Liability Insurance

Liability insurance is a crucial aspect of financial protection and risk management for individuals, businesses, and professionals across various industries. In a world filled with potential hazards and unforeseen circumstances, this type of insurance acts as a safety net, providing coverage for legal liabilities that may arise due to accidents, injuries, or property damage. With an ever-evolving legal landscape and increasing awareness of risk, understanding liability insurance and its intricacies has become essential for anyone seeking to safeguard their assets and future.

The Fundamentals of Liability Insurance

Liability insurance serves as a financial safeguard, protecting individuals and entities from the potential costs associated with legal claims and lawsuits. These claims can arise from a wide range of incidents, including personal injury, property damage, professional errors, or even defamation. The insurance policy typically covers the costs of legal defense, settlements, and any compensatory damages awarded by a court.

The core concept behind liability insurance is risk transfer. By purchasing a policy, the insured party transfers the financial risk of potential liabilities to the insurance company. This transfer of risk provides peace of mind, knowing that in the event of a claim, the insured will not be left financially devastated. Instead, the insurance company steps in to manage the claim, handle legal proceedings, and cover the associated costs up to the policy limits.

Types of Liability Insurance

Liability insurance comes in various forms, each tailored to specific needs and industries. Here are some of the most common types:

- General Liability Insurance: This is a broad category that covers a wide range of liabilities, including bodily injury, property damage, personal and advertising injury, and medical payments. It's often a foundational policy for businesses, providing protection for common risks.

- Professional Liability Insurance (also known as Errors and Omissions Insurance): Tailored for professionals such as doctors, lawyers, accountants, and consultants, this insurance covers liabilities arising from professional services and advice. It protects against claims of negligence, errors, and omissions in the course of business.

- Product Liability Insurance: Essential for manufacturers, distributors, and retailers, this insurance covers liabilities associated with defective products that cause harm or property damage. It provides protection against lawsuits arising from product-related incidents.

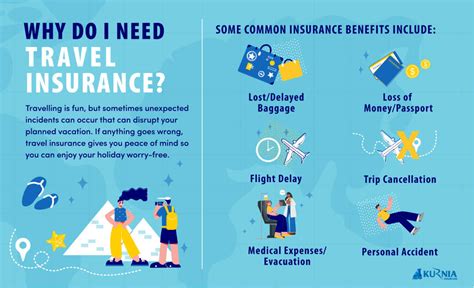

- Cyber Liability Insurance: In the digital age, this type of insurance has become increasingly important. It covers liabilities arising from cyber attacks, data breaches, and other online risks. With the rise of cyber threats, this insurance is crucial for businesses that handle sensitive data.

- Umbrella Liability Insurance: Designed to provide additional coverage beyond the limits of other liability policies, umbrella insurance offers an extra layer of protection. It kicks in when the limits of other policies are exhausted, providing higher limits of liability.

The Importance of Liability Insurance in Today’s World

In an increasingly litigious society, the importance of liability insurance cannot be overstated. With the rise of personal injury lawsuits, product liability claims, and cyber attacks, the potential for legal liabilities has grown exponentially. Here’s why liability insurance is vital:

- Financial Protection: The primary purpose of liability insurance is to provide financial protection. Legal claims and lawsuits can result in substantial monetary damages, including compensation for injuries, property repairs, and legal fees. Without insurance, these costs can be devastating, potentially leading to bankruptcy.

- Risk Management: Liability insurance is a critical tool for risk management. By transferring the risk to an insurance company, businesses and individuals can focus on their core operations without the constant worry of potential liabilities. This allows for better planning and resource allocation.

- Legal Defense: Liability insurance policies often include coverage for legal defense costs. This means that if a claim is made, the insured party has access to legal representation to defend against the allegations. Having an experienced legal team can significantly impact the outcome of a lawsuit.

- Peace of Mind: Knowing that you have liability insurance provides peace of mind. Whether you're a business owner, a professional, or an individual, having insurance coverage allows you to operate with confidence, knowing that you're protected against unexpected liabilities.

- Compliance and Business Operations: In many industries, liability insurance is not just a good idea but a legal requirement. From construction sites to healthcare practices, certain businesses must carry liability insurance to operate legally. Additionally, many clients and partners require proof of insurance before engaging in business relationships.

Case Study: The Impact of Liability Insurance

Consider the case of a small construction company that specializes in home renovations. Despite their expertise, accidents can happen. One day, while working on a client’s roof, a worker accidentally drops a tool, which falls and injures a passerby below. The injured person files a lawsuit seeking compensation for medical expenses and lost wages.

Without liability insurance, the construction company would be solely responsible for these costs. Depending on the severity of the injuries, the financial burden could be devastating, potentially putting the company out of business. However, with liability insurance in place, the insurance company steps in to manage the claim. They provide legal defense, negotiate settlements, and cover the costs up to the policy limits.

This real-world example highlights the critical role of liability insurance. It not only protects the construction company from financial ruin but also ensures that the injured party receives the necessary compensation. By transferring the risk to the insurance company, the construction company can continue its operations without the fear of a single incident causing its downfall.

Understanding Policy Terms and Coverage

When it comes to liability insurance, the devil is in the details. Policy terms and coverage can vary widely depending on the insurer, the industry, and the specific needs of the insured. Here are some key aspects to consider:

- Policy Limits: Every liability insurance policy has limits, which are the maximum amounts the insurer will pay for covered claims. These limits can be per incident, per policy period, or a combination of both. It's crucial to understand these limits and ensure they align with your potential liabilities.

- Deductibles and Retentions: Deductibles and retentions are the amounts you, as the insured, must pay out of pocket before the insurance coverage kicks in. These can be a fixed dollar amount or a percentage of the claim. Higher deductibles often result in lower premiums, so it's a balance to consider.

- Exclusions: Insurance policies typically have exclusions, which are specific risks or circumstances that are not covered. It's essential to review these exclusions carefully to understand what's not covered by your policy. Some common exclusions include intentional acts, certain types of professional services, and pollution-related incidents.

- Additional Insureds: In certain situations, you may need to add additional insureds to your policy. This could be a client, a partner, or a vendor who requires proof of insurance. By adding them as an additional insured, you provide them with protection under your policy in the event of a claim.

- Claims-Made vs. Occurrence Policies: Liability insurance policies can be either claims-made or occurrence-based. Claims-made policies cover claims made during the policy period, regardless of when the incident occurred. Occurrence policies, on the other hand, cover incidents that occur during the policy period, regardless of when the claim is made. Understanding the difference is crucial for long-term risk management.

| Policy Type | Key Features |

|---|---|

| Claims-Made | Covers claims made during the policy period; may require retroactive coverage for prior incidents. |

| Occurrence | Covers incidents that occur during the policy period; provides long-term protection for past incidents. |

The Role of Liability Insurance in Business and Industry

Liability insurance is a cornerstone of modern business and industry, playing a vital role in various sectors. Here’s how it impacts different industries:

Construction and Manufacturing

In the construction and manufacturing industries, where physical labor and complex machinery are common, the risk of accidents and injuries is elevated. Liability insurance provides a safety net for these businesses, covering potential liabilities arising from workplace accidents, equipment failures, and even environmental incidents.

For example, a manufacturing plant that produces heavy machinery may face liabilities if a machine malfunctions and causes injury to an employee or a customer. Liability insurance steps in to cover the costs associated with such incidents, including medical expenses, lost wages, and legal fees.

Healthcare and Medical

The healthcare industry faces unique challenges when it comes to liability. Medical professionals, from doctors to nurses and therapists, are at risk of being sued for medical malpractice. Liability insurance, in the form of professional liability or medical malpractice insurance, is essential to protect these professionals and their practices.

Imagine a scenario where a surgeon performs a complex procedure, and an unexpected complication arises. The patient may file a lawsuit claiming negligence. With medical malpractice insurance, the surgeon has coverage for legal defense and any compensatory damages, allowing them to focus on patient care without fear of financial ruin.

Technology and Cyber Risks

In the digital age, technology companies face a unique set of liabilities. From data breaches to cyber attacks, the risks are ever-present. Cyber liability insurance has emerged as a critical tool for these businesses, providing coverage for a range of cyber-related incidents.

Consider a software development company that stores sensitive client data on its servers. If a hacker gains access to this data and steals or corrupts it, the company could face significant liabilities. Cyber liability insurance steps in to cover the costs of data recovery, legal fees, and even business interruption expenses, ensuring the company can continue operating during and after a cyber incident.

The Future of Liability Insurance

As society and technology evolve, so too does the world of liability insurance. Here are some key trends and future implications to consider:

- Increasing Awareness and Education: With the rise of social media and digital communication, awareness of legal rights and liabilities is on the rise. This increased awareness is driving a greater demand for liability insurance, as individuals and businesses seek to protect themselves from potential risks.

- Emerging Risks and Coverage: As technology advances, new risks emerge. From autonomous vehicles to artificial intelligence, the potential for liabilities is ever-expanding. Insurance companies are continually adapting their policies to cover these emerging risks, ensuring that clients have the protection they need in a rapidly changing world.

- Data-Driven Insurance: The use of data analytics and artificial intelligence is transforming the insurance industry. Insurance companies are leveraging data to better understand risks, set premiums, and customize coverage. This data-driven approach allows for more accurate risk assessment and tailored insurance solutions.

- Collaborative Risk Management: In the future, liability insurance may become more collaborative. Insurance companies, businesses, and professionals may work together to implement risk management strategies, share best practices, and develop innovative solutions to mitigate potential liabilities.

- Regulatory Changes: The regulatory landscape is constantly evolving, and this has a direct impact on liability insurance. Changes in laws and regulations can affect the scope of coverage, the definition of liabilities, and the requirements for insurance. Staying informed about these changes is crucial for both insurers and insured parties.

Conclusion

Liability insurance is a vital component of risk management and financial protection in today’s world. From small businesses to global enterprises, individuals to professionals, the need for liability coverage is universal. By understanding the fundamentals, policy terms, and coverage options, individuals and businesses can make informed decisions to safeguard their future.

As the world continues to evolve, the role of liability insurance will only become more critical. With increasing awareness, emerging risks, and innovative technologies, the insurance industry is poised to adapt and provide comprehensive protection. By staying informed and proactive, we can navigate the complexities of liability insurance and ensure a secure future for ourselves and our businesses.

What is the main purpose of liability insurance?

+

The primary purpose of liability insurance is to provide financial protection against legal claims and lawsuits that may arise due to accidents, injuries, property damage, or professional errors. It covers the costs associated with legal defense, settlements, and compensatory damages, protecting individuals and businesses from potential financial ruin.

Who needs liability insurance, and why?

+

Liability insurance is crucial for anyone facing potential legal liabilities. This includes businesses of all sizes, professionals such as doctors and lawyers, and even individuals who own property or engage in activities that could result in injuries or property damage. It provides peace of mind and financial protection, ensuring that unexpected incidents don’t lead to devastating financial consequences.

How does liability insurance work in practice?

+

When a claim is made against the insured party, the liability insurance policy steps in. The insurance company assesses the claim, provides legal defense if necessary, and covers the costs up to the policy limits. This includes compensating the injured party, paying for property repairs, and covering legal fees. The insured party can then focus on their operations without the financial burden of the claim.