Compare My Car Insurance

When it comes to car insurance, making an informed decision is crucial to ensure you receive the best coverage and value for your money. With a vast array of insurance providers and policies available, it can be overwhelming to navigate the market and compare options. This comprehensive guide aims to provide an in-depth analysis of the car insurance landscape, offering valuable insights and practical tips to help you find the perfect insurance plan tailored to your needs.

Understanding Car Insurance Policies

Car insurance policies are contracts between you and an insurance company. They provide financial protection in the event of an accident, theft, or other vehicle-related incidents. Understanding the different types of coverage and their implications is essential to make an informed choice.

Types of Car Insurance Coverage

Here are the key types of car insurance coverage you should be aware of:

- Liability Coverage: This coverage pays for damages you cause to others’ property or injuries you cause to others in an accident. It is typically required by law and provides protection against lawsuits.

- Collision Coverage: Collision coverage covers repairs or replacements for your vehicle after an accident, regardless of fault. It is an optional coverage but is highly recommended, especially for newer or financed vehicles.

- Comprehensive Coverage: Comprehensive coverage protects against non-collision incidents such as theft, vandalism, weather-related damage, or damage caused by animals. It is an optional coverage but provides peace of mind for unexpected events.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses and lost wages resulting from an accident, regardless of fault. It is mandatory in some states and provides comprehensive medical coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance. It covers your medical expenses and vehicle repairs in such cases.

Factors Influencing Car Insurance Rates

Insurance companies use various factors to determine your car insurance rates. Understanding these factors can help you negotiate better rates and make more informed decisions.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary usage (commute, leisure, business), can impact your insurance rates. Sports cars and luxury vehicles often attract higher premiums due to their higher repair costs and potential for theft.

- Driving History: Your driving record is a significant factor in determining insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while multiple violations or accidents may result in higher rates.

- Credit Score: Surprisingly, your credit score can also influence your insurance rates. Many insurance companies consider credit scores as an indicator of financial responsibility, and individuals with higher credit scores may receive lower premiums.

- Age and Gender: Age and gender are factors used by insurance companies to assess risk. Younger drivers, especially males, are often considered higher-risk and may face higher insurance rates. However, this varies by state and company.

- Marital Status: Married individuals are often viewed as more stable and responsible, which can lead to lower insurance rates. Being married may provide an advantage when it comes to insurance premiums.

- Location: The area where you live and park your vehicle can impact your insurance rates. Urban areas with higher crime rates and more traffic may result in higher premiums compared to rural areas.

Researching and Comparing Car Insurance Providers

Now that you have a better understanding of car insurance policies and the factors that influence rates, it’s time to delve into the research and comparison process. Here’s a step-by-step guide to help you navigate the market effectively.

Identifying Your Coverage Needs

Before you start comparing insurance providers, it’s essential to identify your specific coverage needs. Consider the following factors:

- What type of vehicle do you own, and what is its primary purpose (commute, leisure, business)?

- Do you have any specific concerns or risks you want to address (e.g., theft, weather-related damage)?

- Are there any legal requirements or state-mandated coverages you need to adhere to?

- What is your budget for car insurance, and how much can you afford monthly or annually?

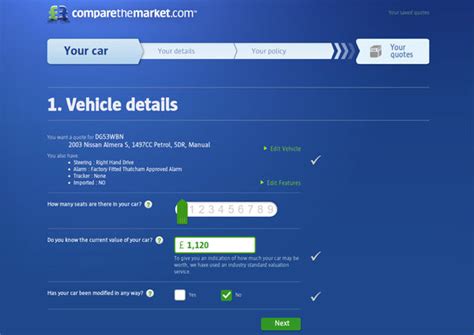

Online Research and Comparison Tools

The internet provides a wealth of resources to help you research and compare car insurance providers. Here are some useful tools and platforms to consider:

- Insurance Comparison Websites: Websites like InsuranceQuotes.com and ValuePenguin offer comprehensive comparison tools where you can input your details and receive quotes from multiple insurance providers. These websites provide an easy way to compare rates and coverage options.

- Insurance Company Websites: Directly visiting the websites of reputable insurance companies can give you insights into their offerings, customer reviews, and additional benefits they provide. Look for detailed information on coverage options, discounts, and customer testimonials.

- Online Reviews and Forums: Reading online reviews and engaging in forums dedicated to car insurance can provide valuable insights from real customers. Platforms like ConsumerAffairs and Reddit often have active communities discussing insurance experiences and recommendations.

Evaluating Insurance Providers

When evaluating insurance providers, consider the following factors to ensure you’re making an informed decision:

- Financial Stability and Reputation: Research the financial stability and reputation of the insurance company. Look for companies with strong financial ratings from reputable agencies like AM Best or Standard & Poor’s. A financially stable company ensures they can fulfill their obligations in the event of a claim.

- Coverage Options and Customization: Assess the range of coverage options and customization features offered by the insurance provider. Some companies may specialize in specific coverage types or offer unique add-ons that align with your needs.

- Customer Service and Claims Handling: Excellent customer service and efficient claims handling are crucial aspects of an insurance provider. Read reviews and testimonials to gauge their responsiveness, and consider reaching out to their customer support to assess their level of service.

- Discounts and Additional Benefits: Many insurance companies offer discounts for various reasons, such as safe driving, bundling policies, or paying annually. Additionally, some providers offer perks like roadside assistance, rental car coverage, or accident forgiveness. Evaluate these benefits and discounts to determine their value to you.

Obtaining Quotes and Negotiating Rates

Once you’ve identified your coverage needs and evaluated potential insurance providers, it’s time to obtain quotes and negotiate rates. Here’s how to approach this process:

- Gather Multiple Quotes: Use the comparison tools and websites mentioned earlier to gather quotes from at least three to five insurance providers. This will give you a good range of options and help you identify the best rates.

- Understand the Quote Details: Carefully review each quote, ensuring you understand the coverage limits, deductibles, and any exclusions. Ask the insurance provider to explain any unclear terms or conditions.

- Negotiate with Multiple Providers: Contact the insurance providers with the most competitive quotes and inquire about any additional discounts or promotions they may offer. By negotiating with multiple providers, you can leverage their competition to your advantage and potentially secure a better rate.

- Consider Bundling Policies: If you have multiple insurance needs (e.g., auto, home, life), consider bundling your policies with the same provider. Many insurance companies offer discounts for bundling, which can result in significant savings.

Making an Informed Decision

With a solid understanding of car insurance policies, rates, and the research process, you’re now equipped to make an informed decision. Here are some final considerations to guide you towards the best choice:

- Review the policy documents carefully, paying attention to coverage limits, deductibles, and exclusions. Ensure the policy aligns with your identified needs and expectations.

- Consider the financial stability and reputation of the insurance company. A stable company with a good track record ensures your coverage is reliable and long-lasting.

- Evaluate the customer service and claims handling process. You want an insurance provider that is responsive and efficient when it comes to assisting you with claims.

- Don’t solely focus on the lowest premium. While it’s important to stay within your budget, ensuring you have adequate coverage and a reputable provider is equally crucial.

Conclusion: Your Journey to the Perfect Car Insurance Policy

Comparing car insurance options can be a complex process, but with the right tools, knowledge, and research, you can navigate the market effectively. By understanding your coverage needs, evaluating insurance providers, and negotiating rates, you’re well on your way to finding the perfect car insurance policy that provides the protection and value you deserve.

How often should I review and compare my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married. Regular reviews ensure you’re always getting the best coverage and rates available.

Can I switch car insurance providers mid-policy term?

+

Yes, you can switch car insurance providers at any time. However, be mindful of any cancellation fees or penalties that may apply. Make sure to coordinate the switch so there are no gaps in coverage.

What should I do if I’m involved in an accident?

+

If you’re involved in an accident, remain calm and follow these steps: (1) Ensure the safety of yourself and others involved; (2) Call the police to report the accident and request a police report; (3) Exchange contact and insurance information with the other driver(s); (4) Take photos of the accident scene and any vehicle damage; (5) Contact your insurance company as soon as possible to report the claim and provide all relevant details.

Can I save money on my car insurance by increasing my deductible?

+

Yes, increasing your deductible can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re taking on more financial responsibility in the event of a claim, which can result in lower monthly premiums.

Are there any car insurance providers that specialize in coverage for specific vehicles or situations?

+

Yes, there are insurance providers that cater to specific niches. For example, some companies offer specialized coverage for classic cars, high-performance vehicles, or even ride-sharing drivers. Researching and comparing providers based on your specific needs can help you find the best fit.