Whats Term Life Insurance

Term life insurance is a fundamental component of financial planning, offering a protective shield for individuals and their loved ones during uncertain times. In this article, we will delve into the intricacies of term life insurance, exploring its definition, benefits, and how it can be a vital asset in your overall financial strategy.

Understanding Term Life Insurance

Term life insurance, often referred to simply as “term life,” is a type of life insurance policy that provides coverage for a specified period, known as the term. Unlike permanent life insurance, which offers coverage for the policyholder’s entire life, term life insurance is designed to meet specific, short-term needs.

During the policy's term, the insured individual pays a premium, typically on a monthly or annual basis. In the event of the policyholder's death within the specified term, the beneficiaries named in the policy receive a lump-sum payment, known as the death benefit. This death benefit can provide crucial financial support to the policyholder's family or dependents, helping to cover expenses such as funeral costs, outstanding debts, or even ongoing living expenses.

Key Characteristics of Term Life Insurance

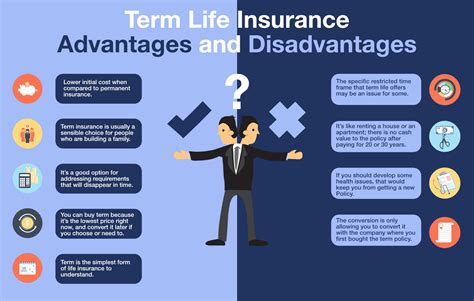

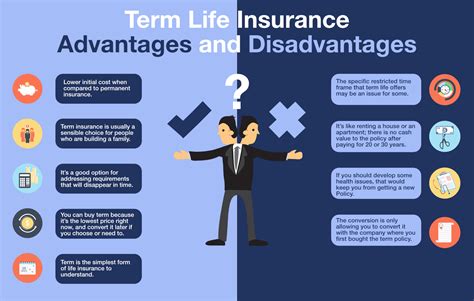

- Affordable Premiums: One of the primary advantages of term life insurance is its affordability. Since it covers a specific term rather than a lifetime, the premiums are often significantly lower compared to permanent life insurance policies.

- Flexible Coverage Periods: Term life insurance policies come in various term lengths, typically ranging from 10 to 30 years. This flexibility allows individuals to choose a term that aligns with their specific needs and financial goals.

- Renewable and Convertible: Many term life insurance policies offer the option to renew the policy at the end of the term, often at a higher premium due to the increased age of the policyholder. Additionally, some policies allow conversion to a permanent life insurance policy, providing long-term coverage if needed.

- Level Premiums: In most cases, term life insurance policies offer level premiums, meaning the cost of the premium remains the same throughout the term. This predictability makes it easier for individuals to budget and plan their financial future.

| Term Length | Common Uses |

|---|---|

| 10-year term | Covering short-term financial obligations, such as paying off a mortgage or providing for children's education. |

| 20-year term | Ideal for families with young children, offering coverage until the children become financially independent. |

| 30-year term | Providing long-term protection, suitable for individuals with significant financial responsibilities or those looking to bridge the gap until retirement. |

How Term Life Insurance Works

When purchasing a term life insurance policy, the policyholder chooses the desired term length and the amount of coverage they require, known as the face value or death benefit. The insurance company assesses the applicant’s health, age, and other factors to determine the premium amount. The policyholder then pays the premium regularly to maintain the coverage.

Upon the policyholder's death within the specified term, the beneficiaries receive the death benefit as a lump-sum payment. This payment can be used to cover a wide range of expenses, including:

- Funeral and burial costs

- Outstanding debts, such as mortgages, car loans, or credit card balances

- Living expenses for the surviving spouse or family members

- Education expenses for children or dependents

- Business expenses, if the policyholder was a key employee or owner

Term life insurance policies often include the option to add riders, which are additional benefits or coverage features. Some common riders include:

- Waiver of Premium: This rider waives the policyholder's premium payments if they become disabled, ensuring continuous coverage.

- Accelerated Death Benefit: Allows the policyholder to receive a portion of the death benefit if they are diagnosed with a terminal illness, providing financial support during a challenging time.

- Children's Term Insurance: Provides term life insurance coverage for the policyholder's children, offering peace of mind for their future.

Example Scenario: Protecting Your Family's Future

Imagine a young couple, Sarah and John, who recently welcomed their first child. They realize the importance of financial security and decide to purchase a 20-year term life insurance policy. With Sarah as the primary breadwinner, they choose a face value of $500,000 to cover their mortgage, outstanding debts, and their child's future education expenses.

Unfortunately, tragedy strikes, and Sarah passes away unexpectedly. The term life insurance policy provides John with the $500,000 death benefit, which he uses to pay off their mortgage, cover funeral expenses, and establish a trust fund for their child's education. This financial support allows John to focus on healing and caring for their family during this difficult time.

Choosing the Right Term Life Insurance Policy

When selecting a term life insurance policy, several factors come into play:

- Coverage Amount: Consider your financial obligations and the amount needed to provide for your loved ones. Calculate your mortgage, outstanding debts, and any future expenses, such as children’s education or business expenses.

- Term Length: Determine the period for which you need coverage. For young families, a longer term (20-30 years) may be suitable, while shorter terms (10 years) can be effective for covering specific financial goals.

- Premium Affordability: Evaluate your budget and choose a policy with premiums that fit comfortably within your financial plan. Remember, term life insurance is designed to be affordable, so don’t hesitate to seek out multiple quotes to find the best fit.

- Riders and Additional Benefits: Review the available riders and consider which ones align with your specific needs. Waiver of Premium and Accelerated Death Benefit riders can provide added peace of mind.

Working with an Insurance Professional

Navigating the world of term life insurance can be complex, and seeking guidance from a qualified insurance professional can be invaluable. An insurance agent or financial advisor can help you assess your needs, compare policies from different providers, and ensure you make an informed decision.

Additionally, insurance professionals can assist with the application process, providing guidance on the required medical examinations (if applicable) and ensuring your policy is tailored to your specific circumstances.

Conclusion: The Value of Term Life Insurance

Term life insurance is a powerful tool for protecting your loved ones’ financial future. By providing a substantial death benefit at an affordable premium, it offers a safety net during uncertain times. Whether you’re a young family starting out or an individual with significant financial responsibilities, term life insurance can be a crucial component of your financial plan.

As you consider your financial strategy, don't underestimate the importance of life insurance. It's an investment in your family's security and peace of mind, ensuring they are protected and provided for, no matter what the future holds.

Can I renew my term life insurance policy if I outlive the term?

+Yes, many term life insurance policies offer the option to renew at the end of the term. However, the premium may increase due to the policyholder’s older age. Renewal options vary between insurance companies and policies, so it’s essential to review your policy details and discuss renewal options with your insurance provider.

Is term life insurance suitable for older individuals?

+While term life insurance is often associated with younger individuals, it can still be beneficial for older adults. Depending on the insurance company and the individual’s health, term life insurance policies may be available for older individuals. It’s recommended to explore options with an insurance professional to find the best coverage and premium for your specific circumstances.

Can I convert my term life insurance policy to a permanent life insurance policy?

+Yes, many term life insurance policies offer a conversion privilege, allowing you to convert your term policy to a permanent life insurance policy, such as whole life or universal life insurance. Conversion typically needs to be done within a specific timeframe and may be subject to additional underwriting requirements. Consulting with your insurance provider can provide insights into your conversion options.