Insurance For Cat

The concept of insurance has evolved significantly over the years, branching out into various specialized domains to cater to the unique needs of different individuals and their beloved companions. One such niche, albeit increasingly popular, is cat insurance. As the global feline population continues to soar, more and more cat owners are recognizing the value of safeguarding their feline friends' health and well-being through insurance plans specifically tailored for cats.

In this comprehensive article, we delve into the world of cat insurance, exploring its history, the diverse range of coverage options available, and the critical factors to consider when selecting a plan. By the end, you'll have a clear understanding of why cat insurance is an essential consideration for any devoted cat owner and the peace of mind it can provide.

A Brief History of Cat Insurance

While the idea of insuring pets may seem relatively modern, the concept’s origins can be traced back to the early 20th century. The first pet insurance policies were introduced in the United States in the 1930s, primarily targeting dogs. These early policies were quite basic, covering only specific conditions and often excluding pre-existing ailments.

It wasn't until the late 1980s that the concept of cat insurance gained traction. The UK was the pioneer in this regard, with the launch of the first dedicated cat insurance plan. This marked a significant shift, as it recognized the unique health needs and vulnerabilities of cats, distinct from those of dogs. Over time, cat insurance evolved, offering more comprehensive coverage and becoming increasingly accessible to cat owners worldwide.

The Importance of Cat Insurance

The significance of cat insurance lies in its ability to provide financial protection and peace of mind to cat owners. Cats, like all living beings, are susceptible to various health issues, some of which can be costly to treat. From routine vaccinations and check-ups to unexpected accidents or chronic illnesses, the financial burden of veterinary care can quickly accumulate.

Cat insurance acts as a safety net, ensuring that cat owners can access the best possible veterinary care for their pets without worrying about the financial implications. It promotes proactive health management, encourages regular check-ups, and enables early detection and treatment of potential health issues. Moreover, it alleviates the stress and anxiety that often accompany unexpected veterinary emergencies.

Types of Cat Insurance Coverage

Cat insurance plans can be broadly categorized into three main types: Accident-only, Accident and Illness, and Wellness Plans. Each type offers a distinct level of coverage and caters to different needs and budgets.

Accident-only Insurance

As the name suggests, accident-only insurance plans cover cats for injuries resulting from accidents. This could include falls, being hit by a car, or any other unforeseen event that leads to physical harm. These plans typically have lower premiums compared to other types of coverage, making them an affordable option for cat owners.

However, it's important to note that accident-only insurance does not cover illnesses or routine care. This means that while it provides protection against unexpected accidents, it won't cover the cost of treatments for conditions like diabetes, kidney disease, or cancer.

Accident and Illness Insurance

Accident and illness insurance plans are the most comprehensive and provide coverage for both accidents and illnesses. This type of insurance is ideal for cat owners who want maximum protection for their feline companions. It covers a wide range of medical conditions, from common ailments like respiratory infections to more serious illnesses requiring extensive treatment.

Accident and illness plans often have higher premiums compared to accident-only plans, but they offer significant peace of mind, knowing that your cat's health is protected regardless of the situation.

Wellness Plans

Wellness plans, also known as routine care plans, focus on preventive care and routine treatments. These plans typically cover annual check-ups, vaccinations, dental cleanings, and sometimes even routine spaying or neutering. They are designed to encourage regular veterinary visits and promote the overall well-being of cats.

Wellness plans are an excellent option for cat owners who want to ensure their pets receive the necessary preventive care but may not need extensive coverage for accidents or illnesses. They are often more affordable than accident and illness plans, making them accessible to a wider range of cat owners.

Factors to Consider When Choosing Cat Insurance

When selecting a cat insurance plan, there are several key factors to take into account to ensure you choose the best option for your feline friend’s unique needs and your financial situation.

Coverage and Benefits

The first step is to determine the type of coverage you require. Consider your cat’s age, breed, and any pre-existing health conditions. If your cat is prone to accidents or has a history of illness, an accident and illness plan might be the most suitable choice. On the other hand, if you’re looking for coverage primarily for preventive care, a wellness plan could be the way to go.

Additionally, review the policy's coverage limits, deductibles, and co-payment structures. Understand what is and isn't covered, including any exclusions or limitations. Some policies may have lifetime limits, which could be a concern if your cat develops a chronic condition requiring long-term treatment.

Reputation and Financial Stability

It’s crucial to choose an insurance provider with a solid reputation and financial stability. Research the company’s history, customer reviews, and their claims process. Look for providers with a track record of prompt and fair claim settlements. A financially stable company ensures that they will be able to honor your policy and provide coverage when needed.

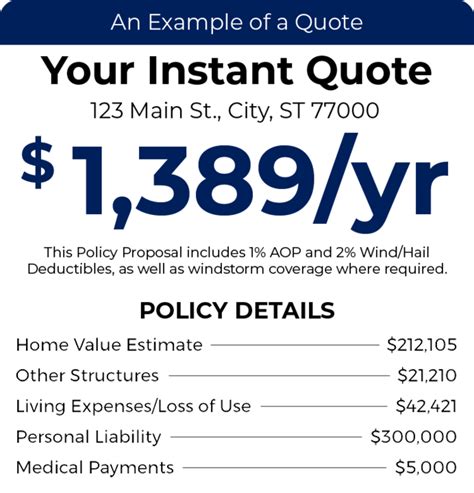

Cost and Affordability

While it’s important to find comprehensive coverage, the cost of the plan should also be a consideration. Compare premiums, deductibles, and any additional fees associated with the policy. Remember that the cheapest plan might not always offer the best value. Assess your budget and choose a plan that provides the right balance of coverage and affordability.

Claim Process and Customer Service

The ease of the claims process and the quality of customer service can significantly impact your experience with a cat insurance provider. Look for companies with a straightforward and transparent claims process, preferably with online claim submission options. Check customer reviews and ratings to gauge their responsiveness and helpfulness.

Consider whether the provider offers 24/7 customer support and has a network of preferred veterinary clinics or hospitals. Having a strong support system can make a significant difference, especially during emergencies.

The Future of Cat Insurance

As the pet insurance industry continues to evolve, so too will the offerings for cat insurance. Technological advancements are likely to play a significant role, with the potential for more personalized and tailored policies based on data analytics. Telemedicine and remote veterinary services may also influence the future of cat insurance, offering convenient and accessible care options.

Additionally, the increasing awareness of pet health and the growing number of cat owners worldwide suggest that cat insurance will become even more mainstream. As the market expands, we can expect to see more specialized plans, innovative coverage options, and improved benefits to meet the diverse needs of cat owners and their feline companions.

Conclusion

In conclusion, cat insurance is a valuable tool for cat owners to ensure the health and well-being of their beloved pets. With a range of coverage options available, from accident-only plans to comprehensive accident and illness policies, cat owners can find a plan that suits their needs and budget. By considering factors such as coverage, reputation, cost, and customer service, you can make an informed decision when choosing a cat insurance provider.

As the pet insurance industry continues to grow and adapt, cat insurance will play an increasingly vital role in providing financial protection and peace of mind to cat owners. It's an investment in your cat's health and happiness, ensuring they receive the best care possible throughout their lives.

What is the average cost of cat insurance?

+The cost of cat insurance can vary widely depending on factors such as the type of coverage, the cat’s age, breed, and health history, as well as the insurance provider. On average, accident-only plans can range from 10 to 20 per month, while accident and illness plans can cost anywhere from 20 to 50 or more per month. Wellness plans may have lower premiums, typically ranging from 5 to 20 per month.

Do all insurance providers cover pre-existing conditions?

+No, not all insurance providers cover pre-existing conditions. In fact, most insurance companies have waiting periods or exclusions for pre-existing ailments. It’s essential to carefully review the policy’s terms and conditions to understand the coverage for pre-existing conditions.

Can I get cat insurance for an older cat?

+Yes, you can get cat insurance for older cats. However, the cost of insurance tends to increase with the cat’s age, as older cats are more prone to health issues. Some insurance providers may have age restrictions or offer limited coverage for senior cats, so it’s important to shop around and compare options.

What happens if I switch insurance providers?

+If you switch insurance providers, your new policy may have different terms and conditions, including waiting periods and coverage exclusions. It’s crucial to understand the implications of switching providers and to carefully review the new policy to ensure it meets your needs.