Medicare Insurance Brokers Near Me

Medicare insurance is a crucial topic for millions of Americans, especially as they approach retirement age. Navigating the complex world of Medicare plans and options can be daunting, which is why many individuals turn to professional help in the form of Medicare insurance brokers. These brokers, with their expertise and knowledge, play a vital role in ensuring individuals receive the coverage they need at the most competitive rates.

Understanding Medicare Insurance Brokers

Medicare insurance brokers are licensed professionals who specialize in guiding individuals through the intricate process of selecting the right Medicare plan. With a deep understanding of the various Medicare options, they act as intermediaries between insurance companies and their clients, providing unbiased advice and tailored recommendations.

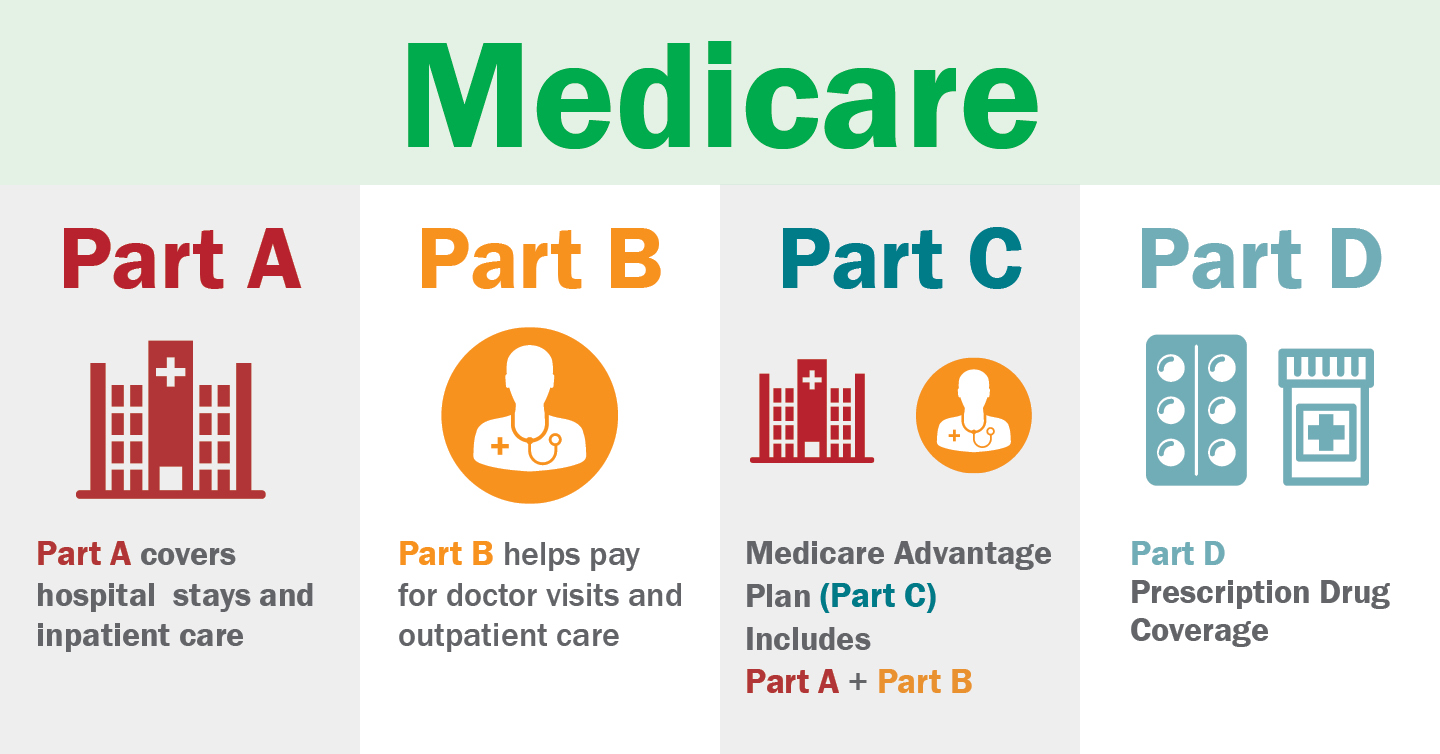

These brokers are well-versed in the different types of Medicare plans, including Original Medicare (Parts A and B), Medicare Advantage plans (Part C), and Medicare Part D prescription drug plans. They are familiar with the nuances of each plan, such as coverage details, cost-sharing structures, and network restrictions.

The Benefits of Working with a Broker

Engaging the services of a Medicare insurance broker offers numerous advantages. Firstly, brokers provide personalized guidance, taking into account an individual’s unique healthcare needs, budget, and preferences. They educate their clients about the different plan options, helping them make informed decisions.

Secondly, brokers have access to a wide range of insurance companies and their respective plans. This allows them to compare and contrast different offerings, ensuring their clients get the best possible coverage. Brokers can also assist with enrollment processes, ensuring a smooth transition onto the chosen plan.

Additionally, brokers can provide ongoing support. They can help resolve any issues that may arise during the plan's duration, whether it's a billing dispute or a change in health circumstances requiring a plan adjustment. They serve as a valuable resource throughout the entire Medicare journey.

| Plan Type | Description |

|---|---|

| Original Medicare | Parts A and B, covering hospital and medical services. |

| Medicare Advantage | Part C, offering an alternative to Original Medicare with additional benefits. |

| Medicare Part D | Prescription drug coverage, offering various plan options. |

Finding a Reputable Broker Near You

Locating a trustworthy Medicare insurance broker in your area is essential to ensuring a positive experience. Here are some steps to help you find the right professional:

Online Research

Start by conducting an online search using relevant keywords like “Medicare insurance brokers near me” or “Medicare plan advisors in [your city].” This will provide a list of local brokers, along with their contact details and potentially, customer reviews.

Reviewing online profiles and websites can give you a sense of each broker's expertise, the services they offer, and their overall reputation. Look for brokers who specialize in Medicare plans and have positive feedback from previous clients.

Referrals and Recommendations

Word-of-mouth referrals can be extremely valuable when seeking a reputable broker. Ask friends, family, or colleagues who have recently navigated the Medicare process for their recommendations. Personal referrals often lead to trusted professionals.

You can also reach out to local senior centers, retirement communities, or healthcare providers for recommendations. These organizations often have connections with reliable brokers who have a proven track record of providing excellent service.

License and Accreditation Checks

It’s crucial to verify a broker’s license and accreditation. Check with your state’s insurance department to ensure the broker is properly licensed to sell Medicare plans. Additionally, look for brokers who are accredited by organizations like the National Association of Insurance and Financial Advisors (NAIFA) or the National Association of Health Underwriters (NAHU), as these accreditations indicate a higher level of expertise and ethical standards.

Interviewing Prospective Brokers

Once you’ve compiled a list of potential brokers, set up initial consultations. These meetings can be conducted virtually or in-person, depending on your preference and the broker’s availability. During these interviews, ask about their experience, the types of plans they typically recommend, and their approach to finding the best coverage for their clients.

Don't hesitate to ask about their fees and how they are compensated. As mentioned earlier, most brokers earn commissions from insurance companies, but some may charge additional fees. Understanding their fee structure upfront can help you make an informed decision.

Choosing the Right Broker

After your initial consultations, select the broker who you feel most comfortable with and who best understands your needs. Remember, this is a long-term relationship, and you want to ensure you have someone who will advocate for your best interests throughout your Medicare journey.

Consider factors like their level of expertise, communication style, and how well they listen to your concerns. Choose a broker who takes the time to thoroughly explain your options and provides honest, unbiased advice.

Maximizing Your Broker’s Expertise

Once you’ve engaged a Medicare insurance broker, it’s important to make the most of their expertise. Here are some tips to ensure a successful partnership:

Provide Accurate Information

Be forthcoming with your broker about your medical history, current health conditions, and any prescription medications you take. This information is crucial for them to accurately assess your needs and recommend the most suitable plans.

Also, share your financial situation and any budget constraints you may have. Brokers can work within your means to find affordable coverage options.

Ask Questions and Seek Clarification

Don’t hesitate to ask questions about the plans your broker recommends. Understanding the intricacies of Medicare plans can be challenging, so seek clarification on any aspects that are unclear.

Ask about the specific benefits and coverage limits of each plan, as well as any potential out-of-pocket costs. Understanding these details will help you make an informed decision and manage your healthcare expenses effectively.

Review Your Plan Annually

Medicare plans can change from year to year, and your health circumstances may also evolve. It’s important to review your plan annually to ensure it still meets your needs. Your broker can guide you through this process, helping you understand any changes to your coverage and recommending adjustments if necessary.

Conclusion: Empowering Your Medicare Journey

Medicare insurance brokers are invaluable resources for anyone navigating the complex world of Medicare plans. By providing personalized guidance and leveraging their industry knowledge, brokers ensure individuals receive the coverage they need at competitive rates. Finding a reputable broker near you is the first step toward a seamless and stress-free Medicare experience.

Remember, with the right broker by your side, you can make informed decisions about your healthcare and have peace of mind knowing you're getting the best possible coverage. Empower yourself with knowledge and take control of your Medicare journey.

How much does it cost to work with a Medicare insurance broker?

+Working with a Medicare insurance broker is typically free to the client. Brokers earn their income through commissions paid by insurance companies when their clients enroll in a plan. However, some brokers may charge additional fees, so it’s important to discuss their fee structure upfront.

What should I look for in a reputable Medicare insurance broker?

+When seeking a reputable broker, look for professionals who are licensed and accredited by recognized organizations like the NAIFA or NAHU. Check online reviews and seek personal referrals. A good broker should have extensive experience with Medicare plans, provide unbiased advice, and tailor their recommendations to your unique needs.

Can a Medicare insurance broker help me with prescription drug coverage?

+Absolutely! Medicare insurance brokers are well-versed in all aspects of Medicare coverage, including prescription drug plans (Part D). They can guide you through the different Part D plan options, help you understand the coverage details, and find a plan that fits your prescription medication needs.