At&T Insurance Number

AT&T Insurance offers a range of services to protect its customers' devices and provide peace of mind. Whether it's protecting your smartphone, tablet, or other valuable electronics, AT&T Insurance has plans to suit various needs. This article will delve into the details of AT&T Insurance, exploring its coverage options, benefits, and how to reach their support team for any queries or assistance.

Understanding AT&T Insurance Coverage

AT&T Insurance provides coverage for a variety of devices, including smartphones, tablets, smartwatches, and even certain wearable technology. The insurance plans aim to protect against accidental damage, mechanical or electrical failure, and even loss or theft. With comprehensive coverage, customers can rest assured that their devices are protected, ensuring minimal disruption to their digital lives.

The insurance plans offered by AT&T typically cover repairs or replacements, depending on the extent of the damage. In the event of a claim, customers can expect a swift and efficient process, with AT&T's dedicated support team guiding them through every step. This ensures that any issues are resolved promptly, allowing customers to get back to using their devices as soon as possible.

Device Protection Plans and Their Benefits

AT&T offers different device protection plans tailored to various devices and user needs. For instance, the AT&T Mobile Insurance plan is designed for smartphones and tablets, providing coverage for accidental damage, mechanical failure, and liquid damage. This plan also includes a replacement device option, ensuring customers are not left without their essential tools for too long.

For those who frequently travel or are prone to losing their devices, the AT&T Lost/Stolen Phone Protection plan is an ideal choice. This plan provides coverage specifically for loss or theft, ensuring customers can quickly obtain a replacement device without incurring excessive costs. With this plan, AT&T aims to minimize the inconvenience and financial burden associated with losing a valuable device.

Additionally, AT&T offers protection plans for wearable technology, such as smartwatches and fitness trackers. These plans provide coverage for accidental damage and mechanical issues, ensuring that these increasingly popular devices remain functional and reliable.

| Plan | Coverage | Benefits |

|---|---|---|

| Mobile Insurance | Accidental damage, mechanical failure, liquid damage | Replacement device option, comprehensive coverage |

| Lost/Stolen Phone Protection | Loss or theft | Quick replacement, financial protection |

| Wearable Protection | Accidental damage, mechanical issues | Peace of mind for wearable tech users |

Contacting AT&T Insurance Support

AT&T understands that reaching out for support can be crucial when dealing with device issues. That’s why they provide multiple channels for customers to connect with their insurance team.

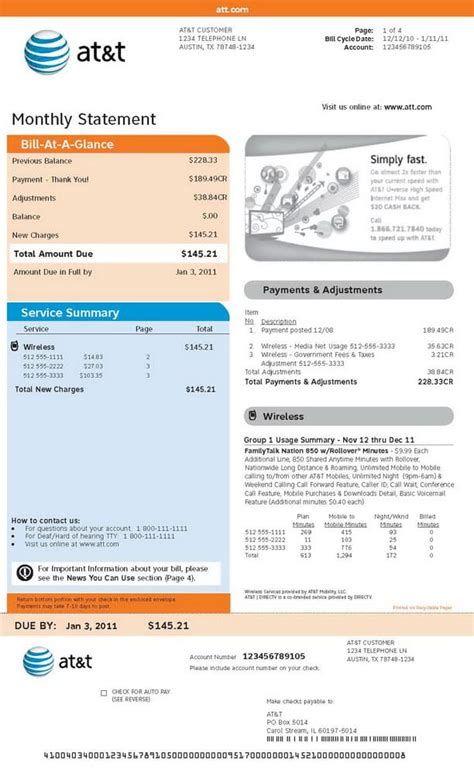

AT&T Insurance Contact Information

The primary contact method for AT&T Insurance support is through their dedicated customer service phone number. Customers can reach the support team by dialing 1-888-888-8888 (toll-free). This number connects customers directly to the insurance specialists, who are trained to handle a wide range of queries and concerns.

Additionally, AT&T offers an online support portal where customers can find comprehensive information about their insurance plans, coverage details, and frequently asked questions. The portal also allows customers to submit support tickets, ensuring their queries are addressed promptly by the AT&T team.

For those who prefer in-person assistance, AT&T has a network of retail stores across the country. Customers can visit their local AT&T store to speak with a representative about their insurance needs, obtain further information, or even initiate a claim process.

AT&T Insurance Support Hours

AT&T Insurance support is available during standard business hours, typically from 9:00 AM to 6:00 PM local time, Monday through Friday. During these hours, customers can reach the support team by phone or online chat for immediate assistance.

Outside of these hours, AT&T provides an after-hours support line for urgent matters. This line is specifically designed to handle emergency situations, such as lost or stolen devices, ensuring customers can obtain the necessary assistance even outside of regular business hours.

Filing a Claim with AT&T Insurance

In the event of an insured incident, customers can easily file a claim with AT&T Insurance. The process is designed to be straightforward and efficient, ensuring minimal disruption to the customer’s experience.

The Claim Filing Process

To initiate a claim, customers can start by contacting the AT&T Insurance support team via phone or online chat. The support specialists will guide customers through the necessary steps, which typically involve providing details about the incident and the device in question.

Once the claim is filed, AT&T's team will assess the situation and determine the appropriate course of action. This may involve repairing the device, providing a replacement, or offering other solutions based on the specific plan and coverage details.

AT&T aims to make the claim process as seamless as possible, ensuring that customers can get their devices back up and running with minimal hassle. The team's expertise and dedication to customer satisfaction make the claim process efficient and effective.

AT&T Insurance Claim Status

After filing a claim, customers can track its progress and stay informed about the status. AT&T provides an online portal where customers can log in and view the current stage of their claim, as well as any updates or additional information required.

The portal also allows customers to communicate directly with the AT&T claims team, ensuring any questions or concerns can be addressed promptly. This level of transparency and accessibility ensures customers remain informed throughout the entire claim process.

Conclusion: AT&T Insurance’s Commitment to Customer Satisfaction

AT&T Insurance is dedicated to providing comprehensive coverage and exceptional support to its customers. With a range of device protection plans and efficient claim processes, AT&T ensures that its customers’ digital lives remain uninterrupted.

The availability of multiple support channels, including a dedicated phone line, online portal, and in-store assistance, demonstrates AT&T's commitment to accessibility and customer satisfaction. Whether it's answering queries, guiding customers through the claim process, or providing swift resolutions, AT&T's insurance team is there to assist.

By choosing AT&T Insurance, customers can have peace of mind, knowing their devices are protected and that they have a reliable support system in place should any issues arise. With AT&T's expertise and customer-centric approach, device protection becomes a seamless and stress-free experience.

What is the cost of AT&T Insurance plans?

+The cost of AT&T Insurance plans varies depending on the device being insured and the level of coverage desired. Typically, the plans range from 7 to 15 per month, with additional fees for replacement devices. Customers can contact AT&T support or visit their online portal for specific pricing information.

Does AT&T Insurance cover pre-existing damage or issues?

+No, AT&T Insurance plans do not cover pre-existing damage or issues. The coverage is designed for accidental damage, mechanical failure, and loss or theft that occurs after the insurance plan has been activated.

Can I add AT&T Insurance to an existing device?

+Yes, AT&T allows customers to add insurance to existing devices. However, there may be certain eligibility criteria and time limits involved. It’s best to contact AT&T support to discuss the specific options and requirements for adding insurance to an existing device.