Low Insurance Quotes

When it comes to insurance, finding the best quotes is crucial to ensure you get the coverage you need without breaking the bank. In an industry as vast and diverse as insurance, navigating the options can be daunting. However, with the right strategies and a bit of insider knowledge, securing low insurance quotes is not only possible but also achievable. This comprehensive guide aims to shed light on the world of insurance, providing you with the tools and insights to make informed decisions and unlock the most competitive rates.

Understanding the Fundamentals of Insurance

Insurance is a financial safety net, designed to protect individuals and businesses from unforeseen circumstances and potential losses. Whether it’s health, life, property, or liability insurance, the core principle remains the same: to provide a sense of security and financial stability in times of need. By paying regular premiums, policyholders transfer the risk of potential losses to the insurance company, ensuring they have the support they need when faced with challenging situations.

The Role of Risk Assessment

At the heart of insurance lies the concept of risk assessment. Insurance companies meticulously evaluate various factors to determine the likelihood of a claim being made. These factors, known as risk factors, encompass a wide range of variables, including age, health status, occupation, location, and even driving habits. By analyzing these risk factors, insurance providers can accurately calculate the potential costs associated with covering a policyholder, which ultimately influences the insurance premium.

For instance, consider a young, healthy individual with a clean driving record. They would likely be considered a low-risk candidate for car insurance, resulting in more affordable premiums. Conversely, an older individual with a history of health issues and a few accidents under their belt would be deemed a higher-risk candidate, leading to higher insurance costs.

| Risk Factor | Impact on Insurance Premium |

|---|---|

| Age | Younger individuals often pay lower premiums, as they are statistically less likely to make claims. |

| Health Status | Individuals with pre-existing health conditions or a history of illnesses may face higher premiums. |

| Occupation | Certain high-risk occupations, such as construction or firefighting, may result in increased insurance costs. |

| Location | The crime rate, natural disaster frequency, and traffic congestion in an area can all impact insurance premiums. |

| Driving Habits | Safe driving habits, such as avoiding accidents and traffic violations, can lead to lower car insurance rates. |

Exploring Strategies for Lower Insurance Quotes

Securing low insurance quotes requires a combination of careful research, strategic decision-making, and a good understanding of your unique circumstances. Here are some key strategies to help you navigate the insurance landscape and unlock the best deals:

Shop Around and Compare

The insurance market is highly competitive, with numerous providers offering a wide range of policies. Taking the time to shop around and compare quotes is essential to finding the most competitive rates. Online comparison tools can be particularly useful, allowing you to quickly assess multiple quotes and identify the best deals.

Consider the following when comparing insurance quotes:

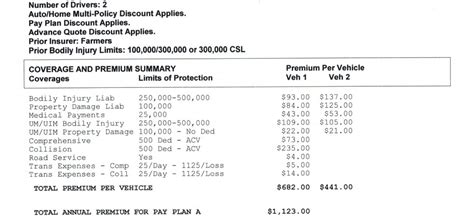

- Coverage: Ensure that the policies you're comparing offer the same level of coverage. Comparing apples to apples is crucial to making an accurate assessment.

- Deductibles: Policies with higher deductibles often have lower premiums. Assess your financial situation and comfort level with deductibles to strike the right balance.

- Additional Benefits: Some insurance providers offer unique perks or discounts. These can include loyalty rewards, safe driver discounts, or even discounts for bundling multiple policies.

Bundle Your Policies

Many insurance companies offer significant discounts when you bundle multiple policies with them. For instance, bundling your home and auto insurance policies can result in substantial savings. Similarly, combining life and health insurance policies or business insurance policies can lead to cost-effective solutions.

Utilize Discounts and Rewards

Insurance providers often offer a variety of discounts and rewards to attract and retain customers. These can include:

- Safe Driver Discounts: For car insurance, maintaining a clean driving record can lead to significant discounts.

- Loyalty Rewards: Some providers offer discounts for long-term customers or those who consistently renew their policies.

- Occupational Discounts: Certain professions, such as teachers or military personnel, may be eligible for special discounts.

- Safety Features Discounts: Installing security systems or anti-theft devices in your home or car can result in reduced insurance premiums.

Optimize Your Coverage

Reviewing your insurance coverage regularly is essential to ensure you’re not overpaying for unnecessary features. Assess your current needs and circumstances, and adjust your coverage accordingly. For instance, if you’ve paid off your mortgage, you may no longer need as extensive a home insurance policy.

Additionally, consider increasing your deductibles. While this means you'll pay more out of pocket in the event of a claim, it can significantly reduce your insurance premiums.

The Impact of Technology on Insurance Quotes

Advancements in technology have revolutionized the insurance industry, making it more accessible and efficient for both providers and policyholders. Online platforms and mobile apps have streamlined the insurance process, allowing for quick and convenient quote comparisons and policy management.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS tracking, has introduced a new era of usage-based insurance. This innovative approach to car insurance allows drivers to pay premiums based on their actual driving behavior rather than generic risk factors. By installing a small device in your car or using a smartphone app, insurance providers can track factors such as miles driven, driving speed, and even the time of day you’re on the road.

This data-driven approach rewards safe drivers with lower premiums, as insurance providers can accurately assess their risk based on real-time driving data. For instance, a driver who primarily drives during off-peak hours and maintains a steady, safe speed may qualify for significant discounts.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics have transformed the way insurance providers assess risk and determine premiums. By analyzing vast amounts of data, insurance companies can make more accurate predictions and offer more tailored insurance solutions.

AI-powered chatbots and virtual assistants are also becoming increasingly common, providing policyholders with instant support and answers to their insurance queries. This not only improves the customer experience but also reduces the administrative burden on insurance providers.

The Future of Insurance: A Data-Driven Approach

As technology continues to advance, the insurance industry is poised for even more significant changes. The increasing availability of data and the development of sophisticated analytics tools are paving the way for a more personalized and efficient insurance experience.

Personalized Insurance Policies

In the future, insurance policies are likely to become even more tailored to individual needs. With the help of advanced data analytics, insurance providers will be able to offer highly customized coverage options, taking into account a wide range of factors beyond traditional risk assessments.

For example, health insurance policies may take into account an individual's genetic makeup and lifestyle choices to offer more targeted prevention and wellness programs. Similarly, life insurance policies could consider an individual's family history and personal health data to provide more accurate coverage options.

Insurtech Innovations

The rise of insurtech, a fusion of insurance and technology, is driving innovative solutions that are disrupting the traditional insurance landscape. Insurtech startups are leveraging technology to offer more efficient and accessible insurance products, often targeting specific niche markets.

These startups are developing cutting-edge solutions, such as peer-to-peer insurance platforms, parametric insurance, and blockchain-based insurance, which are reshaping the industry and providing new opportunities for both policyholders and investors.

Conclusion

Securing low insurance quotes is within reach for those who understand the fundamentals of insurance and employ strategic approaches to their insurance needs. By embracing technology, staying informed about industry trends, and making thoughtful decisions about your coverage, you can navigate the insurance landscape with confidence and unlock the best deals.

Remember, insurance is a vital tool for financial protection, and finding the right coverage at the right price is a key aspect of building a secure and prosperous future. With the insights and strategies outlined in this guide, you're well-equipped to make informed decisions and take control of your insurance journey.

How often should I review my insurance policies?

+It’s recommended to review your insurance policies annually or whenever your circumstances change significantly. Life events such as marriage, divorce, buying a new home, or starting a business can impact your insurance needs and may warrant a policy update.

What are some common mistakes to avoid when shopping for insurance?

+Avoid the following mistakes:

- Not comparing enough quotes: Limiting your search to only a few providers can result in missing out on better deals.

- Failing to read the fine print: Always review the policy terms and conditions to ensure you understand the coverage and exclusions.

- Overlooking deductibles: Higher deductibles can lead to lower premiums, but ensure you’re comfortable with the financial responsibility.

How can I improve my chances of getting lower insurance quotes as a high-risk candidate?

+If you’re considered a high-risk candidate due to factors like a poor driving record or health issues, focus on demonstrating positive changes. For instance, maintain a clean driving record for an extended period, or actively manage your health conditions. Additionally, consider seeking advice from an insurance broker who can guide you towards specialized high-risk insurance options.