Ratings Of Insurance Companies

In today's complex financial landscape, making informed decisions about insurance is crucial. With countless options available, understanding the reputation and reliability of insurance companies is paramount. This comprehensive guide delves into the intricate world of insurance company ratings, offering a deep dive into the factors that influence these ratings and their impact on consumers.

Understanding Insurance Company Ratings

Insurance company ratings serve as a vital tool for consumers, providing an objective assessment of an insurer’s financial health, customer satisfaction, and overall performance. These ratings are typically assigned by independent rating agencies, which conduct thorough evaluations based on various criteria.

Rating Agencies and Their Methodology

The insurance industry is overseen by several renowned rating agencies, each with its own rigorous methodology. These agencies, such as AM Best, Standard & Poor’s, and Moody’s, analyze insurers based on a multitude of factors, including:

- Financial Strength: Assessing an insurer’s ability to meet its financial obligations, such as paying claims, is a cornerstone of these ratings.

- Risk Management: Evaluating the insurer’s ability to identify, assess, and mitigate risks is crucial for long-term sustainability.

- Customer Service: Ratings consider the insurer’s track record in handling customer inquiries, claims, and overall satisfaction.

- Market Position: The insurer’s market share, growth, and competitive positioning are analyzed to gauge its stability and prospects.

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A++ (Superior) |

| Standard & Poor's | AA- (Very Strong) |

| Moody's | Aaa (Highest Quality) |

These agencies regularly update their ratings, ensuring that consumers have access to the most current information when making insurance choices.

Factors Influencing Insurance Company Ratings

Insurance company ratings are influenced by a multitude of factors, each playing a crucial role in shaping an insurer’s reputation and financial stability. Understanding these factors provides valuable insights into the complex world of insurance.

Financial Stability and Solvency

At the core of insurance company ratings is the assessment of an insurer’s financial stability and solvency. Rating agencies scrutinize an insurer’s ability to meet its financial obligations, including paying claims, maintaining adequate reserves, and managing investment risks.

- Capital Adequacy: Insurers must maintain sufficient capital to cover potential losses and unexpected events. Rating agencies analyze an insurer’s capital reserves and their ability to withstand financial shocks.

- Investment Portfolio: The quality and diversity of an insurer’s investment portfolio are critical. Rating agencies evaluate the risk profile of investments and their potential impact on the insurer’s financial health.

Claims Handling and Customer Satisfaction

Insurance companies are ultimately judged by their ability to deliver on their promises, particularly when it comes to handling claims. Rating agencies consider various aspects of an insurer’s claims process, including:

- Timeliness: How promptly an insurer processes and pays claims is a key indicator of its efficiency and customer-centric approach.

- Fairness: Rating agencies assess whether insurers treat customers fairly, ensuring that claims are handled objectively and in line with policy terms.

- Customer Feedback: Consumer feedback and satisfaction surveys provide valuable insights into an insurer’s performance. Rating agencies analyze customer experiences and complaints to gauge an insurer’s overall reputation.

Risk Management and Underwriting Practices

Effective risk management is a cornerstone of successful insurance companies. Rating agencies evaluate an insurer’s ability to identify, assess, and mitigate risks. This includes:

- Underwriting Expertise: Insurers must possess the knowledge and tools to accurately assess and price risks. Rating agencies analyze the insurer’s underwriting processes and their ability to adapt to changing market conditions.

- Risk Mitigation Strategies: Insurers should have robust risk management frameworks in place to identify and address potential risks. Rating agencies assess an insurer’s ability to identify emerging risks and implement effective mitigation strategies.

Regulatory Compliance and Market Reputation

Insurance companies operate within a highly regulated environment. Rating agencies consider an insurer’s track record in complying with regulatory requirements and maintaining a positive market reputation. This includes:

- Regulatory Penalties: Insurers with a history of regulatory violations or penalties may be viewed less favorably by rating agencies.

- Market Conduct: Rating agencies assess an insurer’s market conduct, including its relationships with brokers, agents, and customers. A positive market reputation is a key factor in maintaining strong ratings.

Impact of Ratings on Consumers

Insurance company ratings have a significant impact on consumers, shaping their perceptions and decisions regarding insurance coverage. Understanding this impact is crucial for both insurers and consumers alike.

Consumer Confidence and Trust

Strong insurance company ratings instill confidence and trust in consumers. When an insurer receives high ratings from reputable agencies, it signals to consumers that the company is financially stable, reliable, and committed to delivering on its promises.

Consumers often use ratings as a key criterion when comparing insurance options. A highly rated insurer is more likely to attract new customers and retain existing ones, as consumers feel secure knowing their insurer is well-positioned to meet their financial obligations.

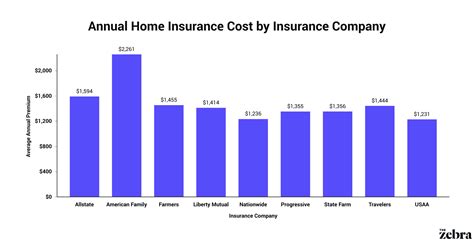

Access to Competitive Premiums

Insurance companies with strong ratings often have the financial stability to offer competitive premiums to their customers. This is particularly beneficial for consumers, as it allows them to secure adequate coverage at a reasonable cost.

Rating agencies consider an insurer’s ability to price its products competitively while maintaining financial stability. As a result, consumers with access to highly rated insurers may enjoy more affordable insurance options.

Enhanced Customer Service and Claims Handling

Insurance companies with high ratings typically invest in their customer service and claims handling processes. This investment translates into a better experience for consumers, who can expect timely and efficient resolution of their inquiries and claims.

Rating agencies consider customer satisfaction surveys and feedback when assigning ratings. Insurers with a track record of excellent customer service are more likely to maintain strong ratings, ensuring that consumers receive the support they need when it matters most.

Long-Term Financial Security

Insurance is a long-term commitment, and consumers seek insurers that can provide financial security over the years. Strong insurance company ratings indicate that an insurer is well-positioned to withstand market fluctuations and unforeseen events.

By choosing a highly rated insurer, consumers can have peace of mind knowing that their insurance coverage is backed by a financially stable company. This long-term financial security is a critical consideration for consumers, especially when planning for major life events or protecting valuable assets.

Future Implications and Trends

The world of insurance is constantly evolving, and insurance company ratings are no exception. As the industry adapts to new challenges and opportunities, rating agencies must keep pace to provide accurate and relevant assessments.

Emerging Technologies and Digital Transformation

The insurance industry is experiencing a digital transformation, with insurers adopting new technologies to enhance their operations. Rating agencies are increasingly evaluating insurers’ ability to leverage technology for improved efficiency, risk management, and customer experience.

From digital underwriting and claims processing to data analytics and artificial intelligence, insurers that embrace these technologies are likely to receive higher ratings. Rating agencies recognize the potential of these innovations to enhance an insurer’s financial stability and customer satisfaction.

Climate Change and Environmental Risks

Climate change is presenting new challenges for the insurance industry, particularly in the context of natural disasters and environmental risks. Rating agencies are increasingly assessing insurers’ preparedness and strategies for managing these emerging risks.

Insurers that demonstrate a proactive approach to climate-related risks, such as investing in resilient infrastructure and developing innovative insurance products, are likely to receive favorable ratings. Rating agencies recognize the importance of insurers’ role in mitigating and managing these risks, both for their financial stability and for the broader society.

Regulatory Changes and Consumer Protection

Regulatory environments are constantly evolving, and insurers must adapt to new requirements and consumer protection measures. Rating agencies consider an insurer’s ability to comply with these changes and maintain a strong focus on consumer protection.

Insurers that proactively implement regulatory changes and demonstrate a commitment to ethical practices are more likely to maintain strong ratings. Rating agencies recognize the importance of consumer protection in building trust and confidence in the insurance industry.

Global Market Dynamics and Competition

The insurance industry is a global marketplace, and insurers must compete not only within their regions but also on a global scale. Rating agencies assess insurers’ ability to navigate global market dynamics and maintain a competitive edge.

Insurers that successfully expand into new markets, develop innovative products, and maintain a strong market presence are likely to receive favorable ratings. Rating agencies recognize the importance of global market success in an increasingly interconnected world.

How often are insurance company ratings updated?

+Insurance company ratings are typically updated on an annual basis. However, rating agencies may conduct special reviews or update ratings more frequently if significant changes occur within an insurer's operations or financial performance.

Do all insurance companies get rated?

+No, not all insurance companies are rated by the major rating agencies. Rating agencies select insurers based on various criteria, including size, market presence, and financial stability. Smaller insurers or those with limited market reach may not be rated by the largest agencies.

Can insurance company ratings change suddenly?

+Yes, insurance company ratings can change suddenly in response to significant events or changes in an insurer's financial performance or risk profile. Rating agencies continuously monitor insurers and may adjust ratings if new information warrants a change.

Are insurance company ratings the only factor to consider when choosing an insurer?

+While insurance company ratings are an important consideration, they are not the sole factor. Consumers should also evaluate an insurer's products, services, customer reviews, and their specific needs and preferences. Ratings provide a valuable perspective, but individual circumstances should also be taken into account.

In conclusion, insurance company ratings are a powerful tool for consumers, offering valuable insights into an insurer’s financial health, customer satisfaction, and overall performance. By understanding the factors that influence these ratings and their impact on consumers, individuals can make more informed decisions when choosing insurance coverage. As the insurance industry continues to evolve, staying abreast of the latest trends and developments in insurance company ratings is essential for both consumers and insurers alike.