Insurance Hmo Vs Ppo

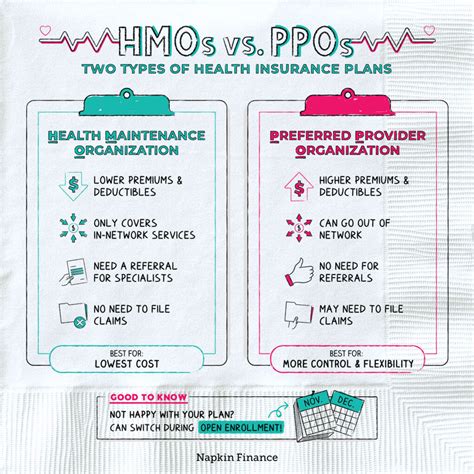

In the world of healthcare, understanding the differences between various insurance plans is crucial for making informed decisions about your coverage. Two prevalent types of health insurance plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). These plans offer distinct features and benefits, catering to different preferences and healthcare needs. Let's delve into the intricacies of HMOs and PPOs, exploring their unique characteristics, coverage options, and the factors that set them apart.

Health Maintenance Organizations (HMOs)

Health Maintenance Organizations, commonly known as HMOs, have been a prominent feature of the healthcare landscape for decades. HMOs are characterized by a network of healthcare providers, including doctors, specialists, and hospitals, with whom the insurance company has negotiated discounted rates for services. This arrangement allows HMOs to offer more affordable premiums and comprehensive coverage for members who primarily utilize in-network providers.

Key Features of HMOs

- In-Network Focus: HMOs emphasize the importance of using in-network providers. Members typically need to select a primary care physician (PCP) within the HMO’s network, who acts as a gatekeeper for accessing specialty care and other services.

- Lower Out-of-Pocket Costs: With negotiated rates, HMO members generally enjoy lower out-of-pocket expenses, such as copayments and deductibles, when utilizing in-network providers. This can make HMOs an attractive option for those seeking cost-effective healthcare.

- Limited Coverage for Out-of-Network Care: One of the primary drawbacks of HMOs is the limited coverage for out-of-network services. Members may face higher costs or even be responsible for the full cost of care if they choose to visit providers outside the HMO’s network.

- Preauthorization and Referrals: HMOs often require preauthorization for certain services and procedures. Additionally, members may need referrals from their PCP to see specialists, ensuring that care is coordinated within the network.

HMOs: A Closer Look

HMOs are particularly suitable for individuals who value cost predictability and prefer a more structured approach to healthcare. By encouraging members to stay within the network, HMOs can provide comprehensive coverage at affordable rates. However, the trade-off is the potential inconvenience of selecting a PCP and obtaining referrals, as well as the limited flexibility to choose out-of-network providers.

| HMO Feature | Description |

|---|---|

| Network Focus | Strong emphasis on in-network providers for comprehensive coverage and cost savings. |

| Primary Care Physician (PCP) | Members must choose a PCP as the gateway to specialty care. |

| Cost-Effectiveness | Lower out-of-pocket costs for in-network services. |

| Limited Out-of-Network Coverage | Members may face higher costs or no coverage for out-of-network care. |

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations, or PPOs, offer a more flexible alternative to HMOs. PPOs maintain a network of preferred providers, but members have the freedom to choose both in-network and out-of-network healthcare professionals. This flexibility comes at a cost, as PPOs generally have higher premiums compared to HMOs.

Key Features of PPOs

- Flexibility in Provider Choice: PPO members can access a wider range of healthcare providers, both in-network and out-of-network, without the need for referrals or preauthorization. This freedom allows individuals to choose specialists based on their preferences and specific healthcare needs.

- Higher Out-of-Pocket Costs: While PPOs offer flexibility, members often face higher out-of-pocket expenses, such as copayments and deductibles, especially when utilizing out-of-network providers. The cost difference between in-network and out-of-network care can be significant.

- Network Discounts: PPOs negotiate discounted rates with their network of preferred providers, resulting in cost savings for members who choose in-network care. These discounts can make PPOs a cost-effective option for those who primarily use in-network services.

- No Referrals or Preauthorization: Unlike HMOs, PPOs typically do not require referrals or preauthorization for services, providing members with greater autonomy in managing their healthcare.

PPOs: Exploring the Advantages

PPOs cater to individuals who value the freedom to choose their healthcare providers without restrictions. The absence of a mandatory PCP and the ability to access specialists directly make PPOs an appealing choice for those with specific healthcare requirements or a preference for a particular specialist. However, the higher premiums and potential for higher out-of-pocket costs should be carefully considered.

| PPO Feature | Description |

|---|---|

| Provider Flexibility | Members can choose in-network and out-of-network providers without referrals. |

| Higher Costs | PPOs generally have higher premiums and out-of-pocket expenses. |

| Network Discounts | In-network care offers cost savings through negotiated rates. |

| Autonomy | No referrals or preauthorization required, providing members with greater control over their healthcare decisions. |

Comparative Analysis: HMO vs. PPO

When deciding between an HMO and a PPO, several factors come into play. The choice ultimately depends on an individual’s healthcare needs, preferences, and financial situation.

Cost Considerations

HMOs generally offer more cost-effective coverage, especially for those who consistently utilize in-network providers. On the other hand, PPOs can be more expensive due to their higher premiums and potential for increased out-of-pocket costs, particularly for out-of-network care.

Provider Flexibility

PPOs provide unparalleled flexibility in choosing healthcare providers, both in-network and out-of-network. HMOs, on the other hand, require members to navigate a more structured network, often with the need for referrals and preauthorization.

Convenience and Autonomy

HMOs can be more convenient for individuals who prefer a streamlined healthcare experience with a designated PCP. PPOs, however, offer greater autonomy, allowing members to make their own decisions about specialists and services without the restrictions of referrals or preauthorization.

Coverage and Benefits

Both HMOs and PPOs offer a range of coverage options, including preventive care, hospitalization, and specialty services. However, HMOs may have more stringent coverage policies, especially for out-of-network care, while PPOs provide broader coverage but at a higher cost.

Real-World Examples

Let’s explore two hypothetical scenarios to illustrate the differences between HMOs and PPOs in real-life situations.

Scenario 1: HMO Plan

Jane, a young professional with a busy lifestyle, chooses an HMO plan. She values cost predictability and the structured approach of having a PCP. Jane consistently utilizes in-network providers, taking advantage of the lower out-of-pocket costs. However, when she needs to see a specialist, she must obtain a referral from her PCP, which can sometimes cause delays in her care.

Scenario 2: PPO Plan

John, a frequent traveler with a specific healthcare condition, opts for a PPO plan. He appreciates the flexibility of being able to access specialists directly without referrals. While John faces higher premiums and out-of-pocket costs, he finds the freedom to choose his providers, especially when traveling, to be invaluable. The absence of preauthorization requirements also aligns with his preference for prompt access to healthcare services.

Performance Analysis and Future Implications

HMOs and PPOs have evolved over the years, adapting to changing healthcare landscapes and consumer demands. As healthcare costs continue to rise, the affordability and comprehensive coverage offered by HMOs remain attractive to many individuals and families. On the other hand, PPOs cater to those seeking flexibility and the ability to choose their healthcare providers without restrictions.

Looking ahead, the future of HMOs and PPOs may involve further innovation and customization to meet the diverse needs of consumers. Some insurance companies are already experimenting with hybrid models that blend elements of both HMOs and PPOs, offering greater flexibility while maintaining cost-effectiveness. Additionally, the increasing focus on value-based care and patient-centered approaches may shape the development of insurance plans, potentially leading to more personalized and tailored options.

Conclusion

Understanding the distinctions between Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) is essential for making informed decisions about your healthcare coverage. HMOs provide cost-effective coverage with a structured network approach, while PPOs offer flexibility and the freedom to choose providers. By carefully considering your healthcare needs, budget, and personal preferences, you can select the insurance plan that best suits your lifestyle and ensures comprehensive and accessible healthcare.

Can I change my insurance plan from HMO to PPO or vice versa?

+Yes, you can typically switch insurance plans during open enrollment periods or if you experience a qualifying life event. However, it’s important to review the specific rules and timelines for changing plans in your region or with your insurance provider.

Are there any penalties for switching from an HMO to a PPO or vice versa?

+Penalties or fees for switching plans may vary depending on your specific insurance provider and the timing of your request. It’s advisable to consult with your insurer or a healthcare professional to understand any potential costs or restrictions associated with changing plans.

How can I determine if an HMO or PPO is the right choice for me?

+Assessing your healthcare needs, budget, and personal preferences is crucial. If you value cost predictability and a structured healthcare approach, an HMO might be suitable. On the other hand, if flexibility in provider choice and direct access to specialists are priorities, a PPO could be a better fit. Consulting with a healthcare advisor or insurance agent can provide personalized guidance based on your circumstances.