Best Renters Insurance Company

Renters insurance is an essential yet often overlooked aspect of protecting one's financial well-being and belongings. With the right policy, tenants can secure their possessions and gain peace of mind, knowing they are covered in the event of unexpected situations like theft, fire, or natural disasters. In the diverse landscape of insurance providers, it's crucial to choose a company that offers comprehensive coverage, competitive rates, and exceptional customer service. This comprehensive guide will explore the best renters insurance companies, delving into their unique offerings, policy features, and real-world experiences to help you make an informed decision.

Assessing the Top Renters Insurance Companies

When evaluating renters insurance providers, several key factors come into play. Here’s a breakdown of the essential aspects to consider:

Coverage Options and Customization

A good renters insurance policy should offer a range of coverage options to cater to diverse needs. Look for companies that provide flexible plans, allowing you to tailor your policy to cover specific items of value, such as jewelry, electronics, or musical instruments. Additionally, consider companies that offer add-ons or endorsements to enhance your coverage further.

Competitive Pricing and Discounts

Renters insurance premiums can vary significantly between providers. It’s essential to compare rates and understand the factors that influence pricing, such as the value of your belongings, the location of your rental property, and any applicable discounts. Seek out companies that offer competitive rates and provide discounts for multiple policies, safety features, or loyalty programs.

Customer Service and Claims Handling

In the event of a claim, you’ll want to work with a company that provides excellent customer service and efficient claims handling. Research companies’ reputation for prompt and fair claim settlements, and consider factors like accessibility of customer support, online resources, and user-friendly digital tools.

Financial Stability and Reputation

The financial stability of an insurance company is crucial, as it ensures they can meet their obligations even in challenging economic times. Look for companies with strong financial ratings from reputable agencies like AM Best or Moody’s. Additionally, consider the company’s reputation and track record, including customer satisfaction ratings and reviews.

Digital Experience and Convenience

In today’s digital age, a seamless online experience is essential. Evaluate companies’ websites and mobile apps for ease of use, clarity in policy information, and the ability to manage your policy, make payments, and file claims online. Look for providers that offer digital tools to streamline the process and enhance overall convenience.

The Top Renters Insurance Companies: A Comparative Analysis

Now, let’s delve into the top renters insurance companies and compare their offerings to help you make an informed choice.

State Farm: Comprehensive Coverage and Personalized Service

State Farm is a well-established insurance provider known for its comprehensive renters insurance policies and personalized service. With a focus on customer satisfaction, State Farm offers a range of coverage options, including personal property, liability, and additional living expenses. Their policies can be customized to fit your specific needs, and they provide add-ons for valuable items like jewelry and collectibles.

State Farm stands out for its excellent customer service, with a network of local agents who can provide personalized advice and support. They offer competitive rates, and their digital tools, such as the State Farm® Mobile app, make it convenient to manage your policy and file claims. State Farm also provides discounts for bundling renters insurance with other policies, such as auto insurance.

Allstate: Customizable Plans and Excellent Customer Service

Allstate is another top-tier renters insurance provider known for its customizable plans and exceptional customer service. Their renters insurance policies cover personal property, liability, and additional living expenses, with the option to add endorsements for specific items like musical instruments or collectibles.

Allstate's strength lies in its ability to tailor policies to individual needs. They offer a range of discounts, including those for loyalty, safety features, and bundling renters insurance with other policies. Allstate's digital platform, MyAccount, provides a seamless online experience, allowing you to manage your policy, make payments, and file claims efficiently. Their customer service team is highly regarded for its responsiveness and dedication to customer satisfaction.

Liberty Mutual: Competitive Rates and Comprehensive Coverage

Liberty Mutual is a leading insurance provider offering competitive rates and comprehensive renters insurance policies. Their policies cover personal property, liability, and additional living expenses, with the option to customize coverage for valuable items like electronics and jewelry.

Liberty Mutual's strength lies in its competitive pricing and range of discounts. They offer discounts for bundling renters insurance with other policies, such as auto insurance, as well as discounts for safety features and loyalty. Liberty Mutual's digital tools, including their mobile app and online account management platform, provide a convenient way to manage your policy and file claims. Their customer service team is known for its efficiency and dedication to resolving customer queries promptly.

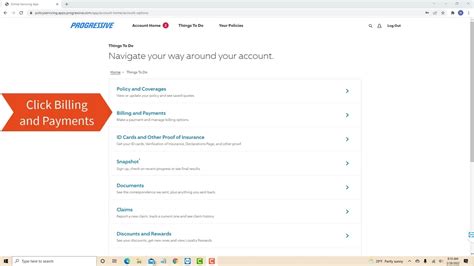

Progressive: Innovative Features and Digital Convenience

Progressive is an innovative insurance provider known for its digital-first approach and competitive rates. Their renters insurance policies cover personal property, liability, and additional living expenses, with the option to customize coverage for specific items.

Progressive stands out for its innovative features, such as the ability to take photos of your belongings and store them digitally, making it easier to file claims. They offer a range of discounts, including those for bundling renters insurance with other policies and for safety features like smoke detectors. Progressive's digital platform, Snapshot®, provides a unique way to customize your policy based on your driving behavior. Their customer service team is highly responsive and dedicated to providing excellent support.

USAA: Exceptional Service for Military Members and Their Families

USAA is a highly regarded insurance provider offering exclusive services to military members and their families. Their renters insurance policies cover personal property, liability, and additional living expenses, with the option to customize coverage for valuable items.

USAA's strength lies in its exceptional customer service and dedication to serving the military community. They offer competitive rates and a range of discounts, including those for loyalty and bundling renters insurance with other policies. USAA's digital tools, such as their mobile app and online account management platform, provide a seamless experience for managing your policy and filing claims. Their customer service team is highly responsive and committed to providing personalized support to military members and their families.

Choosing the Best Renters Insurance Company for Your Needs

When selecting the best renters insurance company, it’s essential to consider your unique circumstances and priorities. Here are some key factors to keep in mind:

- Coverage Needs: Evaluate your coverage requirements, considering the value of your belongings and any specific items you want to insure. Choose a company that offers comprehensive coverage and the flexibility to customize your policy.

- Pricing and Discounts: Compare rates and understand the factors that influence pricing. Look for companies that offer competitive rates and provide discounts for multiple policies, safety features, or loyalty programs.

- Customer Service: Research companies' reputation for customer service and claims handling. Consider factors like accessibility of support, online resources, and user-friendly digital tools.

- Financial Stability: Ensure the company you choose has strong financial ratings and a solid reputation. This is crucial for long-term peace of mind.

- Digital Experience: Evaluate companies' digital platforms and tools for managing your policy and filing claims. A seamless online experience can save time and provide added convenience.

Final Thoughts

Choosing the best renters insurance company is an important decision that can provide you with the protection and peace of mind you deserve. By assessing coverage options, pricing, customer service, financial stability, and digital convenience, you can make an informed choice that aligns with your specific needs. Remember to compare multiple providers and tailor your policy to ensure you have the right coverage at a competitive rate.

Whether you choose State Farm for its personalized service, Allstate for its customizable plans, Liberty Mutual for its competitive rates, Progressive for its innovative features, or USAA for its exceptional service to military members, you can trust that these top renters insurance companies will provide the protection and support you need to secure your belongings and financial well-being.

How much does renters insurance typically cost?

+The cost of renters insurance can vary based on several factors, including the value of your belongings, the location of your rental property, and any applicable discounts. On average, renters insurance policies range from 15 to 30 per month, with some providers offering even lower rates. It’s important to compare quotes from multiple companies to find the best value for your specific needs.

What factors influence the cost of renters insurance?

+Several factors influence the cost of renters insurance, including the value of your belongings, the location of your rental property, and any discounts you may qualify for. For example, if you live in an area with a high crime rate or a history of natural disasters, your premiums may be higher. Additionally, factors like the type of building (apartment, condo, or house) and the presence of safety features can impact your rates.

How can I save money on renters insurance?

+There are several ways to save money on renters insurance. First, compare quotes from multiple providers to find the best rates. Look for companies that offer discounts for bundling renters insurance with other policies, such as auto insurance. Additionally, consider increasing your deductible, which can lower your premiums. Finally, ensure your rental property has safety features like smoke detectors and security systems, as these can often qualify you for discounts.