Group Health Medical Insurance

The Essential Guide to Group Health Medical Insurance: Understanding Coverage, Benefits, and Key Considerations

Group health medical insurance is an essential aspect of healthcare coverage, providing individuals and employees with access to vital medical services and financial protection. In today's complex healthcare landscape, understanding the nuances of group insurance plans is crucial for making informed decisions and maximizing the benefits they offer. This comprehensive guide aims to delve into the world of group health medical insurance, shedding light on its key components, advantages, and considerations to help you navigate this critical aspect of healthcare with confidence.

Unraveling Group Health Medical Insurance

Group health medical insurance, often referred to as group health plans or employer-sponsored health insurance, is a form of health coverage offered by organizations, typically to their employees and their dependents. This type of insurance plan is designed to provide comprehensive medical care to a group of individuals, often at a more affordable rate than individual plans. Group insurance plans are governed by various regulations and laws, ensuring that enrollees receive essential health benefits and adequate protection.

One of the key advantages of group health insurance is its ability to negotiate lower premiums and better coverage due to the larger pool of participants. This collective purchasing power translates into more extensive benefits and cost savings for employees. Moreover, group plans often come with additional perks, such as wellness programs, preventive care initiatives, and access to a broader network of healthcare providers, making them an attractive option for individuals and families.

Understanding Coverage and Benefits

Group health medical insurance offers a wide range of coverage and benefits, tailored to meet the diverse needs of employees and their families. Here’s a breakdown of some of the key aspects to consider:

Essential Health Benefits

Most group health plans are required by law to include a set of essential health benefits, ensuring that enrollees have access to a comprehensive range of medical services. These benefits typically include:

- Ambulatory Patient Services: Outpatient care, including doctor visits, diagnostic tests, and minor surgeries.

- Emergency Services: Coverage for emergency room visits and urgent care.

- Hospitalization: Inpatient care, including room and board, surgery, and intensive care.

- Maternity and Newborn Care: Prenatal, delivery, and postnatal services, as well as care for newborns.

- Mental Health and Substance Use Disorder Services: Includes behavioral health treatment, counseling, and therapy.

- Prescription Drugs: Coverage for a range of prescribed medications.

- Rehabilitative and Habilitative Services and Devices: Services and devices to help individuals regain, improve, or maintain skills and functioning.

- Laboratory Services: Diagnostic and screening tests.

- Preventive and Wellness Services: Immunizations, screenings, and counseling to maintain health and prevent diseases.

- Chronic Disease Management: Coverage for ongoing care and management of chronic conditions.

Additional Benefits and Coverage

Beyond the essential health benefits, group plans often offer a variety of additional coverage options and perks, such as:

- Dental and Vision Care: Separate plans or add-ons for dental and vision services.

- Wellness Programs: Incentives and programs to encourage healthy lifestyles and prevent illnesses.

- Flexible Spending Accounts (FSAs): Tax-advantaged accounts to pay for eligible healthcare expenses.

- Health Savings Accounts (HSAs): Tax-free savings accounts for those with high-deductible health plans.

- Short-Term and Long-Term Disability Insurance: Coverage for income replacement in case of illness or injury.

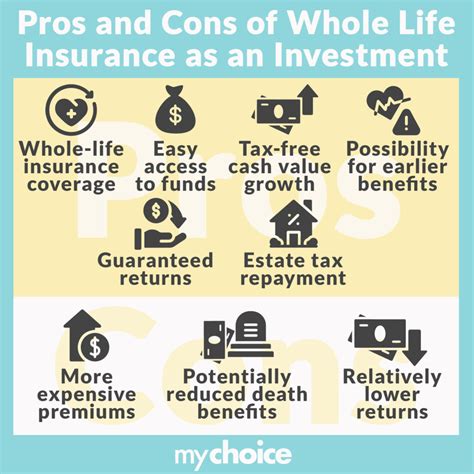

- Life Insurance: Basic or optional life insurance coverage.

- Telehealth Services: Access to remote medical consultations and care.

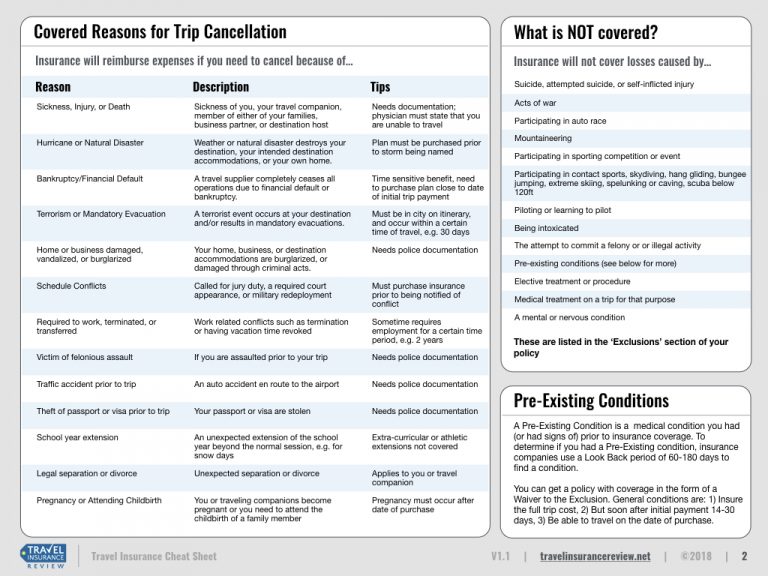

- Travel and Emergency Assistance: Coverage for medical emergencies while traveling.

- Employee Assistance Programs (EAPs): Confidential resources for employees facing personal or work-related challenges.

Network Providers and Coverage Areas

Group health plans often have networks of healthcare providers, including doctors, hospitals, and other medical facilities, with whom they have negotiated discounted rates. Enrollees typically receive the best coverage and lowest out-of-pocket costs when using these in-network providers. However, plans may also offer some level of coverage for out-of-network care, although at a higher cost.

| Network Type | Description |

|---|---|

| Preferred Provider Organization (PPO) | Enrollees have flexibility to choose any provider but receive greater benefits when using in-network providers. |

| Health Maintenance Organization (HMO) | Requires selection of a primary care physician and limits coverage to in-network providers, except in emergencies. |

| Exclusive Provider Organization (EPO) | Similar to HMOs but allows access to specialists without a referral and covers out-of-network emergencies. |

| Point-of-Service (POS) | Combines features of HMOs and PPOs, allowing enrollees to choose between in-network and out-of-network care. |

Key Considerations for Group Health Medical Insurance

When evaluating group health insurance plans, it’s crucial to consider several factors to ensure you’re making the right choice for your healthcare needs. Here are some key considerations:

Cost and Premiums

Premiums are the regular payments made to maintain insurance coverage. Group plans often have more affordable premiums compared to individual plans due to the larger risk pool. However, it’s essential to assess the overall cost, including deductibles, copays, and coinsurance, to understand the true financial impact.

Plan Design and Coverage

Different group plans offer varying levels of coverage and benefits. Assess your healthcare needs and those of your family to determine the most suitable plan. Consider factors such as prescription drug coverage, maternity benefits, mental health services, and any specific medical conditions or treatments you might require.

Network Providers and Access

Review the plan’s network of providers to ensure that your preferred doctors and specialists are included. Consider the plan’s coverage area, especially if you frequently travel or have a second home. Out-of-network coverage is also important to assess for unexpected situations.

Wellness Programs and Incentives

Many group plans now offer wellness initiatives and incentives to encourage healthy behaviors. These programs can include gym memberships, smoking cessation programs, weight loss challenges, and more. Consider the potential benefits of these programs and how they align with your personal health goals.

Employee Contributions and Payroll Deductions

Understand the employee contribution requirements for the plan, including any payroll deductions. Some plans may offer pre-tax deductions, which can provide significant tax savings. Additionally, consider any potential employer contributions or matching programs.

Open Enrollment and Life Events

Most group plans have an annual open enrollment period when you can make changes to your coverage. However, certain life events, such as marriage, birth of a child, or loss of other coverage, may allow for a Special Enrollment Period. Be aware of these opportunities to ensure you can make timely changes to your insurance.

Portability and Continuity

Consider the portability of the group plan if you anticipate job changes or retirement. Some plans may allow you to continue coverage through COBRA or other continuation options, while others may have more limited portability.

FAQ

How does group health insurance differ from individual plans?

+

Group health insurance is typically offered by employers to their employees and is often more affordable due to the larger risk pool. It usually provides a broader range of benefits and may include additional perks like wellness programs. Individual plans, on the other hand, are purchased directly by individuals and can be more costly, with fewer benefits and less flexibility.

What are the essential health benefits required by law in group plans?

+

Essential health benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, laboratory services, preventive and wellness services, and chronic disease management.

Can I choose my own doctor with a group health plan?

+

Yes, most group health plans allow enrollees to choose their own doctors, but the level of coverage and benefits may vary depending on whether the provider is in-network or out-of-network. In-network providers typically offer better coverage and lower out-of-pocket costs.

What are the advantages of wellness programs in group plans?

+

Wellness programs in group plans encourage healthy lifestyles and can lead to better overall health for employees. These programs often include incentives for participating in activities like gym memberships, smoking cessation programs, or weight loss challenges. They can also help prevent illnesses and reduce healthcare costs over time.