Trip Insured

Welcome to an in-depth exploration of Trip Insured, a leading name in the world of travel insurance. In today's fast-paced and unpredictable travel environment, the significance of comprehensive travel protection cannot be overstated. This article aims to delve into the intricacies of Trip Insured, shedding light on its services, benefits, and the impact it has on travelers' peace of mind.

The Evolution of Trip Insured: A Journey to Trust

Trip Insured’s story began in 1998, marking the birth of an ambitious endeavor to revolutionize the travel insurance industry. Founded by a team of seasoned professionals with a collective vision, the company set out to address the growing need for reliable travel protection. Over the years, Trip Insured has consistently evolved, adapting to the ever-changing demands of the travel industry and the diverse needs of its clientele.

The company's commitment to innovation and customer satisfaction has been a driving force behind its success. Trip Insured understands that every traveler's journey is unique, and thus, it offers a comprehensive range of insurance plans tailored to individual needs. From adventurous backpackers exploring new horizons to business travelers seeking seamless protection, Trip Insured has a plan that fits.

The Comprehensive Coverage: Peace of Mind, Every Step of the Way

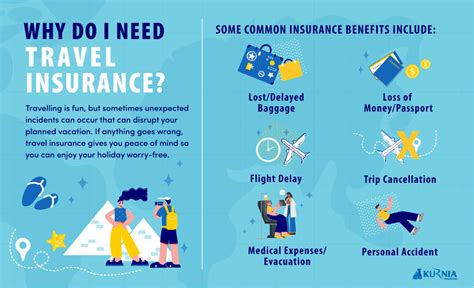

At the core of Trip Insured’s offerings lies its unwavering commitment to providing comprehensive coverage. The company understands that unforeseen circumstances can arise at any time during a trip, and thus, it has designed its policies to offer protection against a wide array of potential travel risks.

Medical Emergencies and Evacuation

One of the key strengths of Trip Insured’s coverage is its robust medical emergency and evacuation benefits. Travelers can rest assured knowing that in the event of an illness or injury, they will have access to quality medical care and, if necessary, be transported to a more suitable facility. Trip Insured’s global network of medical providers ensures that travelers receive prompt and efficient treatment, regardless of their location.

In addition to medical emergencies, Trip Insured also covers the costs associated with medical evacuations, including air ambulance services and necessary medical equipment. This level of protection provides travelers with the peace of mind that they can seek the best possible care without worrying about the financial burden.

Trip Cancellation and Interruption

Trip Insured recognizes that unforeseen circumstances can disrupt travel plans, and thus, its policies offer generous coverage for trip cancellation and interruption. Whether it’s due to illness, injury, or other covered reasons, travelers can receive reimbursement for their non-refundable trip expenses. This coverage extends to situations such as severe weather, natural disasters, or even personal emergencies that necessitate a sudden change of plans.

Lost or Delayed Luggage

Traveling with valuable items can be a source of worry, but Trip Insured’s coverage includes protection for lost, stolen, or delayed luggage. Travelers can receive reimbursement for the cost of essential items they may need to purchase during their trip, ensuring they can continue their journey without inconvenience.

Travel Delay Assistance

Trip Insured understands the frustration and inconvenience that travel delays can cause. Its policies include benefits such as meal and accommodation coverage during unexpected delays, ensuring travelers can maintain their comfort and well-being while they wait for their travel arrangements to be resolved.

The Customer Experience: A Journey of Ease and Excellence

Trip Insured’s dedication to its customers extends beyond its comprehensive coverage. The company prides itself on delivering an exceptional customer experience, ensuring that every interaction is seamless and efficient.

Online Convenience

In today’s digital age, Trip Insured recognizes the importance of providing an accessible and user-friendly online platform. Travelers can easily browse through the company’s range of insurance plans, compare features, and purchase their preferred coverage with just a few clicks. The online process is designed to be straightforward and secure, ensuring a hassle-free experience.

Personalized Support

While the online platform offers convenience, Trip Insured also understands the value of personalized support. Its dedicated customer service team is available around the clock, ready to assist travelers with any queries or concerns they may have. Whether it’s clarifying policy details, providing guidance during a claim, or offering travel advice, the team is committed to delivering exceptional service.

Claim Management

The process of making a claim can be daunting, but Trip Insured aims to simplify it. Its straightforward claim procedures ensure that travelers can navigate the process with ease. The company’s efficient claim management system allows for prompt assessments and reimbursements, providing travelers with the financial support they need during challenging times.

| Coverage Category | Key Benefits |

|---|---|

| Medical Emergencies | Worldwide coverage, medical evacuation, access to quality care |

| Trip Cancellation/Interruption | Reimbursement for non-refundable expenses, coverage for various reasons |

| Lost/Delayed Luggage | Reimbursement for essential purchases, coverage for valuables |

| Travel Delay Assistance | Meal and accommodation coverage, prompt assistance |

How do I choose the right Trip Insured plan for my travel needs?

+Choosing the right Trip Insured plan depends on various factors such as your destination, duration of travel, and the activities you plan to engage in. Trip Insured offers a range of plans with different levels of coverage. Consider the specific risks associated with your trip and choose a plan that provides adequate protection for those risks. It’s also beneficial to compare the coverage limits, deductibles, and any exclusions to ensure you get the best value for your needs.

What happens if I need to make a claim while traveling?

+If you need to make a claim while traveling, Trip Insured provides 24⁄7 assistance. You can contact their customer service team, who will guide you through the claim process. It’s important to gather all the necessary documentation, such as medical reports, receipts, and any other relevant information. Trip Insured’s claim management team will assess your claim promptly and provide you with updates throughout the process.

Are there any limitations or exclusions in Trip Insured’s coverage?

+Like any insurance policy, Trip Insured’s coverage has certain limitations and exclusions. These may include pre-existing medical conditions, high-risk activities like skydiving or extreme sports, and political unrest or natural disasters in specific regions. It’s crucial to review the policy details carefully to understand what is and isn’t covered. Trip Insured provides clear and transparent information about their coverage, so you can make an informed decision.