Home Insurance Rate

Welcome to this comprehensive guide on home insurance rates. In this article, we will delve into the factors that influence these rates, explore the differences between various insurance providers, and provide you with the knowledge to make informed decisions when it comes to protecting your home and assets. With home insurance being a crucial aspect of financial planning, understanding the rate-setting process is essential for homeowners.

Understanding Home Insurance Rates

Home insurance rates are determined by a complex interplay of variables, each contributing to the overall cost of coverage. These rates are tailored to the unique characteristics of your home and your specific circumstances. By examining these factors, we can gain insights into the mechanics behind insurance premiums.

Risk Assessment: A Crucial Factor

At the core of home insurance rate determination lies risk assessment. Insurance providers meticulously evaluate the potential risks associated with insuring your home. Factors such as the location of your property, its age, and the surrounding environment play a significant role. For instance, homes situated in areas prone to natural disasters like hurricanes or wildfires may face higher insurance rates due to the increased likelihood of claims.

Additionally, the construction materials used in your home can impact insurance rates. Properties built with materials that are resistant to fire, wind, or other hazards may enjoy more favorable rates. On the other hand, older homes that require extensive renovations or lack modern safety features may be deemed higher-risk, leading to higher insurance premiums.

Historical Claims Data: A Key Indicator

Insurance companies rely on historical claims data to assess the potential risks associated with insuring your home. They analyze trends and patterns in claims made by homeowners in your area and across similar properties. If a particular region has a history of frequent claims, such as theft or water damage, insurance rates may be adjusted accordingly to reflect the increased risk.

Furthermore, your own claims history can influence your home insurance rates. Insurance providers consider the number and frequency of claims you have made in the past. A clean claims history may result in more competitive rates, while multiple claims within a short period could lead to higher premiums or even the denial of coverage.

| Risk Factor | Impact on Rates |

|---|---|

| Natural Disaster Risk | Higher rates in disaster-prone areas |

| Construction Materials | Favourable rates for resilient materials |

| Historical Claims Data | Adjusted rates based on regional claim trends |

| Personal Claims History | Clean history leads to competitive rates |

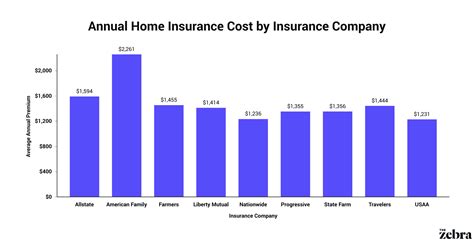

Comparing Insurance Providers: A Comprehensive Analysis

When it comes to choosing a home insurance provider, conducting a thorough comparison is essential. Different insurance companies offer varying levels of coverage, additional perks, and, of course, different rates. By examining the key aspects of these providers, you can make an informed decision that aligns with your specific needs.

Coverage Options: Tailoring to Your Needs

Home insurance policies come in various forms, each offering a unique set of coverage options. Some providers specialize in offering comprehensive coverage that includes protection against a wide range of risks, while others may focus on specific aspects such as liability or natural disaster protection. Understanding the coverage options available is crucial to ensure you select a policy that adequately protects your home and assets.

Consider the unique risks associated with your home and location. For instance, if you reside in an area prone to flooding, you may require additional flood insurance coverage. On the other hand, if your home is located in a neighborhood with a high crime rate, theft protection may be a priority. By assessing your specific needs, you can tailor your insurance coverage accordingly.

Additional Perks: Enhancing Your Protection

Beyond the basic coverage options, insurance providers often offer additional perks and benefits to differentiate themselves in the market. These perks can significantly enhance your protection and provide added peace of mind. Some providers may offer identity theft protection, while others might include rental car coverage or emergency travel assistance.

For instance, imagine you are a homeowner with valuable artwork or collectibles. Certain insurance providers offer specialty coverage for high-value items, ensuring that your cherished possessions are adequately protected. By exploring the additional perks offered by different providers, you can find a policy that not only meets your basic needs but also provides the extra protection you desire.

Comparative Analysis: Unveiling the Best Options

To conduct a comprehensive comparison, it is essential to gather quotes from multiple insurance providers. Obtain detailed quotes that outline the coverage, deductibles, and any additional perks offered. By comparing these quotes side by side, you can identify the providers that offer the best combination of coverage, perks, and, of course, competitive rates.

Consider not only the initial rates but also the potential for long-term savings. Some providers may offer discounts for bundling home and auto insurance policies or for maintaining a long-standing relationship with the company. By analyzing the long-term value proposition, you can make a decision that benefits you both in the short and long term.

Performance Analysis: Evaluating Insurance Providers

Beyond comparing coverage and rates, evaluating the performance and reputation of insurance providers is crucial. Assessing their financial stability, claims handling process, and customer satisfaction ratings can provide valuable insights into the overall quality of their services.

Financial Stability: A Pillar of Confidence

Financial stability is a key indicator of an insurance provider's reliability and ability to fulfill their obligations. Insurance companies must maintain sufficient reserves to pay out claims, even in the event of unexpected disasters or high claim volumes. By examining financial reports and ratings from reputable agencies, you can assess the financial health of different providers and choose a company with a solid financial foundation.

For instance, let's consider a hypothetical scenario where an insurance provider experiences a sudden surge in claims due to a natural disaster. A financially stable company will have the resources to promptly process and pay out these claims, ensuring that policyholders receive the compensation they deserve. On the other hand, a financially unstable provider may struggle to meet their obligations, leading to delayed payments or even insolvency.

Claims Handling Process: A Critical Differentiator

The efficiency and fairness of an insurance provider's claims handling process can significantly impact your overall experience. A well-organized and prompt claims process can provide much-needed relief during stressful times. Look for providers that offer clear and transparent guidelines for filing claims, and consider their track record in resolving claims swiftly and fairly.

Imagine a situation where you have suffered a significant loss due to a fire at your home. An insurance provider with a robust claims handling process will guide you through the necessary steps, provide support, and work diligently to assess and settle your claim in a timely manner. On the contrary, a provider with a cumbersome and inefficient process may cause unnecessary delays and add to your stress during an already challenging time.

Customer Satisfaction: A Measure of Excellence

Customer satisfaction ratings provide valuable insights into the overall experience of policyholders with a particular insurance provider. These ratings, often based on surveys and feedback, reflect the level of trust, responsiveness, and overall satisfaction customers have with the company. By considering customer satisfaction ratings, you can gauge the likelihood of a positive experience with a specific provider.

For example, a provider with consistently high customer satisfaction ratings may indicate a commitment to excellent customer service, fair claims handling, and a strong focus on policyholder satisfaction. On the other hand, a provider with consistently low ratings may suggest potential issues with customer service, claims handling, or other aspects of the overall experience.

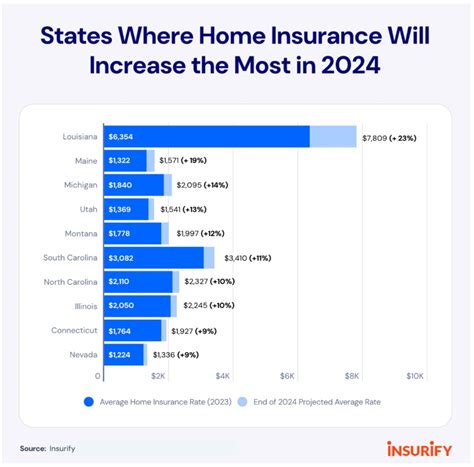

Future Implications: Staying Ahead of the Curve

As the insurance industry continues to evolve, it is crucial to stay abreast of emerging trends and potential changes that may impact home insurance rates. By staying informed, you can make proactive decisions to protect your home and assets effectively.

Technological Advancements: Shaping the Future of Insurance

The rapid advancement of technology is transforming the insurance industry, with innovations such as telematics, artificial intelligence, and data analytics playing a significant role. These technologies enable insurance providers to gather and analyze vast amounts of data, improving risk assessment and claims handling processes. As a result, insurance rates may become more personalized and accurate, reflecting the unique characteristics of your home and your behavior.

For instance, telematics devices installed in vehicles can provide real-time data on driving behavior, allowing insurance providers to offer usage-based insurance policies. Similarly, smart home devices and sensors can provide valuable insights into home occupancy, security, and potential risks, leading to more precise insurance rates. By embracing these technological advancements, you can potentially access more tailored and affordable insurance coverage.

Regulatory Changes: Navigating a Dynamic Landscape

The insurance industry is subject to ongoing regulatory changes, which can impact home insurance rates. Governments and regulatory bodies may introduce new laws or amend existing ones to address emerging risks or protect consumers. Staying informed about these changes is crucial to understand how they may affect your insurance coverage and rates.

Consider the impact of recent climate change regulations on home insurance rates. As governments around the world implement measures to mitigate the effects of climate change, insurance providers may adjust their policies and rates to reflect the increased risk of natural disasters. By staying updated on regulatory changes, you can anticipate potential rate adjustments and take proactive steps to protect your home and assets.

Market Dynamics: A Shifting Landscape

The insurance market is dynamic, with new providers entering the scene and established companies adapting to changing consumer needs. This competition can drive innovation and potentially lead to more competitive rates. By staying informed about market trends and emerging providers, you can explore alternative options and negotiate better rates for your home insurance coverage.

For example, the rise of digital-first insurance providers has introduced new players into the market. These companies leverage technology to streamline the insurance process, offering convenient online platforms for policyholders. As a result, they may provide more affordable rates and personalized coverage options. By exploring these new market entrants, you can potentially access more cost-effective insurance solutions.

Frequently Asked Questions

How often should I review my home insurance rates?

+It is recommended to review your home insurance rates annually to ensure you are getting the best value. Market conditions, your personal circumstances, and the value of your home may change over time, which can impact the competitiveness of your current policy.

Can I negotiate my home insurance rates?

+Yes, negotiating your home insurance rates is possible. By discussing your specific needs, risk factors, and any applicable discounts with your insurance provider, you may be able to secure a more favorable rate. It is worth exploring your options and advocating for the best possible coverage and pricing.

What factors can I control to potentially lower my home insurance rates?

+There are several factors within your control that can potentially lower your home insurance rates. These include maintaining a good credit score, installing security measures like alarms or cameras, and regularly maintaining your home to prevent potential hazards. Additionally, bundling your home and auto insurance policies with the same provider can often lead to discounts.

In conclusion, understanding home insurance rates and the factors that influence them is crucial for every homeowner. By conducting a comprehensive analysis of insurance providers, evaluating their performance, and staying informed about emerging trends, you can make well-informed decisions to protect your home and assets effectively. Remember, a proactive approach to home insurance can provide you with peace of mind and financial security in the face of unforeseen circumstances.