Best Homeowners Insurance For Texas

Homeownership is a significant milestone, and protecting your Texas residence with reliable homeowners insurance is crucial. The Lone Star State is known for its diverse climate, ranging from coastal regions to arid plains, each presenting unique risks. This article delves into the intricacies of homeowners insurance in Texas, offering expert guidance on selecting the best coverage for your specific needs.

Understanding Texas Homeowners Insurance

Texas homeowners insurance is a type of property insurance designed to safeguard your home, personal belongings, and provide liability coverage. The state’s unique weather patterns, including hurricanes, tornadoes, and hailstorms, make comprehensive coverage a necessity. Understanding the specific risks in your region is vital for making informed insurance decisions.

Texas has a competitive insurance market, offering a wide range of options for homeowners. The Texas Department of Insurance (TDI) regulates the industry, ensuring transparency and consumer protection. This regulatory environment allows for a vibrant market with various carriers, policies, and coverage options.

Key Factors to Consider for Texas Homeowners

When shopping for homeowners insurance in Texas, several critical factors come into play. These considerations will help you tailor your coverage to your specific needs and ensure you’re adequately protected:

Coverage Options

Texas homeowners insurance policies typically offer different coverage levels, known as HO policies. The most common types are HO-3 (for owner-occupied homes) and HO-6 (for condo owners). Understanding the differences between these policies and their specific coverage is essential. For instance, HO-3 policies often provide broader coverage for both the structure and personal belongings.

| Policy Type | Coverage |

|---|---|

| HO-3 | Covers dwelling, personal property, and liability |

| HO-6 | Similar to HO-3 but tailored for condo owners, covering unit, personal property, and liability |

Risk Assessment

Texas is prone to various natural disasters, including hurricanes, tornadoes, and wildfires. Assessing the specific risks in your area is crucial for selecting the right coverage. For instance, if you live near the coast, you may need additional hurricane or flood insurance. Understanding these risks helps you choose an insurance provider that offers comprehensive coverage tailored to your needs.

Insurance Carriers

Texas boasts a diverse insurance market with numerous carriers offering homeowners insurance. Some insurers specialize in certain regions or risks, while others provide more generalized coverage. Researching and comparing these carriers is essential. Consider factors like financial stability, customer satisfaction ratings, and claims handling processes.

Cost Considerations

The cost of homeowners insurance in Texas can vary significantly based on location, property value, and coverage options. Obtaining multiple quotes is advisable to ensure you’re getting a competitive rate. Additionally, consider discounts and bundle options to reduce your overall insurance costs. Many carriers offer discounts for safety features like security systems or for bundling homeowners and auto insurance policies.

Deductibles and Limits

Deductibles and coverage limits are critical components of your homeowners insurance policy. Higher deductibles can lead to lower premiums, but it’s essential to ensure the deductible is affordable in the event of a claim. Similarly, understanding your coverage limits, especially for valuable items or specific risks like water damage, is vital to ensure you have adequate protection.

Comparing Top Texas Homeowners Insurance Providers

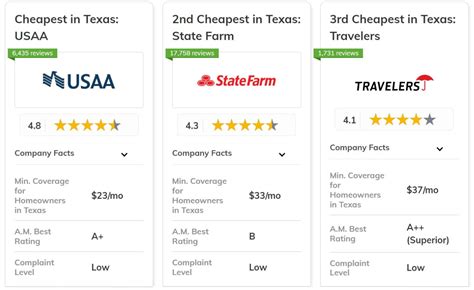

When selecting the best homeowners insurance for Texas, it’s beneficial to compare leading providers based on their coverage, pricing, and customer satisfaction. Here’s an overview of some of the top insurance companies operating in the state:

State Farm

Coverage: State Farm offers comprehensive homeowners insurance, including HO-3 and HO-6 policies. Their coverage extends to dwelling protection, personal property, liability, and additional living expenses.

Pricing: State Farm is known for its competitive rates, often offering discounts for multiple policy bundles and safety features. They also provide flexible payment options.

Customer Satisfaction: State Farm consistently ranks highly for customer satisfaction, with a strong reputation for claims handling and customer service.

Allstate

Coverage: Allstate provides a range of homeowners insurance policies, including HO-3 and HO-6. Their policies cover dwelling, personal property, liability, and additional living expenses, with the option to customize coverage.

Pricing: Allstate offers competitive rates and various discounts, including multi-policy bundles, safe driving incentives, and loyalty rewards.

Customer Satisfaction: Allstate is known for its innovative technology and customer-centric approach, with a strong focus on digital tools and resources.

USAA

Eligibility: USAA is exclusively for active military members, veterans, and their families.

Coverage: USAA provides comprehensive homeowners insurance, including HO-3 and HO-6 policies. Their coverage includes dwelling, personal property, liability, and additional living expenses, with customizable options.

Pricing: USAA is renowned for its competitive rates and excellent customer service. They offer various discounts, including loyalty rewards and military-specific benefits.

Customer Satisfaction: USAA consistently ranks at the top for customer satisfaction, with a strong focus on military families and their unique needs.

Liberty Mutual

Coverage: Liberty Mutual offers a range of homeowners insurance policies, including HO-3 and HO-6. Their coverage includes dwelling, personal property, liability, and additional living expenses, with customizable options for specific risks.

Pricing: Liberty Mutual provides competitive rates and various discounts, including multi-policy bundles, safety features, and loyalty rewards.

Customer Satisfaction: Liberty Mutual is known for its strong customer service and claims handling, with a focus on personalized coverage options.

Progressive

Coverage: Progressive offers homeowners insurance policies, including HO-3 and HO-6. Their coverage includes dwelling, personal property, liability, and additional living expenses, with customizable options for specific needs.

Pricing: Progressive is known for its competitive rates and flexible payment options. They offer discounts for multi-policy bundles, safety features, and loyalty rewards.

Customer Satisfaction: Progressive has a strong focus on digital innovation and customer convenience, with a user-friendly online platform and mobile app.

Texas-Specific Considerations

Texas has unique insurance considerations due to its diverse climate and geographic features. Here are some key factors to keep in mind when selecting homeowners insurance in the Lone Star State:

Wind and Hail Damage

Texas is prone to severe weather, including hurricanes, tornadoes, and hailstorms. Ensure your policy provides adequate coverage for wind and hail damage. Some insurers offer specific endorsements or riders for these risks, which can be beneficial for added protection.

Wildfire Risk

Certain regions of Texas, particularly those with abundant vegetation, face a higher risk of wildfires. If your home is located in a wildfire-prone area, consider adding wildfire coverage to your policy. This can provide additional protection for your home and personal belongings.

Flood Insurance

Texas has several flood-prone areas, especially along the coast. Standard homeowners insurance policies typically do not cover flood damage. It’s crucial to assess your flood risk and consider purchasing separate flood insurance through the National Flood Insurance Program (NFIP) or a private insurer.

Expert Tips for Texas Homeowners

As an expert in the Texas insurance market, here are some valuable tips for homeowners when selecting the best insurance coverage:

Conclusion: Finding the Best Coverage for Your Texas Home

Selecting the best homeowners insurance in Texas involves careful consideration of your specific needs, risks, and budget. By understanding the unique challenges of the Texas insurance market and researching leading providers, you can make an informed decision. Remember to regularly review and update your policy to ensure it aligns with your changing needs.

Whether you're a first-time homeowner or looking to switch providers, the information provided in this article should serve as a valuable guide. Stay informed, compare options, and choose the insurance coverage that offers the right balance of protection and affordability for your Texas home.

What is the average cost of homeowners insurance in Texas?

+The average cost of homeowners insurance in Texas varies based on location, property value, and coverage options. As of our latest data, the average premium for a standard HO-3 policy is approximately 2,300 per year. However, this can range from 1,500 to $3,500 or more depending on individual circumstances.

Are there any discounts available for Texas homeowners insurance?

+Yes, many insurance providers in Texas offer a variety of discounts to help reduce premiums. Common discounts include multi-policy bundles (bundling homeowners and auto insurance), safety features (like security systems or fire protection), loyalty rewards, and safe driving incentives. It’s always beneficial to inquire about available discounts when obtaining quotes.

What should I do if I’m not satisfied with my current homeowners insurance provider in Texas?

+If you’re unhappy with your current provider, it’s important to shop around and compare other options. Review your policy to understand what specific aspects are lacking, whether it’s coverage, customer service, or claims handling. Then, obtain quotes from multiple providers to find an insurer that better meets your needs and provides the coverage and service you desire.

How often should I review my homeowners insurance policy in Texas?

+It’s recommended to review your homeowners insurance policy annually. This ensures that your coverage remains up-to-date and aligns with your current needs. Life changes, home improvements, or shifts in the insurance market can impact your policy, so regular reviews are essential to maintain adequate protection.