s insurance policies offer a sense of security, allowing policyholders to focus on their daily lives without worrying about the financial consequences of unexpected events.

Tailored Coverage

Capital One understands that every individual’s insurance needs are unique. Their insurance services offer customizable coverage options, allowing policyholders to choose the limits, deductibles, and additional perks that align with their specific requirements and budget. This level of personalization ensures that insurance plans are not one-size-fits-all, but rather tailored to meet individual needs.

Competitive Rates

Capital One strives to offer competitive insurance rates, ensuring that their policies are affordable and accessible to a wide range of customers. By providing cost-effective insurance solutions, Capital One enables individuals to secure the coverage they need without placing a significant financial burden on their budgets.

Excellent Customer Service

Capital One’s insurance services are backed by a dedicated team of professionals who are committed to providing exceptional customer support. From policy inquiries to claims assistance, Capital One’s customer service representatives are readily available to offer guidance and ensure a seamless experience for policyholders. The emphasis on customer satisfaction ensures that policyholders receive the support they need throughout their insurance journey.

Real-World Examples: Capital One Insurance in Action

To illustrate the impact of Capital One’s insurance services, let’s explore a few real-world scenarios where insurance coverage made a significant difference:

Auto Insurance: A Preventative Measure

Imagine a young professional who recently purchased a new car. By investing in Capital One’s auto insurance, they gain comprehensive coverage that protects their vehicle and their finances. In the event of an accident, their insurance policy covers the costs of repairs, medical expenses, and even provides rental car assistance, ensuring they can continue their daily commute without disruption.

Homeowners Insurance: Protecting Your Haven

Consider a family that has invested in their dream home. With Capital One’s homeowners insurance, they can rest assured knowing their home and belongings are protected. In the unfortunate event of a natural disaster or burglary, their insurance policy covers the costs of repairs, replacements, and even provides temporary housing if necessary. Capital One’s homeowners insurance ensures that their home remains a safe and secure haven.

Life Insurance: Providing for Your Loved Ones

Think of a couple with young children who want to ensure their family’s financial security. By opting for Capital One’s life insurance, they gain peace of mind, knowing that their loved ones will be financially protected in the event of an unforeseen tragedy. Life insurance provides a safety net, ensuring that their children’s education, living expenses, and future aspirations are taken care of, even in their absence.

Capital One’s Insurance: A Comprehensive Approach

Capital One’s insurance services demonstrate a commitment to providing a holistic approach to financial security. By offering a diverse range of insurance products, Capital One ensures that its customers can safeguard their assets, protect their health, and provide for their loved ones. With customizable coverage, competitive rates, and exceptional customer service, Capital One’s insurance portfolio is a trusted partner in navigating the complexities of modern life.

Conclusion

Capital One’s insurance coverage is an essential component of a well-rounded financial plan. By understanding the range of insurance services available and their benefits, individuals can make informed decisions to protect their assets, health, and loved ones. With Capital One’s commitment to excellence and customer satisfaction, insurance becomes not just a necessity but a valuable tool for building a secure and prosperous future.

How can I get a quote for Capital One’s insurance services?

+

You can easily obtain a quote for Capital One’s insurance services by visiting their official website or contacting their customer service team. The website provides a user-friendly platform where you can input your details and receive personalized quotes for the insurance coverage you’re interested in. Additionally, their customer service representatives are available to guide you through the process and answer any questions you may have.

What makes Capital One’s insurance services unique compared to other providers?

+

Capital One’s insurance services stand out for their commitment to providing personalized coverage options and exceptional customer service. They offer a wide range of insurance products, ensuring that customers can find the right fit for their unique needs. Additionally, Capital One’s focus on competitive rates and flexible payment plans makes their insurance offerings accessible and affordable for a diverse range of individuals and businesses.

Can I bundle my insurance policies with Capital One to save on premiums?

+

Absolutely! Capital One encourages customers to bundle their insurance policies to take advantage of potential premium discounts. By combining multiple insurance policies, such as auto and homeowners insurance, you may be eligible for significant savings. Bundling not only provides convenience but also ensures a comprehensive level of protection for your assets and finances.