Farmers Insurance Pay

Farmers Insurance Group, often simply known as Farmers, is a renowned insurance company with a rich history dating back to 1928. Headquartered in Los Angeles, California, Farmers has grown into a prominent player in the insurance industry, offering a wide range of insurance products and services to individuals and businesses across the United States.

When it comes to the topic of Farmers Insurance pay, it's essential to delve into the compensation structure and benefits provided to employees within this vast organization. Farmers Insurance Group is known for its commitment to providing competitive salaries and comprehensive benefits packages to its workforce, ensuring employee satisfaction and retention.

Compensation Structure at Farmers Insurance

Farmers Insurance Group employs a diverse range of professionals, including insurance agents, underwriters, claims adjusters, customer service representatives, and corporate support staff. The compensation structure varies based on factors such as job role, experience, performance, and geographical location.

Insurance Agents

Insurance agents at Farmers Insurance are often compensated through a combination of base salary, commissions, and bonuses. The base salary serves as a foundation, with additional earnings generated through commissions on insurance policies sold. These agents may also receive performance-based bonuses, recognizing their achievements and contributions to the company’s success.

For instance, a senior insurance agent with extensive experience and a proven track record might earn an annual base salary of $60,000, along with commissions ranging from 10% to 15% on insurance sales. This structure incentivizes agents to excel in their roles and provides them with the opportunity to earn a substantial income.

Underwriters and Claims Adjusters

Underwriters and claims adjusters play critical roles in assessing risks and managing claims, respectively. Their compensation typically consists of a fixed salary, with potential bonuses tied to individual and departmental performance. The salary range for these positions can vary significantly, depending on factors such as expertise, specialization, and the complexity of the work involved.

| Job Role | Average Annual Salary |

|---|---|

| Entry-Level Underwriter | $45,000 - $55,000 |

| Senior Claims Adjuster | $70,000 - $90,000 |

Customer Service and Corporate Support

Employees in customer service and corporate support roles at Farmers Insurance are vital to the company’s operations. Their compensation typically includes a base salary, with opportunities for performance-based incentives and growth within the organization. These roles often provide a stable income and the chance to advance one’s career.

A customer service representative, for example, might start with an annual salary of $35,000, with the potential for annual bonuses based on customer satisfaction ratings and overall team performance. As they gain experience and demonstrate exceptional skills, they may be eligible for promotions and increased compensation.

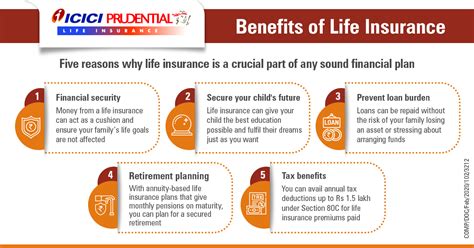

Benefits Offered by Farmers Insurance

In addition to competitive salaries, Farmers Insurance Group provides a comprehensive benefits package to its employees. These benefits aim to support the well-being and financial security of workers, fostering a positive work environment.

Health and Wellness Benefits

Farmers Insurance offers a range of health insurance plans, including medical, dental, and vision coverage. The company contributes significantly to the cost of these plans, ensuring employees have access to quality healthcare. Additionally, Farmers provides access to wellness programs, gym reimbursements, and employee assistance programs to promote overall well-being.

Retirement and Financial Benefits

To support long-term financial planning, Farmers Insurance offers 401(k) retirement savings plans with company matching contributions. This encourages employees to save for their future and provides a solid foundation for retirement. Furthermore, the company may also offer profit-sharing opportunities, allowing employees to share in the company’s success.

Paid Time Off and Work-Life Balance

Farmers Insurance understands the importance of work-life balance and provides generous paid time off benefits. This includes vacation days, sick leave, and personal days, allowing employees to recharge and maintain a healthy lifestyle. Additionally, the company may offer flexible work arrangements, such as remote work options, to accommodate individual needs.

Performance and Growth Opportunities

Farmers Insurance Group recognizes the value of employee growth and development. The company provides numerous opportunities for career advancement and skill enhancement. This includes internal training programs, mentorship initiatives, and professional development workshops.

For instance, insurance agents can participate in specialized training programs to enhance their sales and customer service skills. Underwriters and claims adjusters may have access to advanced certification courses, enabling them to expand their expertise and move into senior roles within the organization.

Future Outlook and Industry Implications

As the insurance industry continues to evolve, Farmers Insurance Group remains committed to staying at the forefront of innovation and technology. The company’s focus on digital transformation and data analytics positions it well for the future. With a strong financial foundation and a dedicated workforce, Farmers is poised to adapt to changing market dynamics and maintain its position as a leading insurance provider.

The compensation and benefits structure at Farmers Insurance reflect its commitment to creating a rewarding work environment. By offering competitive salaries, comprehensive benefits, and growth opportunities, Farmers attracts and retains talented professionals, ensuring its continued success and growth in the highly competitive insurance market.

What is the average salary for insurance agents at Farmers Insurance?

+The average salary for insurance agents at Farmers Insurance can vary based on experience and performance. However, on average, insurance agents can expect to earn an annual base salary of around 50,000, with the potential for commissions and bonuses, resulting in a total income of 70,000 or more.

Does Farmers Insurance offer remote work opportunities?

+Yes, Farmers Insurance does offer remote work opportunities for certain positions. The company understands the benefits of flexible work arrangements and strives to accommodate employee preferences while maintaining productivity and collaboration.

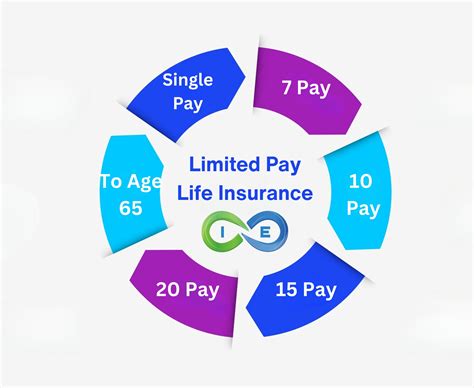

What are the retirement savings options at Farmers Insurance?

+Farmers Insurance provides a robust retirement savings plan, including a 401(k) program with company matching contributions. This allows employees to save for their retirement and take advantage of the company’s commitment to supporting their financial well-being.