Liberty Mutual Insurance Auto Quote

In the vast landscape of insurance providers, Liberty Mutual stands out as a prominent name, offering a comprehensive range of insurance services. This article delves into the specifics of Liberty Mutual's Auto Insurance Quote process, exploring its features, benefits, and the unique value it brings to customers.

Unveiling Liberty Mutual’s Auto Insurance Quote: A Comprehensive Guide

Liberty Mutual Insurance, a stalwart in the insurance industry, provides a seamless and personalized experience for customers seeking auto insurance coverage. This guide aims to navigate you through the intricacies of their auto quote process, highlighting the key advantages and considerations.

Understanding the Liberty Mutual Approach to Auto Insurance

Liberty Mutual’s auto insurance quote process is designed with a customer-centric approach. It prioritizes transparency, offering a straightforward path to understanding coverage options and costs. The company’s commitment to innovation and customer satisfaction is evident in its digital quote platform, ensuring a user-friendly and efficient experience.

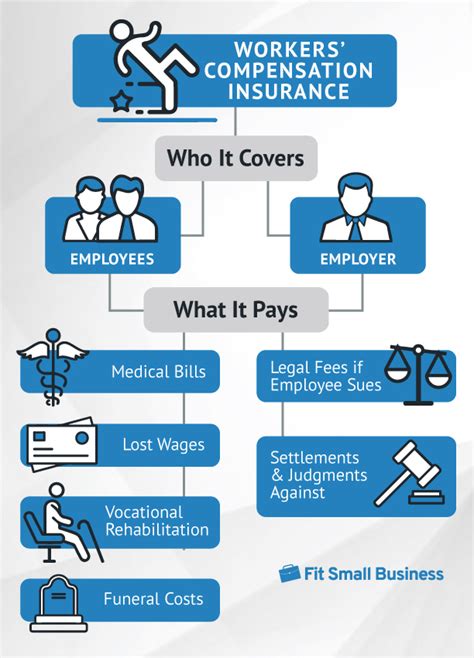

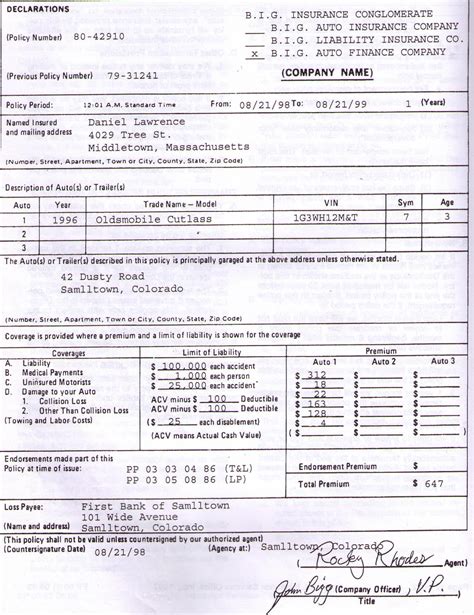

At the heart of Liberty Mutual's auto insurance offerings is a comprehensive suite of coverage options tailored to meet the diverse needs of drivers. This includes liability coverage, collision and comprehensive coverage, personal injury protection, and medical payments coverage. Additionally, the company provides optional add-ons such as rental car reimbursement, gap insurance, and accident forgiveness, allowing customers to customize their policies according to their specific requirements.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you from financial loss if you're found at fault in an accident, covering bodily injury and property damage. |

| Collision Coverage | Covers damage to your vehicle in the event of a collision, regardless of fault. |

| Comprehensive Coverage | Provides protection against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Offers medical coverage for you and your passengers, regardless of fault, including coverage for lost wages and funeral expenses. |

| Medical Payments Coverage | Provides additional medical coverage for you and your passengers, including coverage for non-emergency transportation and childcare expenses. |

The Liberty Mutual Auto Quote Journey: Step by Step

The Liberty Mutual Auto Quote process is designed to be simple and intuitive, guiding customers through a series of straightforward steps. Here’s a breakdown of the journey:

- Personal Information: Begin by providing your basic details, including name, date of birth, and contact information. This step ensures that Liberty Mutual can tailor the quote to your specific needs.

- Vehicle Information: Input details about your vehicle, such as make, model, year, and mileage. This information is crucial for an accurate quote, as it helps determine the value of your vehicle and the associated risks.

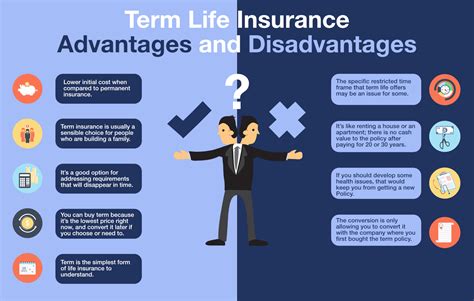

- Coverage Selection: Choose the type and level of coverage you require. Liberty Mutual offers a range of options, allowing you to customize your policy to fit your budget and needs. From liability-only coverage to comprehensive plans, the choice is yours.

- Optional Add-ons: Explore additional coverage options such as rental car reimbursement, gap insurance, and accident forgiveness. These add-ons can provide extra peace of mind and financial protection in various scenarios.

- Discounts and Savings: Liberty Mutual offers a variety of discounts to help make insurance more affordable. These may include multi-policy discounts, safe driver discounts, and loyalty rewards. Be sure to check if you're eligible for any of these savings.

- Review and Confirm: Before finalizing your quote, carefully review the coverage details, terms, and conditions. Ensure that the policy aligns with your expectations and meets your specific insurance needs.

- Payment Options: Liberty Mutual provides flexible payment plans to suit different financial situations. Choose the payment method and frequency that works best for you, whether it's monthly, quarterly, or annually.

Key Benefits of Choosing Liberty Mutual for Your Auto Insurance

Liberty Mutual’s auto insurance offerings are underpinned by a commitment to customer service and financial stability. Here are some key advantages to consider:

- Personalized Coverage: Liberty Mutual understands that every driver's needs are unique. Their customizable coverage options allow you to tailor your policy to your specific requirements, ensuring you're not paying for coverage you don't need.

- Excellent Customer Service: Liberty Mutual prides itself on its customer-centric approach. The company provides 24/7 support, ensuring that you can always reach a representative when you need assistance, whether it's for a claim or a simple policy inquiry.

- Financial Strength: With a strong financial rating, Liberty Mutual offers stability and peace of mind. This means they have the resources to handle claims efficiently and provide reliable coverage, even in the event of a major incident.

- Innovative Tools and Resources: Liberty Mutual's digital platform is designed to make the insurance experience more accessible and efficient. From online quotes to mobile apps, the company leverages technology to enhance customer convenience and engagement.

Real-World Examples and Testimonials

To better understand the impact of Liberty Mutual’s auto insurance, let’s look at some real-world scenarios and testimonials:

"I've been with Liberty Mutual for over a decade, and their personalized approach to insurance has always been a standout feature. The online quote process was seamless, and I appreciated how they tailored the coverage to my specific needs as a driver. Their customer service is top-notch, and I've never had any issues with claims or policy changes."

- John, long-time Liberty Mutual customer

"As a new driver, I was nervous about navigating the insurance process. Liberty Mutual's website made it incredibly easy to understand my coverage options and get a quote. The representative I spoke to was patient and helped me choose the right plan for my budget and driving habits. I feel confident and protected on the road now."

- Sarah, recent Liberty Mutual policyholder

Future Implications and Industry Insights

Liberty Mutual’s commitment to innovation and customer satisfaction positions them well in the evolving insurance landscape. With a focus on digital transformation and a customer-centric approach, the company is well-equipped to meet the changing needs of drivers and stay competitive in the market.

As the auto insurance industry continues to evolve, Liberty Mutual's emphasis on personalized coverage and efficient claim processes will likely remain key differentiators. The company's ability to adapt to emerging technologies and changing consumer preferences will be crucial in maintaining its position as a leading provider.

FAQ

Can I get a quote for multiple vehicles under one policy with Liberty Mutual?

+

Yes, Liberty Mutual allows you to bundle multiple vehicles under a single policy, which can often lead to significant savings through multi-policy discounts.

What factors influence the cost of my auto insurance quote with Liberty Mutual?

+

The cost of your auto insurance quote is influenced by various factors, including your driving record, the make and model of your vehicle, your location, and the level of coverage you choose.

How does Liberty Mutual handle claims and what is their claim process like?

+

Liberty Mutual has a streamlined claim process, offering 24⁄7 claim reporting and a dedicated team to guide you through the steps. They prioritize customer satisfaction and work to ensure a timely and efficient resolution to your claim.

In conclusion, Liberty Mutual’s Auto Insurance Quote process offers a personalized and efficient experience, empowering customers to make informed decisions about their coverage. With a focus on customer satisfaction and financial stability, Liberty Mutual continues to be a leading choice for auto insurance, providing peace of mind and protection on the road.