Cheap Insurance Renters

Finding affordable renters insurance is an important step for anyone renting a home, apartment, or condo. Renters insurance provides crucial financial protection for your belongings and can offer peace of mind, especially when unexpected events occur. However, with a variety of options and pricing structures available, it can be challenging to navigate the market and find the best coverage at the most affordable price. This comprehensive guide aims to demystify the process of acquiring cheap renters insurance, ensuring you receive adequate coverage without breaking the bank.

Understanding Renters Insurance

Renters insurance, also known as tenants insurance, is a form of property insurance that covers personal belongings and liabilities within a rental property. It is distinct from the insurance coverage that a landlord typically carries, which only protects the physical structure of the building. Renters insurance is an essential safeguard for individuals who rent, offering protection against unforeseen events such as theft, fire, or water damage, as well as liability coverage in case someone is injured within the rental unit.

A standard renters insurance policy typically includes coverage for the following:

- Personal Property: This covers your belongings against perils like fire, theft, or vandalism. It can include items like furniture, electronics, clothing, and appliances.

- Liability Coverage: This provides financial protection if someone is injured in your rental unit or if your actions result in property damage to others.

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing and living expenses.

- Medical Payments to Others: Covers minor medical expenses if someone is injured on your rental property, regardless of fault.

Factors Affecting Renters Insurance Rates

The cost of renters insurance can vary significantly based on several factors. Understanding these factors can help you negotiate more affordable rates and make informed choices about your coverage.

Location

Insurance rates are often influenced by the geographic location of your rental property. Areas with higher crime rates or a history of natural disasters may command higher insurance premiums. Conversely, rentals in safer neighborhoods or regions less prone to natural calamities may enjoy more affordable rates.

| Region | Average Annual Premium |

|---|---|

| Northeast | $250 |

| Midwest | $180 |

| South | $150 |

| West | $220 |

Value of Your Belongings

The more valuable your personal property, the higher the cost of your renters insurance is likely to be. It’s crucial to accurately assess the value of your belongings to ensure you have adequate coverage without overpaying.

Coverage Limits and Deductibles

Renters insurance policies come with coverage limits, which dictate the maximum amount the insurer will pay for a covered loss. Opting for higher coverage limits will generally result in higher premiums. Conversely, selecting a higher deductible (the amount you pay out-of-pocket before the insurance kicks in) can lead to lower premiums.

Policy Add-Ons

Renters insurance policies often offer optional add-ons, such as coverage for high-value items (like jewelry or fine art), identity theft protection, or coverage for specific perils (like earthquakes or floods). While these add-ons can enhance your protection, they will increase your insurance premium.

Tips for Finding Cheap Renters Insurance

Navigating the renters insurance market can be daunting, but with the right strategies, you can secure affordable coverage. Here are some tips to help you find cheap renters insurance without compromising on quality.

Compare Multiple Quotes

Obtaining quotes from multiple insurance providers is crucial to finding the best deal. Online comparison tools can simplify this process, allowing you to quickly assess various policies and premiums. Remember, each insurer has unique underwriting guidelines, so comparing multiple quotes can reveal significant differences in pricing.

Bundle with Other Policies

Many insurance companies offer discounts when you bundle multiple policies, such as renters insurance with auto insurance or life insurance. By consolidating your insurance needs with a single provider, you may qualify for significant savings.

Choose a Higher Deductible

Increasing your deductible can lead to lower premiums. However, it’s important to ensure that the chosen deductible is an amount you can comfortably afford to pay out-of-pocket in the event of a claim. A higher deductible may make sense for individuals with limited financial resources or those who are unlikely to make frequent claims.

Opt for Basic Coverage

Renters insurance policies often come with a variety of optional add-ons, such as coverage for high-value items or additional liability protection. While these add-ons can enhance your protection, they also increase your premium. If you’re seeking cheap insurance, consider sticking with a basic policy that covers your essential needs.

Take Advantage of Discounts

Many insurers offer discounts for a variety of reasons. Common discounts include those for smoke detectors, security systems, loyalty (remaining with the same insurer for an extended period), and even for paying your premium in full annually rather than monthly.

Consider a Roommate Policy

If you share a rental with roommates, you might consider a roommate policy. This type of policy covers all tenants under a single policy, which can be more cost-effective than individual policies. However, it’s important to ensure that all roommates are comfortable with this arrangement and understand the policy’s coverage and limitations.

Best Practices for Saving on Renters Insurance

While finding cheap renters insurance is important, it’s equally crucial to ensure that your policy provides adequate coverage. Here are some best practices to follow when selecting a renters insurance policy.

Understand Your Coverage Needs

Before purchasing renters insurance, assess your personal property and determine the value of your belongings. This will help you choose a policy with appropriate coverage limits. Additionally, consider your liability risks and select a policy with adequate liability coverage to protect you from potential lawsuits.

Read the Policy Documents

Insurance policies can be complex, so it’s essential to read the fine print before committing to a policy. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations. Understanding these details can help you avoid surprises in the event of a claim.

Review Your Policy Regularly

Life circumstances and the value of your personal property can change over time. Regularly reviewing your renters insurance policy ensures that your coverage remains adequate and appropriate for your current needs. Consider reviewing your policy annually or whenever significant life changes occur, such as a move, marriage, or the acquisition of high-value items.

Maintain a Good Credit Score

Insurance companies often consider your credit score when determining your insurance premium. Maintaining a good credit score can help you qualify for lower rates. If your credit score is less than stellar, consider taking steps to improve it, such as paying bills on time and reducing your credit card balances.

Top Providers for Cheap Renters Insurance

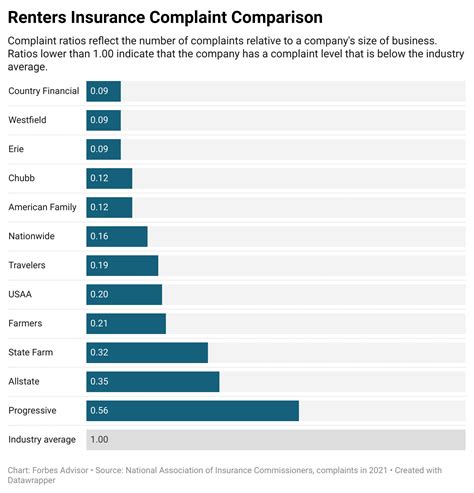

The market for renters insurance is highly competitive, with numerous providers offering a range of policies and premiums. Here are some of the top providers known for offering cheap renters insurance, along with a brief overview of their policies and services.

State Farm

State Farm is one of the largest providers of renters insurance in the United States. They offer a standard renters insurance policy that covers personal property, liability, and additional living expenses. State Farm also provides optional add-ons for coverage of high-value items and identity theft protection.

Allstate

Allstate offers a comprehensive renters insurance policy that includes coverage for personal property, liability, and additional living expenses. They also provide optional add-ons for coverage of high-value items and identity theft protection. Allstate’s renters insurance policies are known for their flexibility and customizable options.

Progressive

Progressive is a well-known insurance provider that offers a range of insurance products, including renters insurance. Their renters insurance policy covers personal property, liability, and additional living expenses. Progressive also offers optional add-ons for coverage of high-value items and water backup damage.

LEER

LEER, short for Lease and Educate for Rental Equity, is a newer entrant in the renters insurance market that focuses on providing affordable coverage to renters. LEER’s renters insurance policy covers personal property, liability, and additional living expenses. They also offer unique features such as a rent loss benefit, which provides additional coverage if you’re unable to rent your unit due to a covered event.

Lemonade

Lemonade is a tech-driven insurance company that offers a unique, app-based renters insurance policy. Their policy covers personal property, liability, and additional living expenses. Lemonade is known for its fast, efficient claims process and its commitment to social impact, as they donate any unclaimed premiums to charities chosen by their policyholders.

FAQs

How much does renters insurance cost on average?

+

The average cost of renters insurance in the United States is around 180 per year, or about 15 per month. However, this can vary significantly based on factors like location, the value of your belongings, and the coverage limits and deductibles you choose.

Do I really need renters insurance?

+

While renters insurance is not legally required in most states, it is highly recommended. Renters insurance provides crucial financial protection for your personal belongings and can cover liabilities if someone is injured in your rental unit. It’s a relatively low-cost way to protect yourself from potentially devastating financial losses.

What happens if I don’t have renters insurance and my rental unit is damaged or burglarized?

+

If you don’t have renters insurance and your rental unit is damaged or burglarized, you will likely have to cover the costs of repairing or replacing your belongings out of pocket. This can be a significant financial burden, especially if you have valuable items or extensive damage. Additionally, if someone is injured in your rental unit and you are found liable, you may be responsible for paying any resulting medical or legal expenses.

Can I add my roommates to my renters insurance policy?

+

Yes, you can typically add your roommates to your renters insurance policy. This is often referred to as a “roommate endorsement” or “named insured” endorsement. By adding your roommates to your policy, you can ensure that their belongings are covered in the event of a loss, and they will also be protected under the policy’s liability coverage.

What should I do if I need to file a claim with my renters insurance provider?

+

If you need to file a claim with your renters insurance provider, the first step is to contact your insurer and provide them with the details of the incident. Be prepared to provide documentation, such as police reports, repair estimates, or receipts for damaged items. Your insurer will then guide you through the claims process, which may involve an inspection of the damage and a determination of the value of your losses.