Worldwide Insurance

Welcome to a comprehensive exploration of the global insurance landscape, where we delve into the intricacies of a multi-trillion-dollar industry that safeguards individuals, businesses, and entire economies. With its vast reach and diverse offerings, insurance is an indispensable pillar of modern society, yet its complexities often remain shrouded in mystery to many. In this article, we aim to unravel these mysteries, offering an insightful journey into the world of Worldwide Insurance.

Understanding the Insurance Ecosystem

The insurance sector, spanning across continents and industries, is a dynamic and ever-evolving ecosystem. At its core, insurance is a mechanism that allows individuals and entities to mitigate risks and financial uncertainties. From health and life insurance to property and casualty insurance, the range of offerings is vast, each tailored to specific needs and circumstances.

The global insurance market is dominated by a handful of major players, including Allianz, AXA, and Ping An, which operate across multiple continents. These multinational corporations offer a wide array of insurance products and services, leveraging their scale and resources to provide comprehensive coverage to clients worldwide. However, the market also boasts a vibrant presence of regional and niche players, each bringing unique value propositions to their target markets.

Key Market Segments

The insurance industry can be broadly segmented into several key areas, each with its distinct characteristics and challenges.

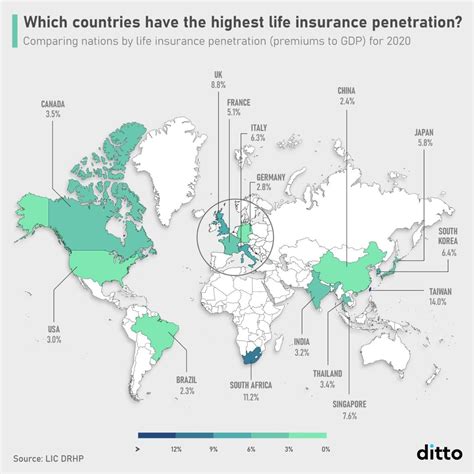

- Life Insurance: This segment focuses on providing financial protection to individuals and their families in the event of death, disability, or critical illness. It often includes retirement planning and investment products, offering long-term savings and wealth accumulation opportunities.

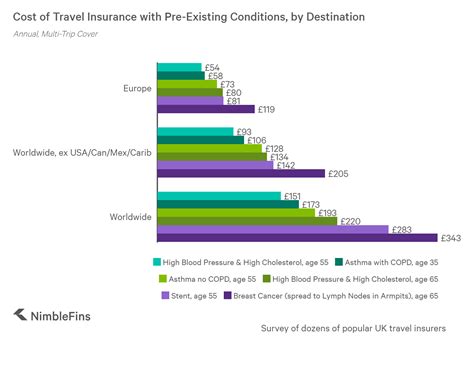

- Non-Life Insurance: Also known as general insurance, this category covers a wide range of risks, including property damage, liability, and business interruptions. It encompasses auto, home, and commercial insurance, among others, offering protection against various perils.

- Health Insurance: With rising healthcare costs and an aging global population, health insurance has become a critical segment. It provides coverage for medical expenses, hospitalization, and sometimes even wellness programs, ensuring access to quality healthcare.

- Reinsurance: Operating at the backend of the insurance industry, reinsurance companies provide risk management and financial protection to primary insurers. They help insurers manage their exposure to large, catastrophic events by sharing the risk.

| Market Segment | Global Premium Share (%) |

|---|---|

| Life Insurance | 45 |

| Non-Life Insurance | 55 |

The Impact of Technology and Innovation

The insurance industry, traditionally known for its conservative nature, has been undergoing a transformative journey fueled by technological advancements. Digitalization and innovation are reshaping the way insurance is delivered, underwritten, and managed, leading to enhanced efficiency, improved customer experiences, and new revenue streams.

Digital Disruption

The digital revolution has ushered in a new era for the insurance sector. Insurers are increasingly leveraging digital channels to engage with customers, streamline operations, and improve risk assessment. From online policy purchases to digital claim submissions and real-time data analytics, technology is enhancing every aspect of the insurance value chain.

One notable trend is the rise of InsureTech, a term coined to describe the integration of technology into the insurance industry. InsureTech startups and established insurers alike are investing in innovative solutions, including artificial intelligence (AI), machine learning (ML), and blockchain, to drive growth and stay competitive. These technologies are being employed for everything from automated underwriting and fraud detection to personalized policy recommendations and claims processing.

The Future of Insurance: Trends and Predictions

Looking ahead, the insurance landscape is poised for continued evolution and expansion. Several key trends are shaping the future of the industry, presenting both opportunities and challenges for insurers.

- Increased Personalization: Insurers are leveraging data analytics and AI to offer more personalized insurance products. By understanding individual customer needs and behaviors, insurers can tailor policies to provide the right coverage at the right price, enhancing customer satisfaction and loyalty.

- Expanded Use of Telematics: Telematics, the technology that tracks and monitors vehicle performance and driver behavior, is expected to gain prominence in the insurance industry. Insurers can use telematics data to offer usage-based insurance, where premiums are based on actual driving behavior, encouraging safer driving practices.

- Growth of Microinsurance: Microinsurance, providing affordable coverage to low-income individuals and communities, is gaining traction. This segment is expected to grow as insurers recognize the potential for reaching previously underserved markets and driving financial inclusion.

- Rise of Parametric Insurance: Parametric insurance, which provides coverage based on predefined parameters rather than actual losses, is gaining popularity. This type of insurance is particularly useful in regions prone to natural disasters, offering swift payouts based on predefined triggers, such as earthquake intensity or wind speed.

Navigating the Regulatory Landscape

The insurance industry operates within a complex web of regulations and oversight, designed to protect consumers and maintain market stability. These regulations vary across jurisdictions, with each country or region having its own set of rules and standards.

Key Regulatory Bodies

Some of the prominent regulatory bodies in the insurance industry include:

- Financial Conduct Authority (FCA): The FCA is the UK's financial regulator, responsible for regulating financial services firms, including insurance companies. It ensures firms operate fairly, honestly, and in the best interests of consumers.

- Insurance Regulatory and Development Authority of India (IRDAI): IRDAI is the statutory body that regulates and develops the insurance industry in India. It sets standards for insurance companies, approves products, and ensures compliance with regulations.

- Financial Services Agency (FSA): The FSA is Japan's financial regulatory body, overseeing insurance companies and ensuring compliance with financial laws and regulations.

- European Insurance and Occupational Pensions Authority (EIOPA): EIOPA is the European Union's insurance regulator, responsible for the supervision of insurance and reinsurance undertakings, and promoting effective and consistent regulation across the EU.

Regulatory Challenges and Opportunities

The insurance industry faces several regulatory challenges, including:

- Compliance with Data Privacy Regulations: With the increasing use of data analytics and digital technologies, insurers must ensure compliance with data privacy regulations such as GDPR in Europe and CCPA in California.

- Capital Adequacy and Solvency Requirements: Insurers must maintain adequate capital to cover potential losses and meet solvency requirements set by regulatory bodies. This ensures financial stability and protects policyholders.

- Regulatory Sandboxes: Some jurisdictions have introduced regulatory sandboxes, which provide a controlled environment for insurers to test innovative products and services without the full burden of regulatory compliance. This encourages innovation while ensuring consumer protection.

Conclusion: Embracing a Global Perspective

The world of insurance is a vast and complex ecosystem, offering a multitude of opportunities and challenges. From life and health insurance to property and casualty coverage, the industry plays a critical role in mitigating risks and providing financial security to individuals and businesses worldwide.

As we've explored, the insurance landscape is evolving rapidly, driven by technological advancements and innovative business models. Insurers are embracing digital transformation, leveraging data analytics, AI, and other cutting-edge technologies to enhance their operations, improve customer experiences, and drive growth. At the same time, they must navigate a complex regulatory environment, ensuring compliance with a myriad of rules and standards.

In conclusion, the global insurance industry is a dynamic and resilient sector, constantly adapting to meet the changing needs of its customers and stakeholders. By embracing a global perspective and staying attuned to market trends and regulatory developments, insurers can continue to provide essential protection and peace of mind to individuals and businesses across the world.

What are the key challenges facing the insurance industry today?

+The insurance industry faces several challenges, including increasing regulatory compliance costs, changing customer expectations, and the need to invest in digital transformation. Additionally, insurers must manage risks associated with climate change and natural disasters, which can lead to significant losses.

How is technology impacting the insurance industry?

+Technology is transforming the insurance industry, with InsureTech companies leading the way in innovation. AI, ML, and blockchain are being used to improve risk assessment, streamline operations, and enhance the customer experience. Digital channels are also making it easier for customers to access and purchase insurance products.

What is the role of reinsurance in the insurance industry?

+Reinsurance plays a crucial role in managing risks for primary insurers. By sharing the risk with reinsurers, insurers can reduce their exposure to large, catastrophic events and maintain financial stability. Reinsurance also helps insurers expand their capacity to underwrite more business and enter new markets.