California Aaa Insurance

California's insurance landscape is a complex and highly regulated environment, with various types of insurance policies catering to the diverse needs of its residents. One particular type of insurance that holds significant importance in the Golden State is AAA insurance, offered by the American Automobile Association (AAA). This article delves into the intricacies of California AAA insurance, exploring its features, benefits, and impact on policyholders in the state.

Understanding California AAA Insurance

AAA insurance in California is a comprehensive automobile insurance package designed to provide extensive coverage and services to drivers across the state. With a rich history dating back over a century, AAA has established itself as a trusted provider of automotive-related services, including insurance, roadside assistance, and travel planning.

In California, AAA insurance offers a range of coverage options tailored to meet the unique needs of the state's diverse population. From standard liability coverage to more comprehensive plans, AAA insurance aims to protect policyholders from financial risks associated with automobile ownership and operation.

Key Features of California AAA Insurance

- Comprehensive Coverage: AAA insurance policies in California typically include comprehensive coverage, which provides protection against damages to the insured vehicle caused by factors other than collisions, such as theft, vandalism, natural disasters, or fire. This coverage ensures that policyholders are financially safeguarded in various unexpected situations.

- Collision Coverage: Collision coverage is a vital component of AAA insurance, offering financial protection in the event of an accident involving the insured vehicle. This coverage helps cover the cost of repairs or replacement, providing peace of mind to policyholders.

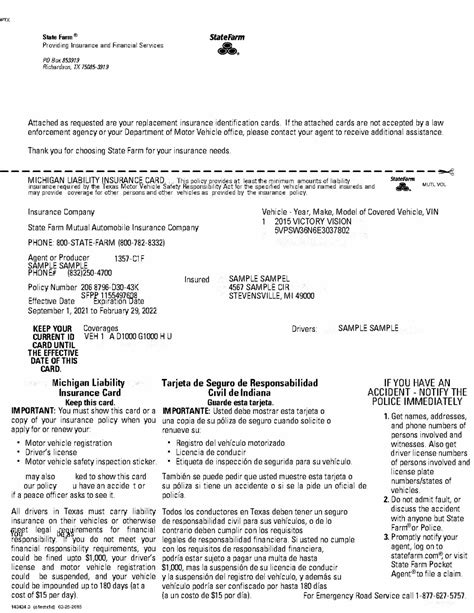

- Liability Coverage: AAA insurance policies in California prioritize liability coverage, which protects policyholders from financial liabilities arising from bodily injury or property damage claims made against them in an accident. This coverage is essential for ensuring legal and financial protection.

- Uninsured/Underinsured Motorist Coverage: Recognizing the prevalence of uninsured or underinsured drivers on California’s roads, AAA insurance includes coverage to protect policyholders in such scenarios. This coverage provides financial support for injuries or damages caused by drivers who lack sufficient insurance.

- Roadside Assistance: AAA is renowned for its roadside assistance services, and California AAA insurance policies often include this benefit. Policyholders can access 24⁄7 emergency roadside assistance for situations such as flat tires, dead batteries, or towing services, ensuring their safety and convenience on the road.

| Coverage Type | Description |

|---|---|

| Comprehensive | Protects against non-collision damages |

| Collision | Covers repairs or replacement after an accident |

| Liability | Provides financial protection for bodily injury and property damage claims |

| Uninsured/Underinsured Motorist | Offers coverage for accidents involving uninsured or underinsured drivers |

| Roadside Assistance | Includes emergency services for common vehicle issues |

Benefits and Impact on Policyholders

California AAA insurance offers a multitude of benefits to policyholders, making it a popular choice among drivers in the state. Here are some key advantages and their impact on policyholders:

Financial Protection and Peace of Mind

The comprehensive coverage options provided by AAA insurance offer financial protection against a wide range of potential risks. Policyholders can drive with peace of mind, knowing they are safeguarded against unexpected accidents, theft, or natural disasters. This financial security is especially valuable in a state like California, where the cost of living and vehicle ownership can be high.

Convenience and Efficiency

AAA insurance policies in California are designed to provide efficient and convenient services. Policyholders can easily access their policy information, make payments, and file claims through online platforms or dedicated mobile apps. Additionally, the inclusion of roadside assistance ensures that drivers can quickly receive help during unexpected breakdowns or emergencies, minimizing downtime and inconvenience.

Customizable Coverage Options

Understanding that every driver has unique needs, AAA insurance offers customizable coverage options. Policyholders can choose the level of coverage that aligns with their budget and requirements. Whether it’s opting for higher liability limits, adding rental car coverage, or selecting specific endorsements, AAA insurance allows drivers to tailor their policies to their individual circumstances.

Educational Resources and Safety Programs

Beyond insurance coverage, AAA is committed to promoting road safety and education. California AAA insurance policyholders have access to a wealth of resources, including driver safety courses, defensive driving programs, and educational materials. These initiatives aim to enhance driving skills, reduce accidents, and create a safer road environment for all.

Discounts and Rewards

AAA insurance policies often come with various discounts and rewards, making them even more attractive to policyholders. These incentives can include discounts for safe driving records, multi-policy bundles, or even loyalty programs that reward long-term customers with additional benefits. Such incentives not only save policyholders money but also encourage safer driving behaviors.

Performance Analysis and Customer Satisfaction

California AAA insurance has consistently demonstrated strong performance and high customer satisfaction. Independent surveys and ratings indicate that policyholders are pleased with the coverage, claims handling, and overall service provided by AAA. The organization’s focus on customer satisfaction and its commitment to providing comprehensive automotive-related services have contributed to its positive reputation.

Furthermore, AAA's extensive network of branches and local offices across California ensures that policyholders have easy access to support and assistance. This physical presence, combined with their digital platforms, creates a seamless and convenient experience for policyholders, further enhancing their satisfaction.

Future Implications and Innovations

As the insurance industry evolves, California AAA insurance continues to adapt and innovate to meet the changing needs of its policyholders. Here are some key future implications and potential innovations:

Telematics and Usage-Based Insurance

AAA is exploring the potential of telematics and usage-based insurance, which could revolutionize the way insurance premiums are calculated. By analyzing driving behavior and vehicle usage data, AAA may offer more tailored and dynamic pricing, incentivizing safe driving practices and rewarding responsible drivers with lower premiums.

Enhanced Digital Services

With the increasing reliance on digital technologies, AAA is investing in enhancing its digital platforms and mobile apps. Policyholders can expect more streamlined and user-friendly experiences, with features such as real-time policy management, instant claim filing, and interactive educational resources. These digital innovations aim to improve convenience and accessibility for policyholders.

Partnerships and Expanded Services

AAA is known for its strategic partnerships, and in the future, we may see expanded collaborations with automotive manufacturers, technology companies, or even healthcare providers. These partnerships could lead to integrated services, such as vehicle maintenance reminders, health and wellness programs, or even telematics-based driver coaching, further enhancing the value proposition of AAA insurance.

Sustainable and Eco-Friendly Initiatives

With growing environmental concerns, AAA may explore initiatives to promote sustainable driving practices and eco-friendly vehicles. This could involve offering incentives for electric or hybrid vehicles, providing educational resources on eco-driving techniques, or even partnering with renewable energy providers to offer discounts or incentives for policyholders who adopt sustainable transportation options.

Conclusion

California AAA insurance is a comprehensive and trusted solution for drivers seeking financial protection and peace of mind. With its rich history, extensive coverage options, and commitment to customer satisfaction, AAA has established itself as a leading provider in the state’s insurance landscape. As the organization continues to innovate and adapt, policyholders can look forward to even more personalized and cutting-edge services, ensuring their safety and convenience on California’s roads.

Can I customize my California AAA insurance policy to fit my specific needs?

+Absolutely! California AAA insurance policies offer a high degree of customization. You can choose the coverage limits, add optional coverages like rental car reimbursement or roadside assistance, and even bundle your auto insurance with other policies like homeowners or renters insurance to save money. It’s important to review your unique needs and discuss them with your AAA insurance agent to ensure you have the right coverage.

What discounts are available with California AAA insurance policies?

+California AAA insurance policies offer a range of discounts to help policyholders save money. Common discounts include safe driver discounts for maintaining a clean driving record, multi-policy discounts for bundling multiple policies with AAA, and loyalty discounts for long-term AAA members. Additionally, AAA may offer discounts for specific occupations, vehicle safety features, or even good grades for young drivers.

How does California AAA insurance handle claims and customer service?

+California AAA insurance prides itself on its excellent customer service and claims handling. Policyholders can expect a seamless and efficient claims process, with dedicated claims representatives available to guide them through the process. AAA offers multiple channels for reporting claims, including online, by phone, or in-person at their local branches. Their goal is to provide prompt and fair resolutions, ensuring policyholders receive the support they need during challenging times.