Auto Insurance Codes

Auto insurance codes are an essential aspect of the insurance industry, serving as a standardized language to classify and communicate risks associated with vehicles and drivers. These codes, often referred to as "Automobile Insurance Codes" or "Auto Insurance Rating Codes," play a crucial role in determining insurance premiums and policy terms. In this comprehensive guide, we will delve into the intricacies of auto insurance codes, exploring their significance, types, and real-world applications. By understanding these codes, both industry professionals and consumers can navigate the complex world of automotive insurance with greater clarity and confidence.

The Significance of Auto Insurance Codes

Auto insurance codes are the backbone of the insurance underwriting process. They provide a structured framework for insurers to assess and manage the risks associated with different types of vehicles, drivers, and driving behaviors. By assigning specific codes to various risk factors, insurers can accurately calculate premiums, tailor coverage options, and mitigate potential losses. These codes ensure a fair and consistent approach to risk assessment, allowing insurers to offer competitive rates while maintaining financial stability.

Furthermore, auto insurance codes facilitate effective communication between insurers, brokers, and policyholders. They serve as a common language, enabling precise and unambiguous discussions about coverage, exclusions, and claims. This standardized approach enhances transparency and builds trust between all parties involved in the insurance ecosystem.

Types of Auto Insurance Codes

The world of auto insurance codes is diverse and encompasses various classifications. Here, we explore some of the most common types of codes used in the industry:

Vehicle Classification Codes

Vehicle classification codes are perhaps the most fundamental type of auto insurance codes. They categorize vehicles based on their make, model, year, and type. These codes help insurers assess the inherent risks associated with different vehicle characteristics. For instance, a sports car might be assigned a higher risk code due to its performance capabilities, while a family sedan may be classified as a lower-risk vehicle.

One widely used vehicle classification system is the "Automobile Rating Symbol Code" (ARSC). This code assigns a unique symbol to each vehicle, taking into account factors such as engine size, body style, and intended use. The ARSC code provides a quick and efficient way for insurers to identify and evaluate the risks associated with specific vehicles.

| Vehicle Type | ARSC Code |

|---|---|

| Sports Car | ARSC-S |

| Family Sedan | ARSC-F |

| SUV | ARSC-SUV |

| Electric Vehicle | ARSC-EV |

Driver Classification Codes

Driver classification codes focus on assessing the risks associated with individual drivers. These codes consider factors such as age, gender, driving experience, and driving record. Insurers use these codes to determine the likelihood of accidents and claims, which directly impact insurance premiums.

For example, young drivers, particularly those under the age of 25, are often assigned higher-risk codes due to their relative inexperience on the road. On the other hand, mature drivers with a long history of safe driving may be classified as low-risk, resulting in more favorable insurance rates.

| Driver Profile | Risk Code |

|---|---|

| Young Driver (18-24 years) | RC-Y |

| Experienced Driver (50+ years) | RC-E |

| Driver with Multiple Violations | RC-V |

| Safe Driver (No Claims) | RC-S |

Usage-Based Insurance (UBI) Codes

Usage-Based Insurance codes have gained prominence in recent years, thanks to advancements in telematics and data analytics. UBI codes focus on monitoring and evaluating driving behavior in real-time. By analyzing factors such as driving speed, acceleration, braking patterns, and mileage, insurers can offer personalized insurance rates based on an individual’s actual driving habits.

For instance, a driver who consistently maintains a steady speed and practices smooth acceleration may be assigned a lower-risk UBI code, resulting in potential discounts on their insurance premiums. Conversely, aggressive drivers who frequently exceed speed limits might be categorized as higher-risk, leading to increased insurance costs.

| Driving Behavior | UBI Code |

|---|---|

| Safe and Prudent Driving | UBI-SP |

| Moderate Risk Driving | UBI-MR |

| Aggressive Driving | UBI-AG |

| Low Mileage Usage | UBI-LM |

Coverage and Policy Codes

Coverage and policy codes are essential for defining the scope and terms of insurance policies. These codes outline the specific types of coverage, limits, deductibles, and additional benefits included in a policy. They ensure that both insurers and policyholders have a clear understanding of the protections and responsibilities outlined in the contract.

For example, a policy with comprehensive coverage might be assigned a code indicating full protection against theft, vandalism, and natural disasters. On the other hand, a basic liability-only policy would have a different code, reflecting its limited scope.

| Policy Type | Policy Code |

|---|---|

| Comprehensive Coverage | PC-C |

| Liability-Only Coverage | PC-L |

| Collision Coverage | PC-Col |

| Personal Injury Protection (PIP) | PC-PIP |

Real-World Applications and Benefits

Auto insurance codes offer a multitude of benefits and applications, both for the insurance industry and consumers alike. Let’s explore some of the key advantages:

Precise Risk Assessment

By utilizing auto insurance codes, insurers can conduct precise risk assessments. These codes provide a comprehensive understanding of the factors influencing insurance premiums, allowing for fair and accurate pricing. Whether it’s evaluating a vehicle’s safety features, a driver’s history, or specific coverage needs, codes ensure a data-driven approach to risk management.

Tailored Insurance Products

Auto insurance codes enable insurers to create tailored insurance products. By classifying risks accurately, insurers can design policies that cater to the unique needs of different driver profiles and vehicle types. This customization ensures that policyholders receive the coverage they require without unnecessary costs.

Fraud Detection and Prevention

Insurance codes play a crucial role in fraud detection and prevention. By analyzing patterns and anomalies in code assignments, insurers can identify potential instances of insurance fraud. For instance, if a vehicle with a high-risk code is consistently associated with low-risk drivers, it may raise red flags, prompting further investigation.

Streamlined Claims Processing

Auto insurance codes simplify and streamline the claims process. When a policyholder files a claim, the associated codes provide a quick reference for insurers to assess the nature of the claim and determine the appropriate coverage. This efficiency enhances customer satisfaction and reduces administrative burdens.

Data-Driven Decision Making

With auto insurance codes, insurers gain access to a wealth of data-driven insights. By analyzing trends and patterns in code assignments, insurers can make informed decisions about underwriting strategies, pricing structures, and product development. This data-centric approach allows insurers to stay competitive and adapt to changing market dynamics.

Future Implications and Innovations

The field of auto insurance codes is continuously evolving, driven by technological advancements and changing consumer expectations. Here are some future implications and potential innovations to watch for:

Advanced Telematics and Data Analytics

The integration of advanced telematics and data analytics is expected to revolutionize the usage of auto insurance codes. Real-time data collection and analysis will enable insurers to offer even more precise and personalized insurance products. Insurers may leverage machine learning algorithms to identify new risk factors and optimize pricing models.

Connected Car Technologies

The rise of connected car technologies, such as vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, presents new opportunities for auto insurance codes. These technologies can provide valuable insights into driving behaviors, traffic conditions, and even road infrastructure, leading to more accurate risk assessments.

Blockchain and Smart Contracts

Blockchain technology has the potential to transform the insurance industry, including the use of auto insurance codes. Smart contracts, powered by blockchain, can automate and streamline various insurance processes, such as policy issuance, claims processing, and fraud detection. This technology ensures transparency, security, and efficiency in code-based transactions.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning algorithms can enhance the accuracy and efficiency of auto insurance codes. These technologies can analyze vast amounts of data, identify patterns, and make predictions about future risks. By leveraging AI, insurers can refine their underwriting processes and offer more competitive insurance products.

Environmental and Sustainability Factors

As sustainability becomes a growing concern, auto insurance codes may incorporate environmental and sustainability factors. For instance, codes could consider the fuel efficiency of vehicles, the use of eco-friendly materials, or even the driver’s commitment to environmentally conscious practices. This integration could encourage greener driving behaviors and support sustainable initiatives.

Conclusion

Auto insurance codes are a vital component of the insurance industry, offering a standardized and efficient approach to risk assessment and management. By understanding the different types of codes and their real-world applications, both insurers and consumers can navigate the complex world of automotive insurance with greater ease and confidence. As technology continues to advance, the future of auto insurance codes holds exciting possibilities, ensuring a more precise, personalized, and sustainable insurance ecosystem.

How do auto insurance codes impact insurance premiums?

+Auto insurance codes play a crucial role in determining insurance premiums. Insurers use these codes to assess risks associated with vehicles and drivers. Higher-risk codes often result in higher premiums, while lower-risk codes can lead to more affordable insurance rates. This risk-based pricing ensures fairness and accuracy in insurance pricing.

Can auto insurance codes be challenged or appealed?

+Yes, in certain circumstances, individuals may challenge or appeal auto insurance codes assigned to their policies. If a driver believes they have been incorrectly classified or if there are changes in their driving behavior or vehicle, they can contact their insurer to request a review. However, it’s important to note that insurers have strict guidelines and criteria for code assignments, and changes may not always be possible.

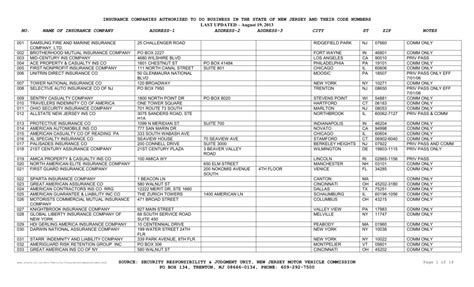

Are auto insurance codes the same across all insurance companies?

+While auto insurance codes serve as a standardized language, they may vary slightly between insurance companies. Each insurer has its own underwriting guidelines and rating systems, which can influence the specific codes used. However, the fundamental principles and risk factors considered in code assignments remain consistent across the industry.

How often are auto insurance codes updated?

+Auto insurance codes are periodically updated to reflect changes in the industry, advancements in vehicle technology, and evolving risk factors. These updates ensure that codes remain relevant and accurate. Insurance companies typically announce any significant code changes to ensure policyholders and brokers are informed of the modifications.