Is Aetna Good Insurance

When it comes to choosing health insurance, one of the leading names in the industry is Aetna. With a rich history spanning over a century and a half, Aetna has established itself as a prominent player in the healthcare sector. In this comprehensive article, we will delve into the world of Aetna insurance, exploring its offerings, reputation, and the value it brings to its customers.

Aetna’s Legacy and Evolution

Aetna Insurance Company has a long and storied history, dating back to 1853 when it was founded as the Aetna Life Insurance Company. Over the years, the company has expanded its reach and evolved to meet the changing needs of the healthcare landscape. Today, Aetna is a subsidiary of CVS Health, a leading healthcare provider, offering a comprehensive range of insurance plans and healthcare services.

The company's journey has been marked by significant milestones. In the early 20th century, Aetna played a crucial role in the development of the insurance industry, introducing innovative products and services. It was among the first to offer disability income insurance and was a pioneer in the field of health maintenance organizations (HMOs). This forward-thinking approach has allowed Aetna to stay ahead of the curve and adapt to the evolving healthcare system.

A Comprehensive Portfolio of Insurance Plans

Aetna offers a diverse array of insurance plans to cater to the varied needs of its customers. From individual and family plans to employer-sponsored group health insurance, Aetna provides coverage options for a wide range of demographics.

Individual and Family Plans

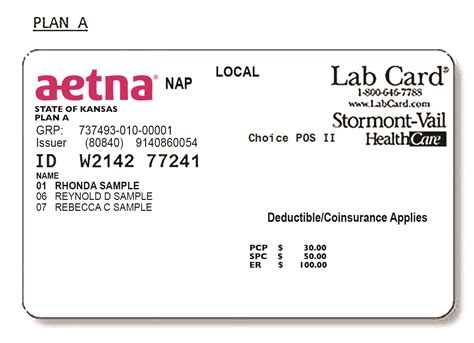

For those seeking personalized coverage, Aetna’s individual and family plans offer flexibility and comprehensive benefits. These plans typically include options for various deductibles, copayments, and out-of-pocket maximums, allowing individuals to choose a plan that aligns with their budget and healthcare requirements.

Aetna's individual plans often come with additional perks, such as access to a network of preferred providers, prescription drug coverage, and preventive care services. The company understands the importance of preventive healthcare and encourages its members to take proactive steps towards maintaining their well-being.

Group Health Insurance for Employers

Aetna recognizes the importance of providing comprehensive healthcare options to employees. As such, they offer a range of group health insurance plans tailored to the needs of businesses. These plans provide employers with the flexibility to design benefit packages that attract and retain talented employees while also controlling costs.

Aetna's group plans often include features such as wellness programs, employee assistance programs, and robust coverage for various medical services. By offering these benefits, employers can promote a healthy workforce and improve overall productivity.

Network of Providers and Access to Care

Aetna takes pride in its extensive network of healthcare providers, ensuring its members have access to a wide range of medical professionals and facilities. This network includes primary care physicians, specialists, hospitals, and urgent care centers, providing Aetna members with convenient and efficient healthcare options.

With Aetna's provider network, members can easily locate in-network doctors and facilities, reducing out-of-pocket expenses. The company's website and mobile app provide tools for searching and selecting providers based on location, specialty, and other criteria, making it convenient for members to find the right healthcare provider.

| Network Type | Description |

|---|---|

| Aetna HMO | Health Maintenance Organization plans require members to choose a primary care physician and obtain referrals for specialist care. |

| Aetna PPO | Preferred Provider Organization plans offer more flexibility, allowing members to see out-of-network providers but with higher costs. |

| Aetna EPO | Exclusive Provider Organization plans limit members to in-network providers but typically offer lower costs. |

Aetna’s Reputation and Customer Satisfaction

Aetna’s reputation in the insurance industry is built on a foundation of trust and customer satisfaction. The company has consistently received positive feedback from its members, who appreciate the quality of care and the ease of navigating the insurance process.

Independent surveys and ratings reflect Aetna's strong standing in the market. The National Committee for Quality Assurance (NCQA) has recognized Aetna for its high-quality healthcare plans and services, awarding the company with top ratings for its performance and member satisfaction.

Additionally, Aetna has been recognized for its commitment to innovation and technological advancements. The company has invested in digital tools and resources to enhance the customer experience, making it easier for members to manage their insurance plans, access healthcare services, and stay informed about their coverage.

Value-Added Services and Wellness Programs

Aetna understands that insurance is more than just coverage; it’s about empowering individuals to take control of their health. As such, the company offers a range of value-added services and wellness programs to support its members on their healthcare journeys.

Wellness Programs

Aetna’s wellness programs are designed to encourage members to adopt healthy lifestyles and prevent illness. These programs often include incentives and rewards for reaching certain health milestones, such as weight loss, smoking cessation, or increased physical activity.

By promoting preventive care and healthy habits, Aetna aims to reduce the incidence of chronic diseases and improve overall well-being. These programs are tailored to individual needs and provide personalized guidance and support.

Digital Tools and Resources

In today’s digital age, Aetna recognizes the importance of providing members with convenient access to their insurance information and healthcare resources. The company has developed user-friendly mobile apps and online platforms that allow members to:

- View and manage their insurance plans and coverage details.

- Search for in-network providers and facilities.

- Access personalized health records and track their medical history.

- Receive reminders for appointments and preventive care.

- Connect with healthcare professionals and seek advice.

Aetna’s Impact on the Healthcare Industry

Aetna’s influence extends beyond its role as an insurance provider. The company has been at the forefront of industry advancements, shaping policies and practices that benefit the broader healthcare system.

Through its research and advocacy efforts, Aetna has contributed to the development of innovative healthcare solutions. The company has collaborated with healthcare providers, policymakers, and other stakeholders to address challenges such as rising healthcare costs, access to care, and the need for more efficient healthcare delivery systems.

Aetna's commitment to social responsibility is evident in its initiatives to improve healthcare equity and access. The company has partnered with community organizations and non-profits to provide healthcare services and resources to underserved populations, ensuring that everyone has the opportunity to lead healthy lives.

Future Outlook and Innovations

As the healthcare industry continues to evolve, Aetna remains committed to staying at the forefront of innovation. The company is continuously exploring new technologies and approaches to enhance the customer experience and improve healthcare outcomes.

Aetna's future initiatives include:

- Expanding its digital capabilities to offer even more personalized and convenient services.

- Investing in telemedicine and remote healthcare solutions to improve access to care.

- Developing predictive analytics and artificial intelligence tools to enhance disease prevention and management.

- Collaborating with healthcare providers to integrate digital health records and streamline the patient experience.

By embracing these innovations, Aetna aims to revolutionize the way healthcare is delivered and accessed, making it more efficient, accessible, and patient-centric.

Conclusion

Aetna’s journey as a leading insurance provider is a testament to its commitment to excellence and innovation. With a rich history and a diverse range of insurance plans, Aetna has established itself as a trusted partner for individuals, families, and employers seeking comprehensive healthcare coverage.

From its extensive provider network to its focus on customer satisfaction and value-added services, Aetna continues to make a positive impact on the lives of its members. As the healthcare landscape evolves, Aetna remains dedicated to driving industry advancements and ensuring that its members receive the best possible care.

How do I choose the right Aetna insurance plan for my needs?

+Choosing the right Aetna insurance plan depends on your specific healthcare needs and budget. Consider factors such as deductibles, copayments, and out-of-pocket maximums. Assess your anticipated healthcare expenses and choose a plan that aligns with your financial situation and provides adequate coverage for your expected medical needs.

What is the process for filing a claim with Aetna?

+To file a claim with Aetna, you can typically do so online through their secure member portal or by submitting the necessary forms and documentation to their claims department. It’s important to keep records of your medical expenses and follow the instructions provided by Aetna to ensure a smooth claims process.

Does Aetna offer dental and vision insurance plans?

+Yes, Aetna offers a range of dental and vision insurance plans to complement their medical insurance coverage. These plans provide additional benefits for dental care, vision exams, and eyewear, ensuring that your overall healthcare needs are addressed.